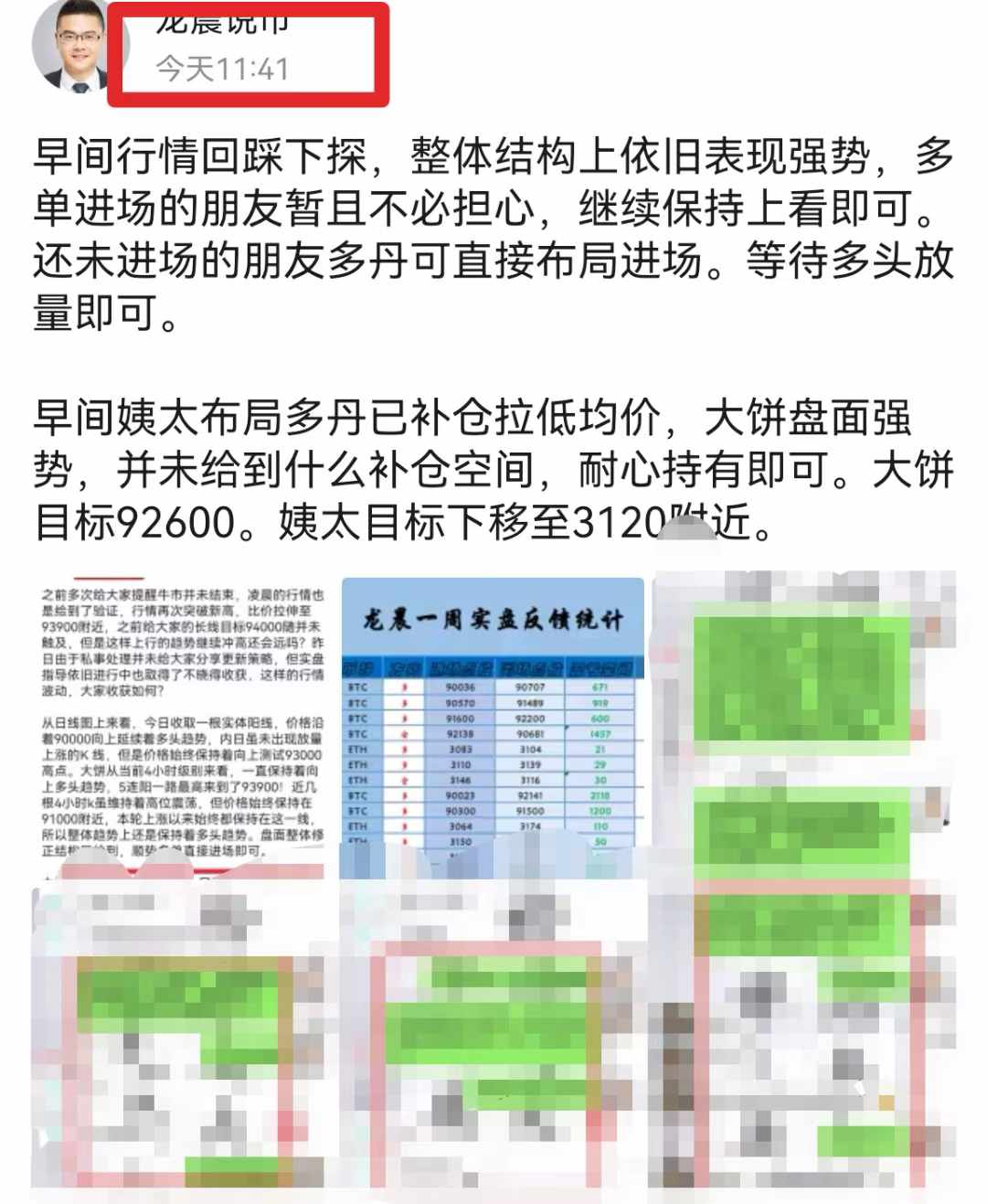

In the afternoon, the bulls made a strong effort to recover. After a morning pullback and correction, Bitcoin rose to around 92,600 at its highest. Ethereum also began to recover in the afternoon, reaching a peak of 3,117 but faced resistance. In the morning, a long position was established around 91,800, with a take profit at 92,600, securing an 800-point gain. After adding to the position, Ethereum's average price came to around 3,190, and the market rose to 3,115 before exiting, securing a 25-point gain. The afternoon market high was also accurately grasped, and the short-term target points were provided in advance, with detailed planning publicly shared across the network. Is this just hindsight?

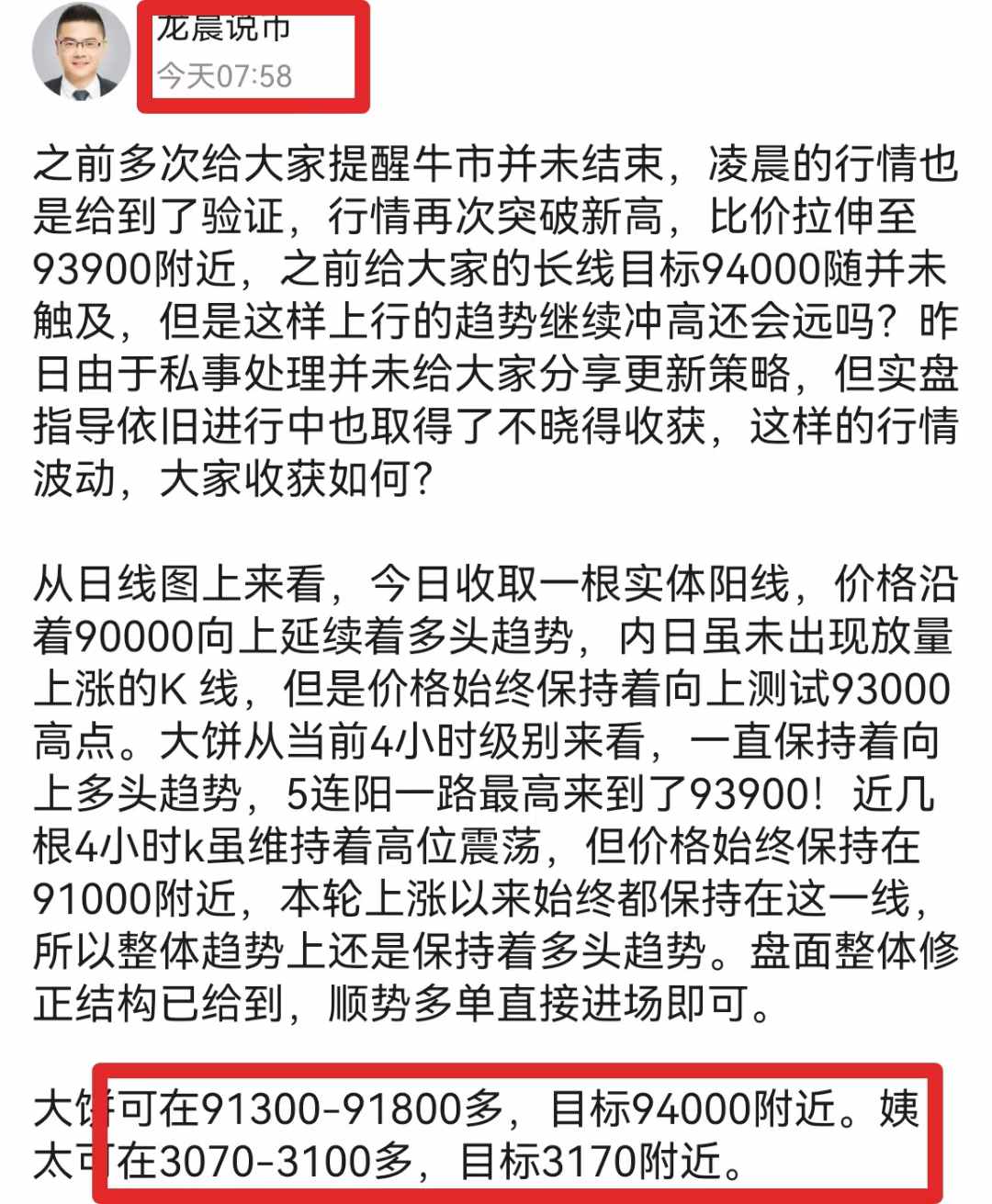

Looking at the hourly chart of Bitcoin, the K-line's operating range has significantly formed an upward trend line, with lows continuously rising and support getting higher. However, the Bollinger Bands are still in a flattening phase and not in a direct upward trend. Therefore, in the short term, the bulls need to increase volume to drive the upward movement of the three lines of the Bollinger Bands and open an upward channel. The morning's pullback tested the bottom at around 91,500, which is near the lower band and faced resistance, forming a new effective support. The afternoon rebound broke through the middle band, which raised the operating range, but there was no significant bullish volume trend to break through the upper band. Thus, a certain pullback is expected in the short term, so there is no need to be overly aggressive in entering long positions. Those entering near 92,600 could consider a short position to look for a pullback. Conservative traders should wait for the market to pull back before establishing long positions.

Bitcoin can be bought in the range of 91,600-92,000, targeting around 93,500. Ethereum can be bought in the range of 3,070-3,100, targeting around 3,150.

Scan the QR code below to follow Long Chen's cryptocurrency insights for the latest strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。