This latest rally highlights the persistent demand for bitcoin in the financial world, especially amid macroeconomic uncertainties and increasing institutional adoption. Crossing the $94,000 threshold cements bitcoin’s status as a leading financial asset, continuing a decade-long narrative of growth and resilience.

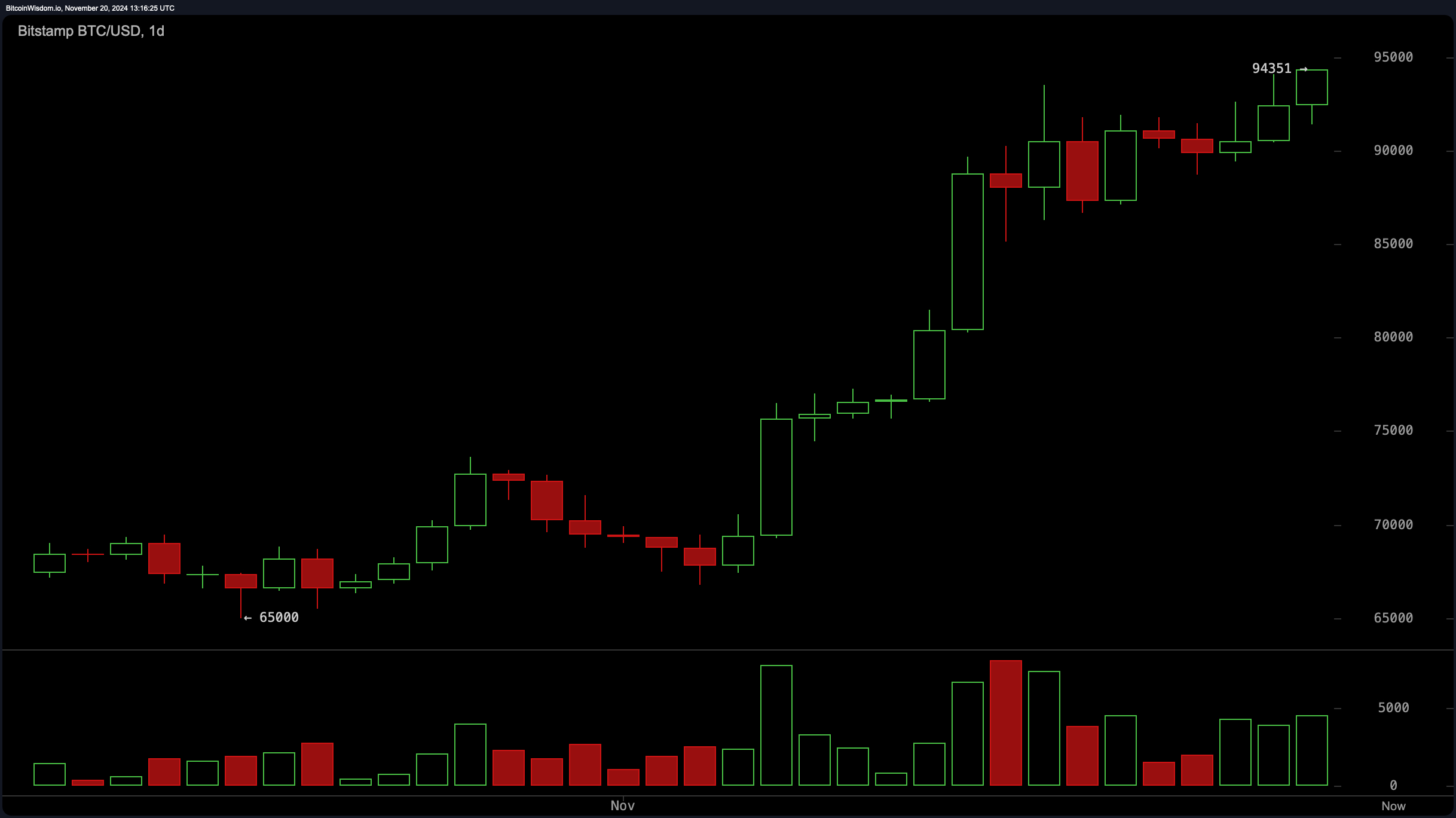

BTC/USD on Bitstamp reached $94,374 per coin.

Analysts view $100,000 not just as a psychological milestone but as a pivotal moment in bitcoin’s journey toward mainstream financial recognition. To some, reaching six figures would symbolize the growing maturity and adoption of bitcoin as an alternative financial system. The figure is more than just a number—it represents a leap in confidence for both retail and institutional participants.

Bitcoin’s trajectory has been marked by volatility and significant milestones, from breaking its first $1,000 in 2013 to nearing $20,000 in 2017. The six-figure target, however, represents something fundamentally different: validation of bitcoin’s economic model and its role as a hedge against inflation. As mainstream financial institutions like banks and asset managers increasingly adopt bitcoin in their portfolios, the $100,000 mark could accelerate this trend.

Investors and traders still remain cautious, though, as the cryptocurrency market is historically unpredictable. Bitcoin’s rise past $94,000 range showcases its allure, but it also highlights the cyclic risks of dropping 75% to 80% lower from the top. Whether bitcoin reaches $100,000 in the coming days or weeks remains uncertain, but the significance of its current price performance cannot be understated.

For now, bitcoin’s $94,000 achievement reaffirms its influence, reminding the world of its ever-expanding role in the modern financial landscape. The $94,000 milestone comes on the heels of fresh BTC options tied to Blackrock‘s IBIT, which made their debut on Wall Street. Luuk Strijers, CEO of Deribit—the world’s largest exchange for digital asset options—shared with Bitcoin.com News that this development is likely to influence the market.

“The launch of IBIT options is having its effect on markets,” Strijers explained. “U.S. retail demand for call options, [plus] market makers hedging by buying [bitcoin] could trigger a gamma squeeze. U.S. institutions and retail who can’t trade on Deribit, the largest crypto options market, will now be able to enter the space and create more open interest around certain price levels which can further trigger volatility and gamma squeezes in addition to Deribit.”

The Deribit executive added:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。