Today, Binance CEO CZ mentioned in a post that two years ago this week, Bitcoin fell to $16,000. At that time, most people were in a panic, while only a few bravely chose to buy in.

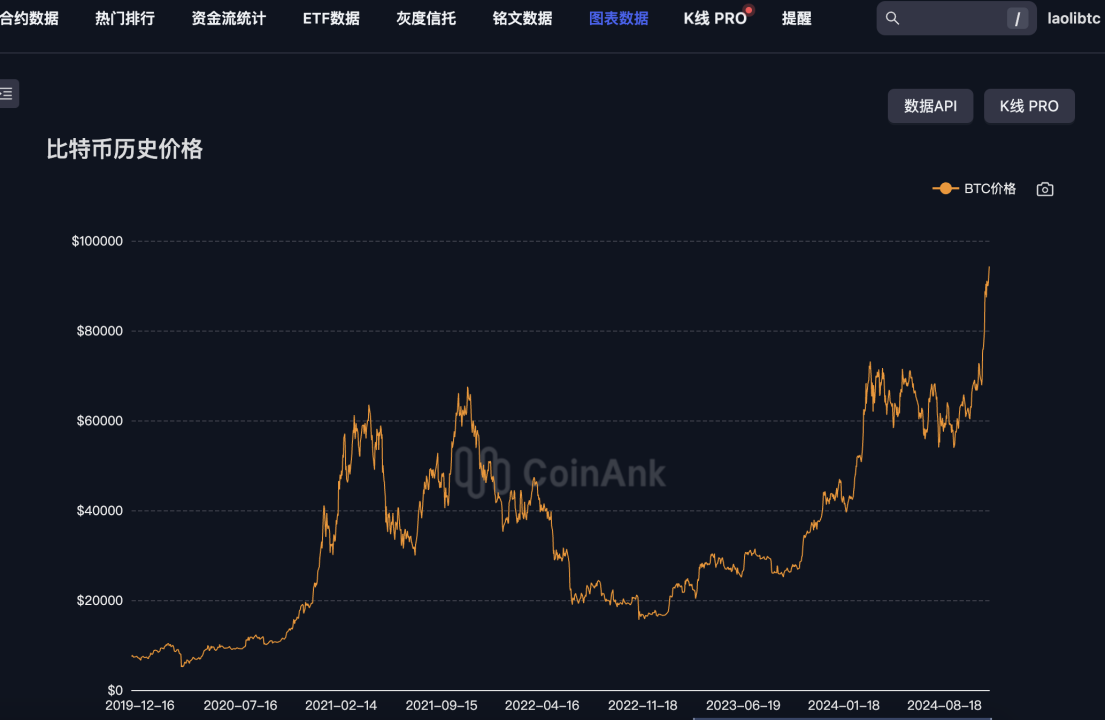

This data reminds me of the synchronous effect of Bitcoin's special date cycle. By querying the historical price data of Bitcoin from Coinank, we discovered an interesting fact in the volatile cryptocurrency market. Two years ago today, on November 21, Bitcoin hit a low of $15,829, which became the historical low point in the last five years.

However, as time has passed, today Bitcoin continues to soar, reaching a historic high of nearly $97,000. Such a huge contrast is astonishing and highlights the unpredictable nature of the Bitcoin market.

Historical dates seem to possess a special magic in the development of Bitcoin, presenting a cyclical effect. Certain specific dates, such as 9.4, 3.12, 5.19, and the date 12.17, which has seen three peaks and troughs, have left a profound mark in Bitcoin's history. These dates sometimes exhibit synchronous phenomena, as if hinting at the price trends of Bitcoin.

Take 9.4 as an example; around this date, the Bitcoin market often experiences significant fluctuations. This could be due to policy adjustments, changes in market sentiment, or other unknown factors, leading to varying degrees of price increases and decreases. Similarly, 3.12 is also a memorable day. On this day, Bitcoin's price plummeted, triggering panic in the market. However, for those visionary investors, it was also an excellent buying opportunity. The same goes for 5.19, where the significant price fluctuations reminded people once again of the uncertainty in the cryptocurrency market. The date 12.17 is even more special, as it has appeared three times in Bitcoin's history with peaks and troughs. This seems to suggest that around this date, there may be some regular changes in Bitcoin's price trends. Of course, this regularity is not absolute; it merely presents a certain trend in historical data.

After Bitcoin set a historic high on November 21, we can closely observe and anticipate future market trends. Although we cannot solely rely on historical dates to predict Bitcoin's price movements, the cyclical effects presented by these special dates can serve as one of our trading references.

We must also be clear that the cryptocurrency market is highly complex and uncertain. The cyclical effects of historical dates are not an absolute rule but a trend analysis based on historical data. When trading BTC, we cannot rely solely on these special dates; we also need to consider various factors, such as macroeconomic conditions, changes in policies and regulations, and market sentiment. Additionally, as a new asset class, Bitcoin's price is highly volatile, and the risks are relatively high. When participating in Bitcoin trading, one should fully understand their risk tolerance, develop reasonable investment strategies, and avoid blindly following trends and excessive speculation.

The study of Bitcoin's special date cycle provides us with a new perspective to observe and analyze the Bitcoin market. Although this cyclical effect is not absolute, it can serve as one of our trading references. In future investment processes, we should remain rational and calm, considering various factors before making decisions.

Author: laolibtc

This article is sponsored by CoinAnk

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。