Do not worry about having no friends on the road ahead; there are like-minded individuals on the investment journey. Good afternoon, everyone! I am the King of Coins from the Coin Victory Group. Thank you all for coming here to watch the articles and videos from the King, and I hope that the brothers who have been following the King will return.

Click the link to watch the video:https://www.bilibili.com/video/BV1LLUQYvEof/

In the cryptocurrency investment field, many friends are still limited by traditional concepts, focusing only on safe-haven assets like gold, while ignoring the growth potential of the cryptocurrency market itself. The definition of safe-haven asset attributes is inherently vague, and it is difficult to judge whether Bitcoin will become the long-term safe-haven choice. However, at this stage, its safe-haven attributes have become evident. First, in the face of the powerful financial market of the United States, especially with the recent strength of the dollar, only Bitcoin has stood out and successfully triumphed. Second, in the context of large-scale conflicts, transferring assets in the cryptocurrency market is extremely convenient, and currently, the only available channel is the cryptocurrency market itself. However, it is important to note that this can lead to exceptionally volatile short-term fluctuations, as once those transferring assets through the cryptocurrency market withdraw their capital, short-term impacts are inevitable. Furthermore, the current trend in the cryptocurrency market basically indicates that a rate cut in December is imminent, consistent with previous predictions. In the larger context, spot users should not overly expect deep corrections; they must dare to enter the market to potentially reap later benefits.

I originally wanted to explain the reasons for Bitcoin as a short-term safe-haven asset, but given the current escalation of the Russia-Ukraine conflict, it will likely lead to a short-term rise, and with long-term support, the trend has already provided an answer. The depth of corrections after each new high has not touched 3000 points. We should abandon fantasies about Ethereum; at this stage, the capital volume can only support Bitcoin's crazy growth, while other coins mostly follow Bitcoin's lead, with volatility about one-third of Bitcoin's, and their investment value is far inferior to Bitcoin's. For example, while SOL has seen considerable gains, it is merely an option for users who cannot purchase Bitcoin to accumulate original capital; one should not expect its returns to match those of Bitcoin. Bitcoin's market value is nearing 2 trillion, accounting for two-thirds of the cryptocurrency market, so we should discard unrealistic fantasies and approach the market lightly. From the perspective of capital inflow, nearly a month into the bull market, Bitcoin has seen a net inflow of 1.4 billion, while Ethereum has experienced negative growth, with 600 million in outflows. This indicates that speculators are cashing out wildly during the bull market, while only retail investors are holding onto their positions. Ethereum is unlikely to create new historical highs in the current bull market, and its investment prospects are concerning, as it has gradually lost competitiveness. In fact, the attributes of Bitcoin and Ethereum are now closely linked to traditional capital; Ethereum intended to harvest traditional capital but has had the opposite effect. As early as a month ago, the Coin Victory Group suggested abandoning Ethereum spot trading, and even leveraging to invest in the Bitcoin bull market. In summary, Ethereum is no longer worth investing too much energy and attention; compared to the returns in a bull market, it is difficult to match its investment value and can be completely ignored by investors.

"Technical Analysis and Trading Suggestions for Bitcoin and Ethereum"

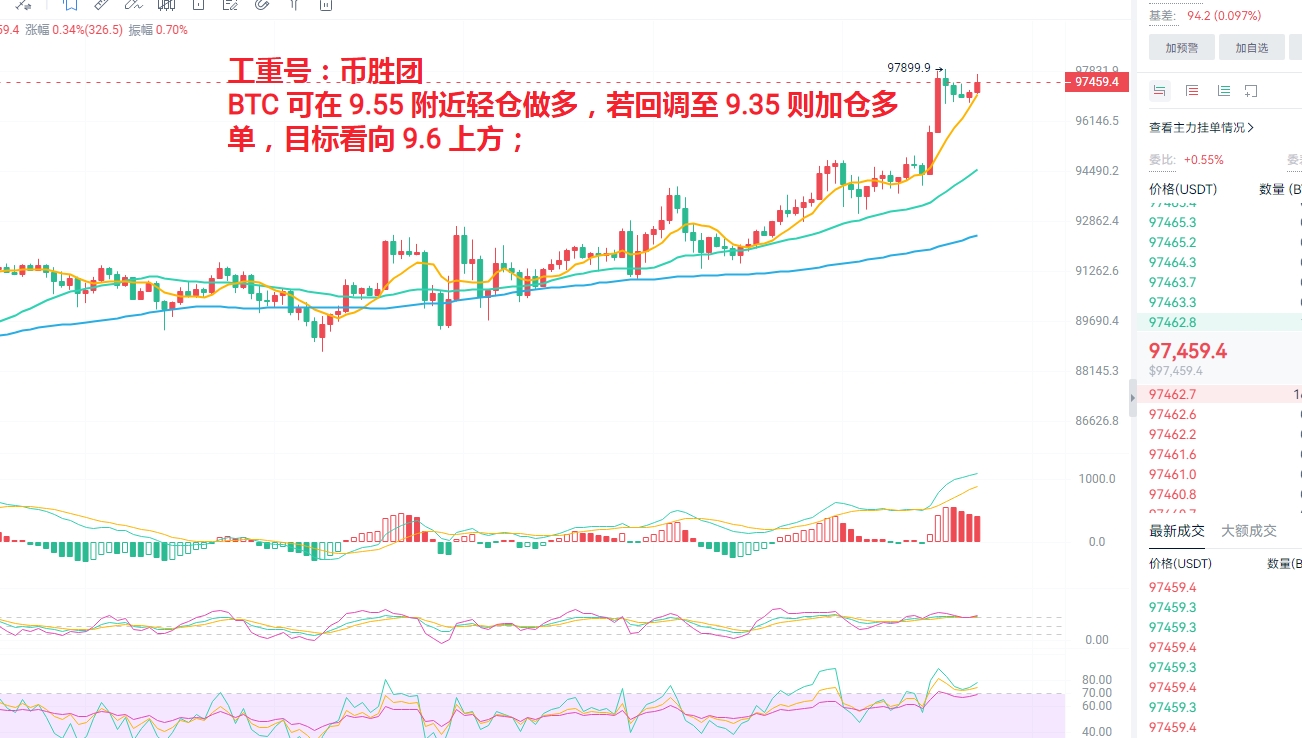

In the daily chart of Bitcoin, there have been three consecutive days of red K-lines, continuously breaking new highs. Although the bulls are not showing a significant volume increase, the market is overall under the control of the bulls, and the upward trend is very evident. Analyzing the 4-hour chart, as emphasized in previous articles, the 4-hour MA30 moving average has not been breached, and the price is steadily rising based on the 4-hour MA30 moving average. In terms of operations, it is recommended to view the 4-hour MA5/10 moving averages as key entry points for long positions, while using the MA30 moving average as a defensive point, firmly executing a bullish strategy. Since there are currently no signals indicating a peak, one should decisively abandon the idea of going short.

The daily chart of Ethereum shows that it has once again found support after retracing to the MA256 moving average. As mentioned in yesterday's article, if it retraces to the 3050 level again and holds, then the short-term will likely return to a bullish rebound trend. Given Bitcoin's strong trend of continuously reaching new highs, Ethereum also has reason to expect a wave of catch-up gains in the near future. In terms of specific operations, it is recommended to lightly position long orders around the 3050 level.

Specific trading points:

BTC can be lightly bought around 9.55; if it retraces to 9.35, then increase the long position, targeting above 9.6;

ETH can be lightly bought around 3050, with a target set in the range of 3160 to 3200.

Investors can use these technical analyses and trading suggestions, combined with their own risk tolerance and investment strategies, to cautiously position and operate in the Bitcoin and Ethereum markets, while closely monitoring market dynamics to adjust investment strategies in a timely manner.

This article is independently written by the Coin Victory Group. Friends who need current price strategies and solutions can find the Coin Victory Group online. Recently, the market has been primarily characterized by fluctuations, accompanied by intermittent spikes, so when making trades, please remember to control your take-profit and stop-loss levels. In the future, when facing significant market data, the Coin Victory Group will also organize live broadcasts across the internet. Friends who wish to watch can find the Coin Victory Group online and contact me for the link later.

Mainly focused on spot and contract trading for BTC/ETH/ETC/LTC/EOS/BSV/ATOM/XRP/BCH/LINK/TRX/DOT, specializing in strategies around high and low support and resistance for short-term fluctuations, medium to long-term trend trades, daily extreme pullbacks, weekly K-top predictions, and monthly head predictions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。