Cryptoquant analysts report that layer one (L1) cryptocurrencies have surged significantly, with notable increases observed in XRP, TRON (TRX), TON, ADA, and SOL. The surge aligns with optimism surrounding regulatory clarity and innovation under the new administration. XRP, for instance, skyrocketed by 120%, reaching $1.12—the highest since November 2021. The rise coincided with record-high decentralized exchange (dex) activity on the XRPL network, where automated market makers introduced earlier this year have driven $3.5 million in daily trading volumes.

TRX achieved a new all-time high in price as transaction activity on the Tron network soared. Cryptoquant highlighted the expansion of the tether (USDT) stablecoin on Tron, which now holds $60 billion in total supply. Tron’s daily transaction count surpassed 10 million, marking an all-time record for the network in 2024. This uptick underscores the robust utility of Tron’s infrastructure in facilitating stablecoin liquidity and decentralized finance (defi) adoption.

Similarly, the TON network has seen a 39% price increase since early November, driven by heightened activity and stablecoin integration. Cryptoquant notes that TON’s daily active addresses grew from 60,000 at the beginning of the year to over 1 million. USDT integration into TON earlier in the year has played a pivotal role in attracting liquidity, with its circulating supply on the network reaching $1 billion.

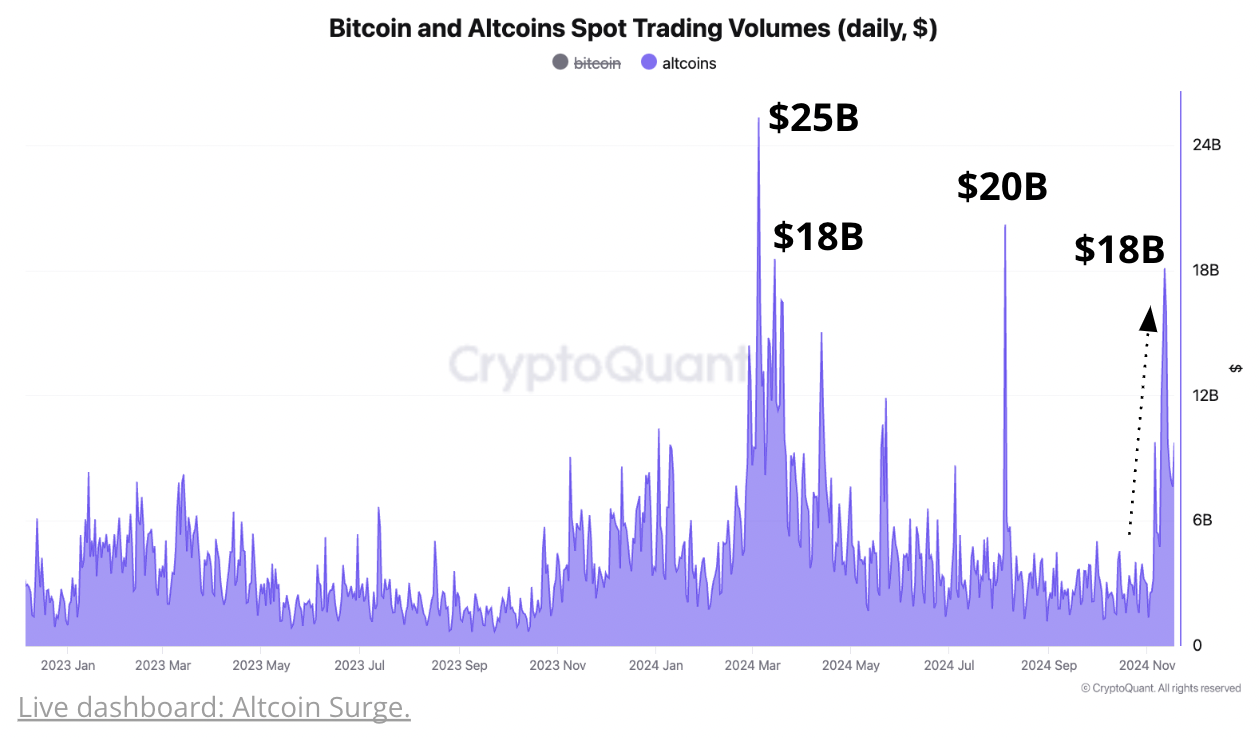

Daily spot trading volumes across altcoins reached $18 billion on Nov. 11, marking the highest levels since August. This surge in market activity follows a period of muted trading volumes earlier in the year, as investors awaited regulatory clarity. According to Cryptoquant, the recent election results have injected optimism into the market, with industry leaders expressing support for policies expected to foster innovation in blockchain and cryptocurrency.

Cryptoquant’s analysts suggest that the current trend reflects growing investor confidence in the potential for mainstream cryptocurrency adoption. While regulatory developments will likely play a decisive role, the observed market activity signals heightened interest in decentralized networks and their role in the future of finance.

As optimism grows, the focus remains on whether these gains will be sustained amid anticipated regulatory shifts. Cryptoquant will continue monitoring onchain metrics to provide insights into this evolving market landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。