Globally, El Salvador may just be an obscure border country, leaving a vague impression of hot volcanic landscapes and diverse ecosystems. But in the crypto world, El Salvador is a well-known entity.

Back in 2021, the global monetary environment could be described as turbulent, with the pandemic leading to a sharp increase in monetary debt, causing global debt levels to soar to $275 billion. A new wave of digital currency experiments emerged globally, and Bitcoin's mainstream adoption surged, reaching $69,000.

In this context, the newly inaugurated President Nayib Bukele of El Salvador made a rather bold decision to create a new financial system with a new currency, designating Bitcoin as the country's sovereign currency. The Congress unexpectedly supported this, ultimately passing the bill with an absolute majority, officially making Bitcoin the legal tender of the country, thus making El Salvador the first country in the world to grant legal status to cryptocurrency. Bukele also announced plans to allocate land for infrastructure related to basic needs, using Bitcoin as the currency for transactions, and to build a complete Bitcoin City. The government even developed an electronic wallet named Chivo to promote public adoption.

This decision caused a global sensation, with the International Monetary Fund, global central banking institutions, and crypto industry practitioners focusing their attention on the small Central American country with a population of less than 7 million. Voices of opposition and ridicule intertwined with applause, as the world hoped to see the results it desired from El Salvador's social experiment, witnessing the potential rise or fall of the "Bitcoin City" vision.

Amidst the hype and promotion, tourists flocked to El Salvador, bringing the first wave of fresh traffic. However, problems soon followed. The high volatility of cryptocurrencies, the security of electronic wallets, and the slow and cumbersome transfer processes quickly led to public dissatisfaction with cryptocurrencies. A year later, only 20% of locals continued to use Chivo. By November 2022, the crypto world faced a severe setback, with Bitcoin rapidly dropping to $16,000, while El Salvador's National Bitcoin Office (ONBTC) was officially established in the same month, creating a misalignment that cast a shadow over El Salvador's Bitcoin plans once again. Subsequently, Bitcoin City seemed to drift further away, and El Salvador gradually faded from the crypto stage.

A typical example is the "Volcano Bond," the world's first sovereign blockchain bond that the Salvadoran government had ambitiously planned to issue to raise funds for the city. The issuance date has been repeatedly postponed, from 2022 to 2023 and now to 2024, and the bond, originally expected to raise $1 billion, remains a distant prospect.

However, as the market has warmed up and regulations have loosened, Bitcoin is now just a step away from $100,000, and global attitudes have changed significantly. The race for national Bitcoin reserves has officially begun, with several countries around the world showing interest in incorporating Bitcoin into their national reserves. Besides the United States, which has made bold statements, Switzerland has also passed legislation to include Bitcoin in its national bank reserve assets. Bhutan's Bitcoin holdings even exceed 30% of its GDP, and lawmakers in Venezuela, Poland, Argentina, and Germany have proposed related initiatives.

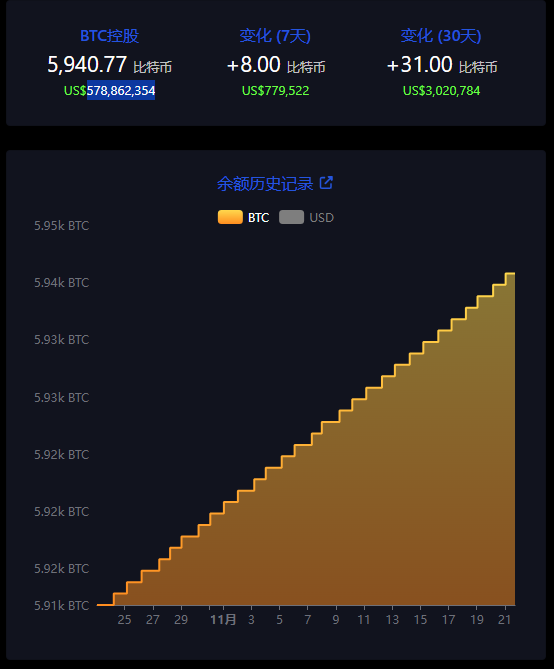

El Salvador seems to have transformed from a radical dreamer into an innovative pioneer, becoming the first to take the plunge. According to The Bitcoin Office, since March 16 of this year, El Salvador has adhered to a principle of purchasing one Bitcoin daily, and as of the time of writing, its Bitcoin holdings have reached 5,940.77 BTC, with a market value of $578,862,354. The hype around Bitcoin City has finally begun to show investment value, with the city taking shape. In August of this year, Turkish holding company Yilport announced an investment of $1.62 billion in two ports in El Salvador, one of which is located in "Bitcoin City." In terms of public education, El Salvador is also making efforts to promote Bitcoin salaries among public servants, shifting the salary structure from traditional currency to Bitcoin, and even launching a Bitcoin certification program to provide training and certification related to Bitcoin for 80,000 public employees.

However, public attitudes have become more conservative than ever. According to a new survey by the Francisco Gavidia University in San Salvador, only 7.5% of respondents indicated that they use cryptocurrencies for transactions, while 92% admitted they do not use cryptocurrencies, and only 1.3% believe Bitcoin is the main direction for the country's future development.

From the data alone, El Salvador's Bitcoin vision still seems far off. Even with strong presidential support, the Bitcoin held by El Salvador accounts for only 1.5% of its GDP, and since 2022, remittances in cryptocurrency have continued to decline, dropping from $84.8 million to $57.4 million. According to data from the Central Bank of El Salvador, from January to August 2024, only 1.1% of all remittances sent to the country involved cryptocurrencies. In April of this year, the first tokenized debt project initiated by Bitfinex Securities to support the construction of a Hilton hotel in El Salvador even failed to attract the minimum required funding of $500,000 to continue operations, reflecting the failure of El Salvador's Bitcoin effect. In response, the president could only helplessly admit, "Bitcoin has not yet achieved the widespread adoption we hoped for."

Nevertheless, since the announcement of Bitcoin as the sovereign currency, El Salvador's fate has been closely tied to Bitcoin. The brand of "Bitcoin City" has already been established, and El Salvador's Bitcoin journey continues. Currently, El Salvador is planning to create a new capital market around Bitcoin and is preparing to introduce more regulatory support policies. The results are already showing; recently, Bitfinex Securities again conducted the first public offering of tokenized U.S. Treasury bonds under El Salvador's legal framework.

In light of all this, Juan Carlos Reyes, the chairman of El Salvador's highest cryptocurrency regulatory body, the National Digital Assets Commission, accepted an exclusive interview with Coindesk to discuss the current status and future of digital assets in El Salvador.

Below is the full text of the interview with the original author Tom Carreras, translated and slightly modified by Tuo Luo Finance:

In terms of regulating cryptocurrencies, El Salvador is ahead of most other countries. As the first country to adopt Bitcoin as legal tender, it has become a hub for many crypto companies.

"From a macro perspective, most people do not understand what we are doing in El Salvador; they can only see a corner of the whole picture," said Juan Carlos Reyes, chairman of the National Digital Assets Commission (CNAD) of El Salvador, during the interview.

"Even those foreign companies that are regulated locally but do not have a full office here do not understand the advanced level of regulation in El Salvador and the rapid pace of development in the industry," Reyes stated, adding that the president's initiative has forced national institutions to work hard to address the impacts brought by new technologies and their close ties to digital currencies.

As a result, El Salvador has avoided granting cryptocurrency regulation and oversight powers to traditional financial regulatory bodies—such as the Financial System Regulatory Authority (SFS)—and instead created the CNAD from scratch, aiming to establish a tailored regulatory framework for cryptocurrencies rather than trying to extend existing rules to digital assets.

"There is a method of inductive reasoning: when I see a bird that walks like a duck, swims like a duck, and quacks like a duck, I call it a duck." But in the context of assets, digital assets are completely different from traditional financial instruments.

This is also why CNAD, under the leadership of computer science heavyweight Reyes since September 2023, immediately adopted a technical approach to regulating cryptocurrencies. The feedback from crypto companies that have obtained Digital Asset Service Provider (DASP) licenses has been very positive.

Nick Cowan, CEO of tokenization solutions company VLRM, stated in an interview, "We were completely taken aback; CNAD is not only knowledgeable and meticulous but also technically proficient."

Victor Solomon, a partner at El Salvador's tokenization consulting firm Tokenization Expert, echoed this view. "We don't want to overly praise El Salvador, but their ability to quickly grasp the core issues to review our applications is astonishing. We don't have to spend time explaining the technical foundations of our operations—they already understand the complexities of tokenization and the compliance measures that will be taken. Reyes understands the real challenges businesses face, from fundraising to navigating regulations, making him not just a regulatory head but an advocate for positively impacting the Salvadoran economy," Solomon added.

Reyes was born in El Salvador and moved to Canada as a child to escape the war that ravaged the country at the time. He describes himself as "accomplished," holding multiple bachelor's degrees in computer science, mathematics, and physics, as well as a master's degree in management from Harvard University. He later pursued a Ph.D. in philosophy at the People's Friendship University of Russia but did not complete it due to the pandemic and the war in Ukraine.

His professional background is highly interdisciplinary, and his work experience is quite extensive. After leading a consulting firm for 15 years, he developed business opportunities for the Missanabie Cree First Nation and even opened a bar on the second floor of his beachfront villa. Since 2013, he has been a believer in Bitcoin, which led him to decide to move back to El Salvador in 2021 to participate in the nationalization process of cryptocurrency.

The CNAD has a fully independent team of 35 employees, and Reyes has set a standard for them: everyone must have a deep understanding of the underlying technology of cryptocurrencies. In fact, currently, 20 employees are pursuing graduate-level crypto courses at CEMA University in Argentina to enhance their expertise.

"In terms of regulating crypto assets, we have the highest quality and most complete team in the world," Reyes said. "If someone doesn't know how to transact in Bitcoin, including my driver, they probably can't work here."

This elite team has undoubtedly left a deep impression on companies seeking to obtain operating licenses in El Salvador.

"Reyes is a technical expert," Cowan's company has worked with dozens of other regulatory bodies worldwide, and he told CoinDesk, "In other jurisdictions, regulators understand regulations and investor protection, which is certainly critical, but they may not necessarily understand the technology, which can sometimes make your work quite burdensome."

"This is a very detailed and complex process. We submitted a 700-page application, but the decision-making process after submission was much faster than in other countries… The process is consistent with any other regulatory procedures we have previously gone through; it didn't take a different route, just faster," Cowan stated.

For Reyes, the agency's knowledge of crypto means it can adhere to one of the most important philosophical tenets in the field—don't trust, verify—and check the blockchain every time it interacts with a new company applying for a license. The team does not rely on documents provided by compliance officers, as such documents are often found to provide misleading information to regulators.

Reyes likes to use an analogy to explain why cryptocurrencies need dedicated regulatory bodies. "If you buy an electric car and it breaks down, you take it to a mechanic with 20 years of experience, but when he opens the hood, he won't find an engine; he'll only find a battery, and he won't know how to deal with it."

This also reflects Reyes's different feelings about cryptocurrencies compared to traditional financial assets. They may appear similar on the surface, but upon deeper examination, they are fundamentally different. This is one of the reasons why global jurisdictions have made slow progress in implementing regulatory frameworks for digital assets.

However, El Salvador is a small country. With a GDP of only $35 billion, it ranks 17th among Latin American countries and 103rd in the world. This country does not have its own currency, strong financial institutions, or even an existing developer ecosystem. Yet, precisely because of this, all these factors have proven beneficial for regulating cryptocurrencies, as El Salvador "starts from a blank slate."

Returning to the electric car analogy, El Salvador can immediately focus on fixing the battery and motor without having to retrofit its existing infrastructure into a garage capable of servicing Teslas.

"In other countries, many new technologies are created by rational individuals who try to push the crypto ecosystem forward, but they do not consider how the technology could be misused and become a tool for money laundering," Reyes said. "Regulators find it difficult to know the extent of regulatory relaxation."

"We are able to make the CNAD the single entry point for all digital assets in this country; any entity that does not have permission from the commission is acting illegally."

Another fact is that financial institutions in Western countries are the creators of existing rules, so overturning the original regulations would have broader and more severe impacts than in Latin American countries. "Traditional finance has lobbying organizations that have been fighting against crypto, such as implementing Operation Chokepoint 2.0 (referring to U.S. regulators restricting cryptocurrency companies from obtaining banking services). They will do everything possible to ensure this industry does not thrive," Reyes said, noting that he once had a Canadian bank account frozen due to his involvement in cryptocurrency activities. "But countries like El Salvador, if they can act quickly and seize the opportunities presented by cryptocurrencies, will benefit immensely."

But what kind of regulatory environment does El Salvador want to create?

Reyes stated that in terms of financial instruments, Bitcoin is "more than sufficient," but beyond that, the CNAD is agnostic about technology. Most of the companies regulated by the agency operate on Ethereum. The sizes of the regulated companies vary widely: there are global heavyweights like Tether and Bitfinex Securities, as well as small local businesses in El Salvador, which, according to Reyes, "start from as little as $2,000."

Consumer safety and financial security are top priorities. For example, this means requiring exchanges to use multi-signature wallets to ensure that another FTX incident does not occur, or requiring companies' private blockchains to adhere to certain security standards. Identity verification for every customer is also mandatory.

"It is important to emphasize that our country has suffered from gang intimidation for many years. Therefore, we place great importance on financial transparency, money laundering, and financial terrorism issues, which have been strongly incorporated into our regulations." He believes that if a crypto company is regulated in El Salvador, it can obtain licenses anywhere in the world.

Reyes is particularly enthusiastic about one area: Real World Assets (RWA). In his view, attempts like those of VLRM and Tokenization Expert will expand investment opportunities for retail investors. "Before Robinhood, most young people in the U.S. could not buy stocks in Tesla or Nvidia. Robinhood democratized all these different stocks that only super elites could purchase. This is precisely the role of tokenization. In the coming years, Salvadorans are expected to access regulated products that cannot be bought in other jurisdictions."

Reyes emphasized, "This is the first time in modern history that developing countries can lead a financial revolution rather than being left behind, only able to pick up the scraps. We are trying to encourage other countries to pay attention to El Salvador and learn how to apply our model to other nations."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。