Author: Duo Nine, Crypto Analyst

Compiled by: Felix, PANews

PANews Note: This article only represents the author's views and does not constitute investment advice. DYOR.

Solana has captured the retail market in a way that no other chain can match in this cycle because it did one thing right.

Competitors like Ethereum have failed in this regard and paid a heavy price. BNB Chain failed. Tron tried but also failed.

These competing L1 chains have failed, while Solana has succeeded, making SOL worthy of respect.

How did Solana do it?

Solana's VC captured the market's greed in a way that no other L1 could.

Tron also has low transaction costs, as does BNB Chain. Solana does not have an advantage in this area. However, the focus of these two competing chains is misplaced.

Binance focuses on their CEX, generating airdrops for users from new coins listed on Binance. Users must stake BNB for this. This method effectively keeps BNB's price high.

BNB also reached an all-time high in this cycle, but it did not rise 28 times like Solana (compared to its low in 2022).

Official data from Tether shows that there are 60.2 billion USDT on the Tron network, nearly half of the total existing USDT supply of 130.7 billion, while there are 66.3 billion USDT on the Ethereum chain, and only 860 million USDT on the Solana network.

USDT on ETH is primarily used for DeFi, while USDT on Tron is used for transfers and payments. Tron and Justin Sun attempted to create memes and bring retail investors onto their chain but failed. They entered the market too late, and TRX's price did not manage to rise 28 times in this cycle.

As for Ethereum, it has completely detached from market reality. Vitalik talks grandly on forums about a 5-year roadmap.

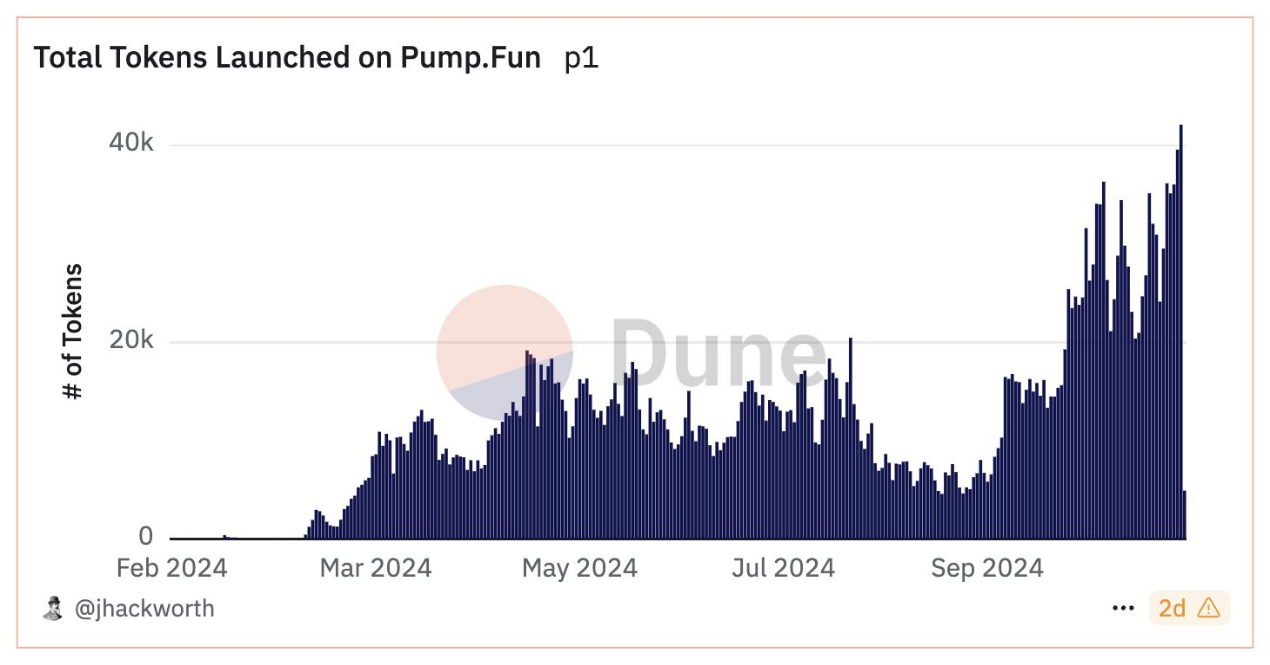

However, retail investors' attention spans are 30 seconds, which is the time it takes for Solana memes to grow 10 times on pump.fun.

What makes Solana a winner?

In addition to low transaction costs and a 28-fold increase since 2022 (which is important for major retail investors), Solana has done another important thing.

They created applications and an ecosystem that satisfy the greedy desires through memes. Solana's VC invested a lot of cash, subsidized network costs, and actively created FOMO through memes.

They also focused on creating applications and wallets that retail investors can easily understand. Retail investors do not care about infrastructure (unlike Ethereum developers); they care about price increases.

Solana achieved this and allowed retail investors to gamble like Degens. Literally, Solana is a meme machine, the king of memes. Their ecosystem continuously produces new memes, just like Tron handles USDT transactions.

Other L1s do not have this advantage, and retail investors love memes.

This also produces unexpected results.

If you talk about cryptocurrency with friends, Solana will be the first and most talked-about altcoin. In this cycle, the question you get from newcomers is "How do I buy Solana?" rather than "How do I buy Ethereum/BNB/TRX?".

This should not be underestimated. New funds are flowing into Solana, and the price of SOL reflects this.

Even Solana's VCs are surprised by this success. They have done well. And they also plan to cash out massively.

At the beginning of 2025, tens of millions of SOL will be unlocked and sold into the market. Retail investors may go crazy investing in SOL due to FOMO. A meme token could essentially cost hundreds of dollars.

In fact, the Solana token is the ultimate meme. Retail investors will actually think, "I will sell this meme coin and then invest the profits into SOL."

They do not realize that Solana is also a meme.

This idea will only drive up Solana's price. As long as retail investors believe Solana is "safe" or a "blue chip," the game will continue until the music stops.

Whenever people bet on memes on SOL and realize "profits" by buying SOL, the real winners are the VCs selling SOL.

Solana does not have real use cases for payments or remittances like Tron, nor does it have DeFi like Ethereum. It has memes. Solana excels in this area and performs well in bull markets.

You can take a gamble on Solana, but ultimately, you should exit and not put your money into SOL or any tokens on the Solana network. It is a centralized database, not a decentralized currency like Bitcoin.

Some may argue that Solana is filled with fake users, which is true.

But this does not stop real retail investors from being lured into its ecosystem.

Once they join, the bots created by Solana start working. On pump.fun alone, hundreds of bots immediately buy up any newly created meme tokens.

This is a flywheel that incentivizes users to keep spending money, hoping that one of their tokens will explode.

Some will, but most won't. This works effectively until retail investors withdraw during a bear market, leading to liquidity drying up.

By then, all the plans will be completed, and VCs will have cashed out hundreds of millions or even billions of dollars.

You see, retail investors only need to spend $100 to buy some meme tokens to become millionaires. This story will satisfy the FOMO needs of thousands of new users.

Then the cycle will repeat. Over and over again. Solana has captured this cycle well. And there have been other similar cycles in the past crypto market.

Related reading: How do VCs view the current Memecoin craze?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。