What is shaved is hair, what is burned is real gold, and what is played is abstraction.

Written by: Joyce, Frost

BlockBeats Note: This article was written on July 1, when Pump.fun launched its live streaming feature, and the phenomenon of "live streaming with memes" was just beginning to gain traction. Recently, Pump.fun officially boosted the live streaming feature again. In the early hours of November 22, a jobless young man from North America stated during a live stream on Pump.fun that he would not stop streaming until the market value of his token (LIVE) reached 100 million. This live stream was also selected by Pump's official team and featured on the homepage. After filling the internal market with 100,000 dollars, the LIVE token surged, and later KOLs like gmony participated in real-time interactions online, ultimately pushing the market value of the LIVE token above 20 million dollars.

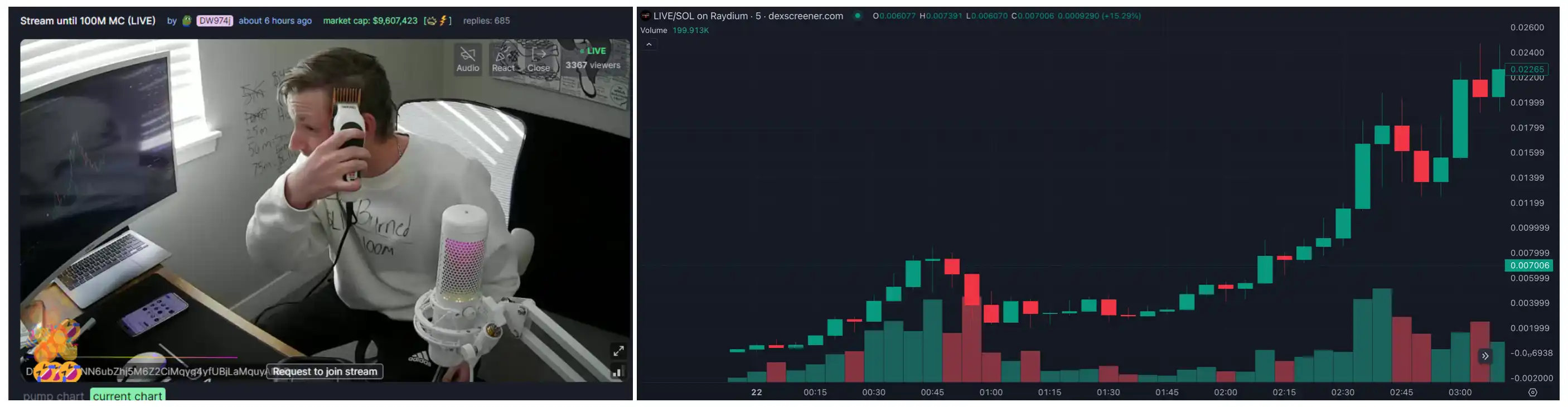

Left: The LIVE token issuer live streaming while shaving his head; Right: The price of the LIVE token

After the "live streaming guy" became a sensation, Pump.fun's official website saw a surge in live streaming activity, with various streamers employing all sorts of tricks to boost the price of their tokens, making Pump.fun gradually resemble a "Kuaishou of the crypto world."

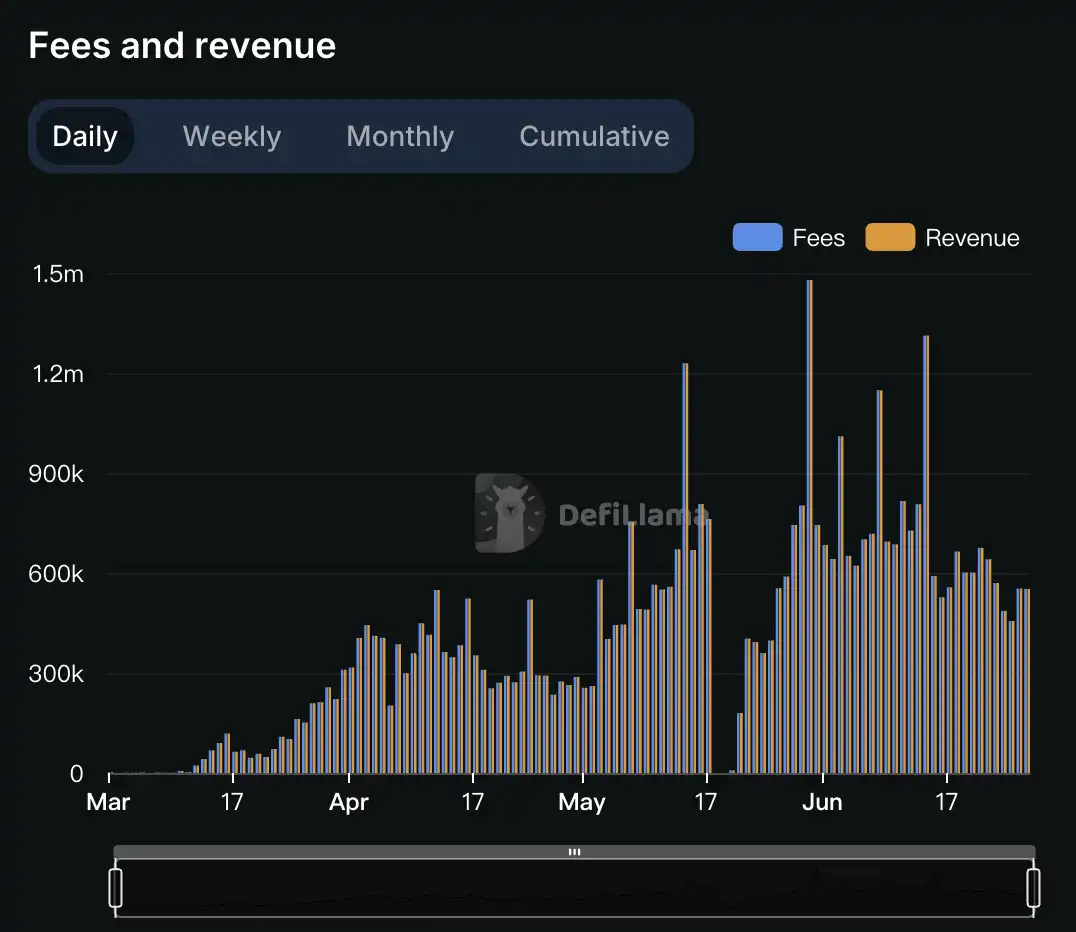

Pump.fun is the most unique product in this cycle. Since its launch over four months ago, more than 1.17 million tokens have been released on Pump.fun, with total revenue exceeding 50 million dollars. How should we understand this number? Compared to the top traffic product Uniswap during the previous bull market, it is estimated that Uniswap Labs had an annual revenue of about 25 to 30 million dollars.

It can be said that Pump.fun is not a typical Web3 project; it lacks a complex token economics model and a DAO governance mechanism. However, with precise market positioning, Pump.fun has created a business model that guarantees profit. Under the dominance of the attention economy, many people interpret the sustained prosperity of the meme coin sector as an advantage of short videos over long videos. So, in the era of "everyone issuing tokens," can newcomers still share in the profits? With the attention economy combined with extreme PVP, what new tricks can meme coins play?

The person who burned himself to promote a meme coin is still live streaming

Do you remember the developer who burned himself to promote his meme coin a month ago? On June 27, last Thursday, he was still live streaming on Twitter.

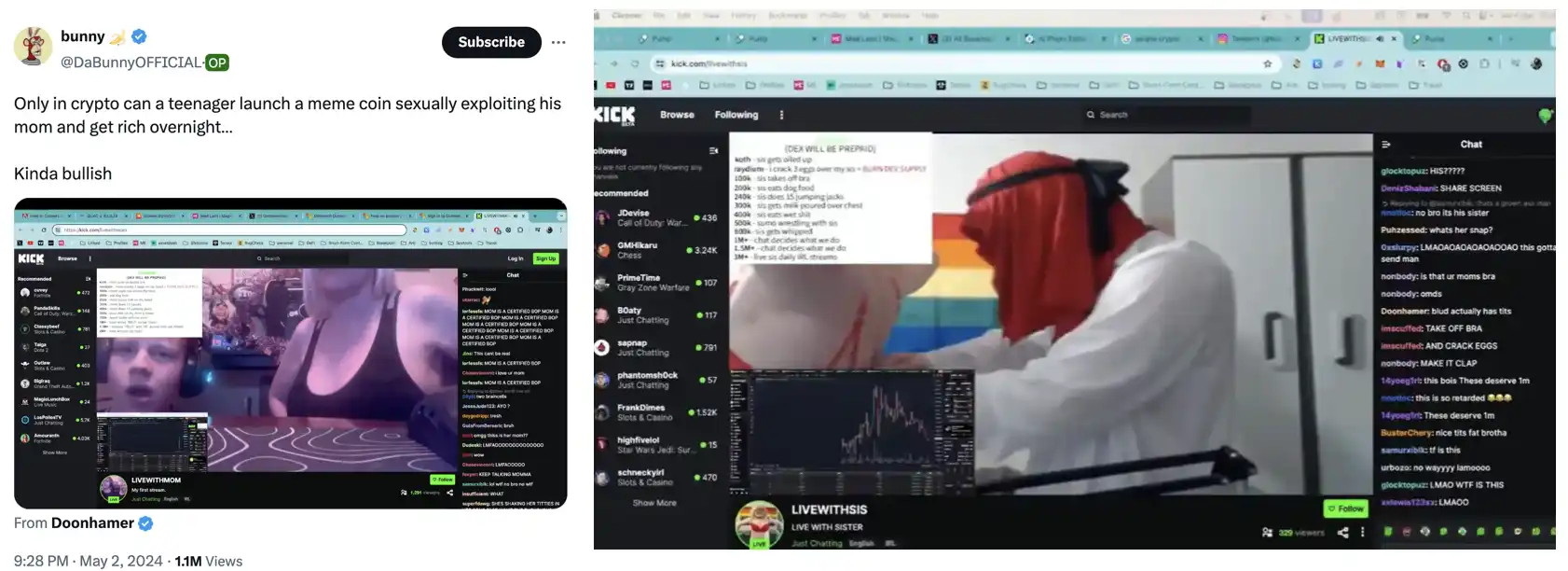

This developer is named Mikol. On May 17, he launched a meme coin called TruthOrDare (DARE) on Pump.fun. At that time, Pump.fun did not have live streaming capabilities, and he could only post images in the comment section. Mikol demonstrated the highlights of Season 1 to the community by live streaming on Twitch, pouring isopropyl alcohol on himself and having friends shoot fireworks in his direction. Amidst the gasps of his fans and the rise of DARE, his body caught fire, resulting in third-degree burns and a trip to the hospital.

The DARE token saw a 12-fold increase on the day Mikol was burned, only to quickly return to zero the next day. Mikol's story was reported by the crypto community media Decrypt, attracting significant attention. In light of this heat, Mikol, lying in the ICU, recorded a video to assure the community that he would not give up on operations, saying, "You will see a better version of me."

Mikol is not the only one who has issued a meme coin and expected a price increase through extreme behavior. The Solana meme craze has brought in many newcomers to crypto, spawning numerous meme coins that are monitored in seconds. In addition to Mikol's "burn coin," there were also meme coins like "LIVEWITHMOM," which live streamed nudity to "ask for purchases."

Although the lifespans of these meme coins are extremely short and very few have market values exceeding 1 million dollars, the combination of live streaming and token issuance has allowed many people with low incomes to find a path to wealth.

A week after this incident, Pump.fun launched its live streaming feature, and the community's first reaction was to advise token issuers, "Please do not self-immolate for profit."

As Mikol's story drew community attention, many expressed that such behavior was too pathological and contrary to the original spirit of crypto, with some suggesting Mikol find a good job after recovering. However, after his condition stabilized, Mikol resumed live streaming on Twitch and simultaneously on Pump.fun. As he wished, his return to live streaming propelled DARE to a 15-fold increase again.

That surge only lasted a day, and the price of DARE continued to decline, seemingly lacking further upward momentum. But since then, Mikol has frequently streamed while bandaged, performing stunts like eating raw eggs, dry swallowing cinnamon powder, and sharing his recovery routine. New members have also joined his "TruthOrDare family," showcasing their skills in eating mustard and raw chili peppers.

Unless in very rare circumstances, it may be difficult for Mikol and his DARE to regain the attention they once had. There are many more like Mikol online, hoping to gain community attention through sufficiently abstract and shocking performances, allowing their memes to soar.

Those who naturally attract high traffic have already entered the token issuance game. From Jenner to Mother, Father, and others, the celebrity coin wave has allowed issuing teams and early followers to profit immensely. Although figures like Vitalik have expressed opposition to this phenomenon, it is hard to stop the growing trend of "entertainment to death" in the crypto community.

It may be considered that the influx of newcomers into the crypto community this time comes from the "sinking market." The meme coin market is still vast, but unlike the meme coins of yesteryear like DOGE and PEPE, which had some connection to the crypto community, the current meme coin craze is pointing in a new direction, targeting the sinking market outside the crypto community.

The crypto market is undergoing a transition from PGC to UGA

There are many practical reasons for the emergence of the meme craze. Indeed, the appeal of crypto narratives in this bull market is not as strong as before. Compared to the opaque chip distribution and grand narratives of "value coins," newcomers are more willing to use memes as their first experience in entering the crypto space.

Behind this is an increasing number of users seeing through the ultimate PVP logic. Regardless of how the narrative changes, it is merely to create a sufficiently Ponzi-like scheme for the next person to take over. The market is not lacking in people issuing tokens; it is just lacking those who can tell the token issuance story well. Since the community consensus has become that "the essence of value coins is also a type of air coin," it makes sense to go straight to the point and issue tokens themselves. The birth of Pump.fun is timely.

The emergence of Pump.fun allows users to publish their own meme coins at an extremely low cost (0.02 SOL) with just one click. Rounds of memes take off and crash within a few hours, with over 10,000 tokens being released daily on Pump.fun, accounting for over 80% of the total token volume in the Solana ecosystem. Recently, Pump.fun's daily revenue has ranged from 450,000 to 1 million dollars, and total revenue has exceeded 50 million dollars since its launch a few months ago.

As pointed out in an analysis report released by Youbi Capital in May, the popularity of low liquidity assets is an inherent response to the current cycle's insufficient liquidity in the market. There is also a potential metaphor for the sharp increase in the number of tokens issued after the transition from PGA (Professional Generated Asset) to UGA (User Generated Asset), leading to increasingly dispersed consensus.

However, new opportunities still exist.

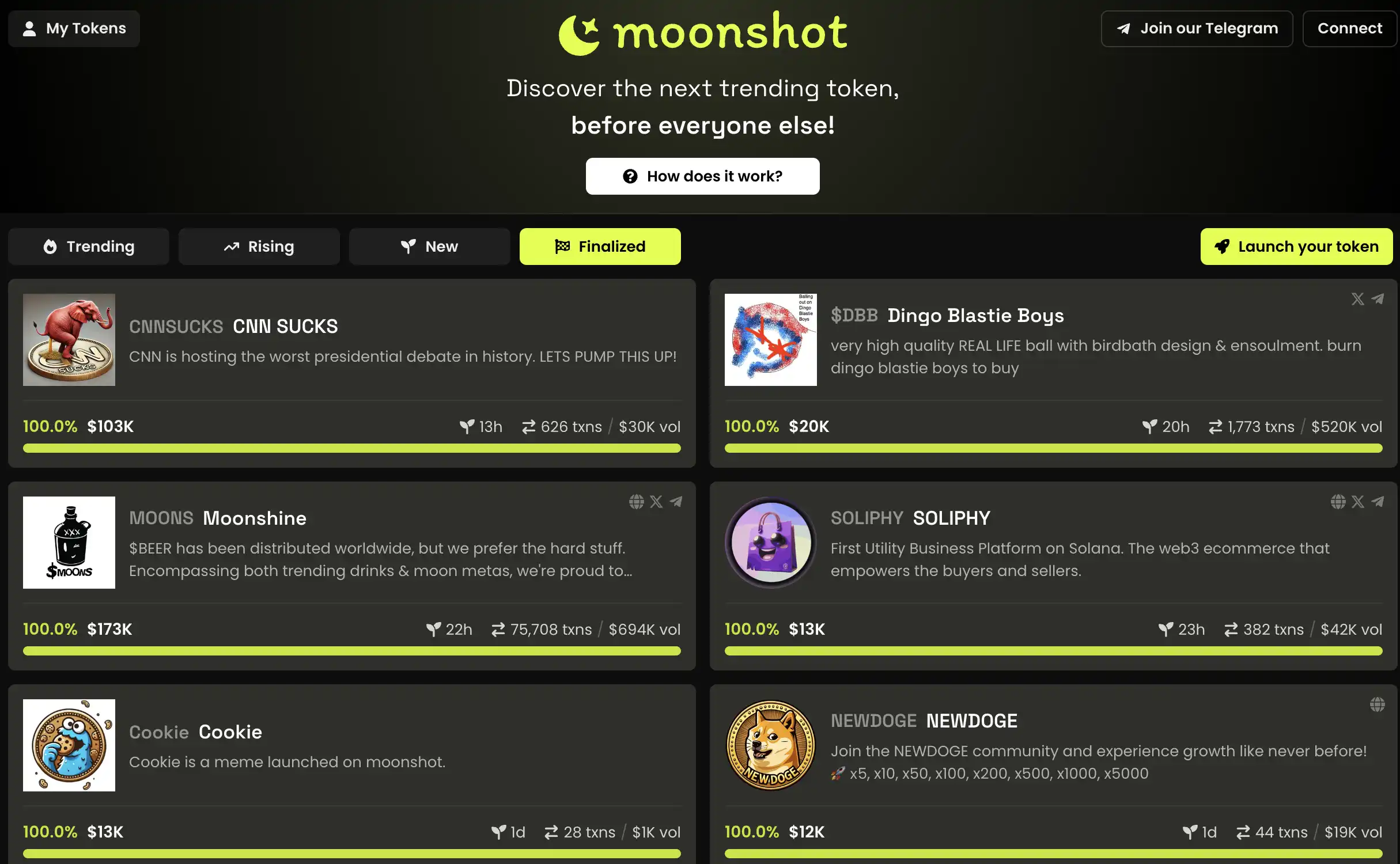

Three days ago, DEX Screener launched the token issuance platform Moonshot. On its first day, over 7,000 tokens were released. At the same time, Solana received community recognition for launching the blinks feature, which allows trading tokens on Twitter. The meme coin SC saw a surge of over 100 times in two days, indicating that the market is eager to grab a piece of the token issuance platform's pie, and users are looking forward to new stories following Pump.fun.

After all, the history of crypto technology has unprecedentedly and significantly lowered the speed and threshold for asset issuance and trading, and its potential application market is still vast. As long as the community's demand for "monetizing attention" persists, there will still be narratives to tell in the crypto market.

What would happen if live streaming occurred in Web3?

In the traditional internet, the "attention economy" industry has developed for about 20 years, transitioning from forums and message boards to image and text microblogging, and then to short video and live streaming. This trajectory is also playing out in the crypto space.

On May 29, Pump.fun announced the launch of its live streaming feature on the platform. For a website focused on making money from meme coins, users indeed had no demand for live streaming. However, as the most information-rich and impactful form of communication, combined with the asset issuance function, live streaming presents an exciting application scenario from the perspective of the attention economy.

Simplifying commercialization to the extreme

The path to commercialization in Web3 is entirely different from that of the traditional internet, but in terms of the attention economy, typical Web2 cases can provide some insights for the crypto industry.

Take Kuaishou as an example. In 2013, Kuaishou, which had been established for less than two years, decided to transform from a GIF-making tool into an internet community. Users began producing content on Kuaishou, recording and sharing their lives and creativity through short videos, and interacting with fans. Unlike emerging platforms like Douyin, Kuaishou's user base is primarily "average social individuals," mainly consisting of young people from second- and third-tier cities.

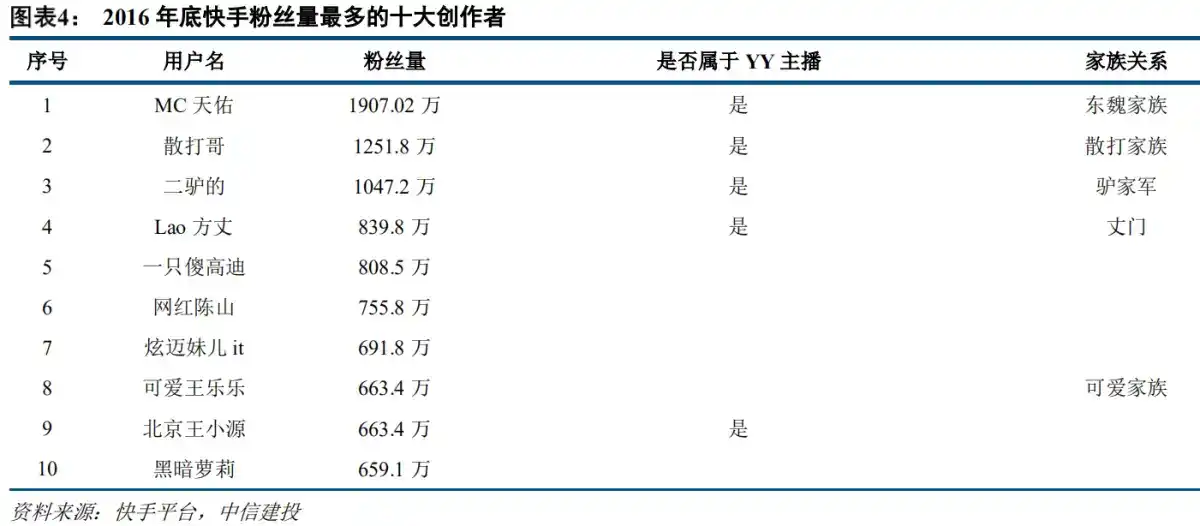

In 2014, YY streamers with a loyal fan base in the sinking market joined Kuaishou, which had a monthly active user count of 1 million at that time. By the end of 2016, Kuaishou's monthly active users surpassed 64 million. During the rapid growth of Kuaishou in these two years, YY streamers occupied the top four positions on Kuaishou's list of leading streamers.

Kuaishou maintained the characteristics of a community in the sinking market, not signing internet celebrities or providing traffic support. Its fair algorithm mechanism encouraged the vigorous development of UGC content. Compared to other products at the same time, Kuaishou stood out with its unique "decentralized community" model.

In 2017, Kuaishou took the lead in seizing the live streaming dividend, becoming the largest single live streaming platform in the world. According to Kuaishou's prospectus, from 2017 to 2019, the company's revenues were 8.3 billion, 20.3 billion, and 39.1 billion yuan, respectively, with live streaming revenues of 7.9 billion, 18.6 billion, and 31.4 billion yuan, accounting for 95.18%, 91.63%, 80.31%, and 68.38% of total revenue. It is evident that live streaming was Kuaishou's core business at that time and its foundational aspect.

After this rapid development, Kuaishou had to adjust its content ecosystem. After all, traditional Web2 companies need to undergo commercial transformation. In this process, only those content producers who have high audience consumption levels, meet traditional social values, and survive in fierce competition can remain in the end.

Looking back, it is more accurate to say that Kuaishou targeted the new user market in the attention economy rather than simply succeeding in the sinking market. Similarly, token issuance platforms aimed at crypto newcomers do not need to consider "commercial transformation."

In traditional internet giants, whether content platforms or shopping platforms, there is a desire to show users "here are good things worth watching/buying," because only content that is recognized and loved by more users has commercial value, which in turn brings profits to the platform. However, Pump.fun does not require commercialization; its profit model is extremely simple and pure. It only needs to show "there are enough coins and traders here," and as long as there are transactions, Pump.fun can make money.

Currently, although Pump.fun has opened comment sections and live streaming features, users log onto Pump.fun primarily to complete the buying or selling process. Discussions about meme coins mainly occur on Twitter, and meme coin developers who want to live stream often choose platforms like Twitch or Kick for promotional purposes.

On the Pump.fun interface, users can only choose based on the number of comments and the market value of the tokens. If there were a live streaming section, would "live streaming miracle coins" emerge on Pump.fun?

Human Nature Game and Regulatory Challenges

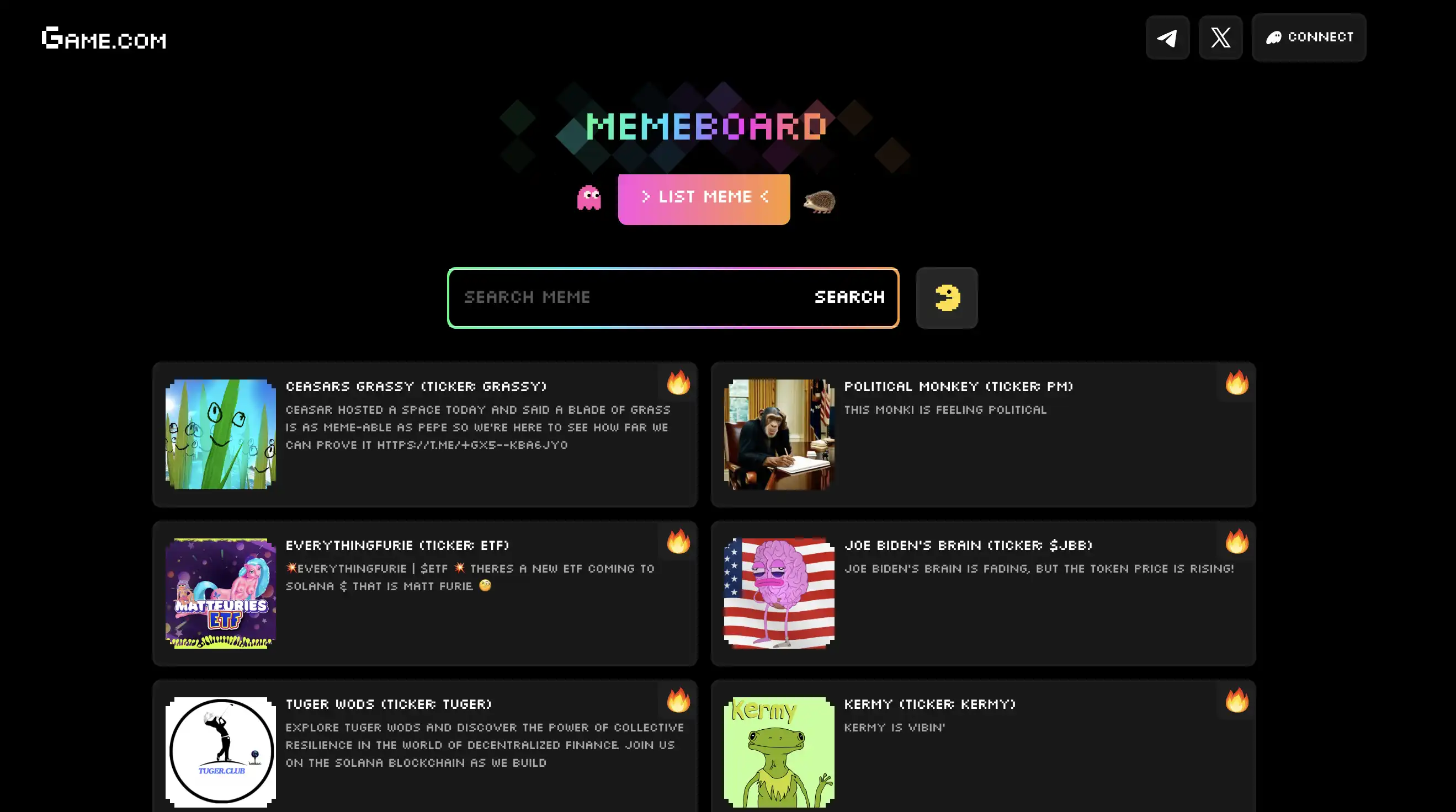

Currently, some meme display platforms have emerged, such as Game.com, which just surpassed 7,000 followers on Twitter, offering paid listing services for tokens. By paying 0.8 SOL, users can publish their issued meme coins on this platform to gain more attention.

However, the Pump.fun team seems uninterested in exploring more on existing services. After all, a small team that has earned over 40 million dollars in six months and maintains a stable daily income of 600,000 dollars has little motivation to disrupt the product or innovate the narrative; positioning itself as a "tool" is sufficient.

As more newcomers flood into the crypto space, live streaming may become a differentiating label for other token issuance platforms like Moonshot.

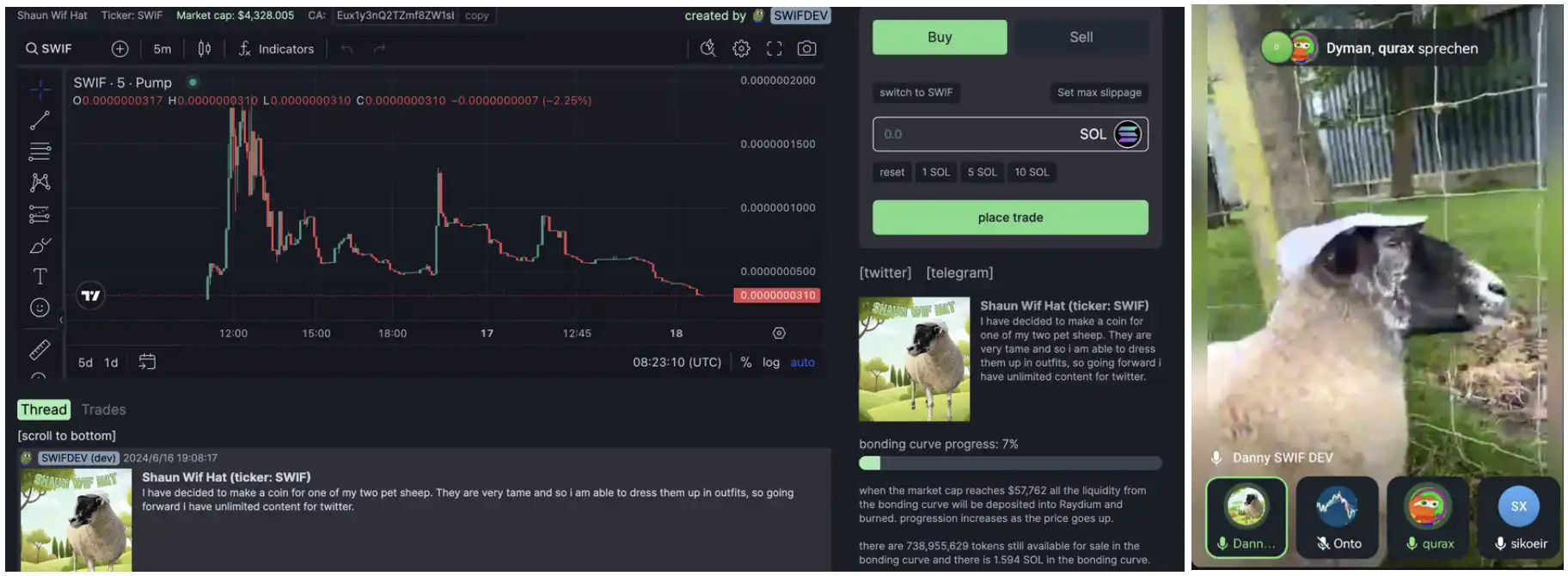

However, the past failures of several "x to earn" projects in Web3 have shown that no matter how clever the design, it cannot challenge human nature. On June 13, a user launched a meme coin themed around a sheep wearing a hat on Pump.fun and live streamed at the same time. But shortly after the live stream began, while the comments were still discussing the sheep's actions, the sniper who bought the token at launch quickly sold most of their tokens at a high price, causing the token price to plummet.

After the token crash, the meme coin issuer explained in the comments, "My token balance remains unchanged and can be verified through Solscan. If I were just trying to make quick money, why would I live stream my sheep but not sell my tokens?"

The lack of selling may be because the token had not yet gone on Raydium. In the end, this token did not reach a market value of 60,000 dollars. The issuer never live streamed his sheep again.

Additionally, regulatory issues are also something that such platforms need to pay attention to. If the live streaming format is combined with asset issuance, various extreme and vulgar behaviors to attract attention are bound to emerge. When Pump.fun announced the launch of its live streaming feature, the community's biggest concern was how the platform would review extreme content. When token issuers post inappropriate behaviors, such as pornography or more extreme actions, should Pump.fun intervene to prevent potential criminal activities?

Conclusion

Returning to the meme coin issuers mentioned at the beginning of this article, one can sense the content ecosystem of traditional internet short video platforms from years ago. After several years of development, these platforms have explored highly lucrative business models.

As a content form that provides "immersive experiences," live streaming has made people realize how simple the aggregation speed of "traffic" can be through imaginative forms. Meanwhile, channels for monetizing traffic, such as tipping and selling goods, have allowed content producers to possess a certain degree of power to counterbalance platform capital.

In the crypto space, the platform's control dissipates in an instant. Yet attention remains the core driving force propelling the entire market forward. If live streaming were to occur in Web3, what kind of stories would unfold? Can the extreme utilization of traffic find new forms of expression in a decentralized environment?

Looking back over the years, amidst the continuous rupture and reconstruction of consensus, the crypto industry has seen countless projects transition from "innovation" to collapse. The emergence of Pump.fun is just the beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。