Bitcoin entered a volatile downward mode after briefly reaching a historic high of $99,588 over the recently concluded weekend. Yesterday evening, it began a significant correction from around $98,500, dropping to a low of $95,745 at midnight. However, as of the time of writing, it has rebounded somewhat, currently quoted at $98,528, down 0.13% in the last 24 hours.

In the context of Bitcoin's decline, the total liquidation amount across the cryptocurrency market in the past 24 hours reached $495 million, with long positions liquidating $364 million and short positions liquidating $131 million, affecting over 193,000 people.

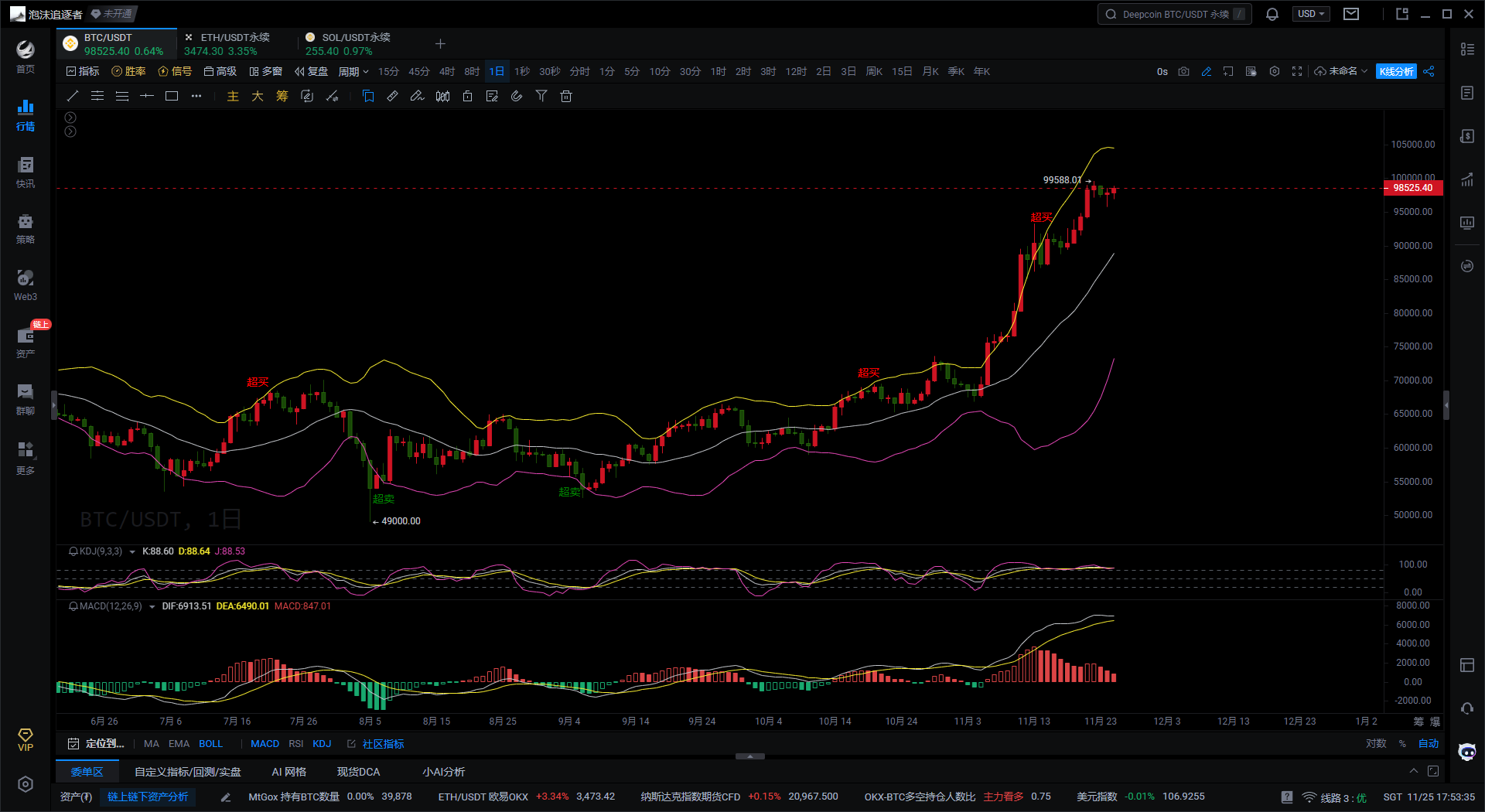

Bitcoin Daily Chart

Firstly, according to the Bollinger Bands indicator on the Bitcoin daily chart, the current price is operating near the upper band and has briefly broken above it, indicating that bulls remain strong. However, the excessive upward movement suggests a potential for a correction. If the price continues to operate near the upper band without breaking below the middle band, it indicates that the bullish pattern remains unchanged. Conversely, if the price breaks below the middle band, a deeper correction may occur.

Secondly, based on the KDJ indicator on the Bitcoin daily chart, both the K and D lines are at high levels, and the J line is already in the overbought zone. The K and D lines show signs of turning downward, indicating a risk of correction in the short term. If the KDJ lines form a death cross, downward pressure will increase. However, if it can maintain high-level consolidation without forming a death cross, there may still be potential for further upward movement.

Lastly, according to the MACD indicator on the Bitcoin daily chart, both the DIF and DEA lines are operating above the zero axis, but the two lines are gradually converging. If a death cross forms subsequently, the market will likely begin a correction. Although the MACD histogram is red, it shows signs of shortening, indicating that upward momentum is gradually weakening.

Bitcoin Four-Hour Chart

Firstly, according to the Bollinger Bands indicator on the Bitcoin 4H chart, the current price is oscillating between the middle and upper bands, with the upper band exerting some pressure on the price. The middle band serves as support; if it breaks below the middle band, the price may move towards the lower band. If the price returns to the upper band and breaks through, it will continue to rise.

Secondly, based on the KDJ indicator on the Bitcoin 4H chart, the KDJ lines are operating at high levels, but the K and D lines show signs of turning downward, and the J line has begun to decline, indicating short-term correction pressure after being overbought. If the K line crosses below the D line to form a death cross, it may trigger deeper downward pressure. If the KDJ continues to form a golden cross after consolidating at high levels, the upward trend will continue.

Lastly, according to the MACD indicator on the Bitcoin 4H chart, the MACD red histogram continues to shorten, indicating that upward momentum is weakening. The DIF line is also approaching the DEA line; if a death cross forms subsequently, the risk of a short-term decline will increase. If the DIF line continues to rise and moves away from the DEA line, it indicates that bullish strength still prevails.

Comprehensive Analysis: From the Bitcoin daily chart, it appears that Bitcoin is currently in a high-level consolidation phase after a strong upward movement. Both MACD and KDJ indicate that there may be adjustment pressure in the short term, but the Bollinger Bands still show bullish strength. The 4-hour level indicates signs of weakening short-term momentum, primarily reflected in the shortening of the MACD red histogram, the downward turn of KDJ, and the pressure from the upper Bollinger Band. However, the middle Bollinger Band still provides support, and the overall trend has not completely weakened.

In summary, the following suggestions are provided for reference:

Suggestion 1: Buy Bitcoin on a pullback to around $98,000-$97,800, targeting $99,800-$100,000, with a stop loss at $97,400.

Suggestion 2: Short Bitcoin on a rebound to around $99,800-$100,000, targeting $97,600-$97,400, with a stop loss at $100,400.

Instead of giving you a 100% accurate suggestion, I prefer to provide you with the right mindset and trend. After all, teaching someone to fish is better than giving them a fish; suggestions may earn you a moment, but the mindset earns you a lifetime! The focus is on the mindset, grasping the trend, and planning positions. What I can do is use my practical experience to help you make investment decisions and manage operations in the right direction.

Time of writing: (2024-11-25, 18:00)

(Written by - Daxian Talks Coins) Disclaimer: Online publication has delays; the above suggestions are for reference only. The author is dedicated to research and analysis in the fields of Bitcoin, Ethereum, altcoins, forex, stocks, etc., with years of experience in the financial market and rich practical operation experience. Investment carries risks; proceed with caution. For more real-time market analysis, please follow the official account Daxian Talks Coins for discussion and exchange.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。