Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

BTC's first attempt to break the 100,000 USD mark seems to have temporarily failed.

From last night to early this morning, BTC experienced its largest "small pullback" in the past half month. According to OKX market data, BTC dropped to 92,601.6 USDT this morning, and as of the time of writing (around 10:30, with all market data taken from this time), it is reported at 94,620 USDT, a 24-hour decline of 2.91%.

The reason for emphasizing it as a "small pullback" is that although BTC has dropped more than 6,000 USDT from yesterday's peak (98,876 USDT), the maximum decline is less than 5% based on the current price benchmark of 90,000 USD, which somewhat deviates from our previous thinking patterns.

The most intuitive difference in this pullback is that Alt-coins did not experience the usual "immediate collapse" upon seeing the big brother retreat. Most Alt-coins, which had been surging for several days, have encountered a slowdown but generally show no significant decline, and some even maintain a slight increase.

ETH, which is in a state of catching up, has surprisingly "held strong," currently reported at 3,452.2 USDT, with a 24-hour increase of 3.27%, along with ecosystem projects like LDO, ENS, and EIGEN temporarily maintaining strong performance.

SOL, which just set a new high, has entered a pullback phase, currently reported at 239.21 USDT, with a 24-hour decline of 4.33%. Additionally, possibly affected by the DEXX hacker starting to sell off, the Solana ecosystem's meme sector has experienced a widespread decline, with MOODENG, SLERF, and BONK all dropping over 10%.

In the U.S. stock market, MicroStrategy (MSTR) closed at 403.45 USD, down 4.37%; Coinbase (COIN) closed at 312.22 USD, up 2.49%; MARA Holdings (MARA) closed at 26.42 USD, up 1.5%.

CoinGecko data shows that the total cryptocurrency market cap has fallen back to 3.41 trillion USD, shrinking by 2.8% in 24 hours. The trading enthusiasm among crypto users has also significantly increased, with the Alternative fear and greed index today reporting 79, still in the "extreme greed" category, but down from last week's average of 90.

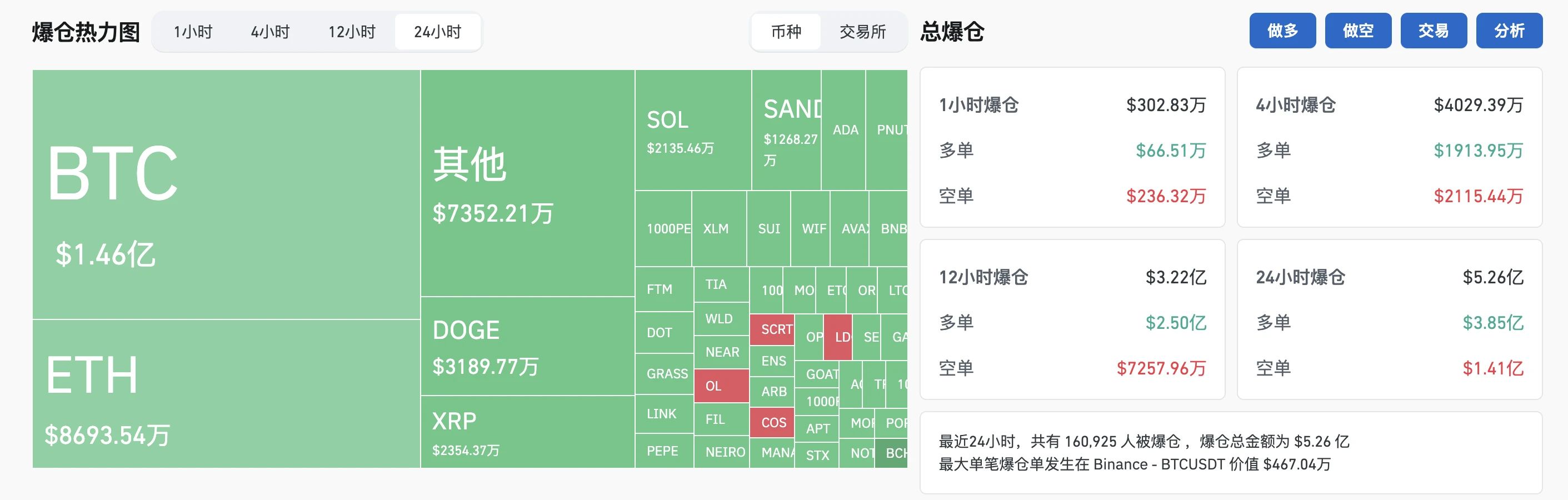

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the total liquidation across the network reached 526 million USD. Although long positions accounted for more than half of the liquidations, short positions also reached a significant 141 million USD. In terms of cryptocurrencies, BTC saw liquidations of 146 million USD, while ETH saw 86.93 million USD.

Causes of the Pullback: Profit Taking & Overbought Adjustment

Regarding the short-term pullback faced by BTC, various institutions and traders have provided their market judgments.

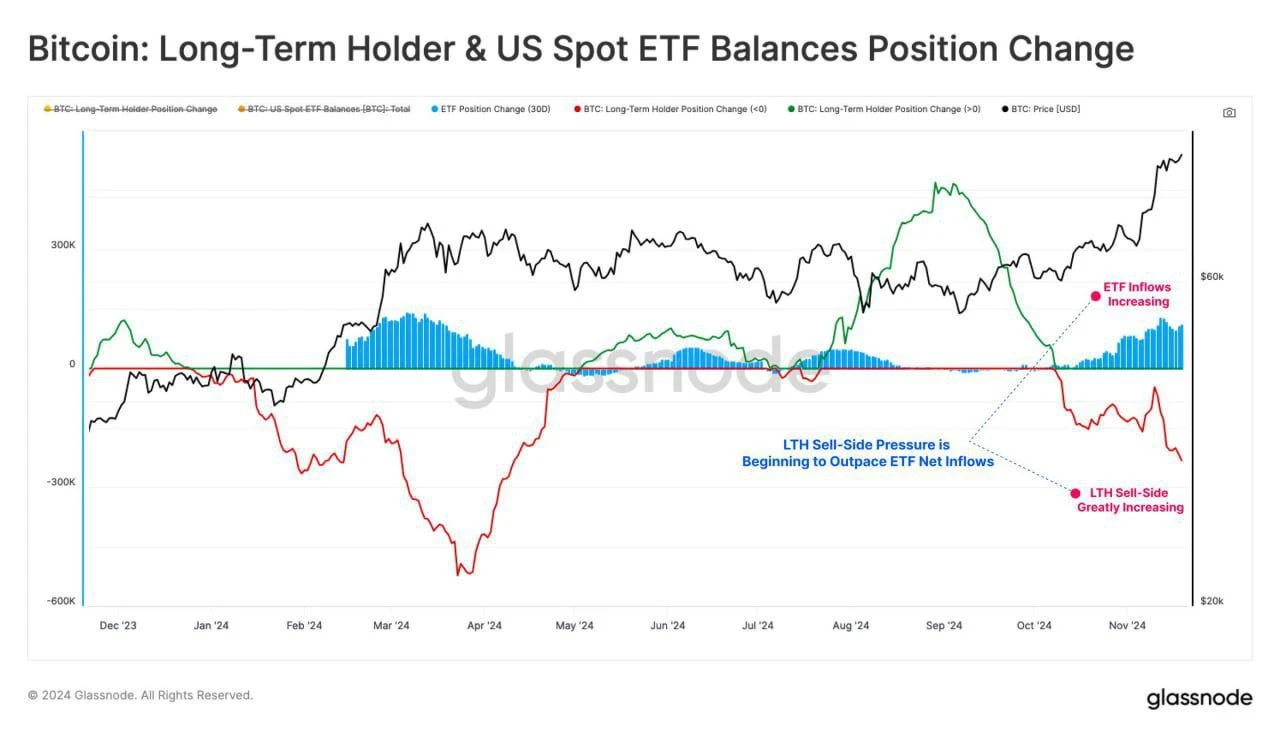

Bitfinex mentioned in its latest report that long-term holders (LTH) have begun to take profits.

Crypto Banter analyst Kyledoops also pointed out the same data, noting that long-term Bitcoin holders have sold 128,000 BTC, although Bitcoin spot ETFs absorbed 90% of the selling pressure during the same period.

Another set of opinions focuses on the market's overbought structure.

Stephane Ouellette, CEO of cryptocurrency investment firm FRNT Financial Inc., stated, “Since Trump's victory, Bitcoin has been overbought, so a stagnation in the upward trend is a normal phenomenon.”

Tony Sycamore, a market analyst at IG Australia Pty, also stated that the recent Bitcoin pullback is “a much-needed correction to eliminate overbought data, rather than a reversal or any sinister situation.”

Market Forecast: Is ETH More Optimistic?

As for the future market trends, opinions vary.

Adrian Przelozny, CEO of cryptocurrency exchange Independent Reserve, stated that the current bullish market sentiment will last until 2025; meanwhile, well-known trader Eugene expressed that he has taken profits on long positions and advised investors to remain cautious.

Relatively speaking, the subsequent trend of ETH, which has begun to enter a catch-up phase, seems more optimistic.

On one hand, while BTC spot ETFs have started to see net outflows, ending a week of net inflows; conversely, ETH spot ETFs have seen two days of net inflows, also ending a week of net outflows.

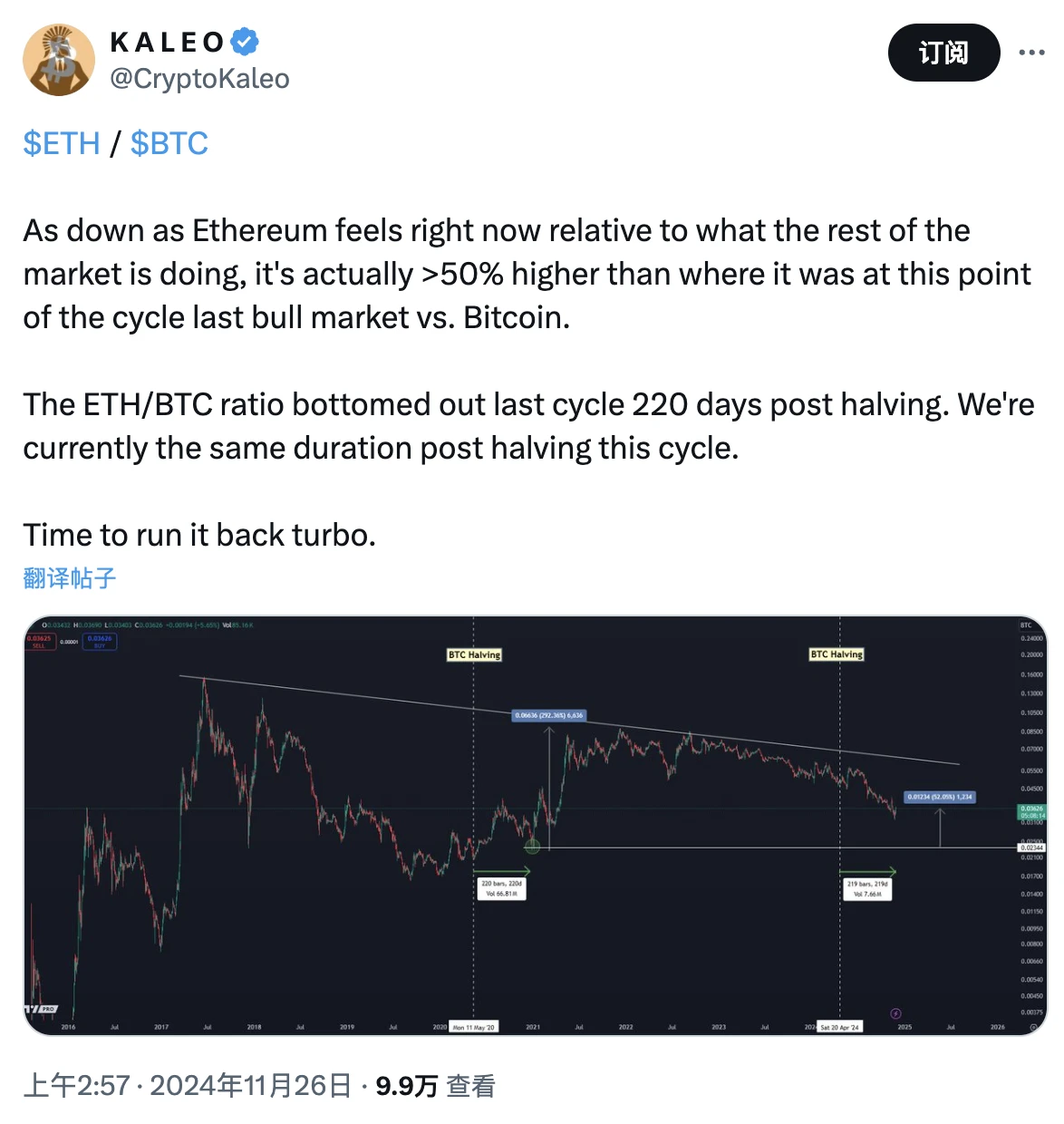

At the same time, well-known analyst Kaleo shared historical data indicating that in the last bull market, the ETH/BTC exchange rate bottomed out 220 days after the halving, and today happens to be the 220th day after this halving…

Considering that ETH has recently shown a rare upward trend against the market, it is not ruled out that a similar scenario may play out again.

As for where the main funds of old coins are, Ryan Sean Adams, co-founder of Bankless, recently tweeted with clear direction—following Meme lord Murad's call for Chinese meme coin players to join the meme coin super cycle, Ryan posted in Chinese on X platform stating, "Ethereum is money"** (similar to a machine translation of "Ethereum is money"), clearly signaling a buy for Ethereum. Previously, he had (also somewhat vacuously) stated, “When demand finally arrives, ETH will experience an unprecedented supply shock, and then Ethereum will be in short supply.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。