Bitcoin, as the leader of the cryptocurrency market, has always been the focus of investors. Recently, Bitcoin reached a high of $99,000 and then fell back, leading investors to speculate whether Bitcoin's price can break through the six-figure mark. Predictions from Kalshi and Polymarket reveal market expectations to some extent.

According to the latest market data from AICoin, Bitcoin is currently priced at $94,503, down 4.63% from the $99,000 high, with a market cap share of 55.91%.

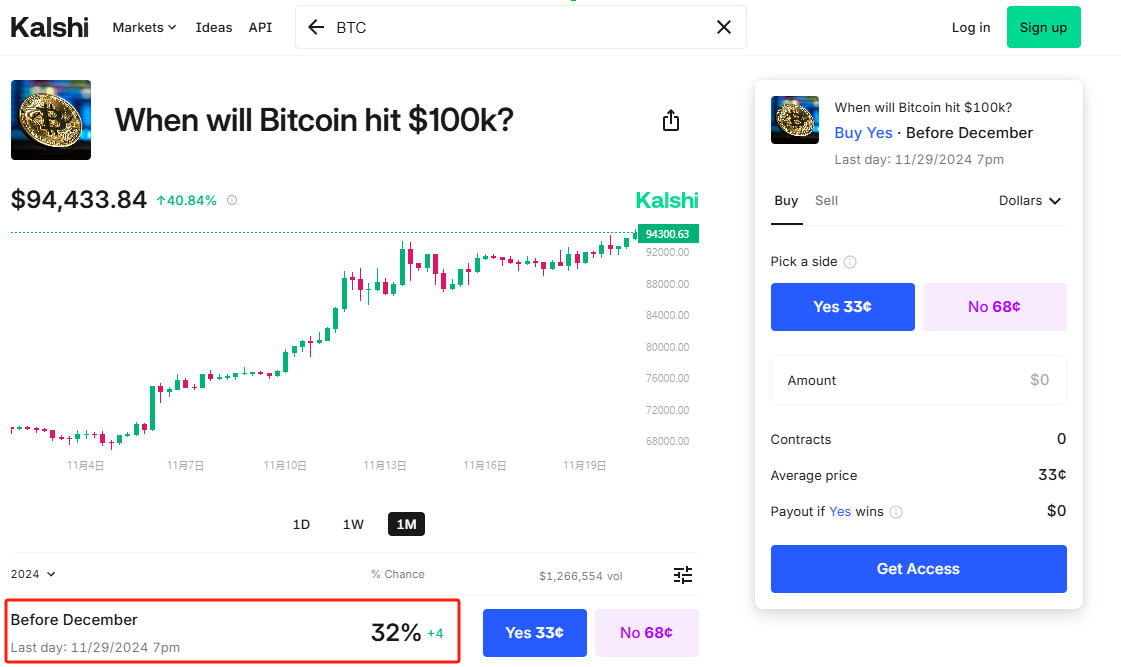

Short-term Correction, Low Probability of Breaking $100,000 Before December

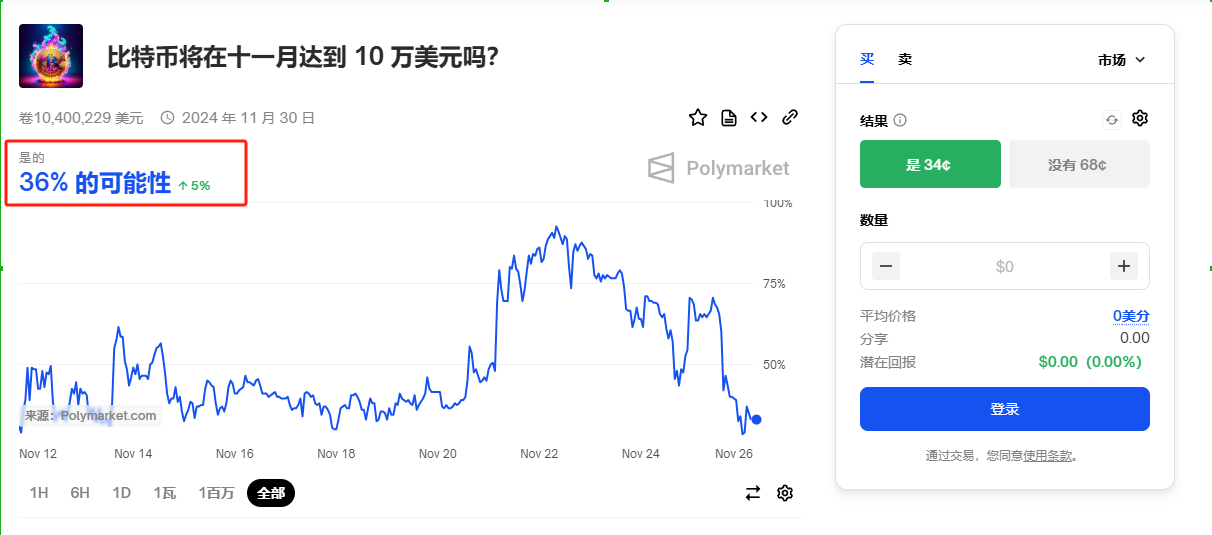

Kalshi and Polymarket are two active prediction market platforms that estimate the likelihood of events through user trading and market data analysis.

According to the latest data, Kalshi currently estimates that the probability of Bitcoin breaking $100,000 before December 1, 2024, is low at 32%. Compared to predictions from a few days ago, this number has recently declined slightly. This means that each "yes" contract is priced at 33 cents, while the "no" contract is priced at 68 cents.

Image Source: Kalshi

On Polymarket, traders estimate the probability of Bitcoin reaching $100,000 before December 1, 2024, is also low at 36%. Just yesterday (November 5), this prediction probability remained above 50% until before 9 PM, indicating a noticeable decline in market confidence regarding Bitcoin reaching $100,000 before December.

Image Source: Polymarket

The prediction probabilities from Kalshi and Polymarket indicate that the market does not have strong confidence in Bitcoin reaching six figures in the short term. This may be due to concerns about whether Bitcoin can stabilize at high levels, coupled with the inherent volatility of the cryptocurrency market. Investors seem more inclined to hold stablecoins or traditional financial assets during uncertain times.

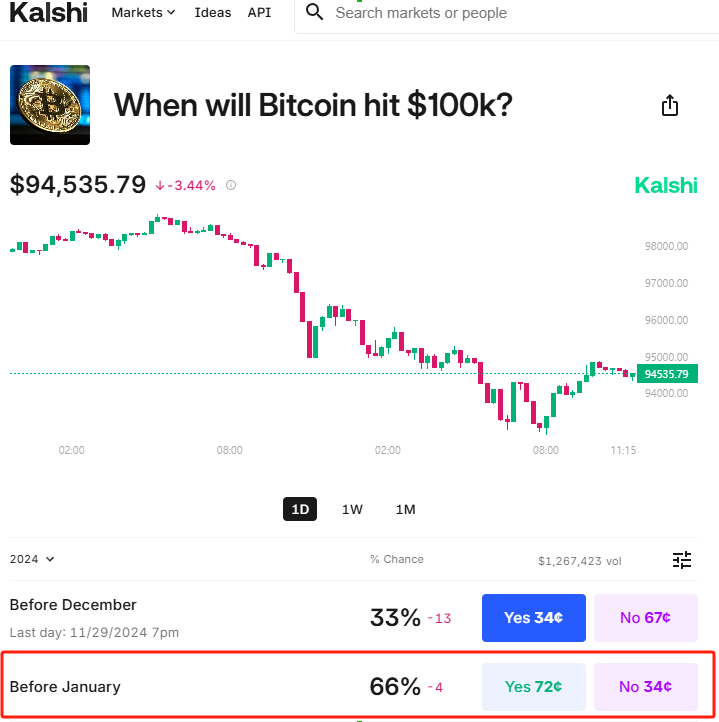

Long-term Bullish, Probability of Breaking $100,000 by Year-End Exceeds 60%

According to the latest data, Kalshi estimates that the probability of Bitcoin breaking $100,000 before January 1, 2025, exceeds 60%, reaching 66%. Although this number has slightly declined compared to predictions from a few days ago, it still remains above 50%, indicating that the market still believes Bitcoin will break the $100,000 psychological barrier during this bull market.

Image Source: Kalshi

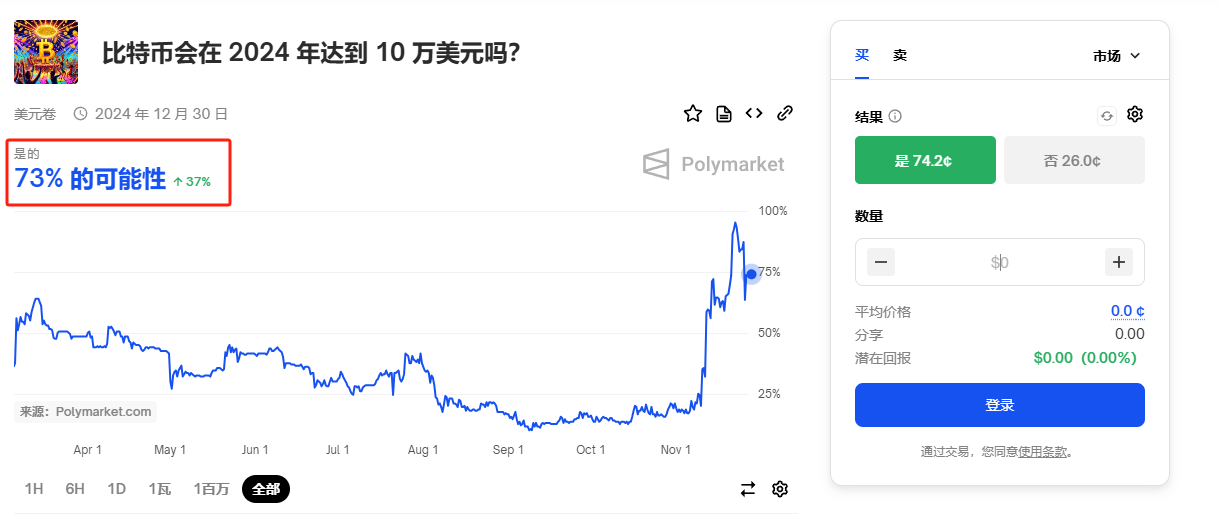

On Polymarket, traders estimate the probability of Bitcoin reaching $100,000 before January 1, 2025, is as high as 73%, significantly exceeding the 50% probability.

Image Source: Polymarket

This indicates that although Bitcoin faces correction pressure in the short term, the market remains optimistic about Bitcoin's long-term prospects. This optimism is primarily driven by several factors, including global inflation pressures prompting investors to seek safe-haven assets, further solidifying Bitcoin's status as digital gold. Additionally, Trump's election has brought new policy support for Bitcoin. The market generally expects that the Trump administration may adopt a more crypto-friendly policy, further driving up Bitcoin's price.

IG Australia Pty market analyst Tony Sycamore stated that the recent Bitcoin pullback is a "much-needed correction to eliminate overbought readings, rather than a reversal or any sinister behavior."

Market trader Crypto Jackson also tweeted that despite today's pullback, there is no doubt that the crypto market is in a bull market.

Image Source: x

Conclusion

Overall, while Bitcoin's price may be affected by market volatility in the short term, the long-term outlook remains promising. With continued interest from institutional investors and changes in the global economic environment, the goal of Bitcoin breaking $100,000 by year-end remains achievable. In the coming months, market participants should closely monitor Bitcoin's price movements, as well as changes in policy and the economic environment, to better seize investment opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。