Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

Last month, the meme trading platform Moonshot became popular, with the community claiming it solved the "last mile" problem of meme tokens and had a strong listing effect. In our article "Promoting Meme Barometer, Does Moonshot Really Have a Listing Effect?," we verified through backtesting that the listing effect of Moonshot is extremely short-lived, significantly effective only around the 5-minute mark, with no long-term benefits, which is inconsistent with community claims.

However, last week, after CHILLGUY was listed on Moonshot, its market cap surged from $16 million to $200 million in one day, and reached a market cap of $500 million four days later.

To explore whether Moonshot has reversed the fundamental rule of "short-lived listing effects," we reviewed the price data of tokens listed on Moonshot over the past week, aiming to verify the accuracy of our conclusions once again.

Short-term Listing Effect Enhanced, Long-term Still Ineffective

In our previous article, we concluded that the price increase of Moonshot tokens is significant in the first 5 minutes, slightly differentiated in the first hour, begins to diverge after 4 hours, and ultimately most tokens trend towards zero.

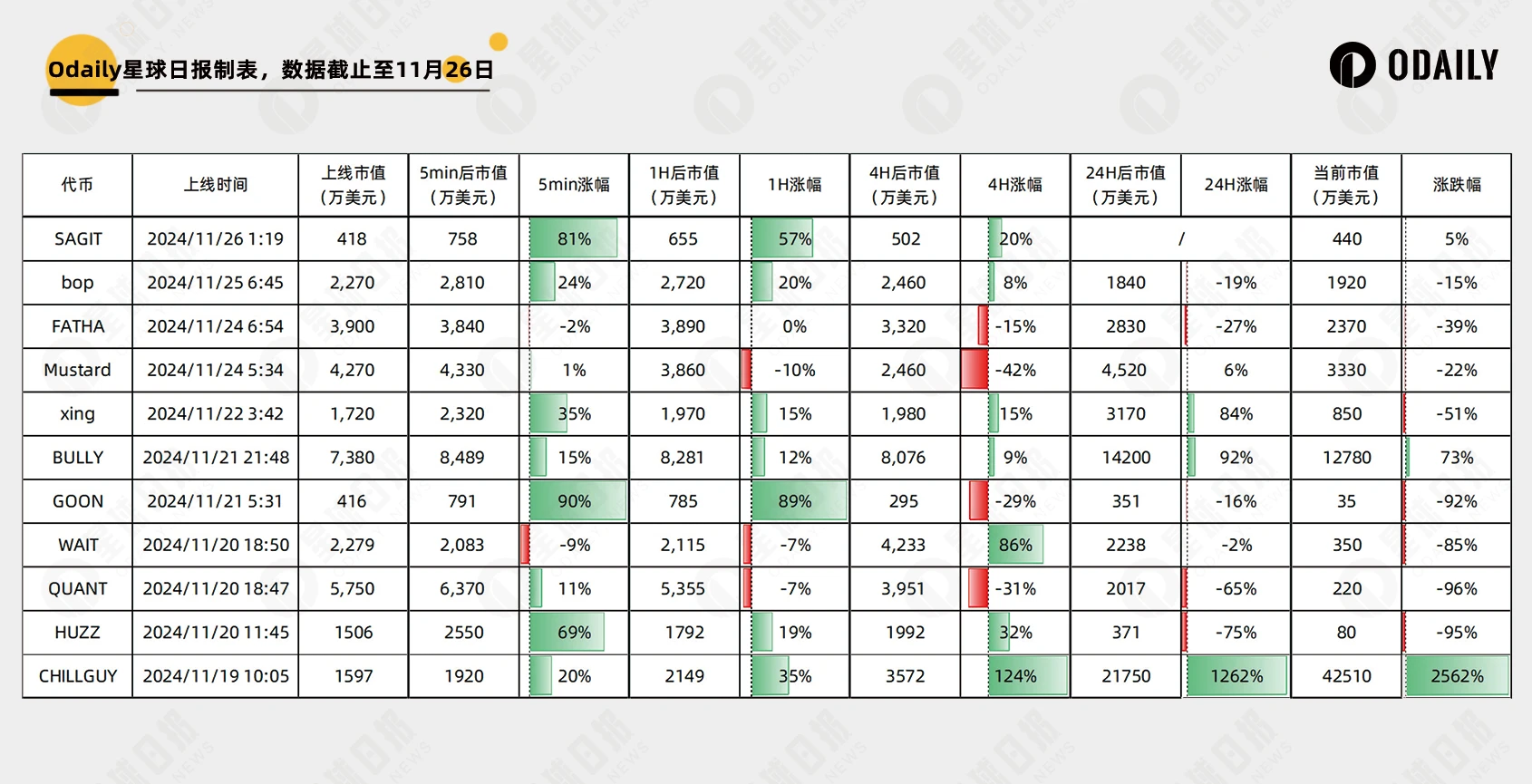

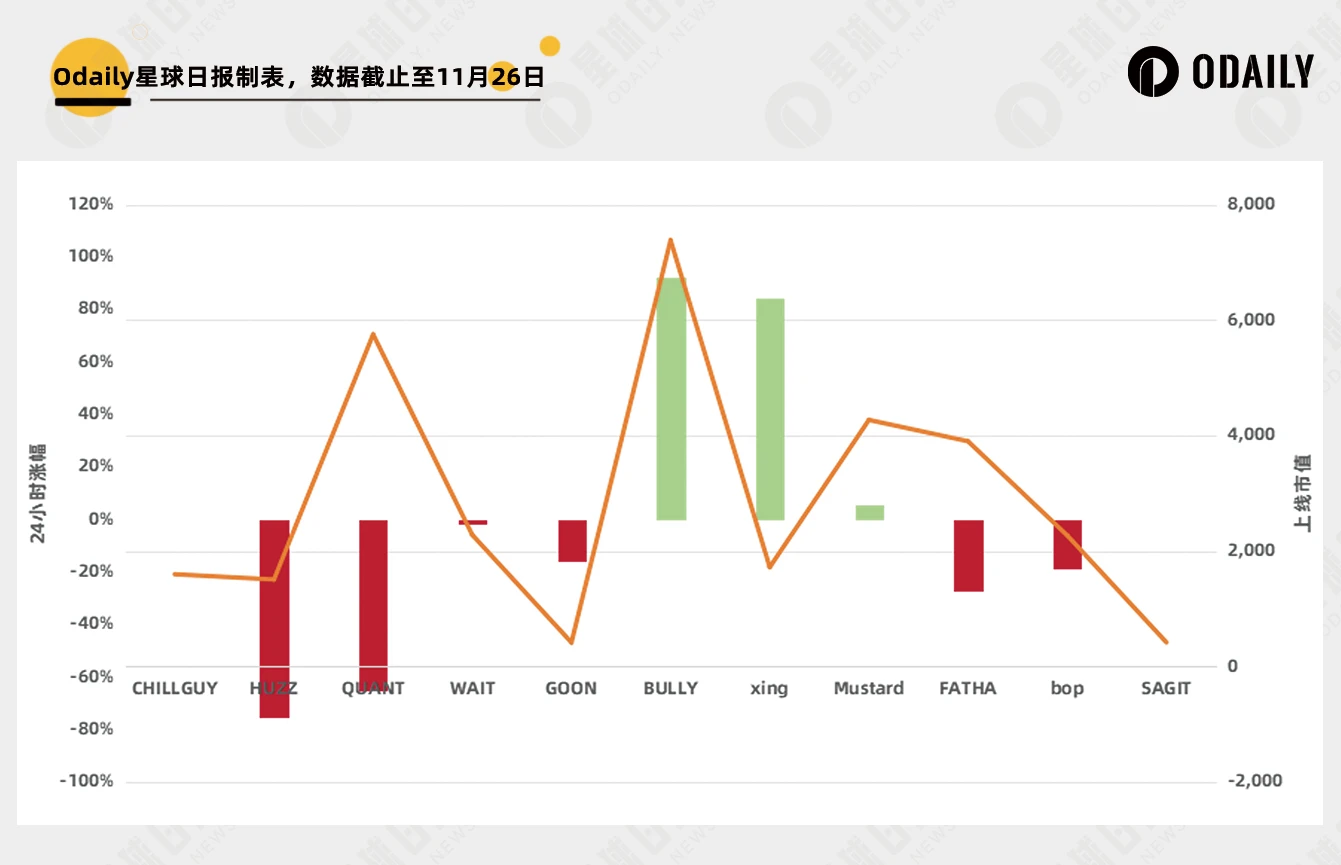

The price changes of the 11 tokens listed in the past week at 5 minutes, 1 hour, 4 hours, 24 hours, and to date are shown in the following chart.

It can be seen that the average price increase in 5 minutes rose from 14.7% a month ago to 30.6%, and most tokens can maintain this increase in the 1-hour phase. This indicates that Moonshot has likely become the domain of "quantitative announcement bots," with the 5-minute price increase almost entirely driven by news arbitrage from bots.

Extending the time frame, price changes begin to diverge; apart from CHILLGUY, most tokens continue to decline, with some tokens nearing zero.

Detailed Data Display

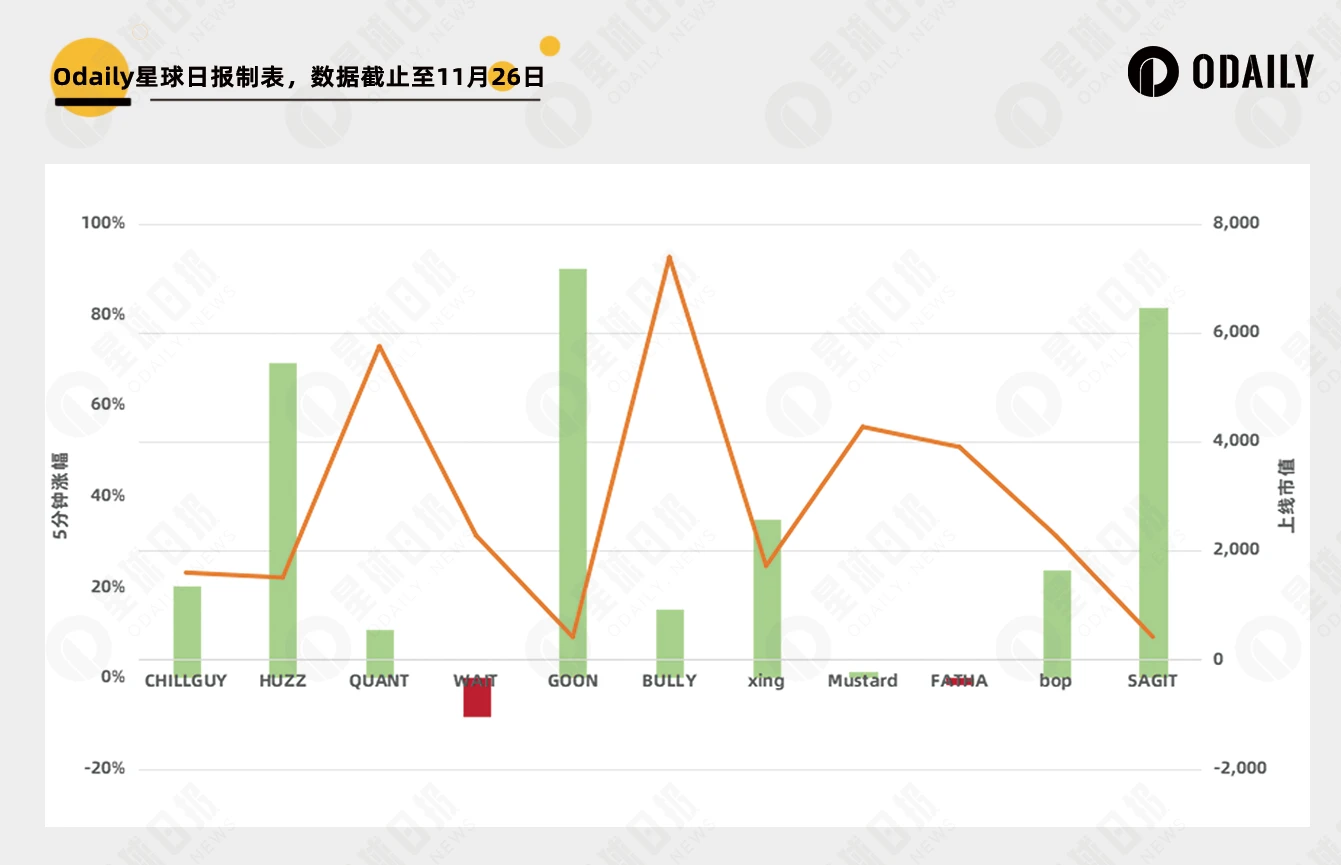

The price changes of Moonshot tokens in the first 5 minutes are shown in the following chart, where we have included the closing market cap one minute before the token listing for comparison. It is evident that the 5-minute price increase is negatively correlated with the initial market cap; the larger the market cap, the less likely it is to rise, which further confirms that the price increase during this phase is driven by news arbitrage bots.

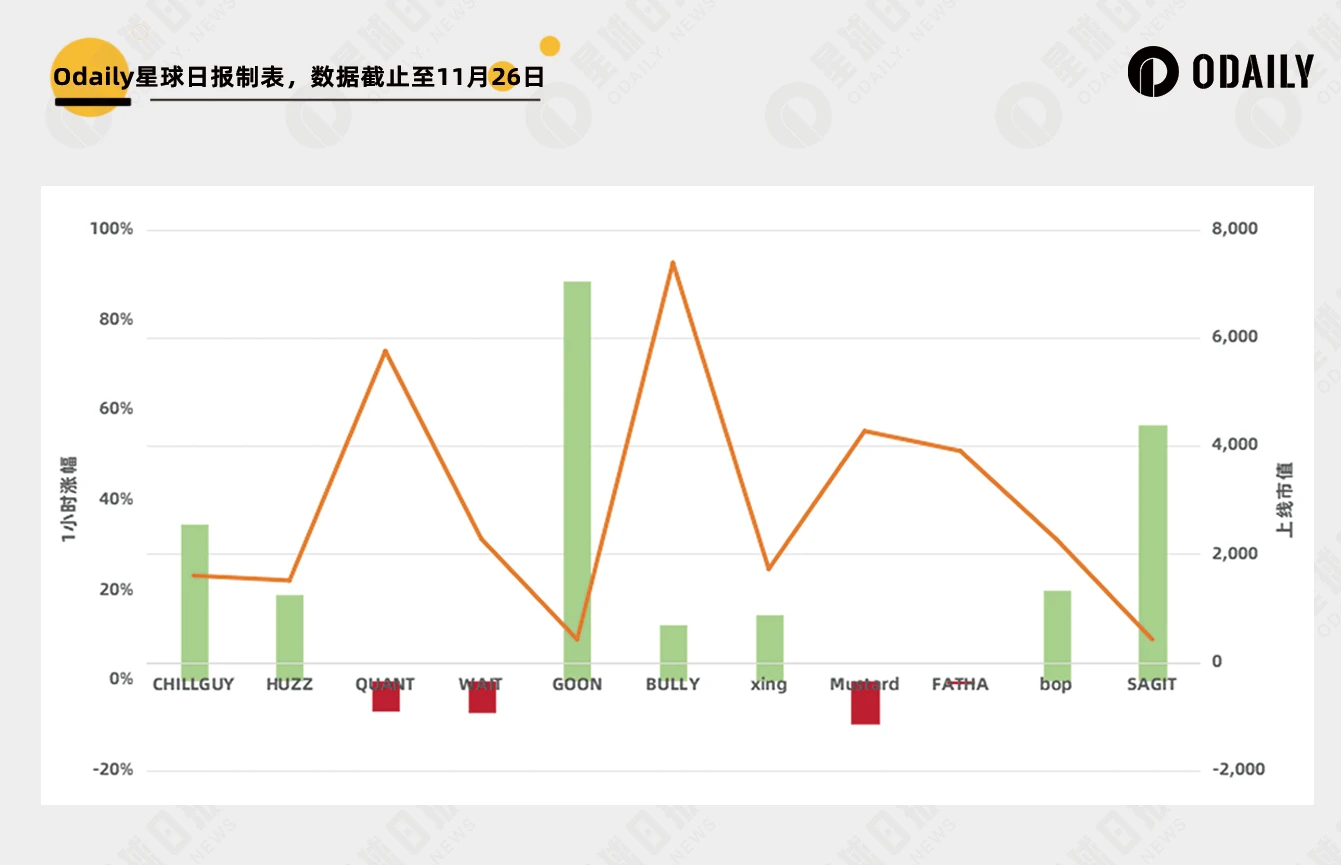

The price changes of tokens in the first hour are shown in the following chart, where most maintain their original increases. The author speculates that this may be due to the exchange between bots and real users.

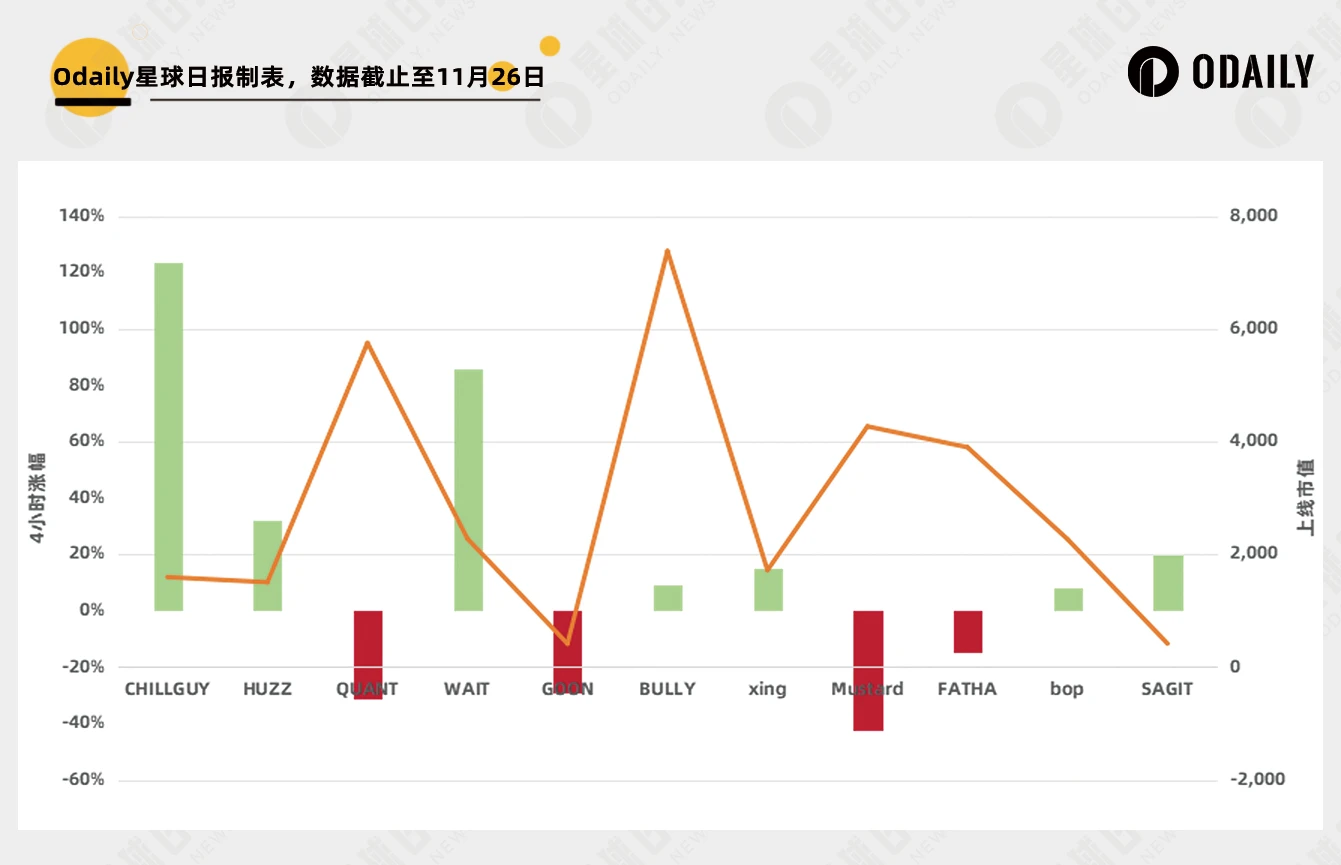

The price changes at 4 hours and 24 hours are shown in the following chart (excluding CHILLGUY due to its excessive increase), where the price changes of various tokens begin to diverge, but most "break" and continue to decline. By the 24-hour mark, 6 out of 10 tokens had decreased, with the average price increase for CHILLGUY at 5% over 4 hours, and a price decrease of -2% over 24 hours.

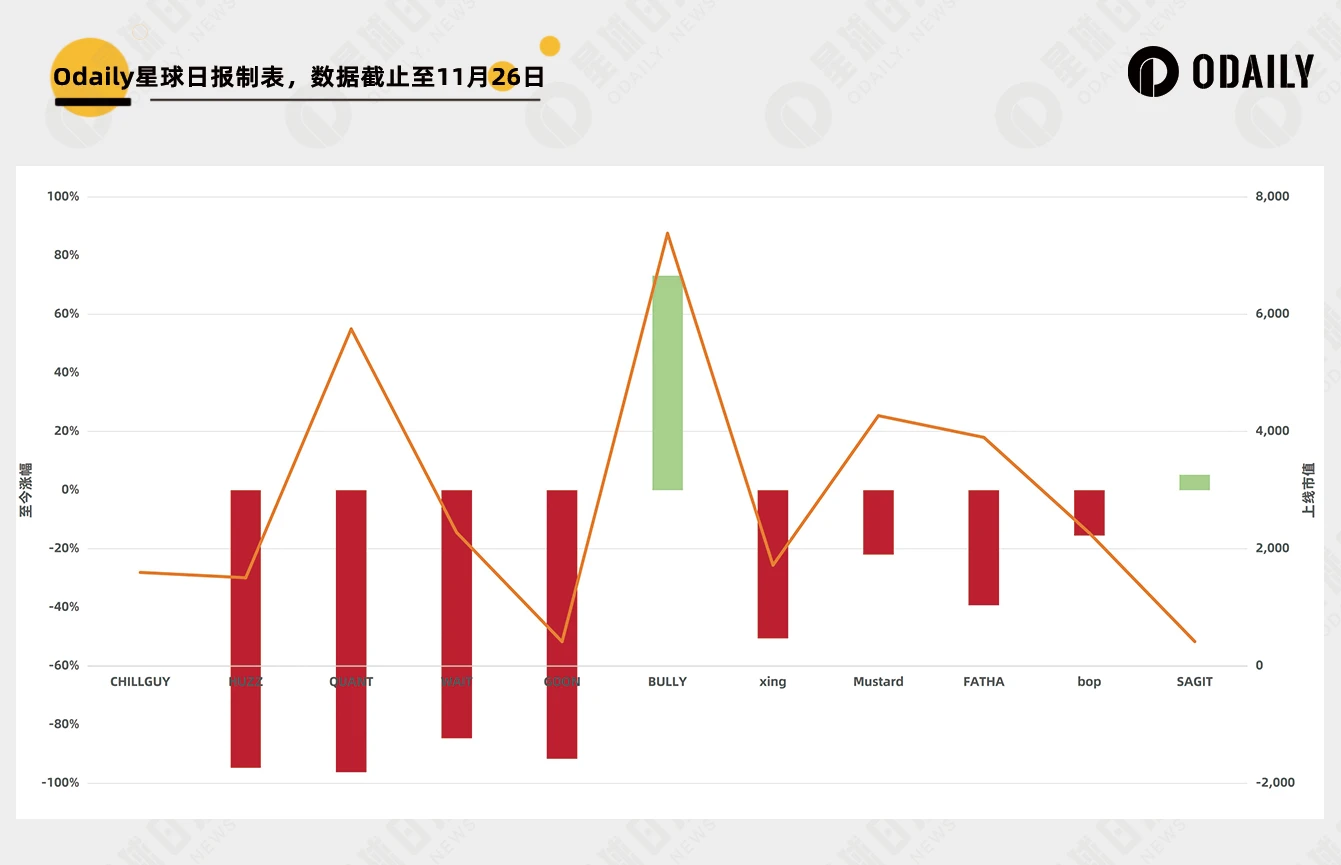

The price changes from the announcement of the token to now are shown in the following chart, with an average decrease of 41.5% excluding CHILLGUY.

In summary, it is very clear that CHILLGUY is just an exception among the tokens listed on Moonshot. The "short-term listing effect" of Moonshot has been enhanced, but only arbitrage bots can profit, while the "medium to long-term wealth creation effect" still does not exist.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。