The world is bustling, all for profit; the world is in turmoil, all for profit! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends for your attention and likes, and reject any market smokescreens.

Finally escaped a disaster again, the depth of this pullback is truly enviable. Many friends are struggling with whether the market can still be bullish in the future? A rise of 20,000 points can also see a pullback of 4,000-5,000 points overnight, which is a fatal blow for contract users. For spot users, it is a test of psychological endurance. After two days of probing, including issues related to later capital levels, this wave of decline can be said to have come somewhat unexpectedly. By the time Lao Cui reacted, there was simply no time to write an article, so everyone must maintain their own mindset to view the market and not wait for Lao Cui's articles as a reference every day. To reiterate, Lao Cui's articles do not have reference value; investment is always accompanied by risks. The publication is merely a platform agreement, and everyone can just enjoy the excitement. Let's directly enter today's market theme analysis:

First, let's look at the economic threats to the cryptocurrency market. The Russia-Ukraine conflict is expanding its impact every day, even resorting to the use of highly dangerous weapons. Everyone may have slightly underestimated the Russia-Ukraine situation. After more than a thousand days of war, people have become somewhat numb, and many financial analysts have begun to overlook the military impact. It is important to understand that weapons like ballistic missiles, once launched between two nuclear powers, can directly escalate military impacts at the moment of launch. Fortunately, Ukraine is a conventional country and does not possess nuclear weapons. Yesterday, Putin directly declared that after expanding the war, nuclear weapons would be aimed at the old American territory, seemingly indicating a loss of control. The military aspect should not be something Lao Cui explains to everyone, but this aspect has seriously threatened the growth of the cryptocurrency market. At this stage, the only influence that can reverse the cryptocurrency market is the military aspect. Many friends feel that deep pullbacks are a basic operation in the cryptocurrency market, but this is not the case. Yesterday's pullback was not just in the cryptocurrency market; what about the US stock market and gold? Do not doubt the short-term safe-haven attributes; it is just that the military escalation does not have the traditional title of a safe-haven asset. Looking at gold during the pullback reveals the problem; this is not a wave of selling specifically targeting the cryptocurrency market.

The previous paragraph mentioned the trends of the US stock market and gold. The depth of their pullbacks is indeed not as intense as Bitcoin's reaction; in contrast, one must first think that Bitcoin is a financial market that has not seen a pullback since Trump took office, rising 20,000 points without a pullback. A short-term deep pullback is within our acceptable range. The reasons for the pullback have been discussed; under intense growth, there will definitely be the birth of bubbles. The depth of this pullback is the normal price that the cryptocurrency market should have. When the market feels that this round of impact will reach the 100,000 mark, the market has already encountered problems. The most concerning point is that after yesterday's deep pullback, Trump urgently purchased 1.7 million in cryptocurrency assets. Do you think there will still be a deep pullback under this news? Let me remind everyone that under the current trend, spot users must maintain a stable mindset; true growth has not yet arrived, and the larger trend will not end because of this round of deep pullback. This sudden decline may cause large funds to reassess this market.

Now let's look at the overall impact of capital levels. Bitcoin directly escaped 1 billion in assets yesterday, and 3.2 billion in the past half month. Speculative assets have basically exited the market, and the remaining assets are prepared to fight alongside us, looking at the bullish main force above 100,000. The total market value of all assets in the cryptocurrency market has already exited about 0.3 trillion in the short term, which is within a normal range. Indeed, approaching December's interest rate cut will bring about a new depth of pullback, and the hype around December's non-rate cut has begun again. The probability of not cutting rates has reached 48%. Those who have been following Lao Cui naturally understand that the interest rate cut will basically arrive on time. The strength of the dollar, from the current perspective, has basically met the requirements for the US. Looking ahead, the possibility of an interest rate cut does have some impact, but it is best to remain skeptical about the US's previous non-farm data. If one blindly believes the US data, this round of interest rate cuts should not occur. The credibility of the data is still under suspicion, and the current pullback is basically deep enough for the overall situation.

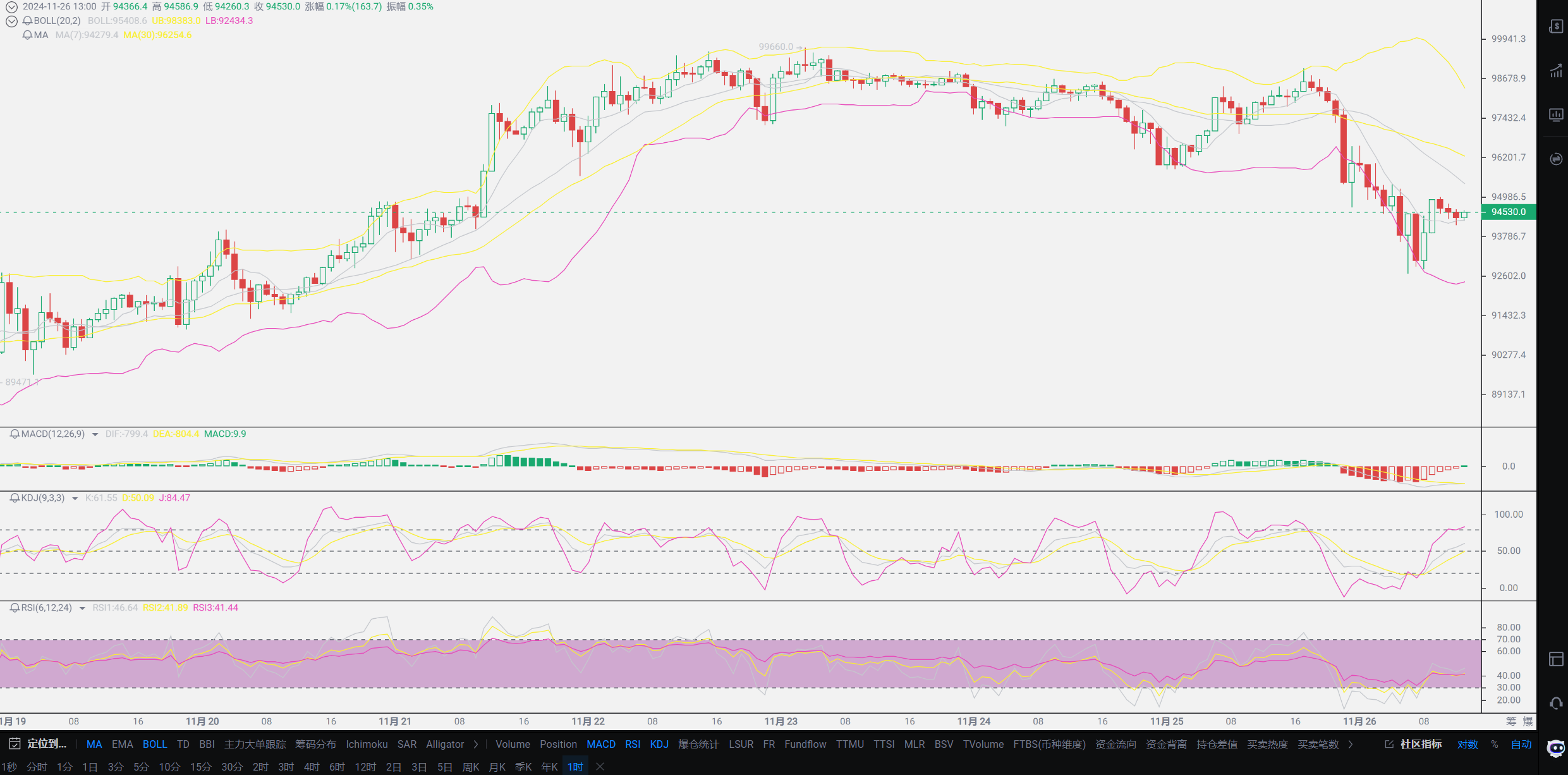

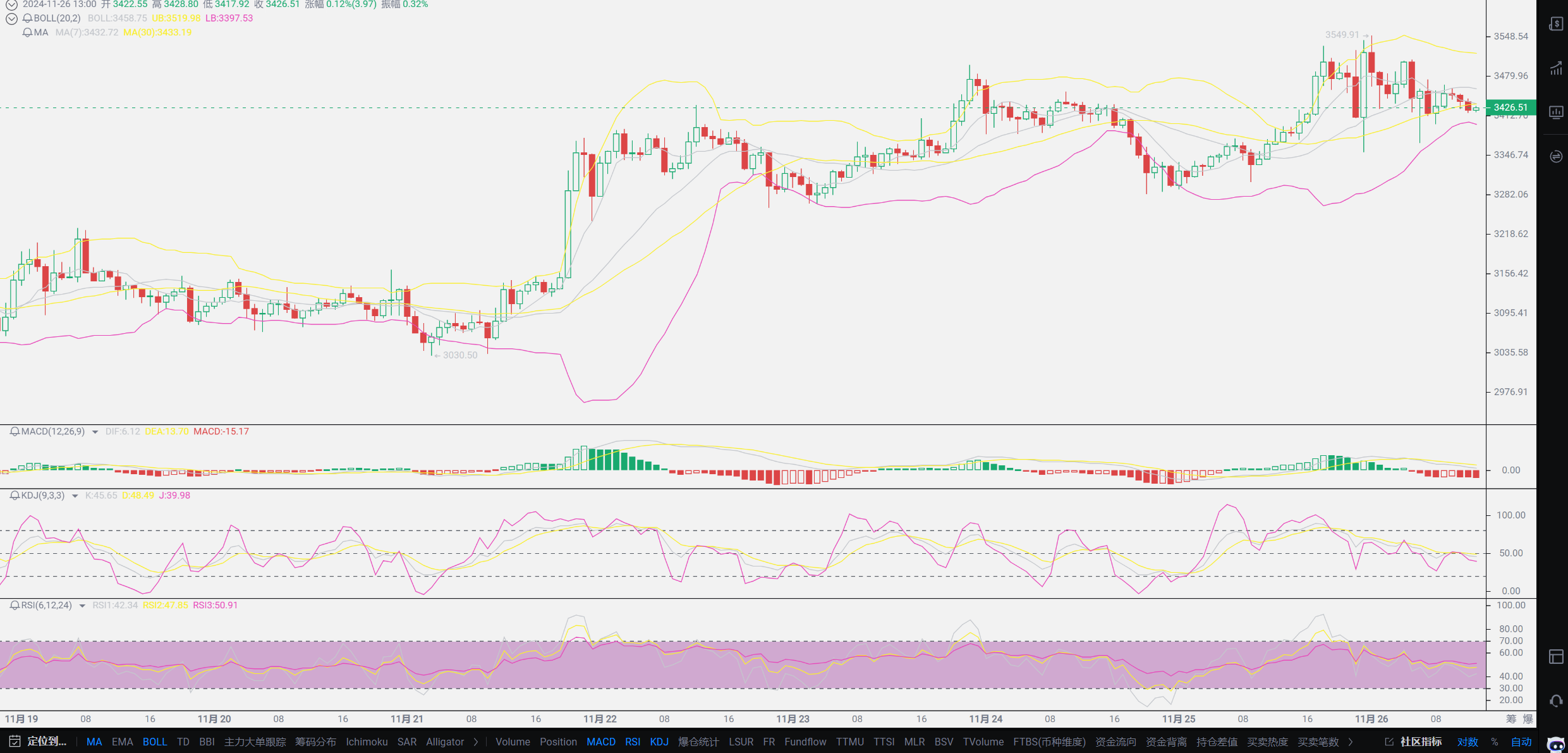

Everyone needs to pay attention to the current capital pressure on Bitcoin; the pressure from above still exists. The result of the interest rate cut in December will basically be known at the beginning of the month. After this wave of pain passes, Lao Cui's strategy remains bullish. For altcoin users, the performance of altcoins is still relatively reliable at present because the flow of bubbles has a smaller impact on altcoins. After all, most of the capital flow is concentrated on Bitcoin, and other coins are not significantly affected. The best strategy is, if your Bitcoin long position is significantly affected, you can short some other altcoins. Bitcoin contracts will definitely be bullish, while Ethereum's strategy is the opposite of Bitcoin. As long as Ethereum has a growth of over 100 points, you can confidently short Ethereum, as Ethereum's pullback depth will definitely reach 50 points or even more. Try to respond to Bitcoin's trends separately from other coins; you can treat other coins as hedging assets, but Bitcoin cannot be shorted. Although a bearish trend was observed last night, it was not communicated to everyone due to constraints with the users at hand, and there was no time to communicate. Those who need communication can directly message Lao Cui. As the market gradually rises later, the bubble will rapidly expand, and the 90,000-100,000 mark is very likely to be washed back and forth before the US elections, with the depth becoming deeper. Contract users who cannot grasp the short-term trends may choose not to enter the market. However, if Bitcoin reaches a pullback depth of 3,000-5,000 points, spot users must consider averaging down; position management is very important, and be prepared to average down at any time.

Lao Cui's summary: There is actually nothing that needs to be emphasized in this section; everything that should be mentioned has already been covered in the text. What needs to be emphasized is that the current trend is influenced by the later effects after Trump took office. The capital that should have entered the market has basically all entered, and the remaining game is to see who loses patience first. Frequent washouts will definitely cause contract users to suffer significant losses, but the action of bottom-fishing must be bravely executed. The arrival of the interest rate cut in December will inevitably lead to another wave of increases, and the appointments in the cryptocurrency market after Trump takes office are also very important. From the perspective of market sentiment, the bullish sentiment will continue until 2025. What spot users need to do now is to average down at low levels; the deep pullback provides an opportunity for everyone to enter and ambush. Contract users who cannot see the situation clearly in the short term can choose not to enter the market. For users with large capital, continue with Lao Cui's previous thinking; the first order must be entered with a light position, and then gradually average down. The entry point can only be around 5% of the overall position. This 5% limit is the maximum restriction, and the minimum can even be as low as 0.5%. Entering at the current price is also acceptable!

Original content by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the final victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。