Today (November 26), BTC fell to a low of $92,000, a decrease of 6.34% from its peak of $99,000, and a drop of 2.56% within 24 hours. The market is discussing the resistance BTC faced when attempting to break through the psychological barrier of $100,000.

BTC Market Cap Declines to 55.88%

According to AICoin (aicoin.com) market data, BTC has retraced to a low of $92,000 today, with its market cap now down to 55.88%. In the 4-hour cycle, the MACD histogram has turned negative, indicating a strengthening of bearish momentum in the short term. The DIF and DEA lines show signs of a death cross, suggesting a high probability of continued weakness. The current RSI value is at 42.7, which is relatively low and has not yet entered the oversold zone, indicating there is still room for further decline.

Image Source: x

BTC is currently priced at $94,872, having fallen below the EMA7 (95,561.6) and EMA30 (96,355.5), and is approaching the EMA120 (89,127.8), indicating a bearish short-term trend.

During Bitcoin's volatility, many investors choose to increase leverage in hopes of achieving higher returns, but the rapid market correction has led to many high-leverage positions being liquidated.

This significant drop in BTC has triggered a large number of liquidation events. According to data, the total liquidation amount of BTC options contracts in the past 24 hours reached $146 million, with long positions liquidating $116 million and short positions liquidating $30 million, clearly revealing the risks of high-leverage operations during sharp price fluctuations.

Image Source: Network

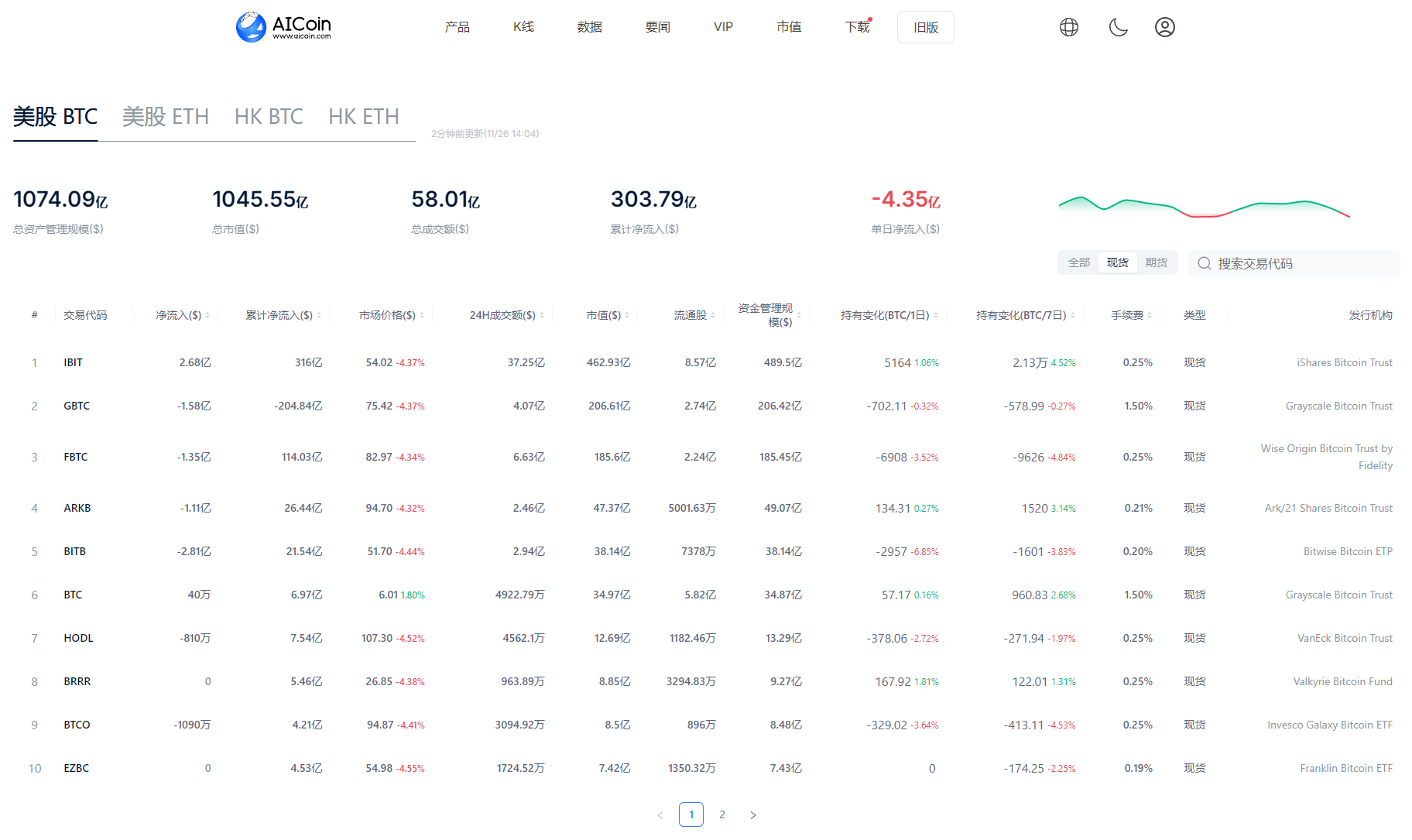

BTC Spot ETF Net Outflow Exceeds $400 Million

According to AICoin data, yesterday (November 25), the BTC spot ETF experienced a net outflow of $435 million, marking the first net outflow since November 15. Among them, the Bitwise ETF BITB had the largest net outflow of $281 million, followed by Grayscale's ETF GBTC, which saw a net outflow of $158 million yesterday. GBTC has accumulated a total net outflow of $20.484 billion. Notably, IBIT continues to see net inflows, with $268 million flowing in yesterday.

Image Source: AICoin

The outflow of ETF funds generally reflects investors' concerns about market volatility and indicates a cautious attitude among investors in the face of an uncertain policy environment. Although Bitcoin's status as an investment tool may further solidify in the long term, current market conditions prompt investors to lock in profits and reduce risk exposure when prices are high.

It is worth noting that while there is an overall net outflow from ETFs, some investors are still taking advantage of market corrections to make strategic purchases, especially those institutions and individuals who are optimistic about Bitcoin's long-term performance. This phenomenon highlights the divergence in the market and the competition among different investment strategies.

IG Australia Pty market analyst Tony Sycamore commented on the recent BTC drop, stating that the recent pullback in Bitcoin is "a much-needed correction to eliminate overbought readings, rather than a reversal or any sinister behavior," and added, "This also reminds us that the market, even the cryptocurrency market, cannot move linearly indefinitely."

Tony Sycamore is optimistic about BTC breaking through $100,000, stating, "After this correction, BTC will break $100,000."

Image Source: x

Summary

Data shows that Bitcoin faced resistance when attempting to breach the $100,000 mark, leading to a large number of liquidations, highlighting the high risks and uncertainties in the market. Meanwhile, the net outflow of ETF funds further indicates investors' cautious attitude towards short-term trends. However, analysts remain optimistic about BTC's current pullback. In this context, investors need to pay attention to market trends and policy changes, reasonably avoid risks, and achieve stable investment returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。