Original | Odaily Planet Daily (@OdailyChina)

“Has the Meme coin you recently purchased plummeted? If it has, do you want to continue to increase your position or cut your losses and exit?” Today, Asher is here to motivate those who “still believe in the big cycle of Meme and continue to explore potential Meme coins.”

First, you need to know that Meme coins are prone to wild fluctuations because their LP pools are very small. For example, a Meme coin with a market cap of over $100 million may have an LP liquidity of only $3 million or even less, so when community sentiment shifts, the token price can fluctuate dramatically. This is why the community often says, “If you want to earn dozens of times your investment, be prepared to lose 80% first.”

As Meme godfather Murad previously stated on the X platform, “The key to wealth in this cycle is to buy top Meme coins and hold. Simple, but not easy. You will be tempted to trade. You will be tempted to sell and then re-enter during a downturn. You will be tempted to sell too early. Buy, hold, wait.”

I believe most of you have tried to earn more SOL through internal trading and various PVPs, but most have ended up losing all the SOL in your wallets. Therefore, compared to PVP, in a bull market, “researching, buying, and holding” is more likely to earn “a windfall.” If the Meme coins you hold have a smaller market cap, you could aim for tenfold or even hundredfold returns; if the Meme coins you hold have a market cap of over $100 million, you could aim for the possibility of being listed on Binance.

In this bull market, Meme coins are one of the most watched sectors, and questions like “Which projects should be focused on?”, “What is the suitable buying price?”, and “When is the right time to sell?” have become hot topics of daily discussion among group members. To this end, I will share a weekly list of Meme projects worth focusing on and review the performance of last week's projects. Let’s embrace the Meme craze together.

Here is this week's key Meme focus list: FRED, ai16z series (ai16z, ELIZA, degenai).

FRED

Project Introduction:

Fred is a raccoon, an animal that was euthanized alongside the squirrel Pnut.

Reasons for Optimism:

Binance's best content creator of 2024, @AhmetCrypto42 (Binance CEO Richard Teng interacted with him on Twitter), serves as the project ambassador, and the content of his tweets indicates that @AhmetCrypto42 is working hard to get FRED listed on Binance.

In FRED's top holdings, most addresses have previously gained significant profits through PNUT. Recently, these addresses have shown a trend of reducing their PNUT holdings and increasing their FRED holdings. Additionally, since last weekend, several addresses have started building positions in FRED, ranking in the top 30 by holding ratio.

Price Performance:

According to GMGN data, FRED's market cap fell from a peak of $350 million to a low of $40 million, and is currently at $96 million.

Contract Address:

CNvitvFnSM5ed6K28RUNSaAjqqz5tX1rA5HgaBN9pump

ai16z

Project Introduction:

ai16z is a decentralized AI trading fund based on the Solana blockchain. As an “AI investment DAO,” the core of ai16z is to utilize AI agents to gather market information, analyze community consensus, and automatically conduct token trading both on-chain and off-chain. This new model aims to combine AI trading strategies with decentralized governance through tokenization, providing investors with more transparent and trustworthy investment opportunities.

Moreover, the project has the endorsement of a16z founder Marc Andreessen, who shared the concept image of ai16z and the official Twitter link on his official account.

Reasons for Optimism:

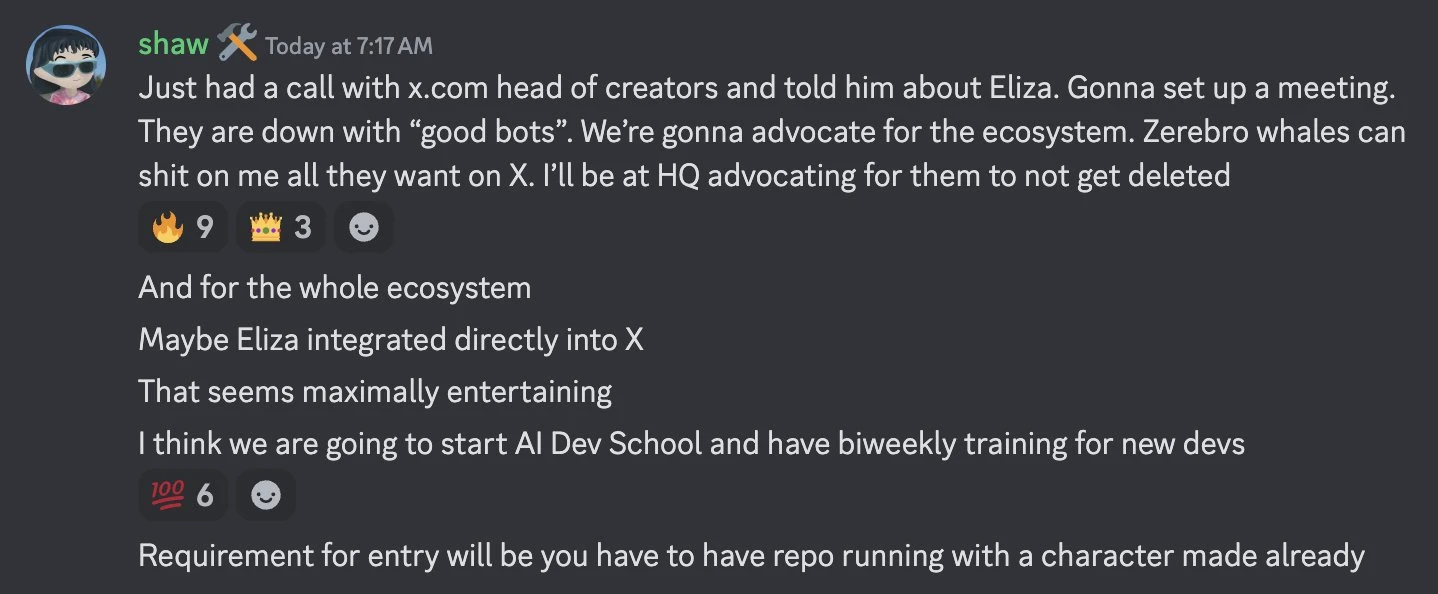

- Today, ai16z partner Shaw shared recent updates about ai16z in their alpha community, stating that they have spoken with the creator lead of the X platform to discuss the future of AI agents on the platform. Overall, the creator lead is supportive of all AI agents on the X platform; they plan to launch the autonomous trading feature of ai16z DAO next week; and they are in talks with companies like the Ethereum Foundation, Magic Eden, and Jupiter for potential collaborations.

- To prevent a repeat of the “ELIZA case,” on November 24, they stated that they are currently focusing only on the ai16z and degenai projects.

Price Performance:

According to GMGN data, ai16z's market cap fell from a peak of $600 million due to the “ELIZA case” (for more details, refer to: The capitalization controversy reignites, eliza vs ELIZA is more dramatic than neiro vs NEIRO), dropping to a low of $120 million, and is currently at $240 million.

Contract Address:

HeLp6NuQkmYB4pYWo2zYs22mESHXPQYzXbB8n4V98jwC

According to what Shaw said today, the ai16z project will soon announce multiple positive news. Therefore, the two “sister” projects of ai16z are also worth paying attention to, namely the uppercase ELIZA and degenai. Due to the previous “ELIZA case,” we will focus on analyzing uppercase ELIZA below.

ELIZA

Project Introduction:

ELIZA is an AI Agent supported by ai16z. The virtual image corresponding to Eliza is shown below, depicting a black-haired girl in an orange outfit themed around ai16z.

Reasons for Optimism:

The AI Agent concept, backed by the ai16z project itself, positions ELIZA to potentially become a “leader” when the AI Agent concept rises in the future.

A brief addition regarding the “case”:

The lowercase eliza tokens spontaneously sent to the ai16z DAO were not transferred or sold by the official (foundation address: AM84n1iLdxgVTAyENBcLdjXoyvjentTbu5Q6EpKV1PeG), and the ai16z team itself did not dump the tokens;

The one who dumped the lowercase eliza is a partner of ai16z, Logan (@futjr_). According to Discord, due to this dumping, the ai16z team has terminated their partnership with him;

10% of the total supply of uppercase ELIZA was airdropped to lowercase eliza holders (on-chain record: https://solscan.io/tx/3yiFers7odN92p4bE6Yk9iFyXVxfmW4YdMRe8uT4ZcvK81E48LEiRyH1Y5Gop55R2cUeP6ZQE7fqAqNJv2jphuRW); 10% of the total supply was allocated to the ai16z DAO (on-chain record: https://solscan.io/tx/5f1YvP1PwoZWhex5xY4Mb9DuAGQEnxcoHZjzBKHjqfBqeY6Ky4WrN2PEdJKA2QubxCFTp6SniUd4YuWCzEPooTyW); the project itself holds 3% of the supply through the Squads wallet for future development, and all this data is visible on-chain.

Price Performance:

According to GMGN data, ELIZA's market cap fell from a peak of over $100 million due to the “ELIZA case,” dropping to a low of $13 million, and is currently at $20 million.

Contract Address:

5voS9evDjxF589WuEub5i4ti7FWQmZCsAsyD5ucbuRqM

Last Week's List

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。