Key Indicators: (November 18, 4 PM - November 25, 4 PM Hong Kong Time)

BTC against USD rose by 7.0% ($91,750-$98,200), ETH against USD rose by 8.6% ($3,140-$3,410)

BTC against USD year-end (December) ATM volatility increased by 3.0 points (57.0->60.0), year-end 25d skew decreased by -1.0 points (5.9->4.9)

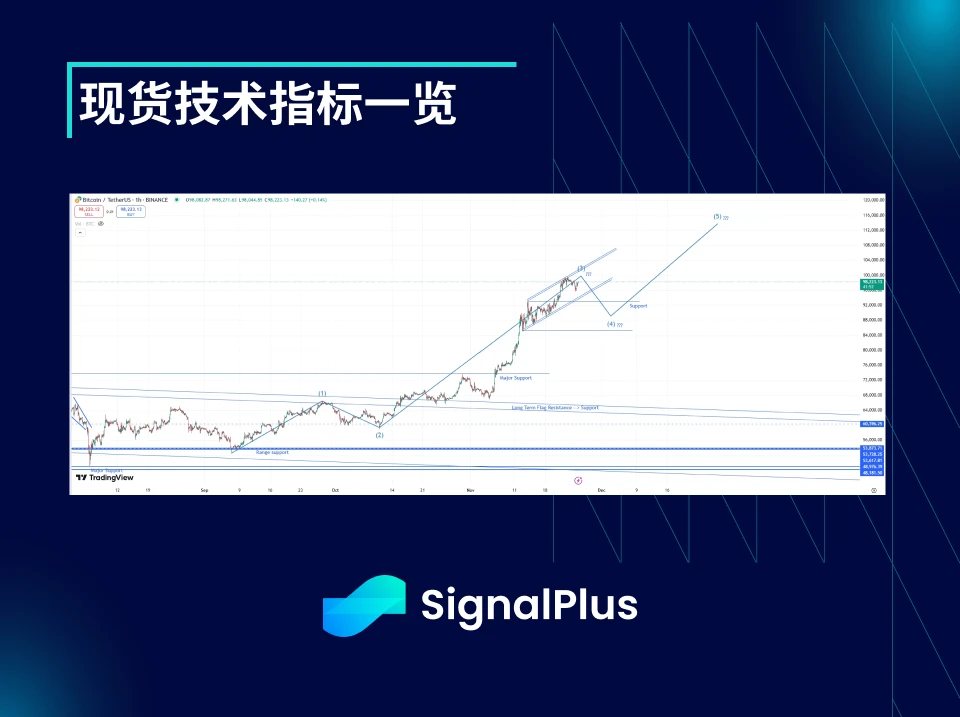

The upward trend in prices continues, but actual volatility is slowing down and momentum is gradually stagnating. These signs suggest that a peak may be emerging in the short term (but whether we have reached the peak or will continue to break through the $100,000 price remains to be seen).

We believe that a washout will not lead to a significant drop in coin prices, as there is very good support between $85k-$93k, and the chaos and frenzy caused by MSTR will temporarily provide enough buy orders for the market. The market price movements align well with the Elliott Wave Theory we have been tracking.

If the coin price breaks through $100k-$104k, it will further open up space for a third wave of upward movement (as shown in the chart), and it would mean that the rise will extend to $130k-$150k, rather than the $115k-$120k we currently anticipate.

Market Themes

Over the past week, the "Trump trade" has continued. The US dollar has risen against other fiat currencies, and US Treasury yields have also been on the rise. The performance of cryptocurrencies has once again decoupled from the dollar. Bitcoin tested a high of $99.8k but lost momentum before the critical psychological level of $100k. Other altcoins have also shown impressive gains, and ETH has finally awakened from its slumber.

Scott Bensent has been confirmed as Trump's Secretary of the Treasury, eliminating the potential bullish factor of Howard Lutnick being elected.

Last week, MSTR announced the purchase of 55,000 bitcoins (at an average price of $97,862, totaling $5.4 billion), fully utilizing the funds raised from selling shares and issuing convertible bonds. As prices approached their peak, the impact of ETF holders rebalancing their positions outweighed MSTR's continued purchases, resulting in a relatively balanced overall supply and demand in the market within the $97k-$100k price range.

ATM Implied Volatility

Although prices briefly surged to $100k this week, considering all factors, a stable short-term implied volatility is very reasonable, as actual volatility has not significantly increased due to the active price movements. There is more demand for upward opportunities in the long term, leading to an increase in implied volatility for March/June.

If spot prices struggle to break through $90k-$100k, we expect the market to take profits on short-term positions as the year-end approaches, leading to increased pressure on the short-term curve, especially with Thanksgiving and Christmas coming up. Naturally, this will cause the term structure to steepen.

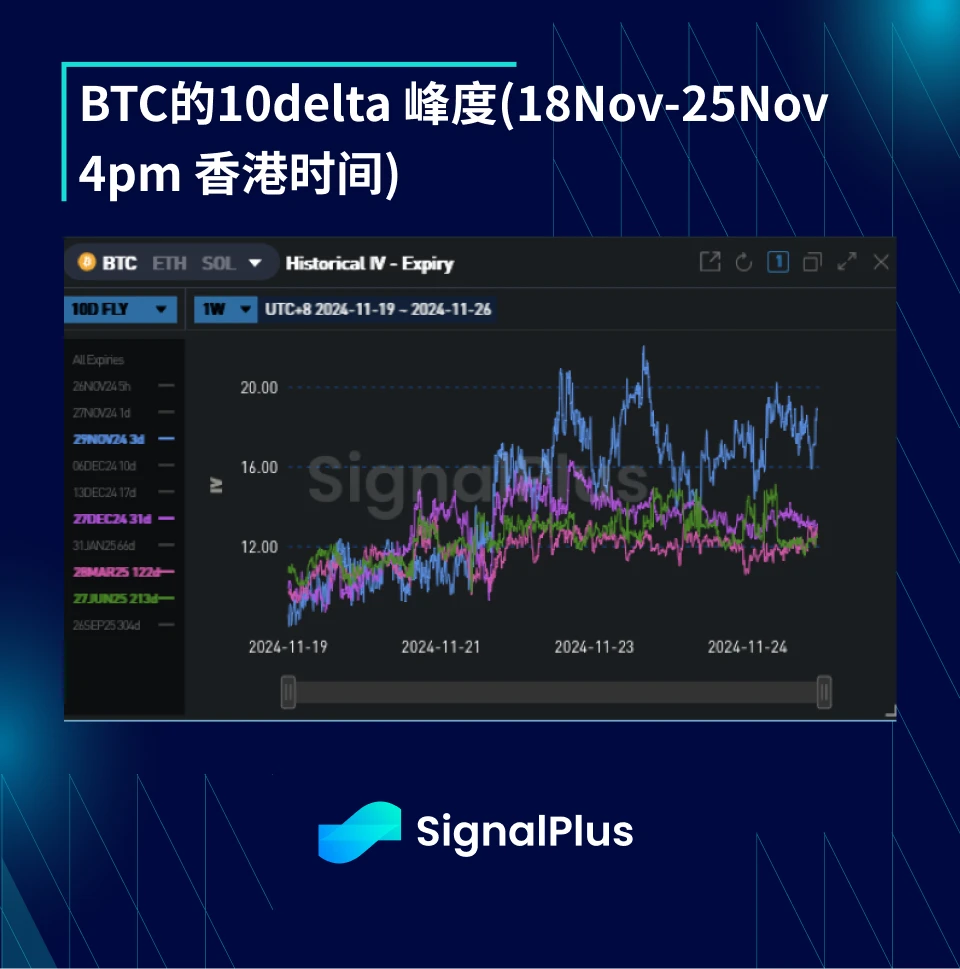

Skew/Kurtosis

This week, skew remained relatively stable. As the coin price failed to break the $100k barrier, market anxiety about a downward correction in coin prices is growing. Additionally, the implied/actual volatility has struggled to rise at price peaks, especially in the short term, which has suppressed the correlation between price and volatility, further dampening skew. At further points on the curve, the correlation between price and volatility is more pronounced (implied volatility for March/June/September is higher at price peaks), thus skew has received better support at the far end of the curve.

With the volatility of actual prices significantly rising this week, kurtosis has also increased sharply. We observe a demand for wing strike prices in the market, especially around the upper $100k area. At the same time, there is also demand for short-term lower strike prices, mainly for the protection of spot and margin.

Wishing everyone good luck in the coming week!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time crypto information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。