Macroeconomic Interpretation: Yesterday, international gold and oil prices saw a significant pullback, with WTI and Brent crude oil futures experiencing a sharp decline, and oil stocks also performed poorly. This was mainly due to Israel and Lebanon reaching an agreement on the terms of a ceasefire, which is expected to end the ongoing conflict that has lasted for more than a year. This news alleviated market concerns about oil supply disruptions and eased local conflicts, reducing risk aversion and causing gold and oil prices to drop. Many may wonder why BTC also fell? Let's discuss this in detail:

- The reasons for the decline in oil prices are twofold: first, the Israel-Lebanon ceasefire agreement alleviates concerns about supply disruptions; second, there is an oversupply of oil, with a slowdown in global economic growth and a transition in energy consumption leading to weak demand, while oil-producing countries like the U.S. are increasing production to offset the effects of OPEC+ production cuts.

As for the long-term trend of oil prices, different institutions have varying opinions. The OPEC+ meeting in December may delay the increase in supply, providing support for oil prices; Goldman Sachs pointed out that there is potential for short-term oil price increases, but mid-term price risks are skewed to the downside; JPMorgan predicts a global oil supply surplus by 2025, with Brent and WTI prices expected to decline.

- International gold prices also fell sharply as a result. Israel and Lebanon have reached an agreement on the terms of a ceasefire, which has eased geopolitical tensions and cooled market risk aversion, leading to a setback in gold prices. Several media outlets reported relevant details, such as the ceasefire agreement including a transition period, withdrawal of Israeli troops, deployment of Lebanese forces, and the establishment of a supervisory committee. Additionally, the conflict between Israel and Lebanon continues, with Israeli forces conducting airstrikes on Hezbollah command centers, and Hezbollah also launching attacks on Israel.

Regarding the impact on the gold market, gold prices face short-term pressure but remain attractive in the medium to long term. In the short term, the news of the Israel-Lebanon ceasefire agreement has reduced risk aversion, leading some investors to take profits, which is the main reason for the sharp decline in gold prices. At the same time, a stronger dollar, fluctuations in the U.S. macroeconomic environment, and Trump's nomination of Basant for Treasury Secretary also exert some pressure on gold prices.

From a medium to long-term perspective, some supporting factors still exist. Global economic uncertainty remains high, and as the year-end approaches, market demand for gold may increase. The long-term logic supporting gold prices, such as U.S. re-inflation and de-dollarization, has not yet reversed. Expectations for Fed interest rate cuts have increased, reducing the opportunity cost of holding gold. Furthermore, global geopolitical risks have not completely disappeared; if tensions rise again, the demand for gold as a safe haven may quickly rebound. For example, Goldman Sachs analysts predict that driven by the normalization of demand from individual investors and institutions, gold prices will rise to $3,000 by December next year; UBS also believes that gold prices will further increase by the end of 2026. For investors, a diversified investment strategy can be adopted, such as allocating various assets like physical gold, gold ETFs, gold stocks, and gold futures to achieve portfolio diversification and reduce the risks associated with holding a single asset.

- The cryptocurrency market is influenced by various factors, leading to significant market fluctuations. The progress of the Israel-Lebanon ceasefire agreement has somewhat affected market sentiment, causing a shift in investor preference for risk assets, with some funds possibly flowing out of the cryptocurrency market. Additionally, the sharp decline in Bitcoin prices has triggered panic in the market, leading to over 170,000 liquidations. From a medium to long-term perspective, the trajectory of the cryptocurrency market remains highly uncertain. Policies following Trump's administration, such as support for the cryptocurrency industry or trade protectionism, may have different impacts on the market. On one hand, supportive policies for the cryptocurrency industry may promote its development; on the other hand, trade protectionism may increase inflationary pressures, affecting the Fed's monetary policy, which in turn impacts market liquidity. Simply put, if the dollar strengthens, it may suppress BTC prices. We also need to pay attention to market changes and avoid excessive chasing of highs to cope with potential market volatility.

BTC Fundamentals + Data + Technical Analysis:

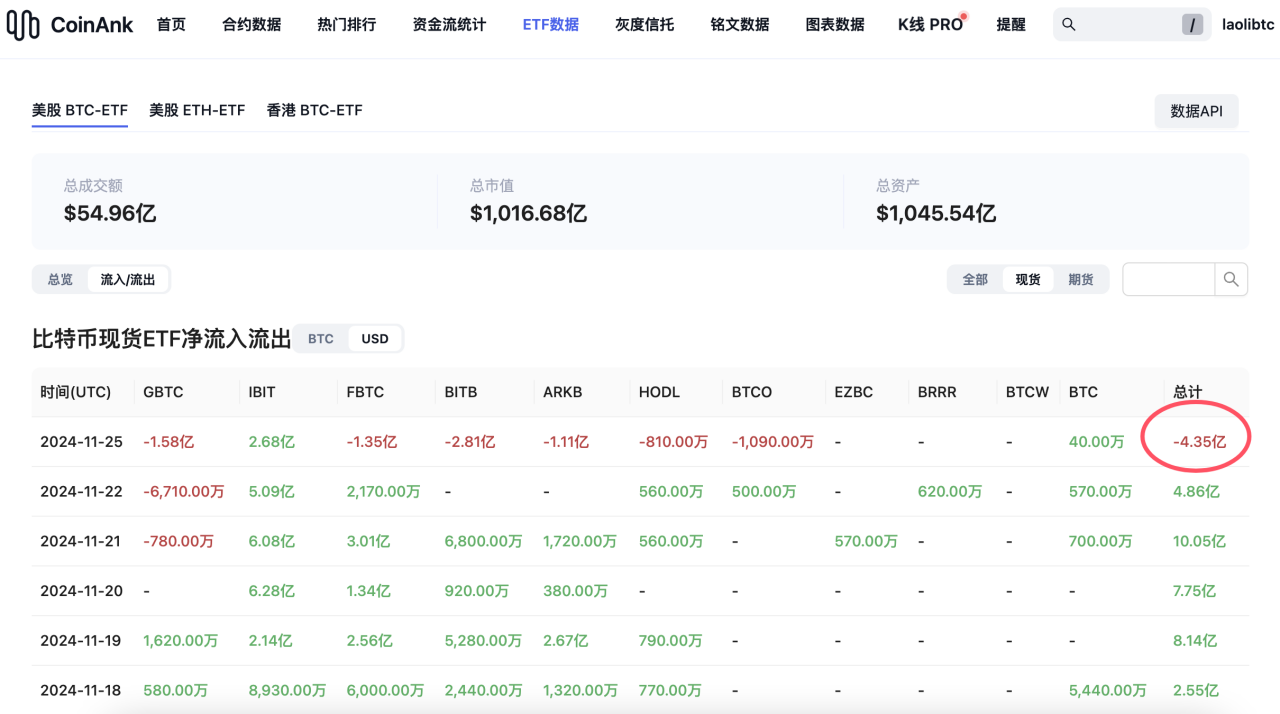

In addition to the macro factors from the Israel-Lebanon ceasefire agreement, the cryptocurrency market itself has intrinsic logic affecting the decline in BTC prices. According to CoinAnk data, there was a net outflow of $438 million from Bitcoin spot ETFs, marking a record scale of outflow for this phase; MicroStrategy also saw a further decline of 4.4%, creating a linkage; and ahead of the release of the Fed's meeting minutes and PCE data, many positions were closed to take profits to avoid potential large fluctuations.

Data also verifies this: after Bitcoin prices approached $100,000, reaching an all-time high, long-term holders of 14 million BTC were all in profit territory, triggering accelerated selling behavior. Since Bitcoin prices crossed the historical high, over 200,000 BTC have been sold, which is not a small-scale change. Long-term holders, when Bitcoin prices are strong and market demand is sufficient to absorb the selling pressure, have begun to take profits. In this process, ETFs have played a crucial role, absorbing over 90% of the selling pressure from long-term holders. However, given that unrealized profits have risen to more extreme levels, it is expected that more long-term holders will accelerate their selling pace. In the short term, this scale of selling has exceeded the inflow of funds into ETFs, leading to the decline in BTC prices.

BTC fell from around $99,000 yesterday to a low of about $92,326, aligning with our previous prediction of "a four-hour level top divergence adjustment, and likely forming a daily death cross, entering a significant pullback." In the evening, we will continue to monitor the performance of U.S. stocks, gold, and the dollar index, as they may continue to form a linkage.

According to CoinAnk trends, the analysis indicates that breaking below $95,000 has shifted to a four-hour bearish trend, with significant support levels below around $91,000, which is close to the first support level we analyzed yesterday. Important support levels below are around $87,000 and $85,000. Resistance above is referenced at the recent high point of the $98,870-$99,588 range, as well as the historical high.

Written by: laolibtc

CoinAnk Data

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。