Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: November 26, 21:26 Beijing time

Market Information

- Industry insiders: Bitcoin's failure to break through $100,000 is just a temporary episode;

- Trump is considering appointing an artificial intelligence minister to coordinate federal policies and the government's use of emerging technologies;

- Moody's: Market uncertainty has become a foregone conclusion during Trump's administration;

- New York Fed: The current impact of the crypto industry on financial stability is limited, but continued expansion could pose risks;

- With capital shifting from Bitcoin and an increase in derivative activities, Ethereum is showing strong momentum;

Market Review

Previously, I mentioned that the high point would be refreshed, and at that time, the high point was 93,372. Now the high point is 99,640, which is close to 100,000. Congratulations to those who followed along and made a profit. However, just as it was about to break through, Bitcoin started to pull back from its highest point, with the current lowest point at 91,500. This pullback has been relatively quick, and after this pullback, many people may feel a bit panicked, wondering if a major correction is coming. In fact, after such a significant rise, a pullback of around 10,000 is a normal trend, so don't lose your composure. The high point for Ethereum's surge is at 3,548. Previously, we predicted that Ethereum would reach the range of 3,250-3,570, and it has basically reached near 3,570. Subsequently, it followed Bitcoin's pullback. This wave of long positions in Ethereum has also made a certain profit; even if held until now, it is still profitable, as the price was around 3,140. Ethereum's decline has not been as significant as Bitcoin's because it did not rise as much. Currently, Ethereum still needs to pay attention to the situation of breaking through the upper pressure and see if it can continue to rally and create new highs;

Market Analysis

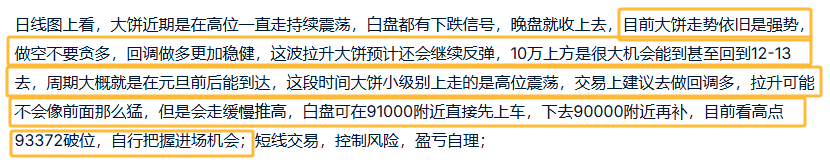

BTC:

From the daily chart, although Bitcoin's pullback has approached 10,000, the current price is high, and a pullback of 10,000 after such a significant rise is a normal trend. However, this decline is in stark contrast to the previous continuous rise, making the market a bit hard to accept. From the market news perspective, Microsoft will assess whether to purchase Bitcoin in early November, and with Trump coming to power, there are still unknown policies yet to be announced, such as designating Bitcoin as a national reserve currency, etc. These are all factors for Bitcoin's rise. The short-term pullback is an opportunity for us to position ourselves, and the future rally will not stop at 100,000. Looking at the chart, there is a dense accumulation of chips during the decline, and this position can also serve as a support level. Bitcoin's decline is basically nearing its end, and long positions can start to enter. The support level is at 88,700, and around this position, we can set stop-loss orders. You can start with a light position at 92, add a few times, and finally set the stop-loss below 887. The target is to look at 100,000+. Manage your entry opportunities; for short-term trading, control risks and manage your own profits and losses;

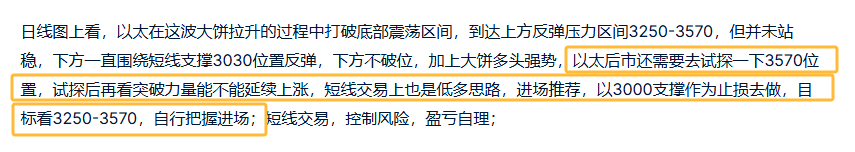

ETH:

From the daily chart, after Ethereum surged above 3,250, it has not broken this support level during the subsequent decline. Although it has not broken the upper level of 3,570, we can plan around this point since the decline has not broken the support. Ethereum should not blindly look bullish like Bitcoin; these policies are aimed at Bitcoin. The strength of Ethereum's rebound during Bitcoin's surge is evident. In Ethereum trading, pay attention to the support at 3,250 and the resistance at 3,570, and trade within this range for high shorts and low longs. If it breaks, you can chase it. The current price is around 3,330, and you can manage your entry. If the support at 3,250 is broken, do not hold. The target is to look at 3,570. Manage your entry opportunities; for short-term trading, control risks and manage your own profits and losses;

In summary:

Don't panic about Bitcoin's pullback; a pullback is an entry opportunity;

The article is time-sensitive, be aware of risks, and the above is only personal advice for reference!

Follow the WeChat public account "Crypto Lao Zhao" to discuss the market together;

All suffering stems from the pursuit of certainty. Impermanence is the norm and the way life should be. Always wanting to grasp the market, not acting on a 50% certainty, not acting on a 70% certainty, but waiting for a 100% certainty—where in the market is there a 100% certainty? Trading is about trading risks, trying to make the odds stand on your side. Those who give love will receive love in return; those who bring blessings will receive blessings. Sometimes, learn to take a little loss, be a bit foolish, a bit clumsy. For example, if the market is bullish, once this is confirmed, don't get too stuck on the position, lower your position a bit, and then get in first; at worst, it will reverse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。