Since 2020, the business intelligence firm has been on a bitcoin shopping spree, with its latest acquisition adding 55,500 BTC to its holdings. As of today, Microstrategy’s bitcoin stash stands at 386,700 BTC, valued at $35.5 billion. Yet, this ambitious strategy hasn’t come without backlash.

The company, along with its founder and executive chairman Michael Saylor, has faced scrutiny for leaning heavily on debt offerings to fund these purchases. Skeptics point to rising interest rates, which make borrowing increasingly expensive, sparking debates about the long-term viability of such a financial approach. Some worry that Microstrategy’s enormous bitcoin holdings could lead to excessive centralization, potentially endangering the decentralized nature of BTC.

“Michael Saylor is now the 2nd most powerful person in Bitcoin, after Satoshi, Vinny Lingham stated. “He can single-handedly decide the fate of any future contentious issue with a simple ‘it’s my way or I dump it all….’. Decentralization – not so much anymore, but at least number go up,” Lingham added.

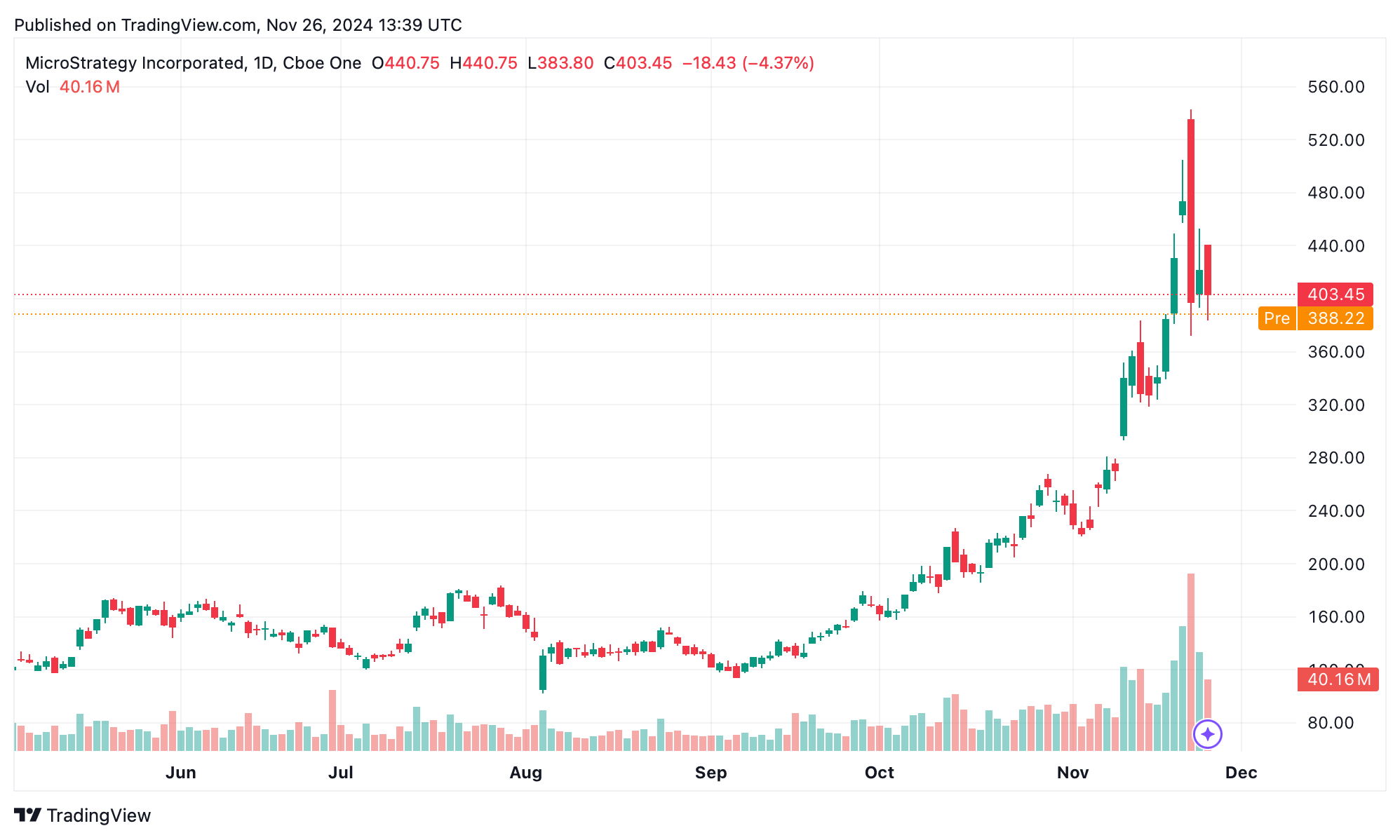

Microstrategy shares at 8:39 a.m. Eastern Time on Tuesday, Nov. 26, 2024.

The most glaring issue is how Microstrategy has bankrolled its massive bitcoin holdings—with debt. Bitcoin’s notorious price swings add a layer of risk to this strategy. If its value takes a steep dive, Microstrategy could struggle to meet its debt payments. A drop in bitcoin prices might also hit the company’s stock hard, making it even tougher to secure new funding or refinance its current obligations.

Crypto investor Hedgex.eth didn’t hold back, going as far as to compare Microstrategy’s approach to a pyramid scheme. “Michael Saylor is a psychopath,” the investor posted to X. “He will do more damage to bitcoin than anyone else using endless leverage. MSTR is a ponzi.” Another observer warned that a reckoning is inevitable, whether it happens soon or further down the road. The person stated:

At some point, the next ‘unexpected’ BTC implosion will likely be tied to MSTR. No idea exactly how or when, and it’s likely a few years away – but its highly probable to happen, and when it does it will be exceedingly obvious in hindsight.

Vinny Lingham chimed in, agreeing with the X poster and referencing a post he shared in mid-October, stating, “Unpopular opinion: Microstrategy will ultimately, and eventually, do more harm to Bitcoin (and crypto) than what FTX did.” Many others are calling Microstrategy a “Ponzi” with long threads on why “it’s both genius and terrifying.”

“We are in an asset bubble,” Ahan Vashi wrote. “Don’t see it – Look at MSTR. Microstrategy is essentially running an open Ponzi scheme by issuing stock and bonds to speculate in BTC. Instead of getting called out, Microstrategy is being appreciated for this strategy by the crowds.” Another individual remarked, “MSTR is the biggest bubble in stock market history … A market cap of nearly $110 billion and earnings of only $500 million a year is truly concerning and designed to load retail into a Ponzi scheme stock.”

The person added:

Microstrategy will pop just like it did in 2000…

X user Fernando Ulrich pushed back against the Ponzi comparisons, stating, “Microstrategy is no Ponzi. Financial engineering leveraging bitcoin? Yes. That’s not a Ponzi. Unless you consider BTC a ponzi in itself, but that’s a different discussion. Who should buy MSTR or his bonds? Whoever understands BTC’s risks. Saylor does use fin-technobabble tho…”

Despite the polarized opinions, Microstrategy’s approach highlights a broader tension in the crypto space: the balance between individual influence and the ethos of decentralization. Saylor’s strategic moves, while elevating bitcoin’s prominence, also amplify concerns about consolidation and control within a system designed to resist it. As the debate unfolds, it raises questions about whether such concentrated ownership could inadvertently undermine the very principles that make bitcoin appealing to its supporters.

Ultimately, Microstrategy‘s experiment with aggressive bitcoin acquisition reflects the evolving dynamics of cryptocurrency adoption in traditional finance (tradfi) today. It exemplifies the high-stakes gamble that comes with blending volatile assets with established corporate structures. While Saylor’s vision has inspired some and alarmed others, the true impact of this strategy will only be revealed over time, as market forces test both the resilience of bitcoin and the fortitude of those leveraging it at unprecedented scales.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。