Interview & Article: Anderson Sima, Executive Editor of Foresight News

Interviewee: Jason Huang (@Jhy256), Founder of NextGen Digital Venture

British science fiction writer Douglas Adams once commented on technological progress: "Any technology that is invented between the ages of 15 and 35 is revolutionary and will change the world. Any technology invented after the age of 35 is against the natural order and will be condemned by the heavens." Jason is 36 this year, and he believes he has found that revolutionary product.

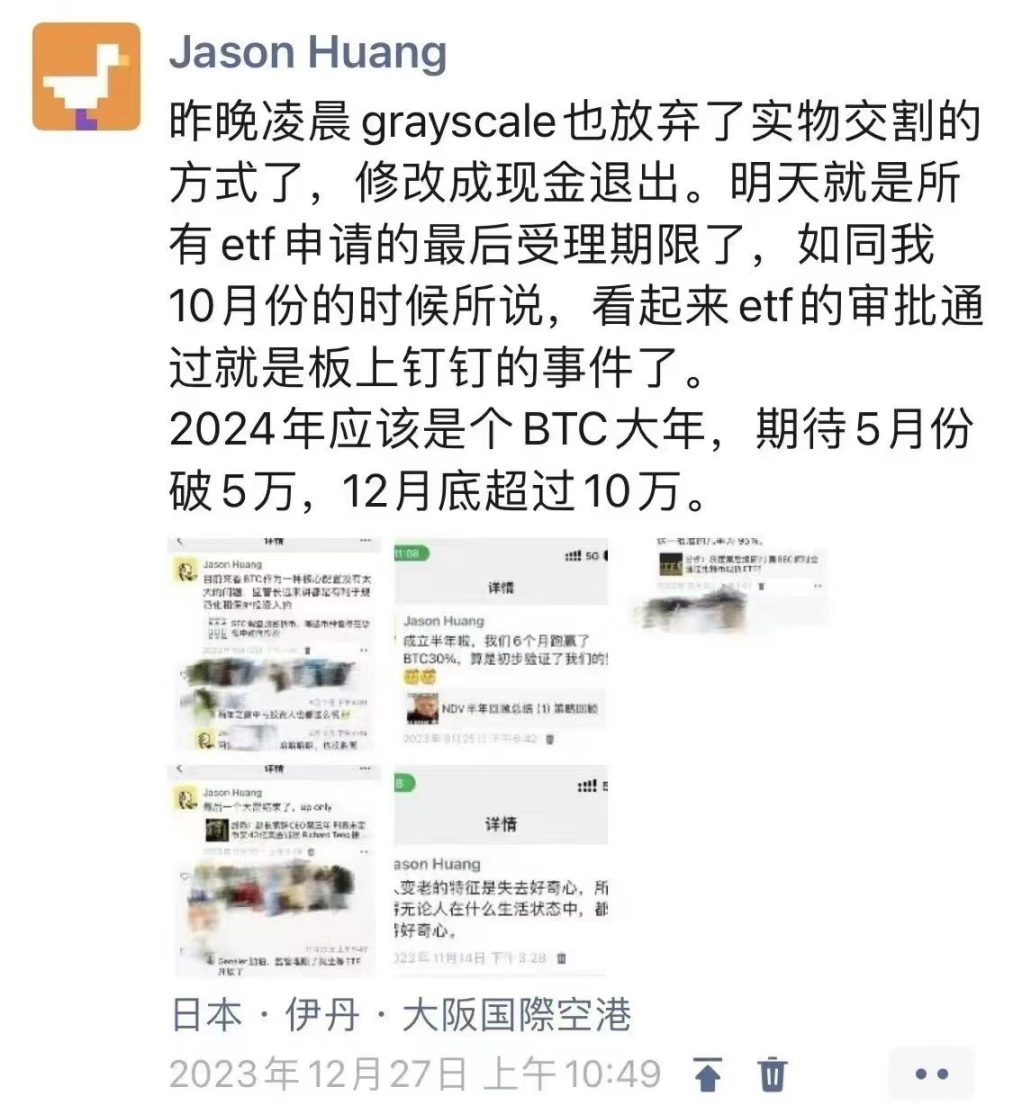

During the Christmas holiday of 2023, Jason spent time with his family in Osaka. On the way back, he made a prediction about the crypto market at the airport (at that time, Bitcoin was priced at about $43,000), stating that Bitcoin's price is expected to break $50,000 by May 2024 and reach $100,000 by the end of the year.

Reality often surpasses predictions; by December 2024, Bitcoin has already surpassed $99,000, and Jason's prophecy is just half a step away from realization. According to his estimates, the LPs of the first fund established by his company, NextGen Digital Venture, will achieve returns exceeding 300%.

The NDV first fund focuses on cryptocurrency stocks and was established in collaboration with the cryptocurrency wealth management company Metalpha (NASDAQ: MATH). At the time of its establishment, the U.S. spot ETF had not yet been approved, and traditional financial capital had not yet paid attention to digital assets. NDV captured the price increase of digital assets during the entire ETF approval process.

Jason Huang has extensive experience in the venture capital field, having worked at Huaxing Capital and Qiming Venture Partners. In 2022, at the age of 34, he chose to leave the family office Blue Pool Capital, co-founded by Jack Ma and Joe Tsai. Under the puzzled gaze of some, he plunged into the cryptocurrency field and founded NextGen Digital Venture. That same year, the Golden State Warriors, led by Stephen Curry, who is the same age as him, won the NBA championship, which is his favorite team and player. "Curry's championship in 2022 gave me tremendous courage to start my business," Jason Huang said.

Shortly after founding NDV in 2023, I interviewed Jason about the dynamics of the cryptocurrency market at that time, and some of the content resonates with today. A year later, I invited NDV founder Jason Huang again to discuss the changes in the cryptocurrency industry over the past year and future investment trends. Below is the edited interview content.

Over 3 Times Return Rate in 20 Months

Foresight News: Last year when we interviewed, the NDV first fund had just launched. At that time, the Bitcoin spot ETF had not yet been launched, but you were very firm in holding Grayscale's trust products. Can you briefly introduce the situation of NDV over the past year?

Jason: One of the most important things we did in the first year was to allocate most of the fund's positions to GBTC, which was trading at a discount to Bitcoin at the time. It gradually recovered, and after the ETF was approved, the discount was completely restored. By the end of last year, we realized that after the ETF approval, it would turn into a pure Bitcoin index, so we switched strategies to focus on stocks related to cryptocurrencies, such as Coinbase and MicroStrategy this year.

Overall, we have believed from the beginning that the best investment approach is to invest in securities or stocks related to cryptocurrencies because it is difficult for traditional finance to directly buy coins as the first step into digital assets. Stocks are a way that institutional investors are more familiar with, and our positioning is to help traditional finance invest in the cryptocurrency-related field and gain returns. We entered the market on March 29 last year at $29,000, and now the overall fund has more than tripled in profit, outperforming Bitcoin significantly.

Foresight News: Looking back at the decision made at that time, there must have been many different voices coming from the traditional VC investment field, right?

Jason: Indeed, many people did not understand, and even now, friends still ask me about the reasons for my decision at that time. But I believe finance is merely about innovation on the funding and asset sides, and you must grasp one end. In earlier years, Sequoia China and Hillhouse Capital also rose with the waves of China's internet and healthcare industries. If cryptocurrency develops, we have the same level of opportunity; it just takes time. Our fund is not even two years old; everything is just beginning.

Foresight News: So what is NDV's positioning in the market?

Jason: As I just mentioned, the essence of finance is innovating on the funding and asset sides. NDV's positioning is essentially doing two things:

1) Bringing traditional financial capital into Crypto

2) Bringing excellent assets into Crypto

We have accomplished the first part through our stock fund, and as the regulatory environment in the U.S. changes, we can also focus on the second part. Changes in the management of the U.S. SEC may bring a whole new opportunity for Crypto. When tokens can pay dividends and can be issued compliantly at lower costs, it may bring new changes to the world of coins. I am seriously researching which assets may bring about these new changes. This will be a significant theme in the coming years.

Bitcoin's Future: A National Reserve Asset?

Foresight News: What changes might the cryptocurrency market see after Trump takes office?

Jason: I think the most important change will be the potential replacement of the SEC chairman, as Gary's resignation probability is very high (Note: Shortly after the interview, Gary announced his resignation). This may lead to changes in Bitcoin market regulatory policies. As for market feedback, if the Democrats were elected, the rise might be more moderate; now, with the Trump administration's policies being friendlier, the market is racing ahead, making it harder to predict.

In this election, the Republican Party has gained majority support in both the House and Senate, as well as the Supreme Court. In U.S. history, only two presidents have had such treatment—Lincoln and FDR; now the third is Trump. Many people around Trump hold large amounts of Bitcoin, including Vice President JD Vance and Musk, as well as Peter Thiel behind Vance.

If the U.S. Congress begins discussing using the Federal Reserve's budget to purchase Bitcoin, even just the discussion could lead to a significant price increase for Bitcoin, and it is possible that the price of one Bitcoin could reach $200,000 to $300,000, but it is uncertain whether this will be a priority for the Trump administration.

Foresight News: There is a trend for Bitcoin to evolve from digital gold to a national strategic reserve asset. What are your thoughts on this?

Jason: I can't discuss specific institutions, but there are indeed some sovereign funds in discussion. After talking with some medium-sized countries' sovereign funds, they are not yet at the stage of considering Bitcoin as a strategic reserve. I even think the U.S. might act faster. Some sovereign funds are cautious due to previous investment failures in exchanges or related companies, and they are still watching how the U.S. will act.

However, once the market changes, this trend may happen faster than we think. I originally thought this could be a six-year story, but it might be completed in just two years.

Foresight News: Will these funds from traditional fields directly invest in Bitcoin itself?

Jason: It is rare for them to invest directly in Bitcoin itself. Many members of the investment committees of the university funds and pension funds I interact with are mostly in their 60s to 70s. For them, Bitcoin is a very difficult new concept to understand, but if you pitch it as a new technology field, the acceptance will be much better. At that point, they may be willing to invest in related companies rather than Bitcoin itself. However, the approval of the ETF will allow institutional investors to allocate more compliantly to BTC, which is why this round of the bull market is a "Bitcoin bull."

Is Ethereum Alibaba and Solana Pinduoduo?

Foresight News: It seems that your strategy does not involve much in Ethereum ETFs. In the last cycle, Ethereum's increase far exceeded that of Bitcoin, but now there is a lot of dissatisfaction with Ethereum. What considerations do you have for not touching Ethereum?

Jason: When introducing the cryptocurrency world to traditional funds, I found that they already struggle to understand Bitcoin, and it is even harder for them to grasp Ethereum. Moreover, my investment logic leans more towards investing in things that can change, such as X factors that can alter market rankings. For example, Pinduoduo, which rose to prominence and disrupted the e-commerce landscape. I believe Ethereum currently lacks substantial innovation or large-scale applications, which can be felt from market enthusiasm and capital flows. On the contrary, Solana has a bit of that Pinduoduo flavor; although I do not hold Solana, I like stories that have changes.

Foresight News: What is your current personal asset allocation structure?

Jason: When I founded NDV, I invested almost all my liquid assets into cryptocurrencies, except for my house or assets in the primary market. I put most of my personal liquid funds into my own fund, as I believe this is the best explanation to my LPs. Currently, the ratio of Bitcoin to other cryptocurrencies in my assets is about 5:1 to 4:1.

The non-Bitcoin investments are projects run by founders I know well and who are very capable, or those recommended by friends. For example, I wrote on X in early October that I bought a meme recommended by my partner Christian, which has increased about 20 times from the bottom to now. The core here is trust transfer; I believe in what reliable people are doing or the endorsements from people I trust very much. But I treat these as venture capital when I buy in, and I am willing to take on the risk of loss.

Foresight News: What are your plans for the next year?

Jason: I have made a commitment to the investors of the first fund that I will liquidate the fund at the peak of the cryptocurrency four-year cycle. I personally judge that the peak should occur within the next 12 months, depending on the macro environment and policy changes. After that, I will seriously explore the matter of bringing Web2 to Web3 that I mentioned earlier.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。