Original Title: "Federal Reserve November FOMC Meeting: Rate Cut Pace May Slow or Even Pause, Neutral Rate Outlook"

Original Author: Natalia Wu, BlockTempo

The Federal Open Market Committee (FOMC) of the Federal Reserve decided to cut interest rates by 25 basis points in its November meeting, bringing the benchmark rate down to a range of 4.50%-4.75%. Last night (26th), the Federal Reserve officially released the minutes of the November FOMC meeting. At that time, Fed officials expressed confidence that inflation is easing and the risks of a significant slowdown in the economy and labor market have diminished, thus supporting further rate cuts in the future.

However, they also emphasized a cautious approach, stating that rate cuts would be "gradual" based on data performance, and if inflation data does not meet expectations, the pace of rate cuts may slow or even pause.

"When discussing the outlook for monetary policy, participants expect that if the data aligns with expectations, inflation continues to decline to 2%, and the economy remains close to maximum employment levels, then a 'gradual' shift towards a more neutral policy may be appropriate."

Some analysts believe that after profit-taking following Trump's election victory, the Fed's slowdown in rate cuts may delay the peak of the Bitcoin bull market.

Will the Fed Slow Down Rate Cuts?

The meeting minutes also revealed that at this month's meeting, 19 officials unanimously approved the 25 basis point rate cut. Some officials believe that the upside risks to inflation have changed little, while the downside risks to economic activity or the labor market have weakened.

Some officials pointed out that monetary policy needs to balance the risks of easing too quickly versus too slowly; acting too quickly could hinder further efforts to combat inflation, while acting too slowly could excessively weaken the economy and employment. Some participants indicated that if inflation remains persistently high, the FOMC may "pause" the easing of policy rates and maintain them at a restrictive level.

Additionally, many officials believe that the uncertainty surrounding the so-called neutral rate complicates the assessment of the degree of monetary policy restriction. The neutral rate refers to a policy level that neither restricts nor stimulates economic growth.

Officials' estimates of the neutral rate have continued to rise over the past year. Austan Goolsbee, president of the Chicago Federal Reserve Bank, stated on Tuesday that his prediction for the neutral rate is close to the median estimate of Fed officials in the September dot plot, which is 2.9%.

Fed Officials Support December Rate Cut

The Fed will hold its December FOMC meeting on December 18. Goolsbee predicted this week that the Fed will continue to cut rates, taking a position of "neither restricting nor promoting economic activity" and stated, "Unless there is some compelling evidence of economic overheating, I see no reason not to continue lowering the federal funds rate."

Last week, he reiterated his support for further rate cuts and expressed an open attitude towards acting at a slower pace.

On the same day, Neel Kashkari, president of the Minneapolis Federal Reserve Bank and known as a hawk, explicitly supported the Fed cutting rates in December, stating that it is still reasonable for the central bank to consider another rate cut in December.

"As of now, to my knowledge, we are still considering a 25 basis point cut in December—this is a reasonable debate for us."

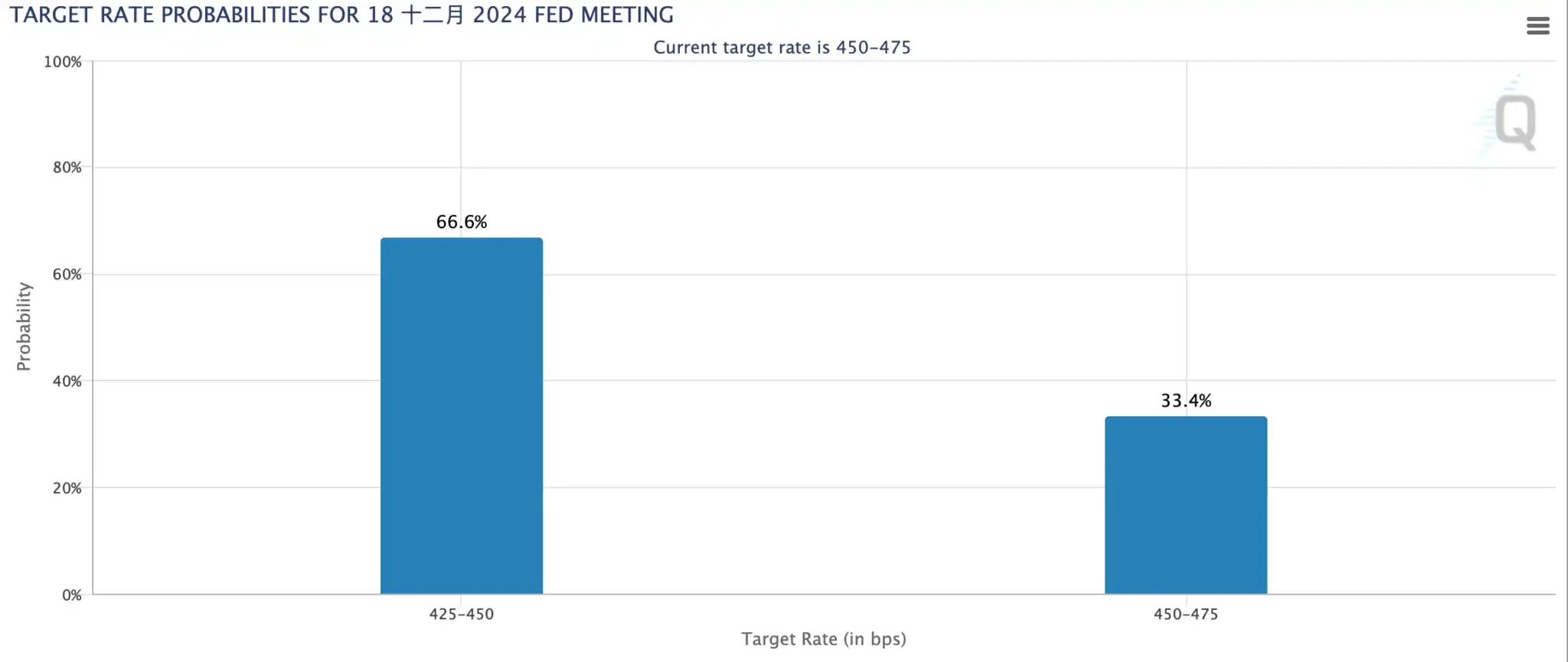

FedWatch: December Rate Cut Probability Exceeds 60%

However, given the ongoing economic resilience in the U.S. and recent strong inflation data, several Fed officials have urged a cautious approach to future rate cuts. Fed Chair Jerome Powell also hinted at a hawkish stance earlier this month, suggesting that officials would "proceed cautiously" with rate cuts.

"The economy is not signaling any urgent need for rate cuts; the better economic conditions allow us to act cautiously in our decision-making."

Powell's hawkish signals have led to a sharp decline in market expectations for another 25 basis point cut in December, but after the release of the FOMC meeting minutes yesterday, the market slightly increased its bets on a 25 basis point cut in December, rising from about 52% to the current 66.6%, with the probability of pausing rate cuts remaining at only 33.4%.

However, both the market and institutions predict that the Fed will slow down the pace of rate cuts next year. Nomura Securities recently projected that the Fed will pause rate cuts at the December meeting and will only cut rates by 25 basis points in March and June of 2025; Cathay United Bank's chief economist Lin Qi-chao stated last week that the Fed will still cut rates by 25 basis points in December this year, with further cuts of 25 basis points in March and June next year.

Source: FedWatch Tool

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。