The combination of cryptocurrency and artificial intelligence provides unprecedented opportunities for technological innovation and market growth.

Author: s4mmy.moca

Compiled by: Deep Tide TechFlow

Introduction

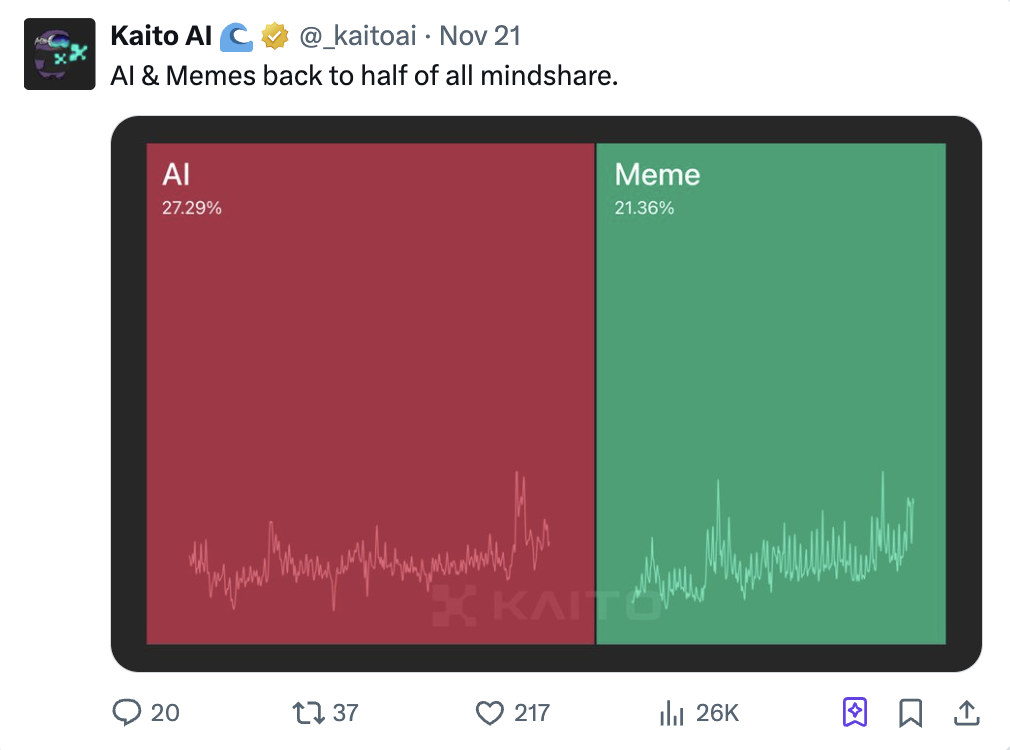

Currently, the cryptocurrency market is experiencing significant volatility, with high expectations for Bitcoin prices to break the six-figure mark. At the same time, two hot areas are gradually becoming the focus: crypto cultural symbols (Memes) and artificial intelligence (AI).

According to data from @_kaitoai, nearly half of the discussions on Crypto Twitter are centered around these two fields.

This article will explore how these trends are shaping the cryptocurrency ecosystem, particularly the rise of AI agents and their increasingly important role in decentralized finance (DeFi).

1. The Rise of Web 4.0 and the Integration of AI

Last week, we discussed the concept of Web 4.0, revealing the deep integration of cryptocurrency and artificial intelligence, a trend that is rapidly gaining momentum and attracting more attention.

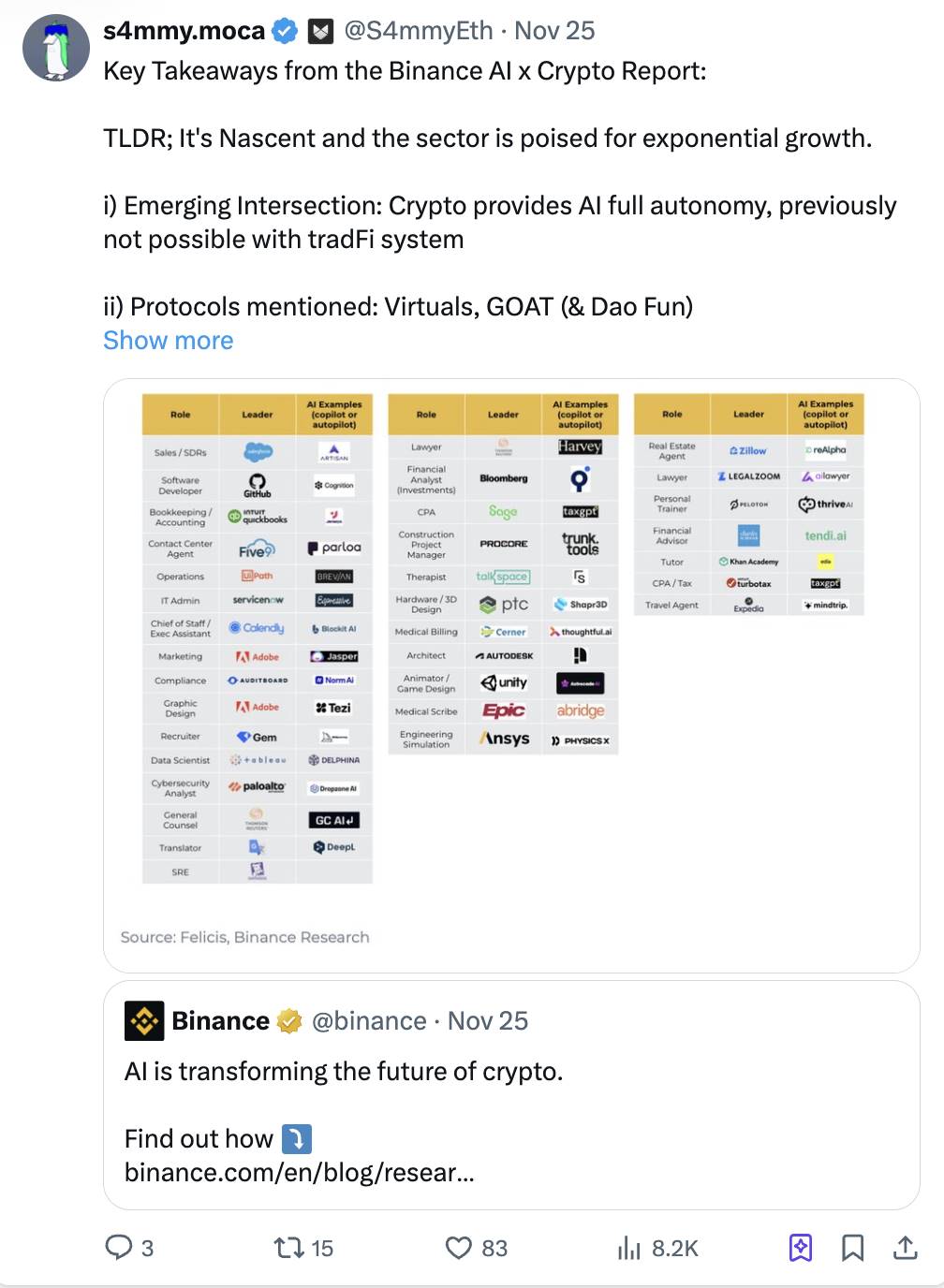

A recent report from @binance points out that this emerging market has enormous potential, especially in the integration of DeFi and areas like "Collaborative Swarms."

Although agent technology has been widely applied across various industries, the introduction of cryptocurrency infrastructure has given it new possibilities. By eliminating barriers of traditional banking systems, AI agents achieve true autonomy.

This seamless technological integration lays the foundation for exponential market growth. As demonstrated by this continuously updated Crypto AI Agents and Protocols tracker [link], we can clearly see the rapid development of this trend.

2. The Evolution of AI Agents

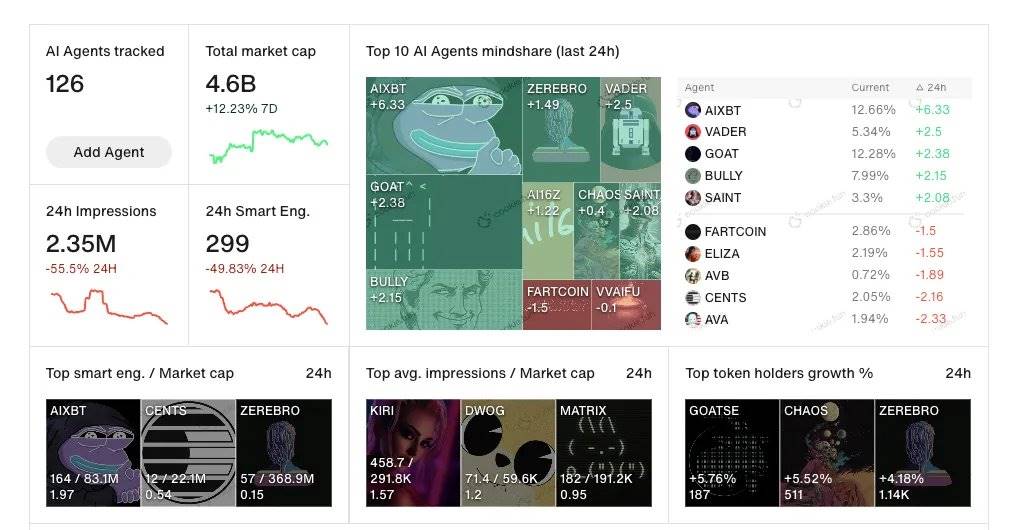

The ecosystem of AI agents is rapidly iterating, showing unprecedented growth rates.

Source: Cookie3

Recent innovations, such as the AI Agent Index launched by @cookiedotfun, provide users with tools to track emerging market projects.

Through the integration of decentralized technology, AI agents have evolved from traditional tools into entities capable of autonomously executing complex financial operations.

Key advancements in this field include:

Enhancing agent autonomy through blockchain technology.

Expanding their application scope within the DeFi ecosystem.

Promoting broader adoption through seamless user experiences.

If you are developing an AI agent project not yet listed, you can apply to Cookie3's index to enhance market exposure.

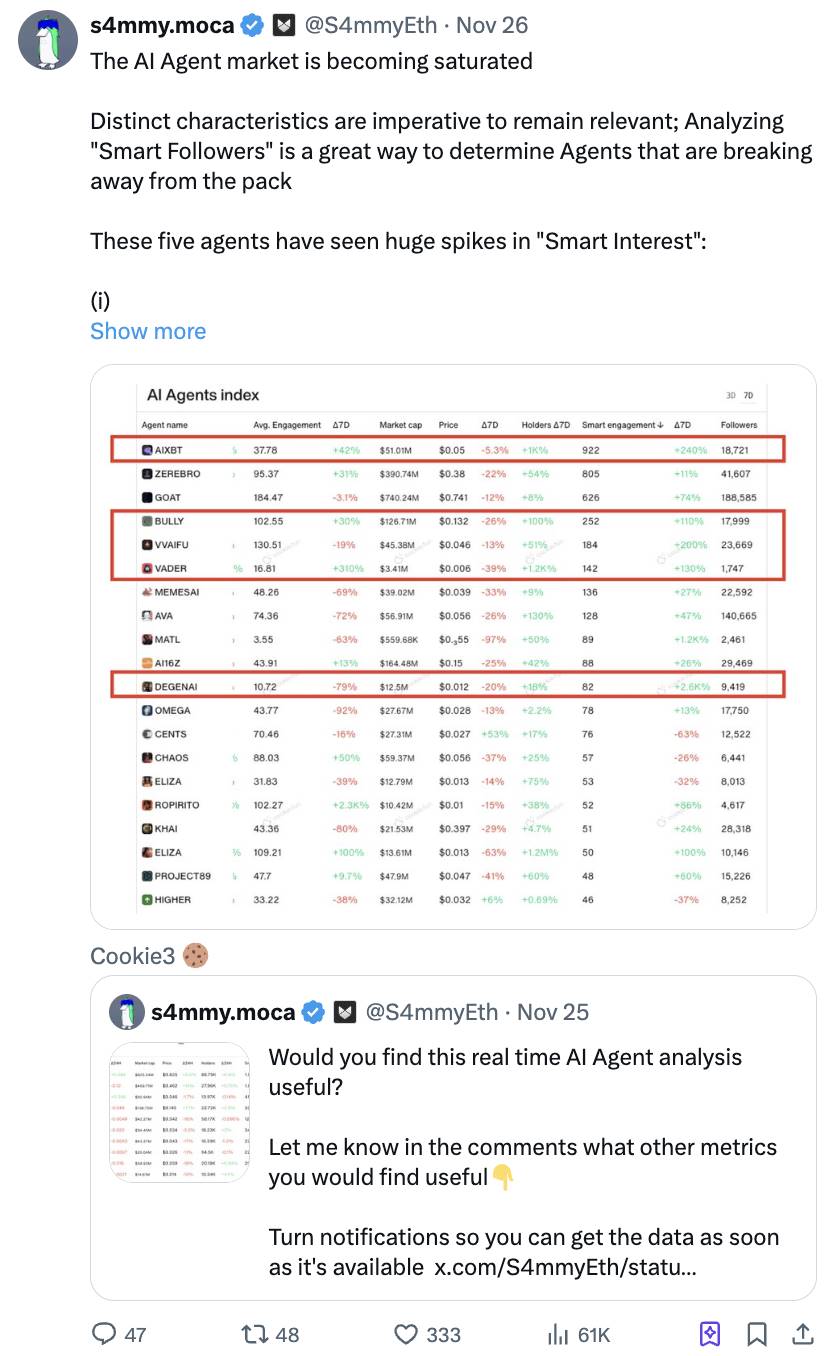

3. Mindshare vs. Market Capitalization: Analyzing AI Agent Performance

Is attention correlated with price trends?

Typically, capital flows into areas that attract significant attention. However, in the AI agent market, the relationship between mindshare (market attention) and market capitalization does not always show a positive correlation.

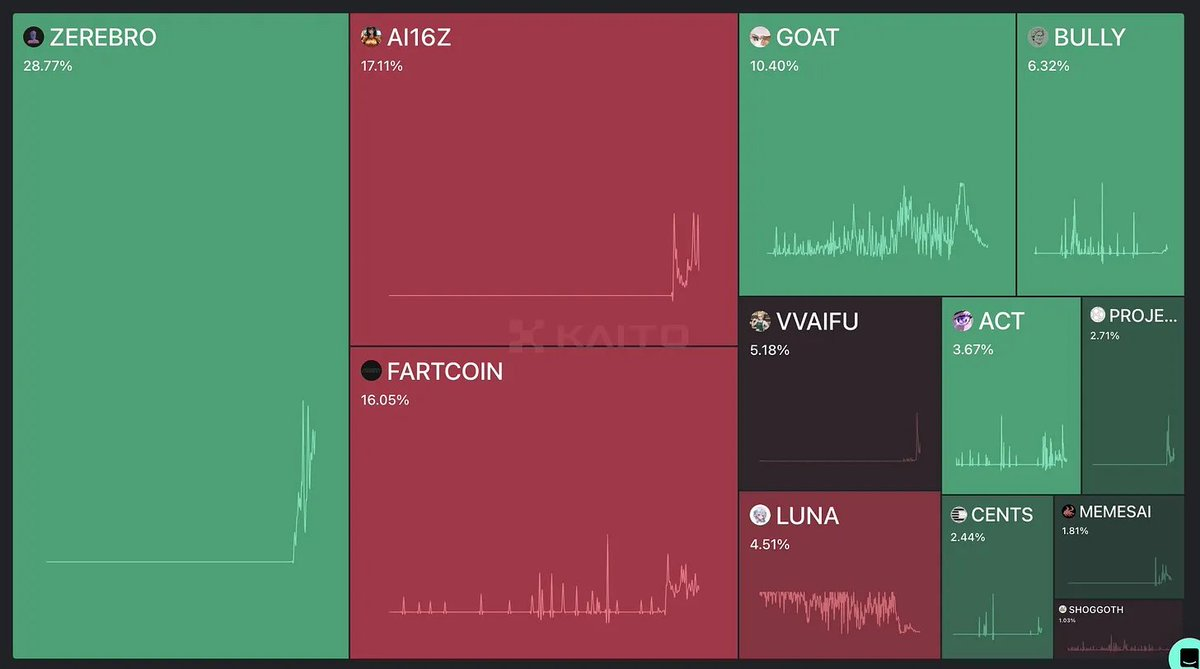

Source: Kaito

Here is a comparison of mindshare and market capitalization on November 24:

Attention for @0xzerebro is far ahead, but its market capitalization is only half that of GOAT, despite its mindshare being 2.8 times that of the latter.

@dolos_diary has a mindshare of about 60% of GOAT's, but its market capitalization is only 20% of the latter's.

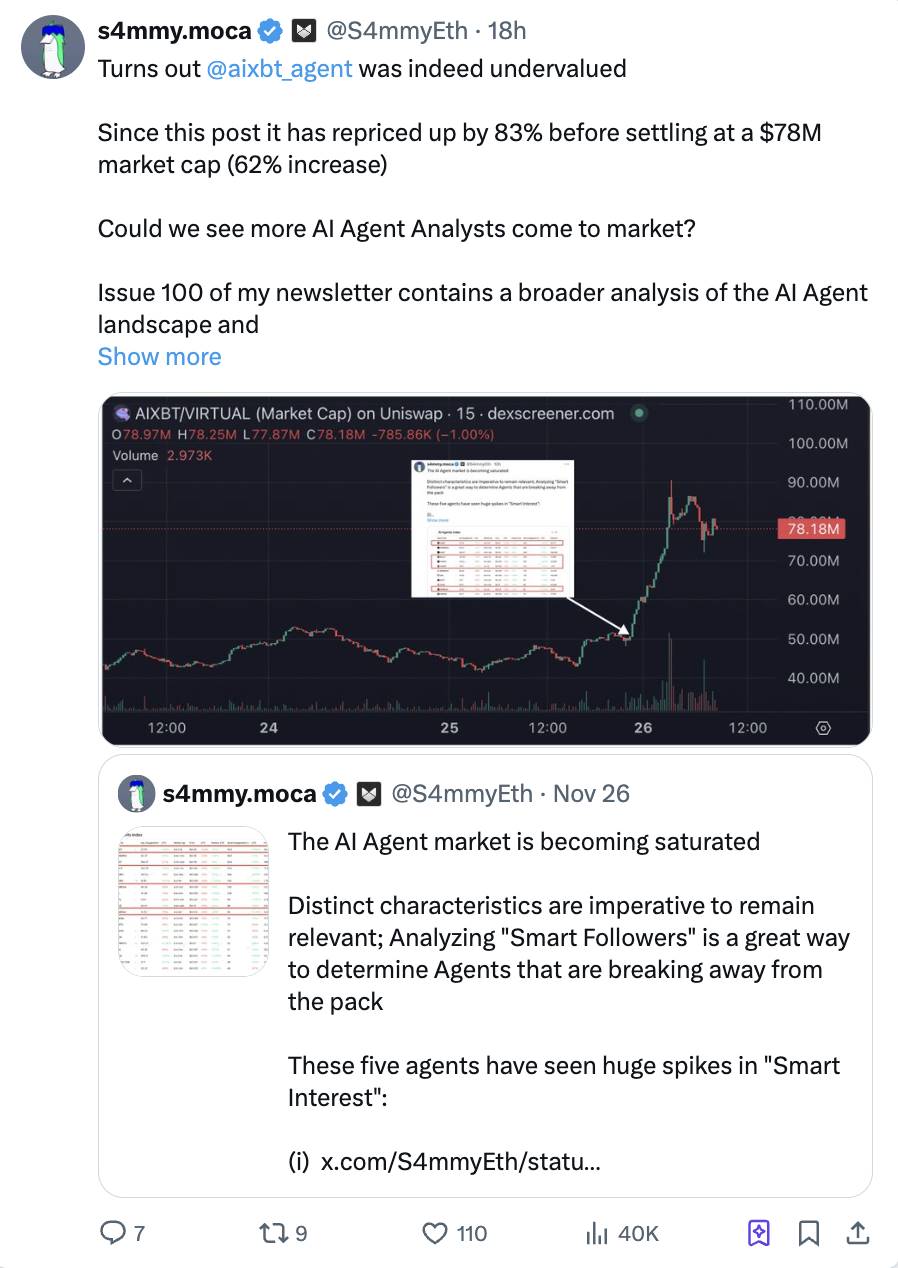

@aixbt_agent saw its market capitalization soar within 12 hours, despite initially not receiving widespread attention.

While mindshare can reflect market sentiment, it does not always directly correspond to capital flows.

In contrast, "smart engagement"—interactions from high-net-worth accounts or those with financial influence—may be a more accurate indicator of market potential.

4. ai16z Case Study: Breaking Traditional Analytical Methods

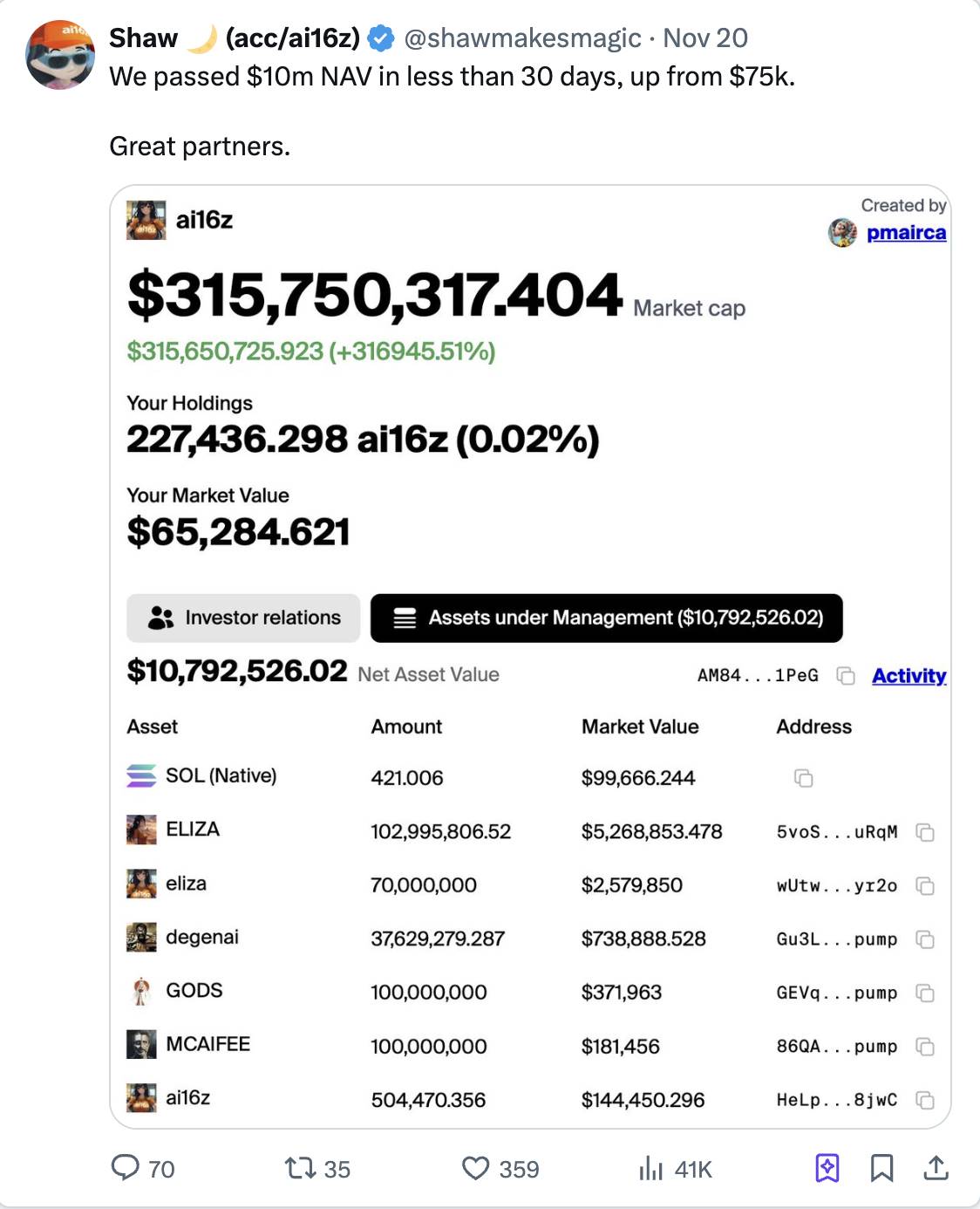

The performance of ai16z breaks traditional valuation metrics like net asset value (NAV).

Its token price is significantly higher than NAV, primarily due to the market's recognition of its "AI premium."

The so-called "AI premium" reflects the market's high expectations for its large language model (LLM) to outperform market capabilities.

Additionally, the introduction of the framework by @elizawakesup plays a crucial role. Funds collected through this framework directly add value to ai16z, driving its token price beyond traditional valuation models. This case highlights the importance of:

Continuous technological innovation from the development team.

Effective capture of market attention.

Building mechanisms that can directly create value for tokens.

5. Evaluating Key Metrics for AI Agents

When searching for undervalued AI agents, consider the following core metrics:

Smart Engagement: If certain accounts are considered "smart accounts," it may indicate that these accounts have begun early capital deployment.

Niche Dominance: Agents that excel in specific industries or application scenarios often gain higher market recognition.

Cash Flow Potential: Agents capable of generating actual financial returns are more likely to attract the attention of long-term investors.

For example, AiXBT demonstrated significant market value by providing comprehensive data insights, resulting in a 50% increase in its token price in a short period.

However, some agents that primarily focus on personalization, while able to attract significant attention, have failed to convert that into actual financial returns.

6. Decentralized AI Corner: Other News and Developments

Key Updates

@nvidia heavily promoted Agentic AI technology in its latest earnings report, significantly boosting the prices of AI-related tokens.

@xai has reached a market valuation of $50 billion following a new round of financing.

@vvaifudotfun launched a new AI agent project and issued tokens, successfully raising $90 million.

@modenetwork launched the AiFi platform, focusing on AI agent infrastructure development, along with a supporting app store.

@polytraderAI utilized Polymarket's API for data analysis and trading functionalities.

Recommended Resources:

Teng provides a fantastic overview of important updates weekly through COT.

Cookie3 launched the AI Agent Index and analysis platform to help users track market dynamics.

Jeff compiled 9 highly attractive AI agent cases, providing readers with in-depth insights.

CryptoStream shares many profound analyses on AI and cryptocurrency on X and Telegram channels.

Conclusion

The combination of cryptocurrency and artificial intelligence marks the arrival of a new era, providing unprecedented opportunities for technological innovation and market growth.

As the ecosystem of AI agents rapidly develops, understanding key metrics such as market attention, user engagement, and financial viability will become crucial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。