Macroeconomic Interpretation: At 3 AM today, the Federal Reserve released the minutes of its meeting, indicating that officials expect future interest rate cuts to be gradual. They expressed optimism about easing inflation and a strong labor market, providing room for further rate cuts, but emphasized that these cuts will be implemented gradually. The minutes noted that economic activity continues to expand steadily, employment growth is slowing, the unemployment rate is rising but remains low, and inflation has significantly eased from its peak, although core inflation remains relatively high. Officials believe it is appropriate to continue reducing the Fed's securities holdings, and if data aligns with expectations, inflation continues to decline to 2%, and the economy approaches maximum employment levels, a gradual shift to a more neutral policy stance may be appropriate. Some officials warned that if the progress in improving inflation stalls, the pace of rate cuts may slow or even pause. Data from the Chicago Mercantile Exchange shows that the market estimates a roughly 63% chance of a 25 basis point rate cut by the Fed in December.

From our perspective, the minutes from this meeting convey several key signals that are significant for future investment strategies: The Fed's adjustment of the federal funds rate target range to 4.50%-4.75% in early November aligns with market expectations and demonstrates the Fed's flexibility and foresight in monetary policy. Rate cuts help reduce corporate financing costs, enhance market liquidity, and support economic growth. The minutes emphasized that future rate cuts will be implemented in a "gradual" and "cautious" manner. This indicates that the Fed will fully consider changes in the economic situation during the rate-cutting process to avoid excessive easing that could lead to a rebound in inflation or asset bubbles. For investors, this means that the future market environment will be relatively stable.

At the same time, the minutes mentioned that the labor market remains robust, but the pace of job growth has slowed, and the unemployment rate has risen. Although this change exerts some pressure on economic growth, it also provides room for future rate cuts. Investors can focus on companies and industries that benefit from rate cut policies, such as U.S. stocks, gold, and our cryptocurrency market. Additionally, the minutes pointed out that inflation has significantly eased from peak levels but will still take time to reach the 2% target. This means that in future investment strategies, attention should be paid to the trend of inflation changes and their impact on the prices of various assets in the global market.

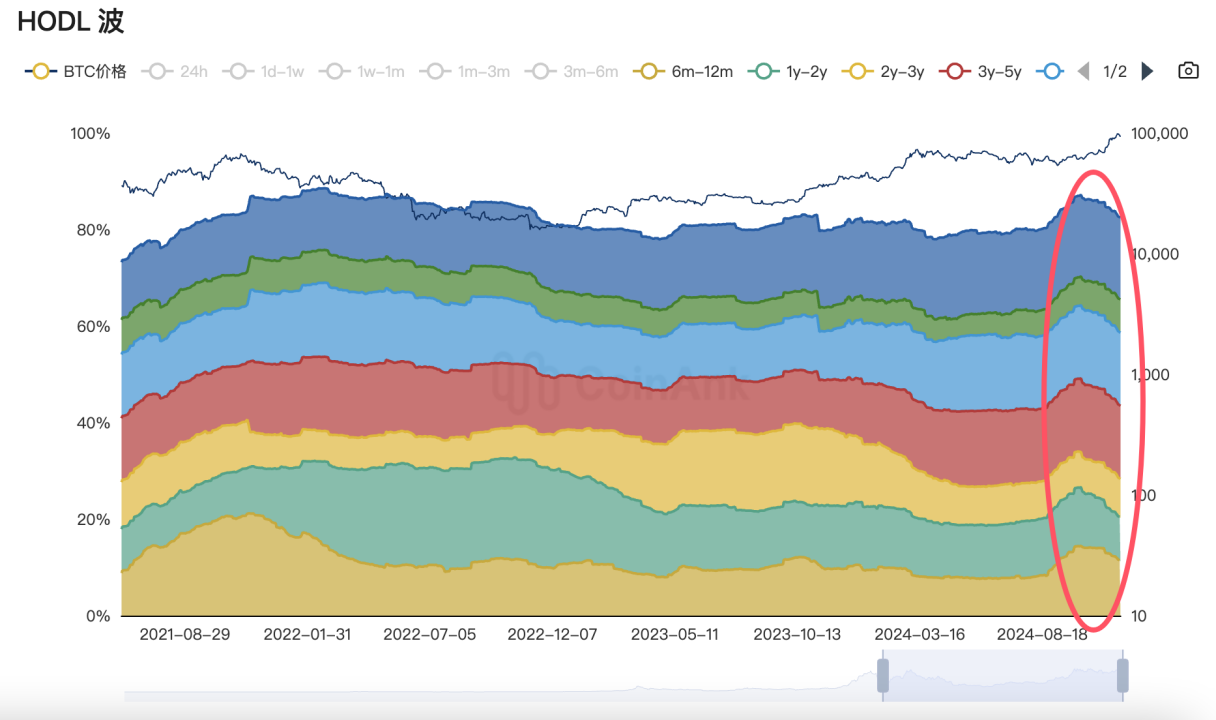

Data Analysis: According to CoinAnk data, there has been a significant decline in the number of long-term holding addresses, which we generally define as addresses holding coins for more than 155 days. Statistics show that around the historical price peak, long-term holders sold over 200,000 coins, with sales reaching as high as 728,000 coins in the past 30 days.

Regarding this selling behavior, we believe that as BTC prices continue to rise, long-term holders may have reached their profit targets and thus choose to sell to lock in profits. Despite BTC reaching a historical high, there remains uncertainty in the market. Long-term holders may adopt a cautious attitude towards future market trends, opting to sell to mitigate risks. Additionally, the $100,000 mark is seen as a psychologically significant selling point. Many investors may believe that at this price level, BTC is overvalued, leading them to sell to avoid potential correction risks.

The selling has also had a significant impact on the market, as the actions of long-term holders may lead to a price correction for BTC. As the selling volume increases, the supply-demand relationship in the market changes, making price declines possible. Selling behavior may weaken market confidence. When a large number of long-term holders choose to sell, other investors may develop doubts about the market outlook, further exacerbating price declines. Selling behavior may lead to increased market volatility. As prices rise and fall, investor sentiment may change, resulting in significant market fluctuations.

BTC Technical Analysis:

BTC continued to fluctuate and retreat yesterday, rebounding to around 90,800, aligning with our previous prediction that "a relatively important concentration of chips is distributed just below $91,000, close to the first support level." After the dollar index's bullishness was realized, a correction occurred, and U.S. stocks rebounded overnight, but BTC was more affected by HODL selling and net outflows of ETF funds.

According to CoinAnk's main chip distribution chart, a short-term rebound occurred below the $91,000 support level, and the four-hour top divergence repair is basically complete; however, the daily death cross continues, and after the rebound repair, a correction is expected to occur. Important support levels below are around $87,000 and $85,000. Resistance above is around $96,500, recent highs of $98,870-$99,588, and the historical high.

Written by: laolibtc

CoinAnk Data

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。