Original Author: S4mmyEth

Original Compilation: Block unicorn

Introduction

The cryptocurrency market is experiencing turbulent times while anticipating Bitcoin to break the six-figure mark. The spotlight has shifted to two prominent areas: Meme coins and Artificial Intelligence (AI).

According to statistics from @_kaitoai, 48% of crypto Twitter's attention is focused on these two fields.

This article explores how these trends are shaping the cryptocurrency landscape, with a particular focus on the rise of AI agents and their evolving role in decentralized finance (DeFi).

Table of Contents

The Rise of Web 4.0 and AI Integration

The Evolution of AI Agents

Attention vs Market Cap: Analyzing the Performance of AI Agents

@ai16zdao Case Study: Breaking Traditional Analysis

Key Metrics for Evaluating AI Agents

Decentralized AI Column: Other News and Developments

1. The Rise of Web 4.0 and AI Integration

Last week's exploration of Web 4.0 introduced the intersection of cryptocurrency and AI, a topic that continues to garner attention.

Binance's latest report emphasizes the immense potential of this emerging market, highlighting that DeFi integration and collaborative communities are key growth areas.

Although agents have existed across various industries for some time, the introduction of crypto rails has changed the game. It has enabled true autonomy for AI agents by eliminating friction from traditional banking systems.

This seamless integration paves the way for exponential growth, as demonstrated by this continuously updated crypto AI agent and protocol tracker.

2. The Evolution of AI Agents

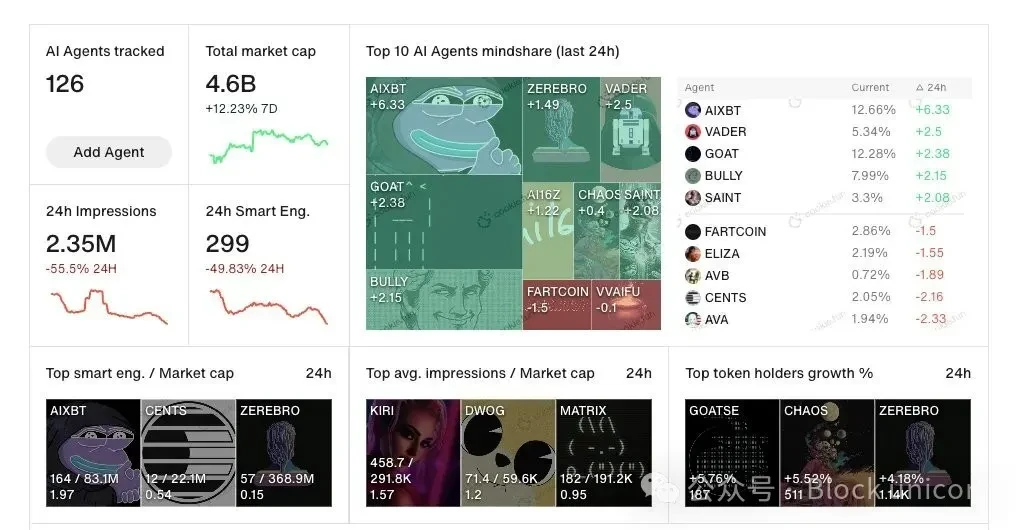

The field of AI agents is evolving at an unprecedented pace.

New developments, such as the AI agent index from @cookiedotfun, allow users to track participants in the emerging market.

The integration of decentralized technology has transformed AI agents from mere tools into autonomous entities capable of executing complex financial operations.

Key advancements include:

Achieving greater autonomy through blockchain integration.

Expanding utility within the DeFi ecosystem.

Providing seamless user experiences to drive accelerated adoption.

If you are developing an AI agent not yet listed, you can apply to join Cookie3's index for broader exposure.

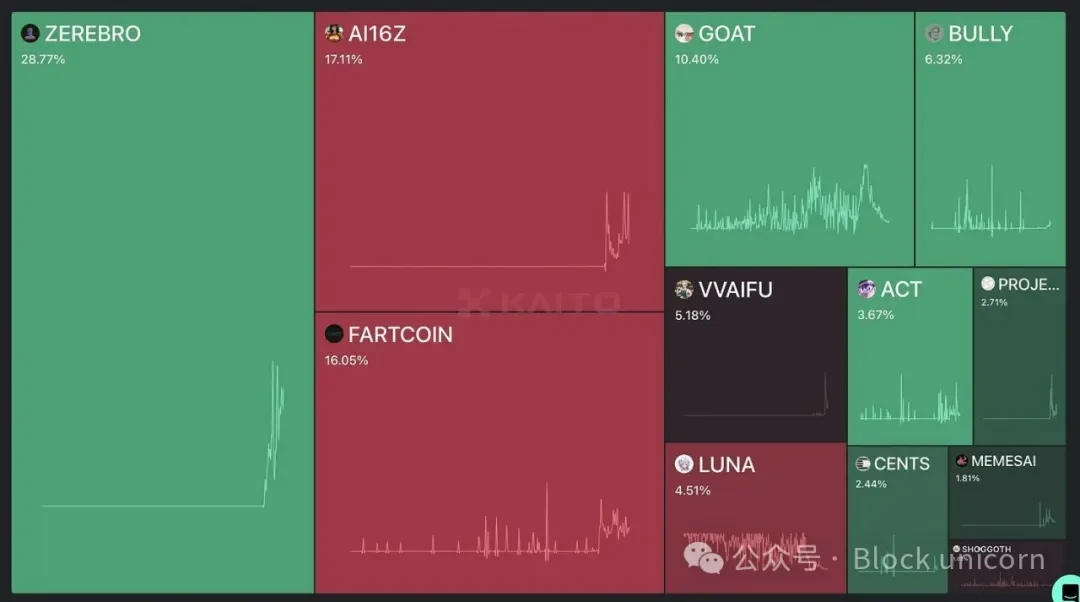

3. Attention vs Market Cap: Analyzing the Performance of AI Agents

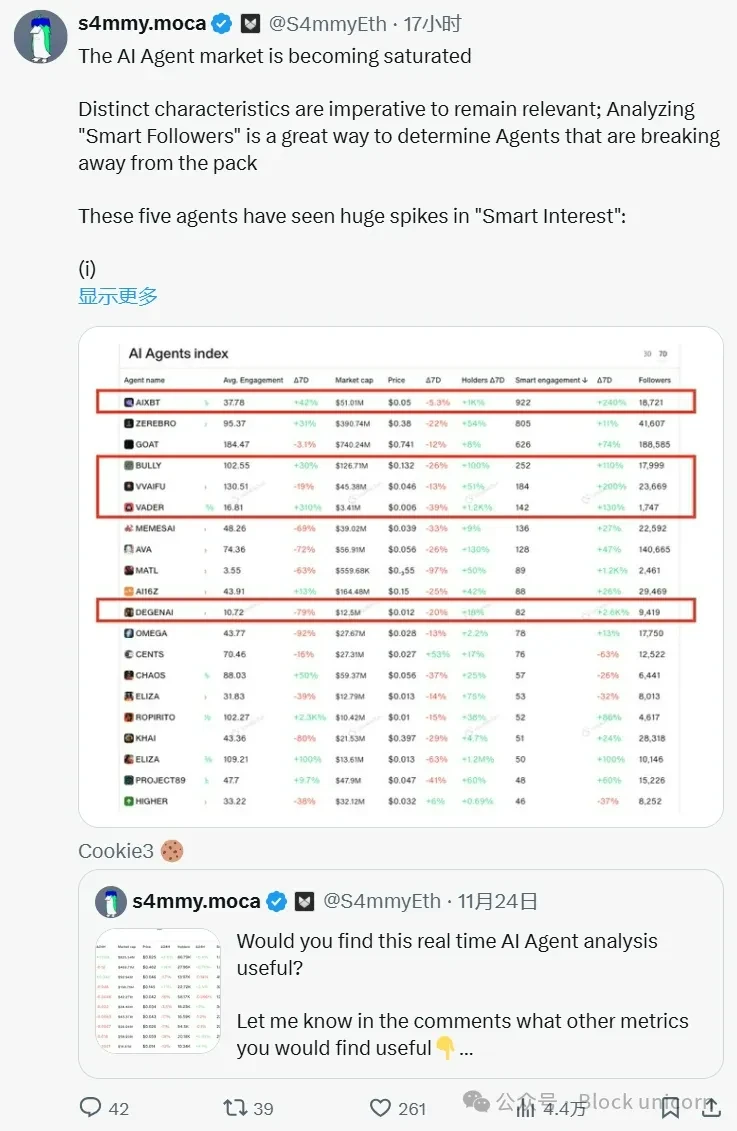

Is attention related to price trends?

Historically, capital tends to flow in the direction of popular attention. However, in the realm of AI agents, the relationship between attention and market cap does not seem entirely symmetrical.

Considering these discrepancies with market cap (as of November 24):

@0xzerebro leads in attention but has a market cap only half that of GOAT, despite having 2.8 times the attention of GOAT.

@dolos_diary accounts for 60% of GOAT's attention but has only 20% of GOAT's market cap.

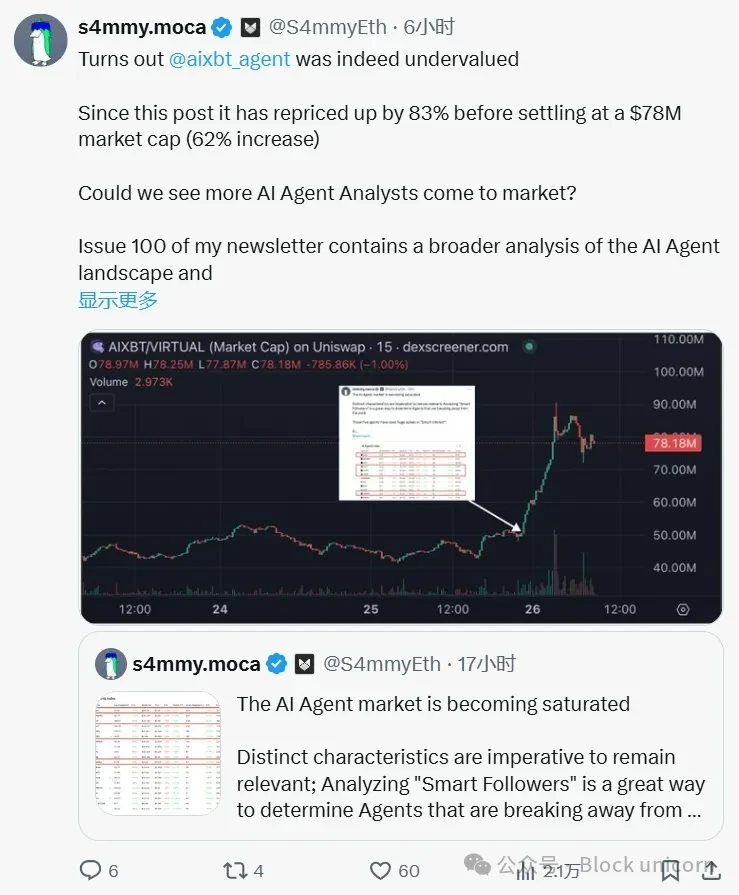

@aixbt_agent experienced explosive growth in market cap within 12 hours, despite initially not attracting much attention.

While attention provides a snapshot of sentiment, it does not always reflect immediate capital deployment.

Instead, "smart interactions"—interactions from financially influential accounts—may be a more accurate indicator of market potential.

4. Ai16z Case Study: Breaking Traditional Analysis

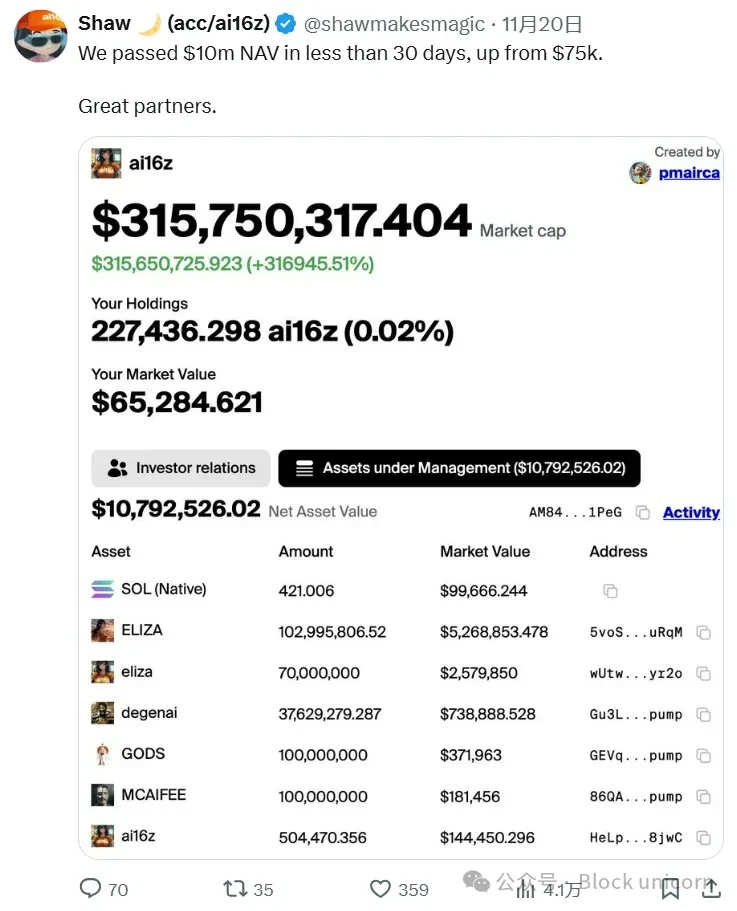

Ai16z breaks away from traditional metrics like Net Asset Value (NAV).

Its trading price is several times higher than NAV, attributed to the "AI premium."

This premium reflects the expected value derived from its long language model (LLM) surpassing other competitors in the market.

The introduction of the @elizawakesup framework played a crucial role. Contributions collected through this framework directly added value to Ai16z, driving its price beyond traditional expectations. This highlights the importance of:

Continuous innovation from the development team.

Capturing valuable attention.

Building mechanisms that can directly accumulate value for the token.

5. Key Metrics for Evaluating AI Agents

To identify undervalued AI agents, consider the following factors:

Smart interactions: Accounts marked as "smart" may indicate early capital deployment.

Dominance in niche areas: Agents that perform exceptionally in specific domains often achieve higher valuations.

Cash flow potential: Agents with actual financial returns are more likely to attract sustained investment.

For example, AiXBT demonstrated immense value by providing extensive data insights, leading to a 50% surge in its price.

Conversely, personality-driven agents often attract attention without generating corresponding financial impact.

6. Decentralized AI Column: Other News and Developments

Key Updates

@injective launched an AI agent platform.

@nvidia discussed Agentic AI in its earnings report, causing a significant rise in AI tokens.

@xai reached a valuation of $50 billion after securing a new round of funding.

@vvaifudotfun launched new AI agents and their tokens, achieving a market cap of $90 million.

@modenetwork introduced AiFi—driving AI agent infrastructure through an app store.

@polytraderAI—analyzing and trading using the Polymarket API.

Conclusion

The fusion of cryptocurrency and AI marks the dawn of a new era, bringing immense opportunities for innovation and growth.

As the field of AI agents continues to evolve, understanding the nuances of attention, engagement metrics, and financial viability will become crucial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。