1. Opening Remarks

【Market Insights】 In-depth analysis from price to trading volume!

Trading volume (Volume) indicates the number of trades within a specific time period and can directly reflect the influx of capital. However, it is important to note that interpreting trading volume alone is not very meaningful, as it simultaneously represents equal numbers of buyers and sellers.

To comprehensively analyze trading volume, it is necessary to consider the following factors:

Price trend

Price position

Order book and market orders, among other indicators

As the saying goes: "Novices look at price, while veterans look at volume." So how should we specifically interpret it?

In this opportunity-filled market, recognizing the market truth that "volume comes first, price comes later" is crucial. The following will introduce six patterns of trading volume and three stages to help you better interpret market trends:

Follow us @AICoinzh, like, share, and bookmark this post to benefit more people!

2. Six Patterns of Trading Volume

【1. Price Up, Volume Up】 When both price and trading volume increase simultaneously, this is a strong bullish signal, usually indicating strong buying power and a positive, optimistic market atmosphere.

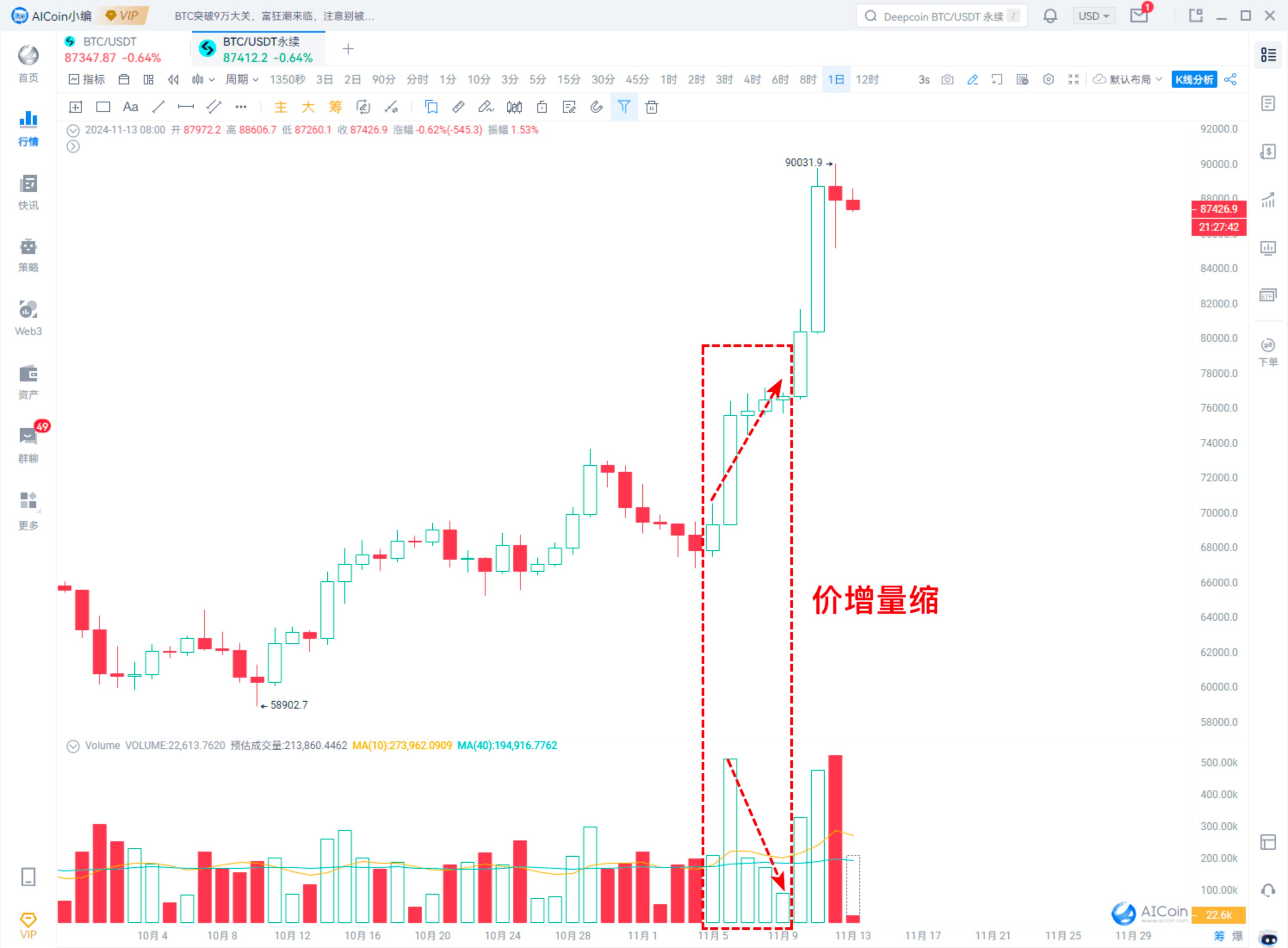

【2. Price Up, Volume Down】 This means that the price is rising, but trading volume is decreasing.

If this occurs at the beginning of a trend, it is usually a normal bullish phenomenon; however, if it appears at the end of a trend, one should be wary of potential reversal risks.

【3. Divergence Between Price and Volume】 The trends of price and trading volume are inconsistent.

For example, if the price is rising but trading volume is gradually decreasing, this is a signal of insufficient momentum, indicating that the upward trend may be difficult to sustain, and one should be cautious of potential pullback risks.

【4. Price Down, Volume Up】 When the price is falling and trading volume is increasing.

This is usually a bearish signal, indicating strong selling power and significant selling pressure in the market.

However, if this occurs in an oversold market, it may instead be a reversal signal, suggesting potential rebound opportunities.

【5. Price Down, Volume Down】 The price is falling, but trading volume is decreasing.

Typically, this situation is seen as a signal that the downtrend is nearing its end, indicating that selling power is weakening and downward momentum may be dissipating. At this time, one should pay attention to potential trend reversal or stabilization signals.

【6. Price Stable, Volume Stable】 Both price and trading volume remain stable and unchanged.

This generally occurs in a market consolidation phase, showing that buyers and sellers are temporarily balanced, and the market lacks a clear direction.

In this case, investors typically wait for external stimuli or new market news to break the balance and guide the next movement.

3. Three Stages of Trading Volume

【1. Bottom Volume Spike】

Entry Timing: Consider entering when a volume spike occurs at the bottom of a trend.

Application: If a trend breakout pattern appears, consider closing positions to lock in profits.

【2. Middle Volume Spike】

Operational Strategy: Use small amounts of capital for tentative buying while maintaining a wait-and-see approach.

Application: Closely observe subsequent price movements. If the price rises, consider holding; if it falls, it may just be a temporary stabilization.

【3. Top Volume Spike】

Operational Strategy: Exercise caution and consider shorting.

Application: If it breaks below a key level (in conjunction with pattern analysis and other methods), it is a short signal.

In a trend, if the volume-price relationship is reasonable, one can continue to operate according to the strategy.

【Disclaimer】 The market has risks, and investment requires caution. Please carefully consider your personal risk tolerance before use; this article does not constitute any investment advice.

Join the TG group: https://t.me/aicoincn to capture market opportunities in real-time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。