Nearly 600 million liquidated, Bitcoin touched 90,500 USD this morning.

Written by: Shaofaye123, Foresight News

After Bitcoin rose to 100,000 USD, a significant downward spike occurred this morning, with approximately 600 million USD liquidated in the last 24 hours. The CMC altcoin season index rose to 88, with the market having continuously risen for nearly 100 days, entering a critical moment.

Bitcoin spikes to 90,500 USD

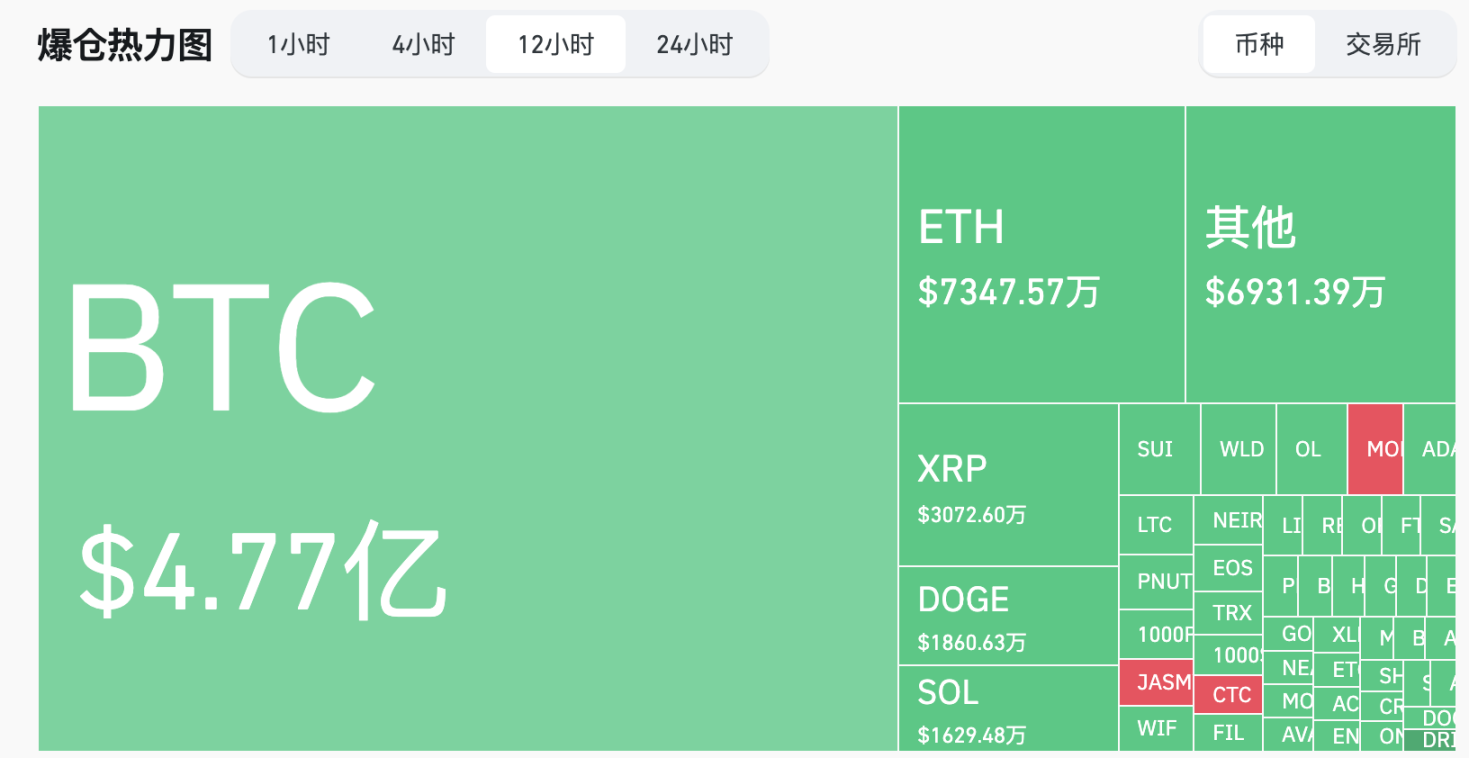

Yesterday, after BTC broke through 100,000 USD, it fell sharply in the evening. At 6:28 AM on December 6, an extreme spike occurred in the BTC/USDT market, with BTC briefly dropping to 90,500 USD. In the last 12 hours, 477 million USD was liquidated, primarily from long positions, totaling 410 million USD. It has gradually recovered to 97,860 USD, and other altcoins like ETH have also gradually recovered after a brief pullback.

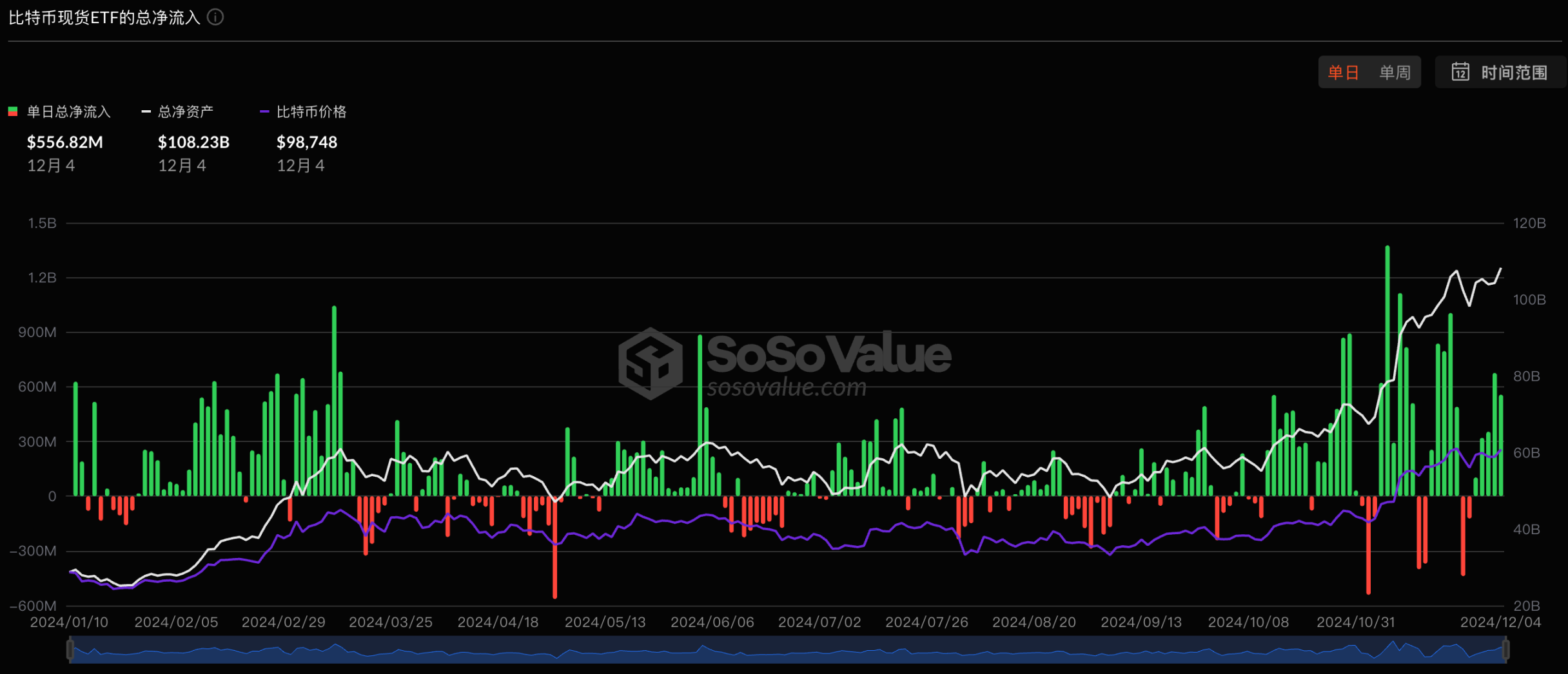

Bitcoin spot ETF data can provide insights into the flow of off-exchange funds. When there is a significant net inflow, buying pressure increases, making it more likely for Bitcoin prices to rise. According to SoSovalue data, Bitcoin spot ETFs are still in a state of continuous net inflow, but the inflow amount is gradually decreasing. Meanwhile, the funding rate for Bitcoin reached a peak on December 5 after consecutive increases, and with the liquidation of long positions yesterday, it has started to decline, indicating a reduction in bullish momentum in the market.

Additionally, on the morning of December 6, U.S. President-elect Trump announced the appointment of David O. Sacks as the White House Director of Artificial Intelligence and Cryptocurrency. As a crypto-friendly figure, David O. Sacks has shown strong belief in cryptocurrency since earlier years. In 2018, he joined the advisory board of the core team of the decentralized trading protocol 0x. With David O. Sacks taking office, Bitcoin may surge again.

MicroStrategy, which is closely related to Bitcoin, is also expected to be included in the Nasdaq 100 index, thus entering the world's largest ETF: QQQ, which will bring passive capital inflows to MSTR. Currently, MSTR has met all the conditions to enter the Nasdaq 100 index and ranks 66th in market capitalization among qualifying companies, with the top 75 companies automatically included in the Nasdaq 100 index.

Altcoins continue to rise, AI sector sees widespread gains

Although BTC experienced a spike yesterday, altcoins did not suffer severe declines, and market sentiment remains optimistic, with the greed index reaching 72.

On December 6, OpenAI officially held a press conference, releasing the complete version of o1 on the first day, along with the o1 Pro Mode. o1 has made breakthrough progress in three key areas: solving high-difficulty math problems, programming ability testing, and analyzing complex scientific questions. Compared to the preview version, various metrics have generally improved by over 40%. Version updates will continue to be released over the next 12 days.

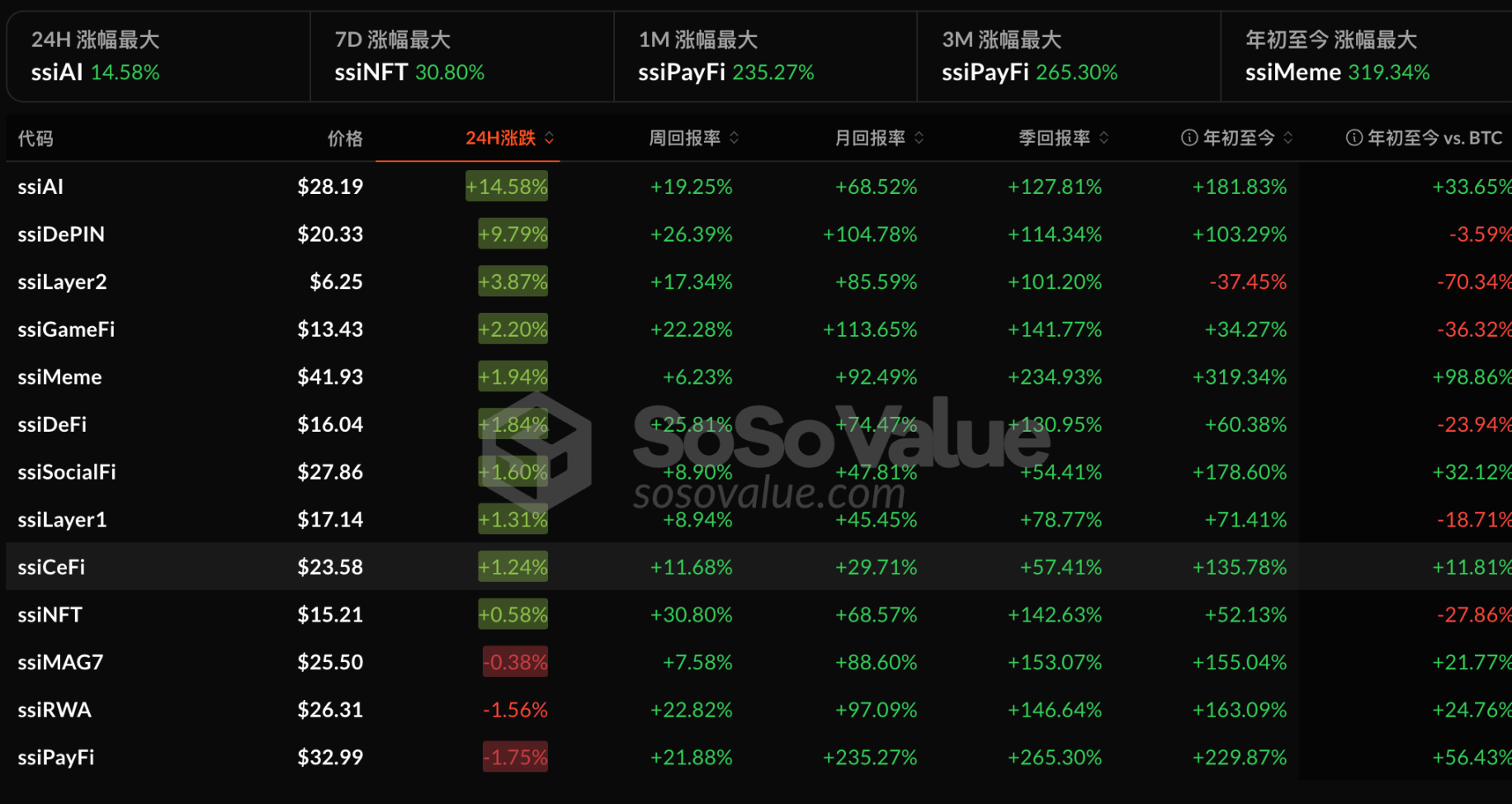

Possibly influenced by the OpenAI press conference, the AI sector saw widespread increases. According to SoSovalue data, the AI sector experienced a general rise yesterday, with JASMY increasing by 45.26% in 24 hours; MASA rising by 28.96%; WLD increasing by 25.86%; and RENDER and ANKR also seeing 24-hour increases of 20%.

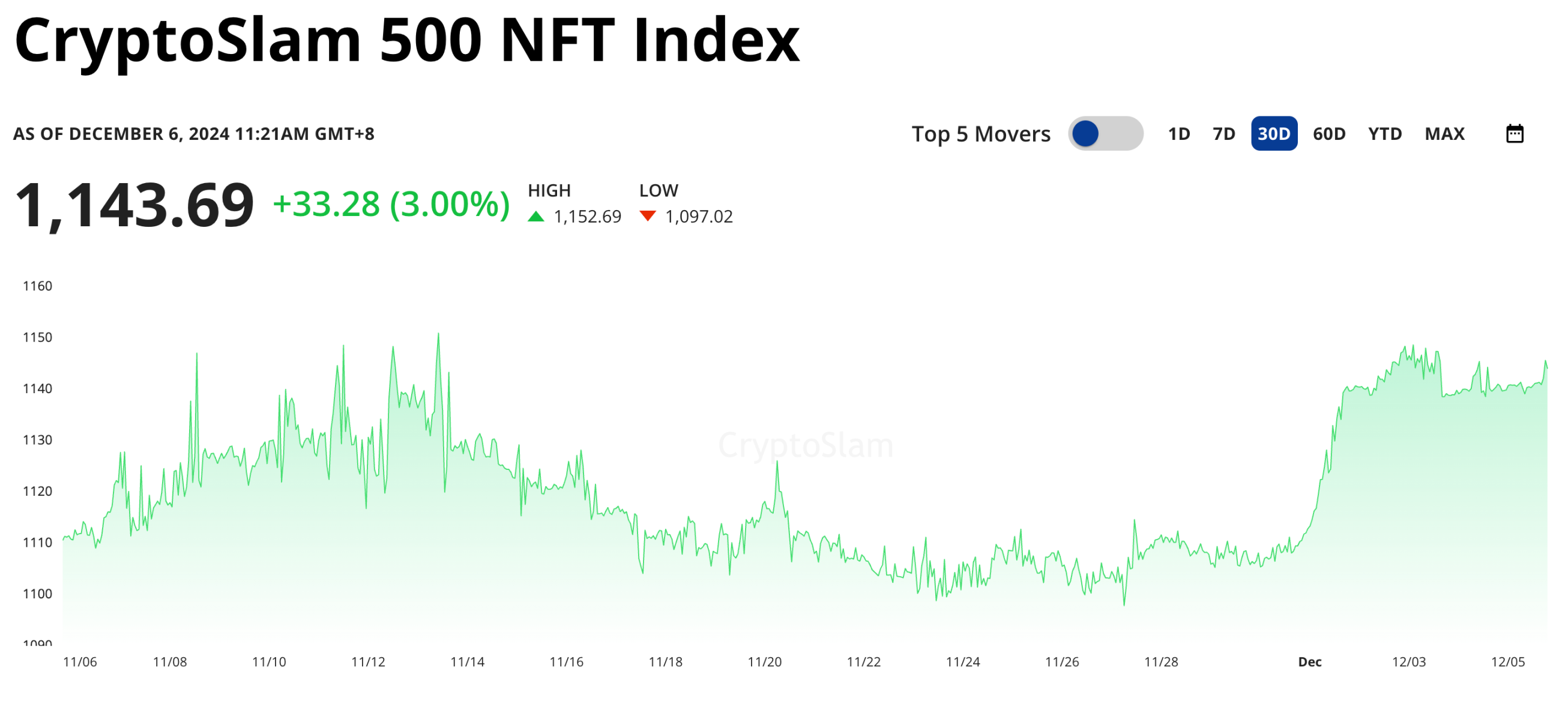

The NFT sector has also gradually warmed up over the past 7 days, becoming the sector with the largest 7-day increase at 30%. According to CryptoSlam data, the CryptoSlam 500 NFT Composite Index, which measures NFT market performance, has also rebounded by about 33% in the past three months.

Furthermore, the DeFi sector has seen consecutive increases, with CRV rising by 60% over the past week, MORPHO increasing by about 75%, and tokens like UNI and AAVE performing exceptionally well. Among public chain tokens, the long-standing "zombie coins" XRP, XLM, and ALGO have seen declines after consecutive rises, while MOVE series token SUI has surged, breaking through 4 USDT, with a recent increase of 25%.

Altcoin index continues to rise, market sentiment remains optimistic

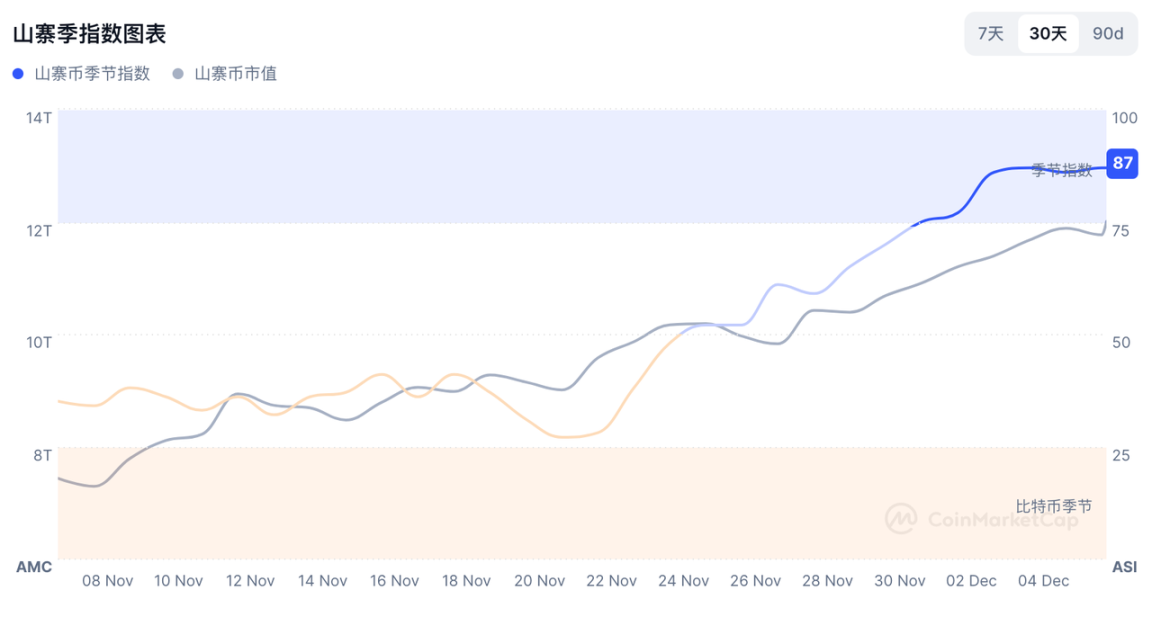

According to the altcoin season indicators from November, various metrics have shown a comprehensive increase, and the market may have reached a peak in the short term, with sentiment remaining optimistic as we enter a critical moment.

From the altcoin season indicators, the current value has risen to 88. This indicator aims to measure the profitability of altcoins compared to Bitcoin. Specifically, it represents how many tokens among the top 50 altcoins have performed better than BTC in the previous quarter (90 days); the higher the value, the more it indicates that it is currently altcoin season. This value has reached a high point this year, compared to around 30 in early November.

Upbit's altcoin trading volume, as a basis for the market's FOMO sentiment index, can also reflect the current state of the altcoin season to some extent. Generally, when Koreans are in a frenzy of FOMO and trading volume peaks, it is time to consider exiting. Currently, this value has also reached a high point for the year.

From the perspective of Bitcoin's market share, it reached a temporary high of 61% on November 21. Historically, when Bitcoin's market capitalization reaches the range of 65-70%, it usually signals the start of altcoin season. After reaching 61% this year, a comprehensive rise in altcoins has begun. Subsequently, BTC.D has continued to decline, currently down to 55%.

Analysts have differing views on the market's future

Regarding the future of the market, analysts have differing opinions, and the market may be entering a critical moment of speculation.

Geoffrey Kendrick, Head of Emerging Markets FX Research and Cryptocurrency Research at Standard Chartered Bank, stated, "We are further optimistic about the market, expecting Bitcoin prices to rise to around 200,000 USD by the end of next year, given the potential for institutional investors to increase their investments in Bitcoin." In his report, he claimed, "By 2025, Standard Chartered expects institutional capital flows to continue to maintain or exceed the pace of inflows into Bitcoin seen in 2024."

Oppenheimer analyst Lau cautioned investors that Bitcoin prices will experience volatility. He stated, "Once Bitcoin prices reach 100,000 USD, investors need to remain cautious, as there may be selling pressure, and the market will look for the next breakout point."

Trader Paulwei noted, "Since September 7, BTC has been on a rapid upward trend for about 90 days, and it will reach 100 days around December 14. Historically, the market tends to experience a pullback trend after rising continuously for 100 days."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。