What exactly did Hyperliquid do right to create a win-win-win situation for airdrops, token prices, and products, and which potential tokens in the ecosystem are worth exploring?

Written by: WOO

Background: Hyperliquid Becomes the Perp Dex Leader

On November 29, the decentralized derivatives exchange Hyperliquid conducted an airdrop of the $HYPE token. Initially, it was thought to be a simple process of boosting trading volume to earn points for token redemption, but everything turned out to be different this time.

After the launch of the Hype token, its price surged from $2 to $12 within a week, reaching a high of 6 times its initial value. The current market capitalization has soared to $4 billion, with a fully diluted valuation (FDV) reaching $12 billion, close to one-tenth of Solana's.

In terms of airdrops, data from ASXN shows that the average user received 2,881 $HYPE tokens. At a price of $12, this means each person received an airdrop worth over $34,000.

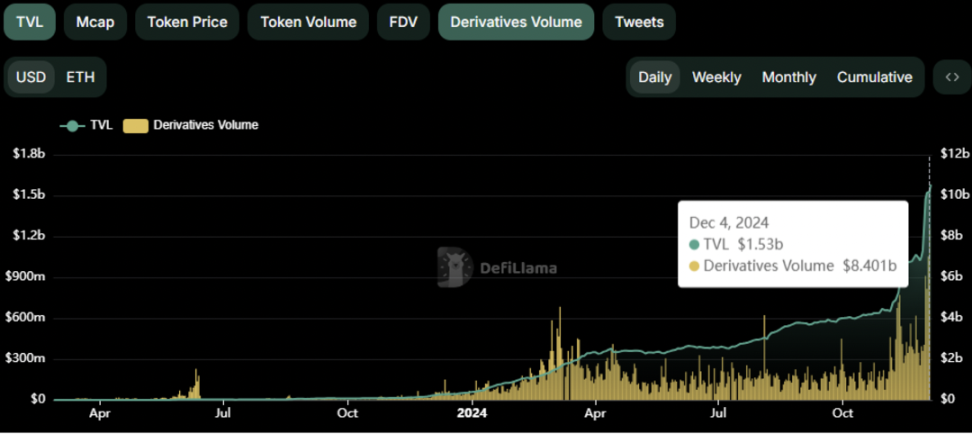

Regarding the product, even after the token distribution and the end of the airdrop event, the total value locked (TVL) has reached $1.6 billion, maintaining its position as the leader among all decentralized derivatives exchanges. Trading volume continues to rise, setting new records, reaching a daily level of $8 billion!

What exactly did Hyperliquid do right to create a win-win-win situation for airdrops, token prices, and products? What potential tokens in the ecosystem are worth exploring? Let’s take a look with WOO X Research.

Reference: DefiLlama

Why Was Hyperliquid Able to Break Through?

In the crypto space, Perp Dex is no longer a new narrative. From the initial DYDX to GMX, which used Vault as a counterparty, Hyperliquid has outperformed them all. What did Hyperliquid do right to stand out?

- Aligning with Current Market Aesthetics: Hyperliquid did not seek VC funding. Founder Jeff even believes that allowing VCs to hold 50% of the token supply early on is a "stain." He thinks most projects take shortcuts: first obtaining investments from market makers, then attracting trading volume through reward mechanisms, but he believes this model cannot be sustained. Jeff's philosophy aligns with the current trend of investors shifting towards meme coins: essentially, there is a disdain for VC tokens, and users are unwilling to let institutions take over. Now, there is finally a "serious project" that does not rely on VCs but is more Crypto Native, operating in a bottom-up manner, which naturally wins market favor.

- User Experience: Hyperliquid is currently built on Arbitrum. To trade, users simply need to deposit stablecoins (USDT, USDC, USDC.e) directly on Arbitrum. After depositing, they can start trading without any gas fees, and the deposit and withdrawal process is straightforward. Additionally, HLP allows users to not only act as traders but also as market makers. While LP counterparty forms are already the mainstream in current Perp Dex, HLP offers users the freedom to choose their market-making strategies and even copy trades, making the design more flexible.

- Valuation Pricing Discrepancy: Hyperliquid is currently viewed as a Perp Dex, but their ambition goes beyond that. Their vision is to become a foundational platform for financial activities, where various DeFi and derivatives protocols can be built, essentially creating their own chain. Currently, Hyperliquid EVM is live on the testnet, but integration with other L1 states is not yet complete. In market pricing, the valuation ceiling for Perp Dex and public chains is entirely different, with the latter having much higher growth potential. Hyperliquid's smart move is not to position itself solely as a Perp Dex but as a public chain, allowing the market to assign a higher valuation potential.

Another reason for the rise of $HYPE is that it cannot be purchased on other exchanges and can only be traded on Hyperliquid, leading to it being humorously referred to as a "single-player coin."

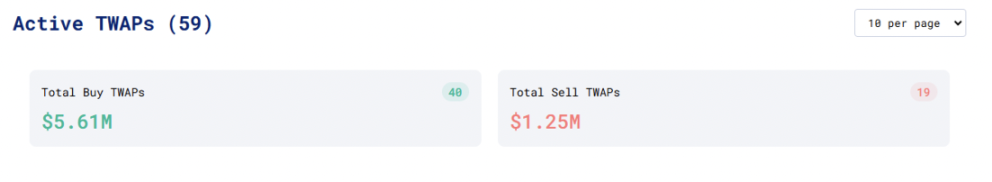

According to the Hyperliquid dashboard created by ASXN, the current demand for buying $HYPE tokens far exceeds selling. The chart below shows that many users are still purchasing HYPE through TWAP (Time-Weighted Average Price) methods, with total purchases reaching $5.6 million, while sales are only $1.25 million.

In addition to the surge in $HYPE, which other ecosystem tokens are worth our attention?

Reference: https://data.asxn.xyz/dashboard/hype

Finding Alpha in Related Concept Tokens

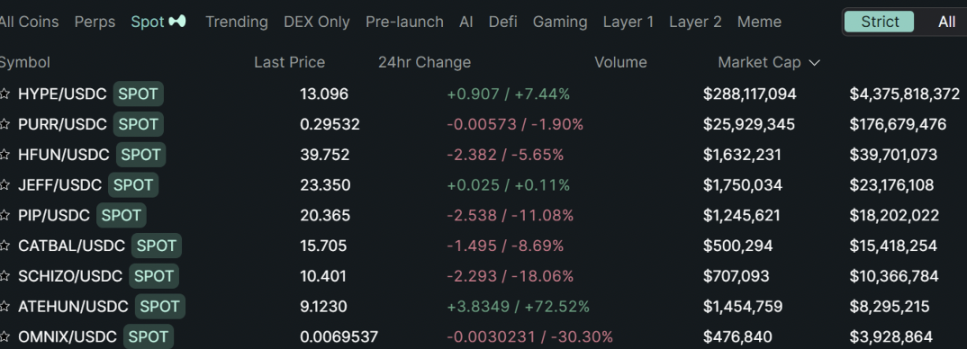

How can we select tokens that are strongly correlated with Hyperliquid from the vast sea of cryptocurrencies? We can refer to the Spot -> Strict section, which includes a total of 11 tokens related to Hyperliquid.

Here are the tokens selected by WOO X Research:

Reference: app.hyperliquid.xy

PURR

Purr is represented by a cute cat and serves as the official mascot of Hyperliquid. It is also an officially recognized meme coin and can be seen as a leveraged version of $HYPE. Each transaction will burn Purr, with approximately 0.33% of the total supply currently burned.

- Current Price: 0.3

- Market Cap: 181M

- 24-Hour Trading Volume: 25M

- Narrative Angle: Official meme, token burn, airdrop expectations

Reference: @Hyperintern

HFun

Hypurr.fun is a Telegram trading bot that allows direct trading of Hyperliquid-related tokens, including features for new token sniping and token deployment. The HFun token allocates 30% to $PURR holders, 30% to the token creators, and 40% for liquidity use.

Recently, they also launched their own AI Agent - Schizo, designed for token issuance.

- Current Price: 39.5

- Market Cap: 39M

- 24-Hour Trading Volume: 1.6M

- Narrative Angle: Trading, token issuance, sniper bot

Reference: https://dexscreener.com/hyperliquid/0x929bdfee96b790d3ff9a6cb31e96147e

Jeff

A meme coin based on the concept of Hyperliquid's founder Jeff, but it was not created by him; it was established by community members.

- Current Price: 23.3

- Market Cap: 23.3M

- 24-Hour Trading Volume: 1.7M

- Narrative Angle: Founder meme

Reference: @JHyperliquid

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。