Analyzing the performance of new coins on Binance in November and the listing strategy.

Written by: Viee, Core Contributor of Biteye

Edited by: Crush, Core Contributor of Biteye

"Within less than an hour of ACT's launch, Twitter exploded."

In November, the launch of ACT and PNUT on Binance ignited the entire market, with ACT's price skyrocketing tenfold in just ten minutes. Some held onto A7, while others regretted selling too soon. Holders became overnight millionaires, leading to a "gold rush" in the Meme market in November, all in pursuit of the next hundredfold gem.

The fear of missing out acted like a domino effect, triggering widespread speculation about Binance's listing strategy: Why did Binance choose these coins, and who will be the next lucky one?

The outstanding performance of ACT and PNUT has drawn attention and prompted new thinking about Binance's listing mechanism. What wealth secrets are hidden behind these narratives and celebrations? Why does Binance repeatedly ignite the market? The following data statistics and analysis will reveal the underlying logic of the "Binance Wealth Effect."

01 In-depth Analysis of New Coins on Binance in November

From the new coin yield data of last month, Binance has demonstrated a flexible strategy that is highly synchronized with market trends when selecting projects. Based on the following table, we will deeply analyze Binance's listing logic from two dimensions: wealth effect and coin selection tendency.

1. Data Analysis: Most New Coins Reach Historical Highs After Listing on Binance

Historically, the performance of new coins listed on Binance typically follows a cycle of "explosion - surge - correction - stabilization." Taking ACT and PNUT as examples: in the early stages of their launch, market sentiment was quickly ignited, and prices surged to new highs in a short time; this was followed by a natural correction phase. Below, we will analyze them one by one:

Significant Short-term Wealth Effect, Incredible First-day Gains

Data shows that the wealth effect of new coins listed on Binance is particularly prominent. Especially on the first day, it becomes a key window for obtaining high returns. For example:

- ACT: The first-day increase reached 2100%, with a peak increase of 4500%, bringing substantial returns to short-term investors.

- PNUT: The first-day increase was 255%, peaking at 2118%, also demonstrating strong market potential.

- THE: As a non-Meme coin, it performed outstandingly on its first day, with a peak increase of 197%, leading the same sector by a wide margin.

The explosive power of these projects is partly due to Binance's precise selection before listing. On the other hand, the initial stage of listing often sees high market sentiment, with funds pouring in to drive prices up rapidly, creating a short-term "wealth creation effect."

Surge Phase: Most New Coins Set Historical Highs After Listing

Data indicates that over 60% of tokens set historical all-time highs (ATH) after listing on Binance. This reflects, to some extent, the influence of new coins on Binance in the market.

Moreover, a closer observation reveals that new coins launched in the past three months have performed particularly well, with 9 new coins quickly reaching ATH after listing on Binance, almost becoming a "guaranteed rise code." Surprisingly, among 12 old coins, even some that had reached highs in the last bull market or earlier this year exploded again with the support of the Binance platform, with 7 of them setting new highs after listing on Binance. This shows that, on one hand, the explosive power of new coins often surpasses that of established tokens, indicating the market's evident enthusiasm for new projects. On the other hand, old coins can still break historical records, highlighting the powerful influence of the "Binance Effect." Perhaps this is not only the market's fervent pursuit of new projects but also a strong validation of Binance's listing strategy and platform appeal.

After Correction, Most Tokens Still Hold Investment Value

Although some new coins experienced corrections after a short-term surge, overall, more than half of the tokens still maintain significant price increases compared to their pre-listing levels, with increases of over 20%. For instance, the relatively outstanding ACT, PNUT, DRIFT, THE, etc., demonstrate strong market resilience.

A correction does not mean a complete loss of investment value; on the contrary, it may provide opportunities for potential long-term investments.

2. Binance's Listing Strategy: Following Trends, Returning to Users and the Market

By interpreting this data, an interesting phenomenon emerges: Meme coins occupy a significant proportion of new coins on Binance, such as CHILLGUY, BAN, SLERF, etc., which is not coincidental. In the past few months, the explosive power of the Meme sector has been evident, as Meme coins, due to their strong community culture, social media effects, and low barriers to entry, have become hot topics in the crypto market. Binance has clearly timed this wave of market sentiment perfectly.

Meme coins listed on Binance often possess several core characteristics: "broad narratives, strong communities, and fair token distribution."

- Broad narratives with moderate market capitalization: Selecting projects with wide influence, clear narratives, and relatively small market caps reduces user participation barriers while ensuring market activity.

- Strong community cohesion: Prioritizing Meme coins with strong influence in overseas communities can drive global market sentiment and spark discussions in Chinese communities.

- Fair token distribution: Ensuring project mechanisms are transparent and fair, avoiding excessive concentration of tokens or market manipulation risks.

For example, projects like CHILLGUY and SLERF had already accumulated a large number of users and topic heat on-chain before listing on Binance. The ACT community is strong, the AI Agent narrative is broad enough, and it is very novel.

It can be seen that Binance's logic for listing Meme coins is not merely about following trends. Reflecting on the first half of this year, the market had complaints about high FDV tokens, and Binance did not blindly list new coins but instead supported small and medium market cap tokens. In the second half of the year, it adopted a more flexible and market-oriented response strategy—selecting tokens that truly have community foundations and narrative potential. The performance of ACT and PNUT is the best proof of this strategy: behind the release of the wealth effect is a precise grasp of market demand.

02 Multiple Playstyles and Strategies for New Coins on Binance

The data analysis above mainly targets tokens listed on Binance through spot or contract methods. In fact, Binance's "listing" playstyle has long surpassed traditional spot trading, forming a mature and diversified mechanism. Whether for high-risk tolerance veteran players or novices seeking stable gains, Binance has corresponding strategies and channels, allowing users to meet their needs and even pursue multiple lines simultaneously. Next, let's review several popular participation methods provided by Binance:

1. Spot and Contracts

Spot and contracts need no further explanation; they are the most familiar participation methods for users. When new coins are listed, the spot market often experiences a surge in prices. Especially with this round of Meme coin listings, many players seized the opportunity to double their investments in the spot market. The contract market is more suitable for traders seeking high leverage and high returns, allowing both long and short positions to capture profits from market fluctuations.

Strategy: Conduct In-depth Research on New Coin Projects, Avoid Being a "Headless Fly"

Each time a new coin is listed, market sentiment often heats up quickly, but the real winners are usually those players who have done their homework in advance. By thoroughly researching the project's white paper, token economic model, and community activity, one can assess the project's true potential.

2. Launchpool

Binance's Launchpool is a zero-risk mining option, the first choice for stable returns, providing users with opportunities to stake assets like BNB and FDUSD for mining. Successful projects like ENA and TON allow users not only to obtain project tokens but also to enjoy high annualized returns. Earlier this year, Launchpool created a buzz, with some projects' annualized returns even reaching over 200%, becoming an important channel for chasing new coins.

The following chart shows the annualized returns of projects that have been launched in 2024 based on publicly available data from Binance, calculated over the complete mining cycle.

From nearly 20 periods of Launchpool data, most projects performed excellently on their first day, with an average return exceeding 100%. For example, Ethena's first-day annualized return reached 288.86%, while its historical peak APY astonishingly hit 447.7%. Similarly, Manta's historical peak APY reached 375.31%, showcasing tremendous profit potential.

Additionally, the listed coins indicate that there are many quality projects, most of which have strong fundamental support, which is also one of the important reasons for subsequent price increases. For instance, Usual achieved an APY of 57.33% on its launch day, and its current market performance has surpassed the opening, with an APY of 78.40%. ENA is similar, with a current APY of 282.72%, far exceeding its launch day performance.

Overall, Binance's Launchpool not only provides safe, low-barrier participation opportunities but also brings considerable returns. Moreover, Launchpool yields are stable, requiring no significant risk. This is especially significant for users who hold BNB long-term, as the returns are substantial.

Strategy: Pay Attention to Launchpool and Airdrop Opportunities, Accumulate Small Gains for Big Wins

For investors with lower risk tolerance, Launchpool and airdrops for BNB holders are excellent entry methods. Holding BNB not only allows participation in mining but also reduces holding costs, serving as an important source of low-risk returns.

3. Pre-market Trading

Pre-market trading is a new feature provided by Binance, allowing users to buy and sell specific tokens before they officially launch on the spot market, thus locking in price advantages earlier. This phase is usually highly volatile but also signifies potential high-return opportunities.

Strategy: Make Good Use of Pre-market Trading to Seize Market Opportunities

Pre-market trading offers an opportunity for early positioning, but it is highly volatile. Setting reasonable stop-loss and take-profit levels to avoid blindly chasing prices is the core strategy for pre-market trading.

4. Airdrops for BNB Holders

For long-term holders of BNB, airdrop activities are undoubtedly one of the most robust ways to "win by lying down," as holding assets directly translates to earnings. Binance frequently takes snapshots of BNB holders to airdrop tokens for newly launched projects. For instance, before some popular projects launch, BNB holders may qualify for token airdrops. At the end of November, Binance's HODLer program launched the second phase of airdrops for the project Thena (THE), where, based on user-provided data, an average of 1 BNB yielded 1.455 tokens, with the current price of THE around $2.9, making the returns quite considerable.

5. Megadrop Web3 Wallet Tasks

The Megadrop platform offers two participation methods: locking BNB and completing Web3 tasks. Users can accumulate points by subscribing to BNB fixed-term products; the longer the lock-up period and the larger the amount, the higher the points. Additionally, these locked BNB can automatically participate in Launchpool mining, achieving a "two-for-one" benefit without extra operations. For retail investors without a large amount of BNB, completing tasks in the Binance Web3 wallet can also earn airdrop points, truly lowering the participation threshold.

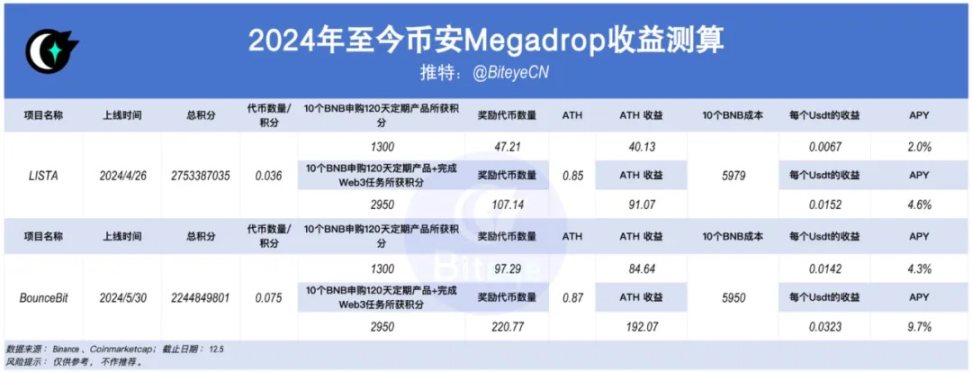

According to the product yield list previously announced by Binance, the standard annualized interest rate for subscribing to a 120-day BNB fixed-term product is around 3.5%.

The following chart shows the yield calculations for two phases of Megadrop, indicating that the annualized interest rate generally meets or even exceeds 3.5%. If users also participate in Web3 tasks, there is a chance to double their returns; for example, BounceBit's annualized return can reach as high as 9.7%.

Compared to Launchpool, Megadrop focuses on providing early participation opportunities before listings while lowering the threshold through on-chain tasks, making it more friendly to attract new users. Launchpool, on the other hand, calculates rewards based on staking BNB or designated tokens, covering more projects and suitable for long-term investors. Overall, Megadrop expands the audience for Binance's new listings and injects more vitality into BNB and the Web3 wallet.

In summary, whether through classic spot and contract trading or innovative Launchpool, pre-market trading, and Web3 tasks, it is evident that Binance's ambitions are not limited to short-term surges; it is building a comprehensive yield ecosystem.

03 Understanding the Binance Listing Effect?

The crypto ecosystem on Twitter serves as a wealth amplifier and a narrative generator.

In the second half of 2024, the rise of the Meme market has become an undeniable trend. From the classic SHIB to the recently popular ACT, the biggest characteristic of Meme coins is undoubtedly their high virality and strong community attributes. Unlike VC coins, the key to Meme coins lies in their narrative ability; the ability to stir community emotions determines the fate of the coin. Behind these tokens, there is not only liquidity but also a cultural phenomenon and community dynamics, which can quickly create a self-propagating effect on social platforms, attracting a large number of investors and retail participants. This has made the Meme market the main battleground for hot money.

As the market gradually moves towards rationality, Binance also shows a more profound influence on long-term value.

For example, the recently launched liquidity protocol THENA (THE) on Binance belongs to projects with low TVL, low market capitalization, and low financing. This indirectly reflects that Binance focuses on projects that can help the market develop in a healthier and more sustainable direction, selecting projects that are more valuable to the industry rather than merely those that are popular or capital-driven. This may promote a de-bubbling movement in the crypto market.

In this sense, Binance resembles a "wealth generator," transforming tokens into a form of "narrative capital" through precise token selection, strict listing standards, and a powerful traffic amplification effect, driving the entire industry towards a healthier and more rational direction.

04 New Coin Practical Tips: Understand the Market, Keep Up with the Rhythm

Whether you are a novice or a veteran, understanding Binance's multi-dimensional "listing" mechanism is just the first step; the real challenge lies in how to capture opportunities more safely and efficiently in this process. This is a game that requires strategy, patience, and insight. Here are some practical tips that may help you navigate the next round of opportunities with ease.

1. Keep a Close Eye on Market Dynamics and KOL Analysis, Monitor Community Heat

The crypto market is an emotion-driven market, especially during the launch of new coins. Paying attention to KOL opinions on Twitter can often help capture market trends. Additionally, the success of Meme coins hinges on community consensus, which can be anticipated through social media, on-chain data, etc., to identify potential projects early.

2. Seize the Best Entry Timing, Pay Attention to Take-Profit and Stop-Loss

The initial phase of new coin listings is often the most volatile, usually accompanied by significant surges and corrections. It is advisable to set clear entry and exit strategies to avoid emotional trading. Especially within the first hour after a new coin opens, market sentiment can fluctuate dramatically, requiring extra caution. The first day of trading is highly volatile; setting take-profit points is crucial to avoid missing opportunities due to greed.

3. Diversify Investments, Avoid a "All-in" Mentality

The market always carries risks; spreading funds across different new coin projects not only reduces the impact of a single project's failure but also increases the overall stability of returns.

05 Conclusion

Every new coin launch serves as a litmus test for the market, a self-examination for each player, and a contest of market trends, community power, and investor mentality.

In the wealth game of the crypto world, the true winners are always those who understand the market and keep up with the rhythm. For ordinary investors, seizing opportunities with Binance's new coins requires not only staying updated with platform movements but also deeply understanding its listing logic.

Where is the next ACT or PNUT? Maintain sharp insights, participate cautiously and flexibly; Binance has already set the stage, and how the story unfolds ultimately depends on us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。