In a person's life, there are many people who pass by, but true confidants are few. In investing, there are countless people who bring you into the industry, but how many can help you out of a pit? No matter how coincidental your entry into this industry is, everyone wants to be the protagonist in a successful case. It can only be said that there is years of hard-earned experience here, and here are the strategies you have longed for.

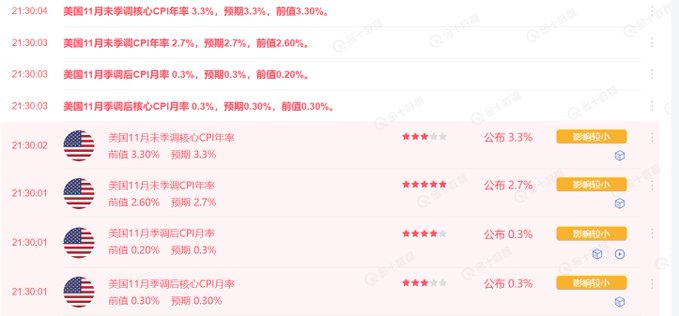

Let’s briefly review yesterday's market. There’s not much to say about the daytime; it basically followed our analysis from yesterday. After confirming short-term support with a pullback, it maintained a slight fluctuation. It was particularly emphasized that the market would react after the CPI data was released last night. The U.S. November unadjusted core CPI year-on-year was 3.3%, expected 3.3%, previous value 3.30%, completely in line with market expectations. The Fed's rate cut of 25 basis points on the 18th is basically confirmed. As a result, U.S. stocks surged, with the Nasdaq continuing to rise, breaking through 20,000 points for the first time, setting a new historical high, and accumulating over 33% this year. Similarly, Bitcoin also started to rise again, returning above $100,000. In fact, this upward trend is a major trend; the articles in the past few days have analyzed this issue, but what was still somewhat unexpected was the exceptionally strong performance of the market. In just two days, it returned again, perhaps this is the meaning of a bull market.

Currently, on the four-hour level, we are in a rebound cycle. Combining with the smaller cycles, there is currently a certain degree of high pullback consolidation, and it is estimated that it will take some time to buffer the selling pressure above. It should be noted that under the current market sentiment, the likelihood is that this pullback consolidation will not take long, which we have been able to feel significantly for nearly two months. As for operations, we still prefer the method we have been using recently, shorting at highs and going long at lows. For intraday shorting, we choose around 101,200, with support around 99,500 below. The extreme position in the short term cannot fall below 98,000.

From a technical perspective, Ethereum has shown a strong reversal after two pullbacks to the downside, indicating that the daily MA30 line has a relatively strong support effect. It has now returned close to 4,000 again. As long as it does not fall below the previous low of 3,500 during this week’s second pullback, the market correction will basically end, and Ethereum is likely to continue to push for higher points.

For altcoins, we previously discussed how to choose strong coins during the decline. Looking back now, those coins that performed strongly and were relatively resilient during the downturn are also leading in the rebound, right? So, the same saying applies: in a major trend, every decline is a good opportunity to buy. Let’s encourage each other!

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies.】

Scan to follow the public account

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。