Table of Contents:

BTC Contract Liquidation Map, Intuitive Reflection of Risk Control Position;

Altcoin Index Trading Analysis;

Token RSI Overbought and Oversold Status.

Interpretation of Fundamental Hotspots: The Impact of Trump and Cryptocurrency Policy on BTC.

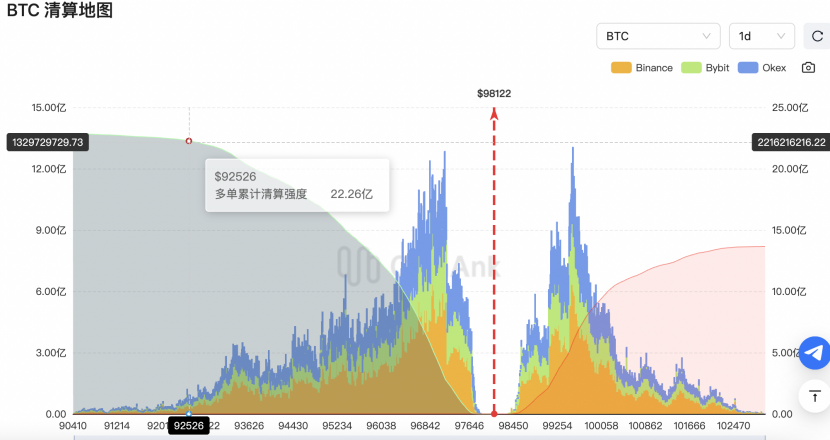

7. BTC Contract Liquidation Map, Intuitive Reflection of Main Risk Control Position

According to the latest contract data, if the BTC price breaks above $103,000, $1.365 billion worth of short positions will be liquidated;

If the BTC price falls below $92,520, $2.226 billion worth of long positions will be liquidated.

These data intuitively reflect the risk control positions of major funds and can also serve as a reference for trading or intervention. However, considering the holiday break for U.S. stocks and futures platforms during the Christmas period, it is expected that traders will take a break, which may lead to a decrease in trading volume and also affect volatility.

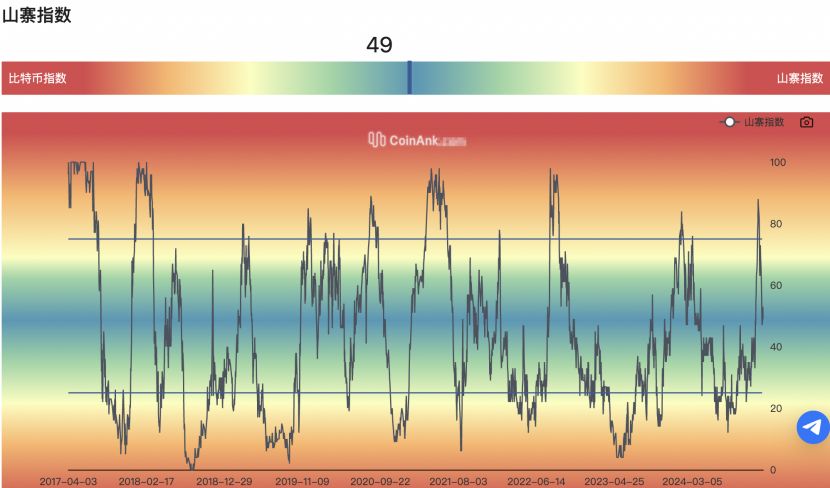

8. Altcoin Index Trading Analysis.

According to the indicators, the current value of the altcoin index is around 49, which is in a balanced area between bulls and bears, and is relatively close to the recent low of around 47. Many altcoins have seen their price lows drop to levels near the starting point before and after the U.S. elections, so overall, altcoins are relatively weak compared to BTC. Of course, this is not considered a very low position; generally speaking, an altcoin index below 25 is a relatively good opportunity for entry. If there are concerns about missing the market, one can start to gradually enter after it falls below the midpoint of 50, with positions built in a pyramid style.

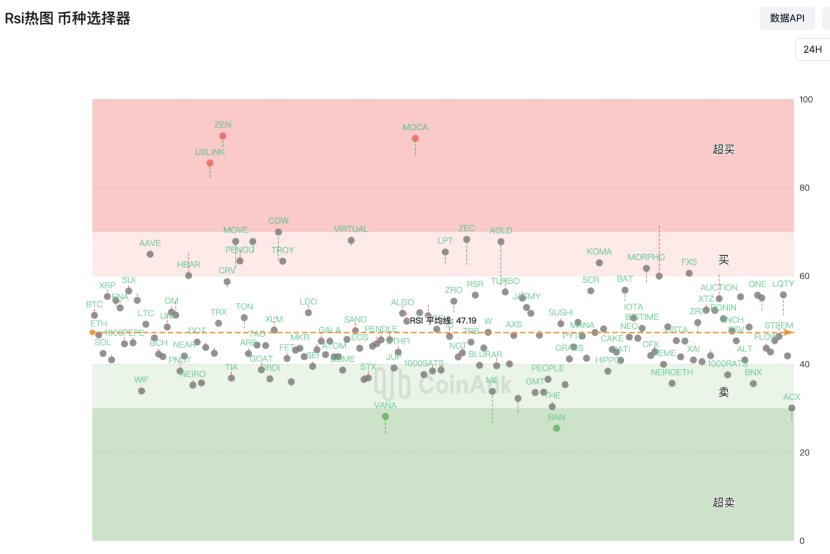

9. Token RSI Overbought and Oversold Status:

According to the CoinAnk RSI indicator filter, on the daily level, ZEN, MOCA, and UXLINK have entered the overbought area with the recent price increase. If they rise to critical points or resistance levels, they may face a pullback in the future; VANA, BAN, ACX, and THE have entered or are close to the oversold area after recent price declines. If they fall to important support areas below, they may face a rebound in the future.

Of course, overbought and oversold indicators lean towards a left-side trading mindset, which is a subjective contrarian thinking of guessing bottoms and escaping tops. In contrast, the Matthew effect and right-side trading mindset are completely opposite, as the strong tend to get stronger and the weak tend to get weaker. An objective trend-following trading mindset may allow overbought and oversold tokens to continue their recent strong or weak trends.

10. Interpretation of Hotspots: The Impact of Trump and Cryptocurrency Regulatory Policy on BTC

Since the conclusion of the U.S. presidential election early last month, the cryptocurrency market has welcomed new development opportunities. Trump's return to power has brought significant changes to the regulatory environment for cryptocurrencies in the U.S., which is reflected not only in policy adjustments but also in a new wave of trading enthusiasm in the market. This article aims to analyze the cryptocurrency regulatory policies after Trump's administration, combined with the latest news, to explore their impact on the cryptocurrency market.

- Trump's Administration and New Cryptocurrency Regulatory Policies

During his campaign, Trump showed a strong interest in the cryptocurrency field and clearly stated after his victory that he would relax regulations on the cryptocurrency industry. This stance resonates with the nearly $20 billion worth of cryptocurrency assets accumulated by the U.S. federal government in recent years, laying a solid foundation for the advancement of the "strategic Bitcoin reserve" plan. The Trump administration plans to clarify regulatory responsibilities to address the long-standing issue of cryptocurrency's status within the U.S. regulatory framework, thereby providing a clearer and more stable legal environment for the industry.

Against this backdrop, the long-stalled "Financial Innovation and Technology Act of the 21st Century" (FIT 21) in the Senate is expected to gain new momentum. This bill aims to establish a clear regulatory framework for digital assets, and once legislated, it will mark an important step forward for the U.S. cryptocurrency industry in terms of compliance regulation. The Trump administration has also nominated supporters of the cryptocurrency field to key positions such as the chairman of the U.S. Securities and Exchange Commission (SEC), further highlighting its emphasis and support for the cryptocurrency industry.

- The Response and Opportunities in the Cryptocurrency Market

After Trump's administration began, the cryptocurrency market quickly responded positively. On one hand, cryptocurrency assets have become core assets in the "Trump trade," performing strongly alongside major U.S. tech stocks. On the other hand, with expectations of a relaxed regulatory environment, the U.S. cryptocurrency industry chain has also welcomed new development opportunities.

Specifically, the increase in trading activity in the cryptocurrency industry is expected to benefit U.S. cryptocurrency exchanges, driving further expansion of their business scale and market share. Additionally, favorable policies will promote the growth of demand for mining machines, bringing new development momentum to mining machine manufacturers and related industry chains. Furthermore, the development of the cryptocurrency industry will also benefit the U.S. utility sector, pushing it towards a more intelligent and digital direction.

- Challenges and Prospects Facing the Cryptocurrency Market

Although Trump's administration has brought many opportunities to the cryptocurrency market, the industry still faces numerous challenges. First, the high volatility of cryptocurrencies remains a significant risk factor, requiring investors to maintain a rational investment mindset and manage risks while enjoying market dividends. Second, as regulatory policies gradually become clearer and implemented, the cryptocurrency industry will face stricter compliance requirements, necessitating companies to strengthen internal controls and risk management to ensure compliant operations.

Looking ahead, as the Trump administration's cryptocurrency regulatory policies are gradually advanced and implemented, the U.S. cryptocurrency market will welcome broader development space. At the same time, the global cryptocurrency industry will also benefit from the policy changes in the U.S. market, promoting further prosperity and development of the global cryptocurrency market.

We believe that Trump's return to power has brought new changes and development opportunities to the U.S. cryptocurrency regulatory environment. With the joint promotion of policy support and market demand, the cryptocurrency market is expected to welcome a broader development prospect. However, investors and companies must remain vigilant, rationally view market fluctuations and risk challenges, and work together to promote the healthy and stable development of the cryptocurrency industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。