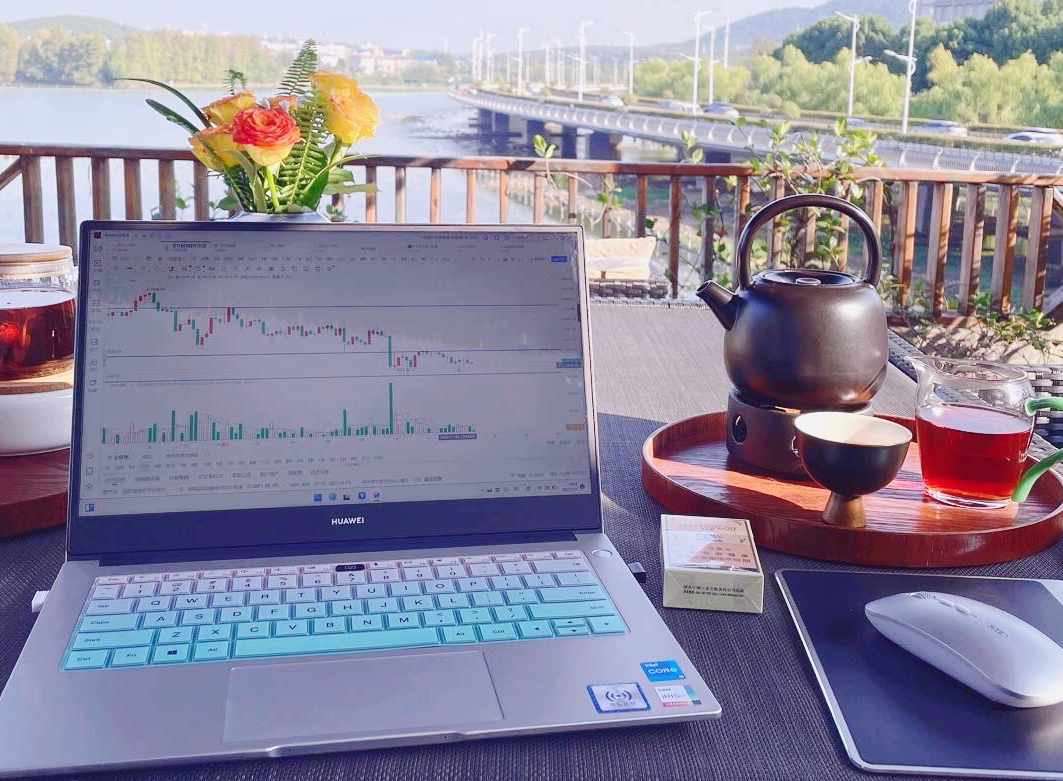

In terms of technology, Ethereum is currently closing above the five-day moving average, and the five-day moving average continues to rise, indicating strength. However, the MA10 continues to press down (this may be a main reason why Ethereum is struggling to rise in the short term). In short, there is still a divergence between bulls and bears in the short term, as Bitcoin is approaching the 100,000 mark. Currently, the profit-taking and buying positions are in disagreement. People can gain some useful technical insights from Bitcoin's market (Bitcoin is currently strong, while Ethereum is relatively weak. If Ethereum catches up, then Bitcoin stabilizing at 100,000 will naturally not be a big issue. For now, we will continue to wait in the short term).

From the 12-hour level, the current lower and middle bands of the BOLL have shown a slight upward rhythm change, while the coin price is closely adhering to the middle band. The short-term decline has not shown effective breakdown (indicating strong support and strong accumulation of chips), so a technical correction will occur in the short term, mainly to repair the price gap between the coin price and MA5. In terms of operations, just buy on the pullback. Specific points of reference are as follows:

BTC: Buy around 98,000-97,500, target 100,000

ETH: Buy around 3,430-3,400, target 3,520

The above is my personal intraday market analysis. For more real-time strategies and free guidance, click on the avatar to follow the homepage introduction. Welcome to exchange and learn together!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。