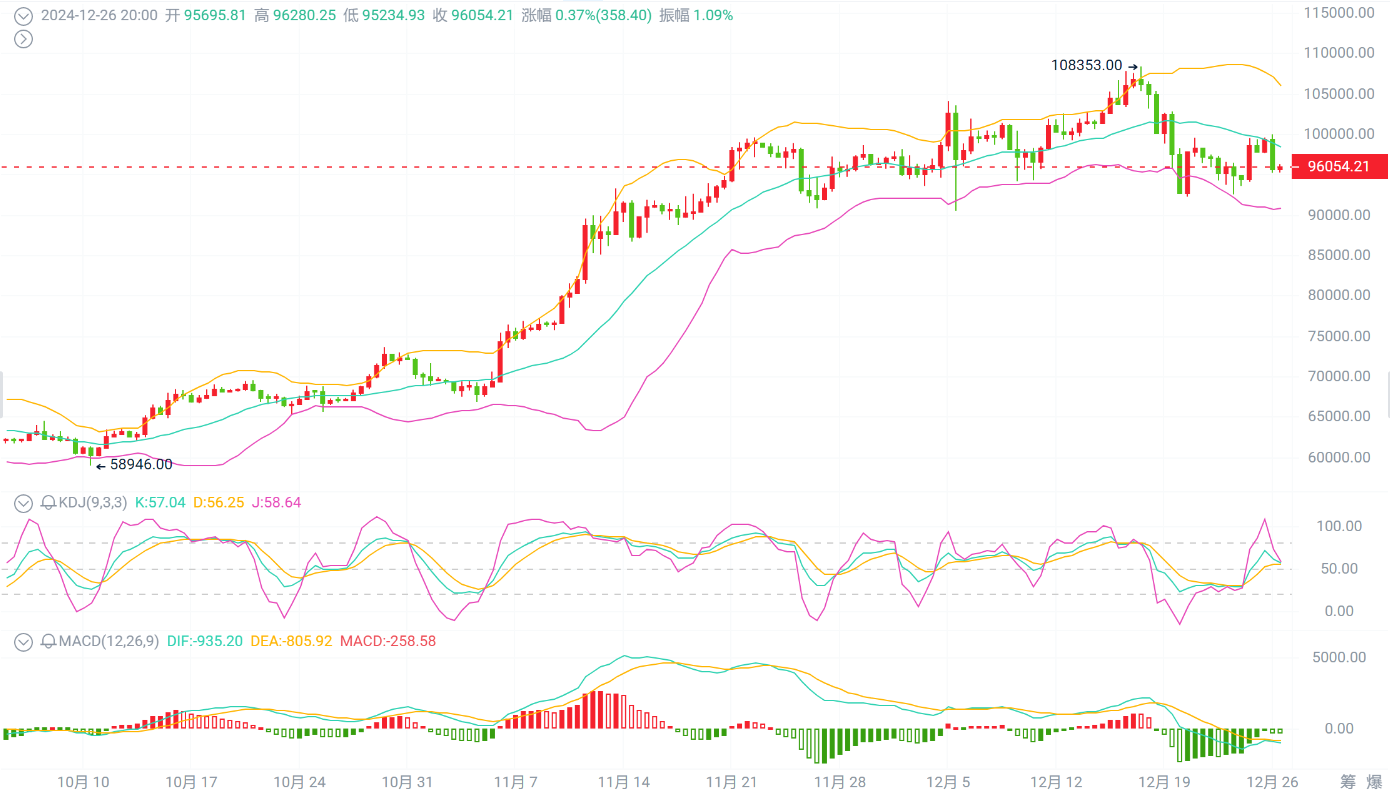

On the daily chart, the KDJ and MACD indicators for Bitcoin/Ethereum have once again turned downwards, showing weakness. The BOLL indicator is also continuing to move downwards overall (currently, the lower band is still in a phase of continuous opening, which suggests that the previous round of gains was primarily for offloading). In the main chart, the price is attempting to break below the MA5 today, while the MA10 high points continue to exert downward pressure. On the 12-hour level, the KDJ three lines have once again turned downwards, and the MACD's short-term golden cross structure at the bottom is also showing signs of weakening. The BOLL indicator continues to oscillate downwards. In the main chart, the three-day moving averages are continuing to decline in different degrees, so we are looking to short in the short term during the early morning. The trading volume is continuously weakening, which can be understood as a reduction in the current market's buying sentiment, and the decrease in support strength is also a reason for the mainstream prices to drop in the short term. In terms of operations, we can short on rebounds; specific points of reference are as follows:

BTC: Short at 96500-97000, target 95000

ETH: Short around 3370-3400, target 3300

The above is my personal analysis of the market in the early morning. For more real-time strategies and free guidance, click on the avatar to follow the homepage introduction. Welcome to exchange and learn together!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。