Original Title: From Science Friction to Science Finance: A Community-Driven Revolution in Biotech

Original Author: Paul Kohlhaas, Founder of BIO Protocol

Original Translator: zhouzhou, BlockBeats

Editor's Note: This article introduces how the BIO Protocol addresses funding, research and development, and market issues in the biotechnology field through a decentralized BioDAO network. By tokenizing intellectual property, decentralizing governance, and providing real-time liquidity, BIO enables patients, scientists, and investors to participate in decision-making, supporting neglected areas such as rare diseases and long COVID. BIO breaks through traditional fund structures, drives innovation in biotechnology, accelerates research processes, and achieves more efficient and equitable capital flow and outcome transformation, ultimately promoting scientific progress and global impact.

The following is the original content (reorganized for readability):

"We live in a society exquisitely dependent on science and technology, in which hardly anyone knows anything about science and technology." — Carl Sagan

TL;DR

Fragmented biopharmaceutical system: Science hits a bottleneck

Andrew Lo's giant fund theory: A milestone in biotechnology finance

Beyond giant funds: The emergence of the BIO Protocol

From funds to ecosystems: Advancing Lo's vision within the BioDAO network

Practices of the BIO Protocol

Orphan drugs, rare diseases, and long COVID: Ethical and economic alignment

Lessons learned from biotech holding companies inspired by giant funds

From science friction to science finance

Bottom-up funding evolution

A universal truth looms over our modern era: scientific knowledge is exploding, yet life-changing treatments—from long COVID to rare autoimmune diseases—remain out of reach for millions. This stark contrast reveals a twisted paradox: the issue is not scientific impossibility, but inefficiency in market structures.

Big pharmaceutical companies invest billions in incremental improvements to existing drugs (such as enhancing existing PD-1 cancer drugs or GLP-1 anti-obesity drugs) through strategies like patent lifecycle management, chasing the latest and hottest clinically validated drug targets in a competitive market—while research into patient needs languishes.

What is the result? An industry mired in science friction, with ballooning costs, capital bottlenecks, and intellectual property silos slowing the progress of potentially transformative innovations, or even shelving them entirely.

1. Fragmented Biopharmaceutical System, Science Hits a Bottleneck

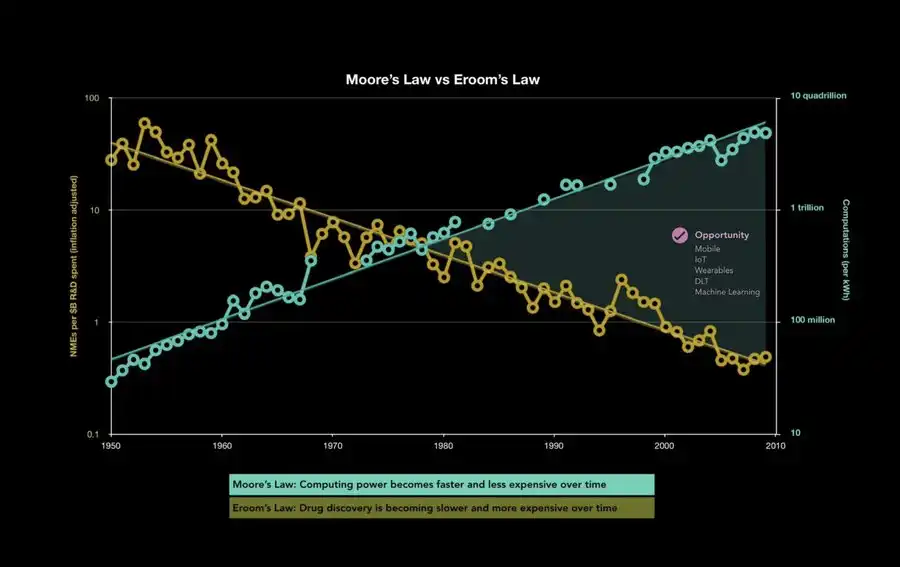

Every day, thousands of people struggle with complex, debilitating, and underfunded diseases like long COVID. Many find that helping them is not "difficult" scientifically; rather, it is too "complex" for the traditional pharmaceutical return on investment (ROI). This is emblematic of a broader crisis, as Eroom's Law reveals: as biotechnology R&D spending soars, the productivity of discovering new drugs plummets. How did we get here?

1.1 The Valley of Death and "Safe Bets"

Promising discoveries made in academia often struggle to transition to early clinical research because no one is willing to fund the risky transitional phase between animal testing and human trials. This notorious "Valley of Death" hinders potential therapies that, from the perspective of big pharmaceutical companies, lack profit potential and are too fraught with risk.

Many venture capital and pharmaceutical companies adopt a "fast follower" strategy, waiting and hoping that others will successfully navigate these risks. These risks may include decoding the pathophysiology of diseases, addressing regulatory challenges (such as the lack of clear clinical endpoints), uncertain commercial viability of pharmaceutical mergers and acquisitions, or the dynamics of health insurance companies in reimbursing treatments. It is a minefield filled with incentives and constraints, yet it does not leverage any collective mechanisms to empower patient voices.

1.2 Overconcentration of Capital

The primary funding channels for biotechnology—big pharmaceutical companies and large venture capital firms—often concentrate investments in "blockbuster" categories. Over 90% of biotechnology capital is concentrated in fiercely competitive, minimally differentiated areas, leading to stagnation in once-promising breakthrough research (such as longevity, complex immune system diseases, or neurological research).

While these clinically lower-risk and commercially attractive treatment areas are very appealing to pharmaceutical companies and venture investors, many also represent the most expensive failures, as only 5% of approved and marketed drugs can achieve blockbuster sales potential.

Otherwise, it is a waste of substantial R&D funds. In Bruce Booth's famous "Atlas 2024 Review," Bruce notes that less than 15% of biotechnology financing rounds have secured over 66% of available venture capital, a significant change compared to a decade ago. We need more meritocratic mechanisms to address public health issues and the impending aging tsunami in Western societies.

1.3 Intellectual Property Lock-in and Data Silos

Under the existing business model, knowledge is trapped behind thick patent walls and closed-door deals, causing progress to slow. Laboratories worldwide often repeat the same high-cost experiments due to a lack of shared insights, adding unnecessary friction. Patient data and clinical insights are so severely fragmented that, under a unified data architecture, they could have significant inferential value, but are instead bogged down by the bureaucracy of hospital administrators, data aggregators, and biobanks.

Intellectual property may have time limits, and only certain specific forms (such as composition of matter patents) hold significant value for venture capital and pharmaceutical companies, which contrasts with the longevity community's enthusiasm for repurposing drugs (such as rapamycin, urolithin A, and metformin). Overall, inefficiencies in resource allocation and commercial constraints stifle real-world health transformations, and real-time transparency could help alleviate some of these issues.

1.4 Opaque R&D and Limited Accountability

The process of unfolding R&D pipelines is slow and convoluted. The flow of funds is hidden; outsiders cannot see whether (or why) trials fail until it is too late. Accountability is limited, leaving patients and the public in the dark.

Management and R&D teams are in constant flux, and as teams change, so do the R&D pipelines. Companies like Roivant have built successful large enterprises by licensing and developing strategically shelved drugs.

1.5 Over a Decade of Capital Lock-in Stifles Innovation

Traditional biotechnology investments often require ten years or more to yield returns—in a fast-paced market, this is nearly eternal. This lack of liquidity leads to a funding shortfall for early research, especially when outcomes are uncertain.

Compared to clinical and scientific explanations of drug treatment potential, biotechnology competes for capital allocation against other asset classes (such as more easily understood revenue/EBITDA growth). In this context, open communities help bridge the gap in the relative value of these therapies in terms of education and socialization.

Biotechnology is at a disadvantage in attracting investors and gaining market share, while other health-related topics (such as longevity) have become cultural phenomena. Certain biomedical breakthroughs (such as statins, PD-1 inhibitors, or anti-obesity drugs) demonstrate astonishing commercial potential (for example, the 2024 Obesity 5 (NONO, LLY, AMGN, ZEAL, and VKTX) yield reached 93%), but the investment structure requires significant revision to ensure that the value of these transformative innovations is not diminished and to ensure better investor accessibility—this is where tokenization will bring about change.

Eroom's Law contradicts the tremendous scientific advances we are experiencing—such as DeepMind's AlphaFold2, the 2024 Nobel Prize in Chemistry, mRNA therapies, GLP-1, cell and gene therapies, etc. The business and stakeholder models of the pharmaceutical and biotechnology industries have rarely been questioned; they would warmly welcome operational structures that could help improve efficiency.

Andrew Lo's Giant Fund Theory: A Milestone in Biotechnology Finance

In 2012, MIT professor Andrew Lo and his collaborators proposed the concept of the "giant fund"—a large, diversified early drug candidate portfolio. Holding 50 to 200 relatively unrelated assets can spread risk: a single biotechnology startup may fail if its sole therapeutic approach fails, but a portfolio can withstand multiple failures as long as a few successful projects can yield returns.

This theory groundbreakingly pointed out the structural inefficiencies in how we fund life sciences R&D. However, Lo's approach remains top-down: large checks from institutional investors, top-level capital allocation, with ordinary scientists or patients having little opportunity to participate in meaningful decision-making.

3. Beyond Giant Funds: Enter the BIO Protocol

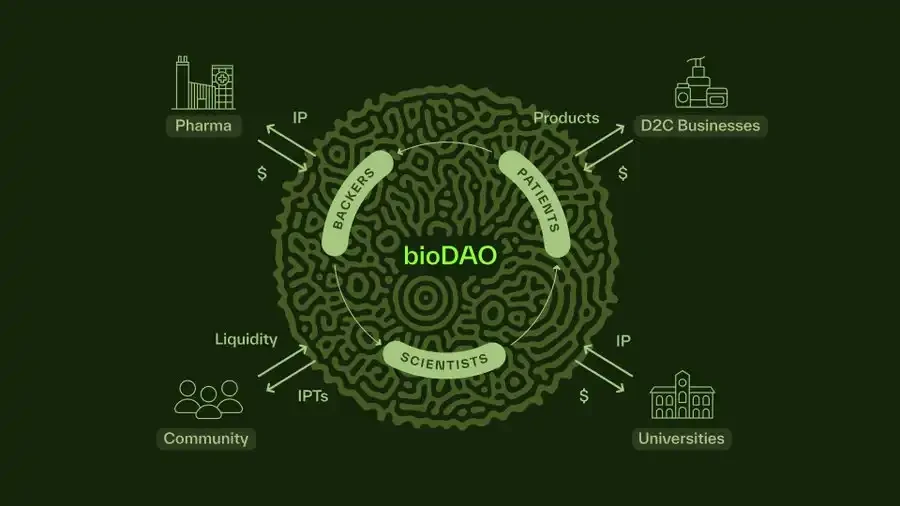

Now, a new wave of decentralized science is emerging, further advancing Lo's vision. The BIO Protocol draws on the core idea of giant funds—managing risk through broad diversification—but reimagines how this diversification, governance, and capital formation occur. The BIO Protocol is not a single massive fund managed by a central authority, but rather:

A decentralized token-holder governance protocol that curates and incubates BioDAOs. These are specialized bottom-up communities that own and guide R&D through on-chain research portfolios.

Tokenizing intellectual property and data through IPT (Intellectual Property Tokens), making them tradable liquid assets, allowing BioDAO researchers and communities to access liquidity earlier than is common in the biotechnology industry.

Deploying capital in real-time, directly into the "Valley of Death."

Placing patients, scientists, and ordinary people at the core, much like a Reddit community has a shared bank account.

3.1 Permissionless Stakeholders

In BioDAOs, anyone directly related to a disease—be it patients, clinicians, or scientists—can join through on-chain governance. Rather than passively hoping "someone" will fund their endeavors, they collectively raise capital through crypto funding, form DAOs, and collaboratively seek research ideas from both internal and global scientists, deciding how to allocate and prioritize resources.

3.2 Tokenized Intellectual Property and Data

BioDAO issues IP tokens (IPT) through @molecule_dao, representing decentralized governance rights over research. These tokens can be licensed, traded, or pooled, effectively providing a new way for DAOs to gradually reduce the risks of early science based on milestone funding deployment. Shared data and data replication are no longer afterthoughts but core, liquid assets capable of driving scientific discovery. Additionally, various researchers can be awarded bonuses, creating incentive mechanisms for decentralized science and drug discovery.

3.3 Bottom-Up Capital Formation

Unlike giant funds that rely on large institutional investors, the BIO Protocol coordinates community-driven fundraising. Through its launch platform, founders of BioDAOs can pitch their research, set up private or public token sales, and reward early supporters with governance rights—without the need for venture capital or big pharmaceutical company scrutiny.

4. From Funds to Ecosystems: Advancing Lo's Vision within the BioDAO Network

4.1 Decentralized "Meta Portfolio"

The BIO Protocol does not hold 200 assets as a single entity but facilitates a governance treasury of thousands of BioDAOs, each focused on a specific scientific niche. This greatly expands the possibility space while allowing for community self-governance. There is no single manager making decisions; instead, the protocol guides the asset development, risk management, and synergies of all these DAOs through its token-holder community.

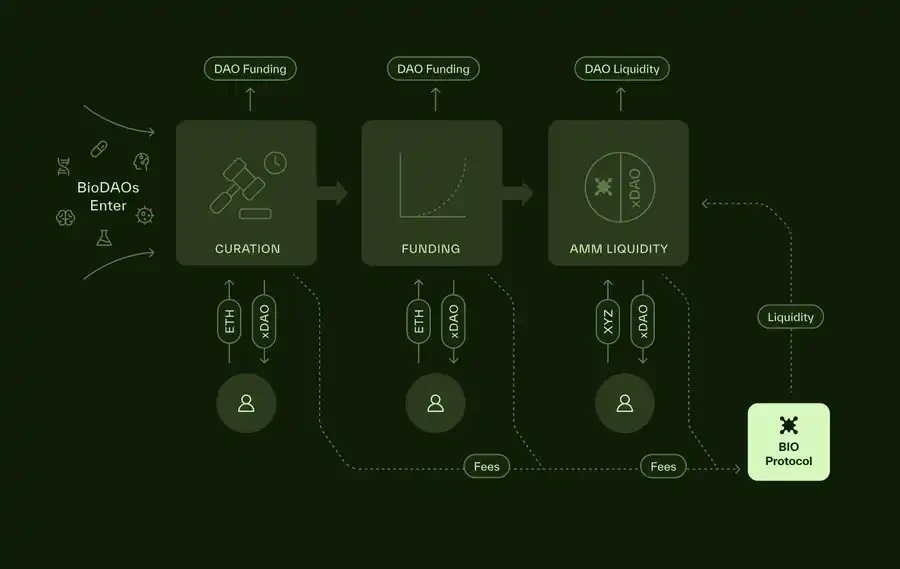

4.2 Permissionless Launch Platform and Acceleration

BIO's real-time decentralized launch platform mechanisms—such as bonding curves or auctions—enable new BioDAOs to launch quickly. Early stakers or token holders can indicate which areas are worth investing in. This approach democratizes biotechnology funding and accelerates capital flow to neglected areas, such as long COVID or rare autoimmune diseases.

4.3 On-Chain Risk Management

Giant funds reduce risk through portfolio theory, and BioDAOs do the same, but on-chain analytics allow them to share standardized reports on clinical milestones, intellectual property valuations, and treasury data. This facilitates real-time insights, enabling the protocol to further diversify risk or rebalance by allocating funds across multiple DAOs or establishing research-based obligations.

4.4 Continuous Liquidity and Evergreen Capital

Traditional funds lock capital for ten years, while BioDAO tokens and intellectual property tokens remain liquid, allowing participants to exit or reallocate capital. If a BioDAO's therapy begins to show promise, it will naturally attract more liquidity. The game theory here is that the therapy will naturally become a "Schelling point" for capital. Meanwhile, the revenues from successful therapies will flow back into the protocol treasury (BIObank), reinvesting capital into new or existing DAOs.

5. Protocol Practices: A Holistic, Bottom-Up Ecosystem

Imagine a team of scientists proposing a new "NeuroDAO" aimed at developing innovative treatments for traumatic brain injuries. They upload preclinical data and a funding roadmap to BIO's user-friendly launch platform. The global BIO community approves or rejects the proposal by staking tokens—without a small committee operating behind closed doors. Once approved:

NeuroDAO mints its intellectual property tokens (IPTs).

These tokens are sold through bonding curves or auctions to raise initial capital.

As milestones (such as preclinical endpoints) are achieved, more capital is automatically unlocked.

The broader community can track progress, further invest, and accelerate the flywheel effect.

If NeuroDAO reaches a significant breakthrough moment—such as discovering a new molecule that accelerates brain recovery—the intellectual property licensing agreements can bring revenue into the treasury to fund further research. This mechanism creates a sustainable flywheel effect, driving a self-reinforcing cycle.

Since its inception, the BIO ecosystem has grown rapidly. In less than two years:

8 BioDAOs have been funded

$30 million has been raised for research

The total value of tokenized intellectual property exceeds $50 million

Over $60 million in funds are in the BIO treasury (AUM)

$8 million has been allocated to scientific projects funded by BioDAOs

60 active R&D projects

34,000 ecosystem token holders (of which 3,716 hold BIO governance tokens)

Multiple BioDAOs have rapidly advanced from seed-stage research to advanced preclinical research, validating that decentralized capital and open collaboration can accelerate biotechnology innovation.

Orphan Drugs, Rare Diseases, and Long COVID: Ethical and Economic Alignment

Long COVID is just one example of an "under-the-radar" but urgent condition. Similarly, orphan diseases—those affecting smaller patient populations—are often overlooked by large pharmaceutical companies because they perceive limited profit potential.

However, in networks like BIO, patient-led or family-led BioDAOs can be established around any disease, utilizing new structures to fund research that large companies are unwilling to support. Smaller patient populations can accelerate clinical trials, shorten timelines, and unlock substantial returns without the "blockbuster or bust" mentality. The ethical consistency is evident: it is not about market size, but about impact.

7. Real-World Momentum: Lessons Learned from Companies Inspired by Giant Funds

Before decentralized science, multi-asset risk-sharing models had been attempted in various forms:

BridgeBio (NASDAQ: BBIO): Focused on rare diseases, adopting a centrally radiating pipeline.

Roivant Sciences: Launched independent "Vants" for each therapeutic area, integrating management fees and capital.

Royalty Pharma: A portfolio with billions of dollars in diversified royalty income streams, demonstrating that securitization can provide stable funding for drug intellectual property.

These companies embody Lo's principle of diversification. The BIO Protocol extends this principle further by democratizing access, distributing governance rights, and achieving continuous liquidity through tokenization.

8. From Science Friction to Science Finance (SciFi)

Close your eyes and imagine it is now 2026. Under the BIO framework, there are already hundreds of BioDAOs addressing a variety of diseases, from pancreatic cancer to autoimmune alopecia. Each DAO is a "community collective mind" composed of patients, researchers, and charitable supporters. They:

Access real-time research data shared across networks, accelerating the advancement of each clinical turning point.

Coordinate clinical trial participants and best practices (if multiple BioDAOs are addressing related fields, BIO can facilitate shared participant pools, data registries, and best practice governance, reducing management overhead).

Use AI to assess risks, potential synergies, and capital allocation.

No longer are ten-year capital lock-ins or heavily guarded institutional barriers stifling breakthroughs. Instead, the entire network functions like a living, breathing organism—fluid, adaptive, and open.

8.1 The Golden Age of Biotechnology

By "tokenizing everything," from preclinical data to late-stage intellectual property, combined with decentralized governance, BIO brings the industry's biggest friction points to light. Suddenly, drug development feels more like science fiction than a long marathon.

8.2 Inclusive Communities, Global Impact

This revolution is not just happening in laboratories. Ordinary investors—those whose loved ones may suffer from rare diseases—can stake tokens to support new research and see transparent progress in the process. Collaboration is no longer a buzzword but an on-chain reality, driving the formation of multinational research teams.

8.3 Reversing Eroom's Law

With friction eliminated, communities from any region can access global funding, and we may finally see the cost/time curve of drug development bending downward rather than upward—realizing the promised exponential scientific progress.

9. The Bottom-Up Evolution of Biotechnology Financing

Andrew Lo's giant fund theory points us toward an important path: large, diversified portfolios can tame the high risks of biotechnology and attract larger-scale capital. However, top-down structures and institutional inertia still suppress the realization of certain innovations. In contrast, the BIO Protocol disrupts this script:

Community-driven: Anyone with a stake—patients, scientists, or curious funders—can participate in governance, propose new BioDAOs, and collectively shape research directions.

Tokenized intellectual property: Data and intellectual property become liquid, paving the way for new funding and collaboration models.

Real-time liquidity: Freeing capital from ten-year lock-ins allows it to flow quickly to breakthrough innovations.

AI-driven risk management: On-chain analytics continuously track performance, synergies, and correlations, allowing capital to flow efficiently across multiple BioDAOs.

By stacking decentralized science solutions (through BioDAOs) under the top-level coordination of BIO (launch platforms, funding, liquidity, meta-governance), the most daunting challenges in the science and pharmaceutical industries can be addressed in a community-driven, transparent, and continuously flowing environment.

Placing families, patients, and scientists at the core of decision-making, BIO aims to "boil the ocean," addressing the dilemmas of early innovation. No longer will half of the world's great ideas rot in the "Valley of Death." Instead, we witness the dawn of a scientific era no longer shackled, free from outdated gatekeepers and friction-filled pipelines.

So next time your family faces a rare disease, the determining factor will no longer be the board's analysis of market size. Instead, it will be a global network—scientists, patients, and ordinary believers—coordinating, funding, and accelerating those truly important therapies together. In short, we return to a sci-fi world where humanity finally unites to turn the impossible into the inevitable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。