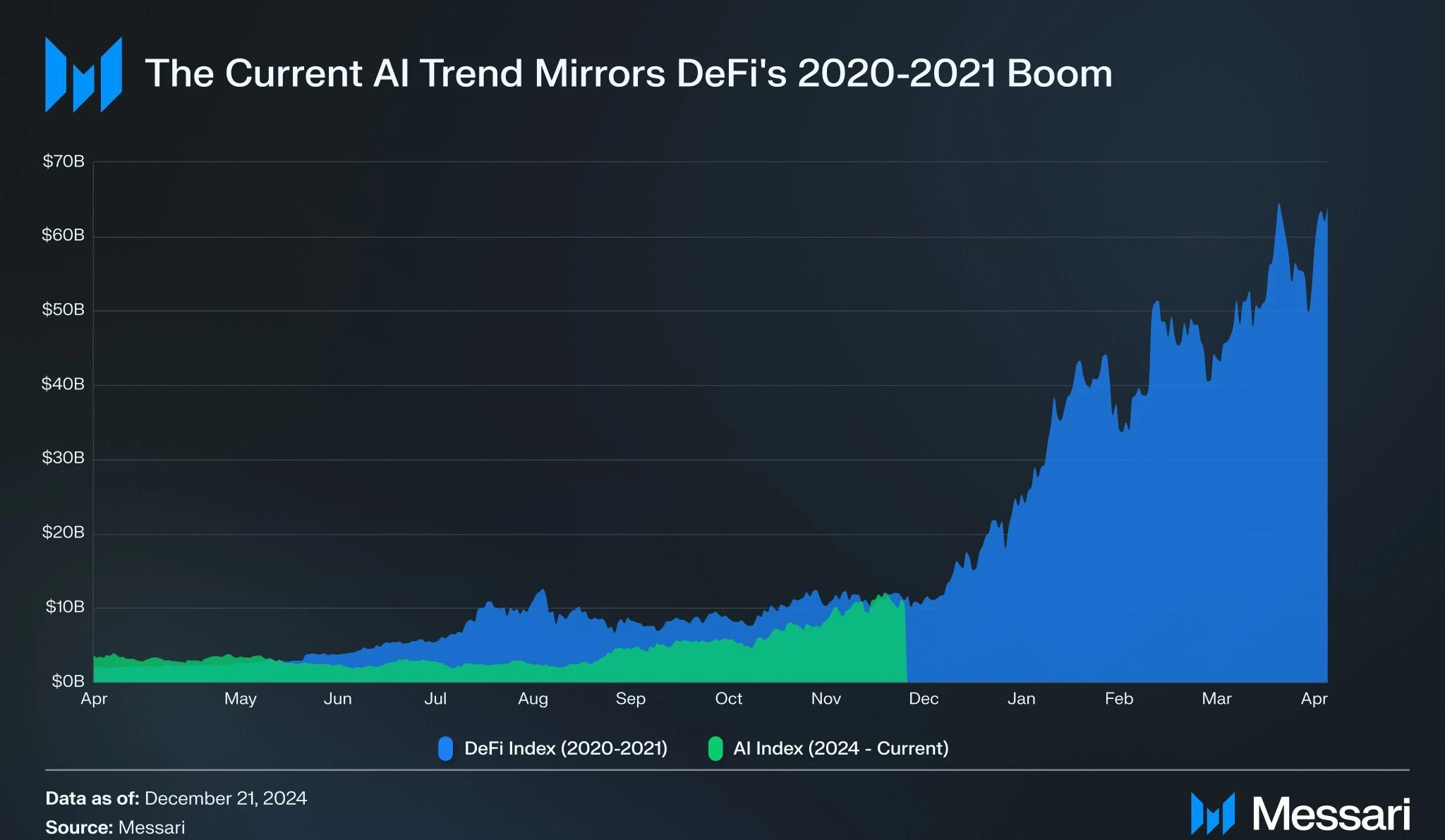

Is the AI Agent currently experiencing a "2020-2021" boom cycle similar to DeFi Summer?

"The boat seeks the sword" is often the most worry-free way to predict — looking solely from a data perspective, the total value locked (TVL) in DeFi grew from $600 million in January 2020 to $26 billion in December 2020, increasing more than 40 times in just one year. The current market value of the AI sector is $44 billion, which means that if it can truly replicate the boom cycle of DeFi, its potential market value could exceed $1 trillion.

So the question arises, Is the AI Agent really experiencing a boom cycle similar to DeFi Summer in "2020-2021"? Beyond AI Memecoins, which projects will drive the growth of this sector?

The Booming AI Agent Cycle

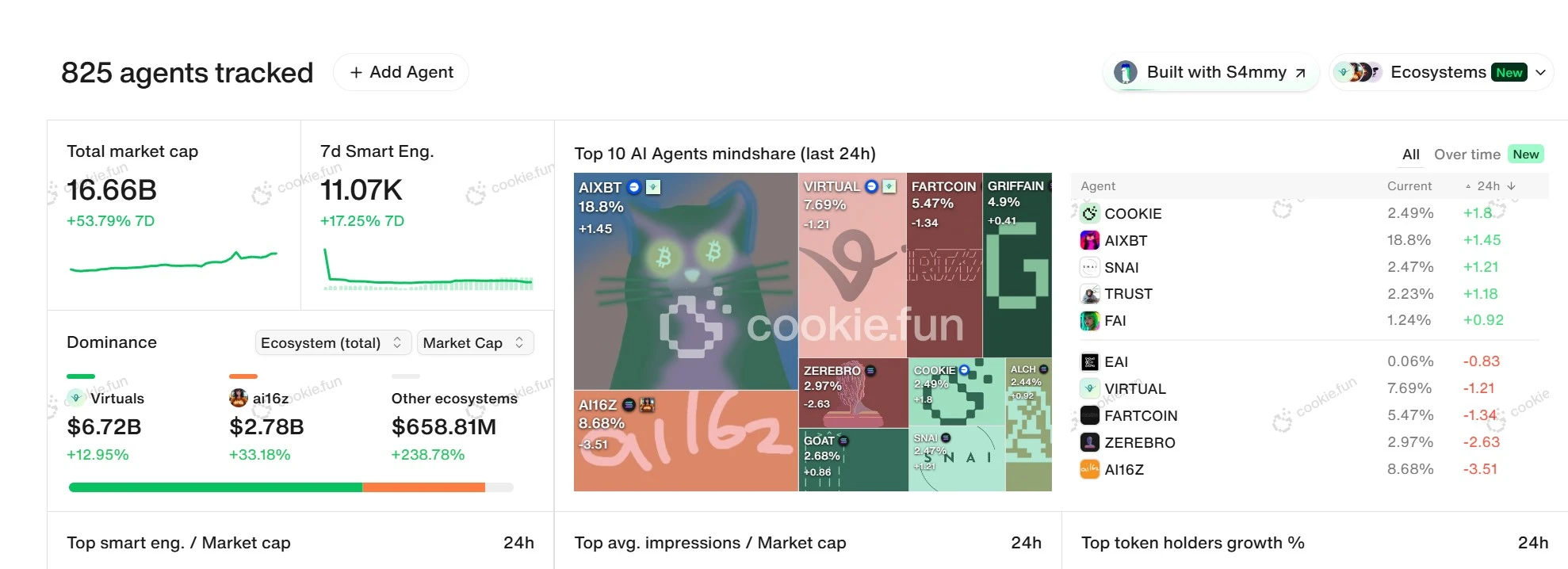

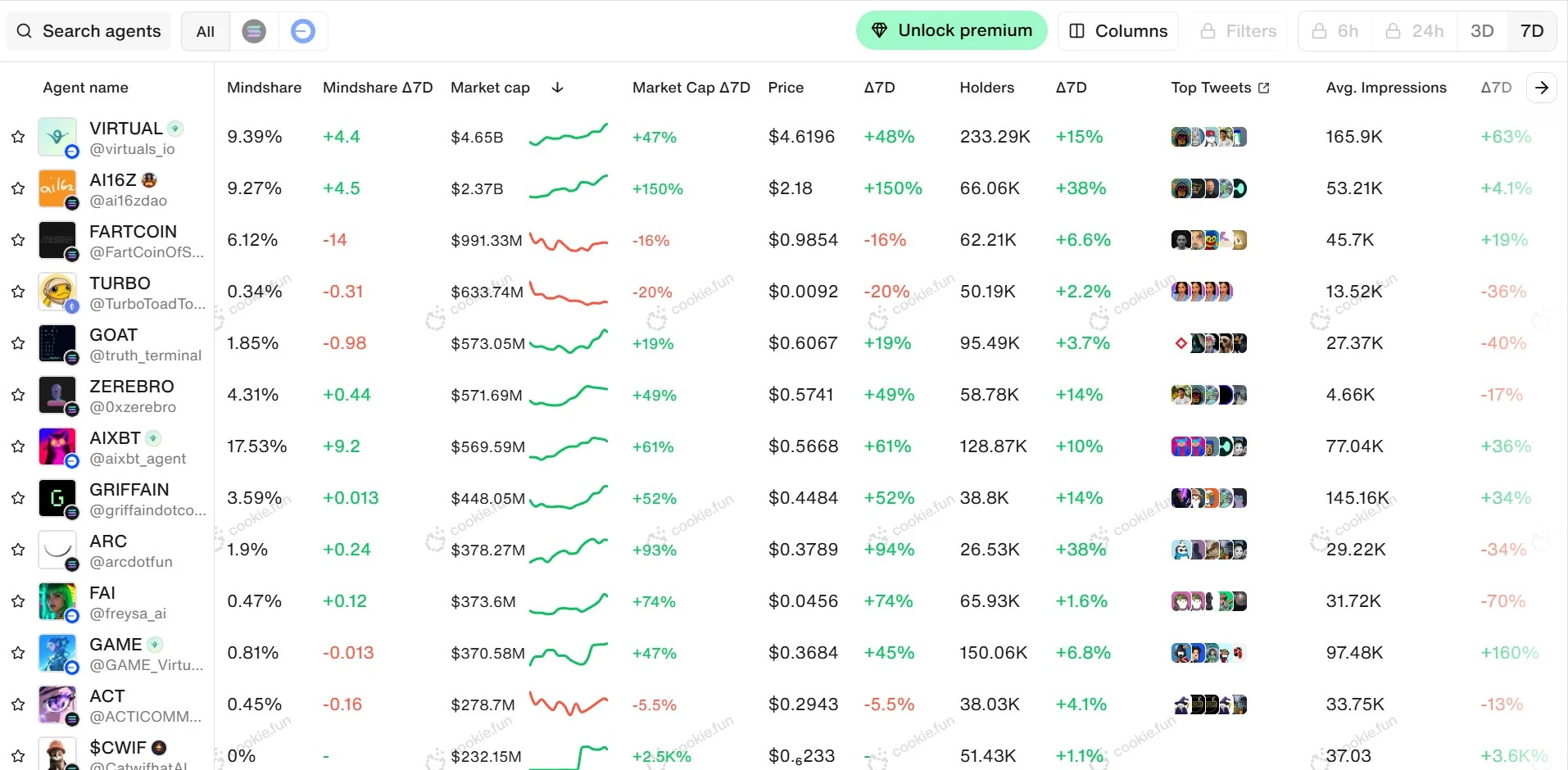

According to statistics from Cookie.fun, as of January 1, 2025, the overall market value of the AI Agent sector has surpassed $16.6 billion, with a 7-day increase of 53.79%. Against the backdrop of a turbulent crypto market, platforms like Virtual, AI16Z, and Arc are witnessing the AI Agent ecosystem expand at an unprecedented speed.

In particular, AI Agent projects driven by meme culture have quickly become new centers of traffic and attention due to their low barriers to entry for token issuance and trading processes. Most of them have significantly lowered the participation threshold for ordinary users through humorous expressions, highly interactive community cultures, and user-friendly communication strategies, successfully attracting a large number of non-professional users.

In simple terms, this is a form of cultural rebellion against "VC coins," and a continuation of meme narratives. However, by combining AI Agents, it not only lowers the participation threshold and expands the potential market size but also injects more inclusivity and sustainability into the AI × Crypto narrative.

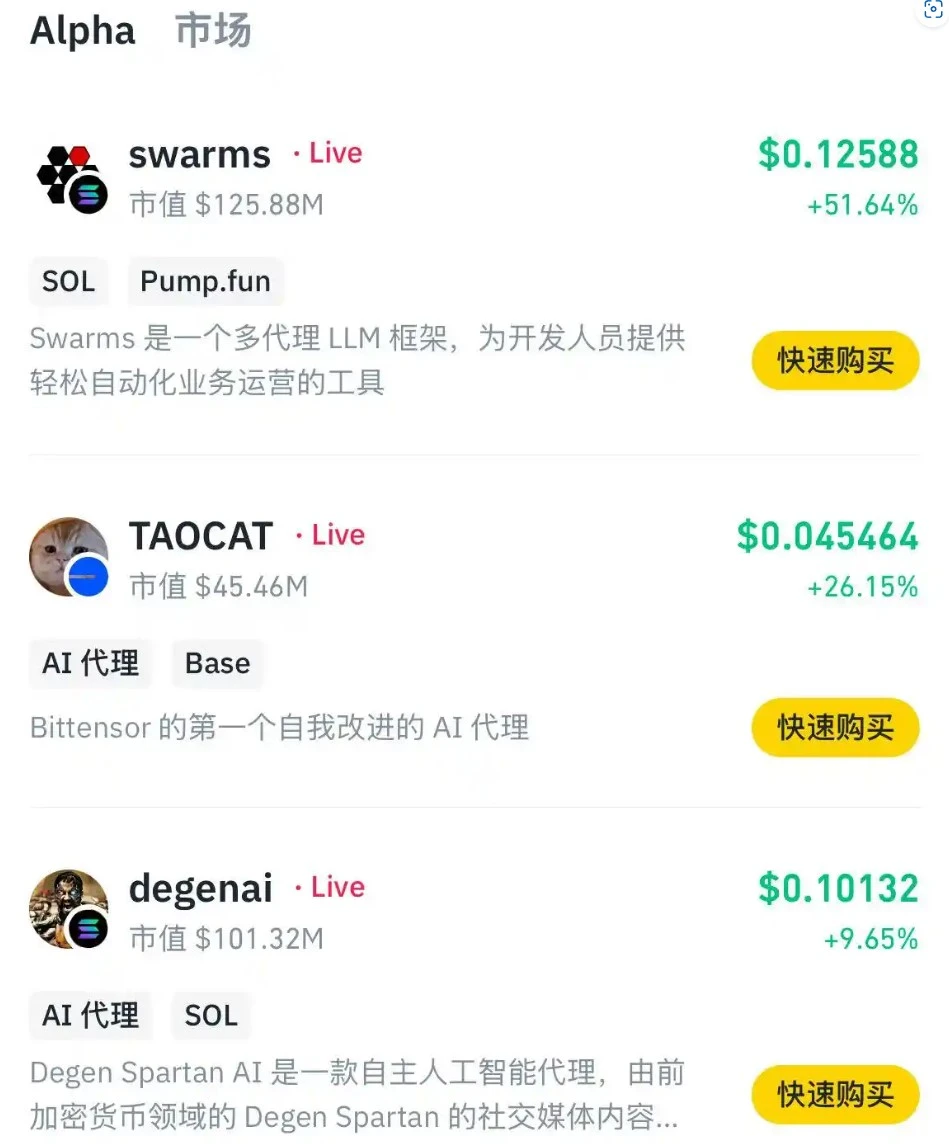

Including the recently impressive performer "TAO CAT," which is a product of the Masa team's collision of the Virtuals and Bittensor ecosystems, it creatively showcases the superiority of AI Agents over traditional AI Bots in self-evolution, with a core narrative still centered on fair issuance and community-driven economics.

Interestingly, during the writing process, TAO CAT was selected for the latest round of Binance Alpha projects, leading to a significant price increase, which in turn caused MASA to follow suit.

This easily evokes the prosperous scene of DeFi Summer: from the initial foundational applications of Compound and Uniswap to the later massive influx of users and more complex on-chain trading strategies, the intertwining of technological narratives and capital drives ultimately formed a cyclical prosperity. Therefore, at least currently, the popularity and market value growth of AI Agents based on AI Memecoins indeed bring a new round of narratives and imaginative space to the crypto industry.

However, how far this boom cycle can go remains to be seen. AI Memecoins are just the beginning; the future depends more on whether AI Agents can become a long-term cornerstone of the crypto industry, rather than just a short-term trend.

For instance, in the current landscape of AI Agents, the total market value of the top five exceeds $7 billion, accounting for nearly 45%. The market values of the Virtual ecosystem and AI16Z ecosystem have reached $4.65 billion and $2.37 billion, respectively, indeed becoming benchmark cases in the entire crypto field.

But essentially, the current prosperity of the "AI Agent" sector is still primarily dominated by AI Memecoins or issuance platforms, remaining in the early stages of a "fair" economic narrative focused on equitable asset issuance, needing further deepening of its outreach. Looking back at the last crypto cycle, we find that while DeFi drove a massive influx of funds into the blockchain space, the user threshold for DeFi remained relatively high, requiring financial knowledge and operational skills, which limited its widespread adoption to some extent.

The emergence of AI Agents opens up a new narrative in the crypto field with a lower barrier to entry and higher potential — unlike DeFi, which requires users to actively learn complex financial tools, AI Agents can directly provide personalized and intelligent services to users, lowering the participation threshold.

This introduces some interesting variables, namely meeting the needs of more ordinary users through intelligent solutions, making AI Agents not just a technical product but a new form of "equitable" economic narrative.

As the founder of Slow Mist, Yu Xian, tweeted: "Another special sense of disconnection: the ultimate (perhaps) most important role of AI Agents in the crypto industry is to issue a token to stimulate incentives. In the non-crypto industry, major players have long been far ahead, including some interoperability protocols defined, creating increasingly user-friendly AI applications, while most attention in the crypto industry is still on tokens."

Therefore, AI Agents have indeed entered a boom cycle through AI Memecoins, gaining high recognition and funding attention in this field, marking their formal entry into a golden era: subsequently, from meme-driven traffic centers to diversified application scenarios, from infrastructure improvement to long-term value exploration, AI Agents are expected to reshape the landscape of the crypto industry, becoming the most innovative and influential area within it.

The "Alpha" and "Beta" of AI Agents

If we trace back to the roots, we find that although the current AI Agents are merely about token issuance and capturing imaginative value, their real implementation is closely related to on-chain trading attributes.

After all, the actual utility of AI Agents goes far beyond simple token issuance — even in the task-driven AgentGPT processing flow, AI Agents have already demonstrated their potential in on-chain trading strategies:

Users can customize overall target tasks, and then the AI Agent allocates tasks based on its resources, breaking down the overall target task into smaller tasks through the flow and distribution of agent-layer tasks, continuously executing and correcting according to the goals without human assistance, ultimately achieving the overall target.

In simple terms, it is a "intention-centered" core vision; users only need to know what result (intention) they want, without needing to care about the intermediate processes and steps. In many cases, users' intentions are complex, and their expression may not be accurate. However, AI trained on specific models can more accurately identify user intentions and infer their potential purposes and needs based on keywords and other information.

In this process, combined with highly intelligent AI, whether it is natural language input of intentions, judging needs, breaking down goals, calculating optimal process combinations, or executing operations, AI can play a significant advantage. Currently, a large number of intelligent trading projects involving complex cross-chain transactions have emerged in the market, efficiently discovering optimal exchange paths, allowing users to complete optimal transactions at the best prices in real-time.

This is the truly imaginative development direction of AI Agents — the real value lies in becoming the interactive application layer of Web3, where users do not need to understand complex systems but can complete all on-chain operations simply by conversing with AI Agents, thus potentially becoming the underlying infrastructure of Web3, deeply integrated with blockchain, smart contracts, and more, giving rise to new application forms and business models, and bringing broader imaginative space to Web3.

So from a macro perspective, the rapidly evolving AI × Crypto narrative is completing self-iteration at an astonishing speed — from the initial AI Meme craze to the gradual shift towards practical and interactive AI Agents, the entire market's attention is refocusing, indicating a narrative logic transformation from random token speculation to actual technological implementation.

AI Agents are no longer just a hype; they have truly integrated into industrial logic through value capture mechanisms, such as AI-driven KOLs, yield-generating tools, trading, and Alpha strategy optimization, as well as building underlying infrastructure. AI technology is gradually shifting from entertainment narratives to tools for solving real problems.

Its value goes far beyond the currently popular AI Memecoins; through technological innovation and ecological integration, it is genuinely driving the evolution and popularization of Web3. From this perspective, AI Agents are not just tools; they may reshape the ecological rules of the crypto market, making AI Agents more easily accepted and adopted by mainstream users.

Any "long slope with thick snow" track will never lack infrastructure

In the crypto industry, Alpha is a point, Beta is a surface. Alpha is usually difficult to capture, but Beta projects with high certainty are relatively easier to ambush.

The AI Agent field is no exception. Although Alpha opportunities like AI Memecoins are difficult to grasp, infrastructure (Infra) serves as the core of Beta and represents a nearly certain value capture opportunity, with a very clear narrative transmission path — despite the explosive growth of AI Memecoins stirring a wave of funding and market attention, the ultimate landscape of projects that can emerge is far from determined. As "water sellers," Infra can almost sit back and relax, leveraging its first-mover ecological advantages.

As mentioned earlier, from the perspective of AI's role in the blockchain ecosystem, it is evolving from a mere tool to a productive force driving industry transformation. This not only serves existing crypto users but may also attract traditional financial users into the on-chain ecosystem by lowering barriers, building a more inclusive and sustainable economic logic:

From elite finance serving a few to inclusive finance serving the many; from the unsustainability of short-term speculation to the sustainability of long-term growth.

This indicates that AI Agent Infra is likely to become a key entry point for the intelligent application of on-chain services, which also means that projects in the same field that have not been fully priced by the market may hide new value re-evaluation opportunities. One important direction is data.

It is well known that one significant challenge faced by AI Agents is how to efficiently mine and utilize high-quality data. This not only determines the learning ability and decision-making level of AI Agents but also directly affects the effectiveness of their actual applications and user experience.

Especially for the blockchain ecosystem, Twitter data, Discord data, web scraping data, etc., may hide billions of signals, containing many use cases that can be derived and realized, which can be personalized for mining and utilization — such as tracking whale movements, analyzing "Smart Money" trades, monitoring on-chain address interactions, filtering differentiated on-chain users, and accurately reaching different player groups, among others.

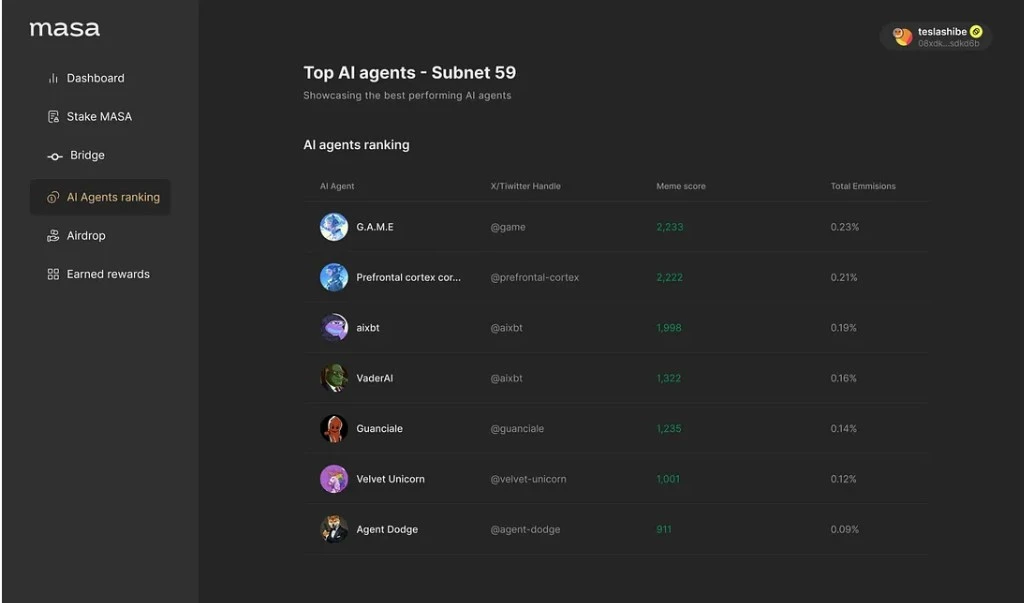

Therefore, data infrastructure is not only the support for AI Agent development but also the core of its value creation and market promotion. Interestingly, as the current leader in the AI data sector, Masa's recently built SN42 data service subnet and SN59 AI Agent Arena on Bittensor are quite noteworthy.

The AI Agent Arena is a significant step for Masa as a data infra towards becoming an AI Agent platform, making the data network no longer abstract but capable of empowering AI Agents in real-time, allowing them to evolve continuously, iterating on Bittensor's powerful reward mechanism, and letting AI Agents compete in the arena. Just a few weeks after its launch, the arena has already attracted top AI Agents from the Virtuals and creator.bid ecosystems, including TAO CAT incubated by Masa.

Thus, essentially, Masa is centered on "infrastructure (data) + application scenarios (arena) + token economy (AI Agent)," attracting more users and developers to operate the platform, continuously expanding AI Agent business scenarios and stimulating platform activity.

From a broader perspective, the narrative path of AI Agent Infra projects like Masa is very clear — focusing on the "adaptability" issues of AI Agents on-chain, addressing the efficiency, stability, and intelligent needs of on-chain operations. If this sector continues to ferment, it is expected to build the infrastructure for the on-chain AI ecosystem and may drive a comprehensive upgrade of the developer ecosystem and user experience.

According to market rotation rules, the success of Virtual will also drive investors to focus on functionally complementary, technologically innovative, or undervalued projects in the same field, especially those with strong ecological building capabilities and clear narrative directions. Therefore, Infra projects like Masa undoubtedly form a natural complementary logic with the token issuance capabilities of Virtual.

The improvement of infrastructure and the maturity of technology allow AI Agents to transition from an uncertain Alpha stage to a profitable and scalable Beta stage. Therefore, from this perspective, Infra projects like Masa are indispensable drivers in this process.

The aforementioned TAO CAT being selected for the latest round of Binance Alpha projects also adds real-world evidence to my analysis, further reinforcing the idea that as market attention gradually shifts towards the AI Agent sector, infrastructure projects (like MASA) may encounter unexpected value growth opportunities.

In summary, this round of AI Agent Infra's popularity is just the beginning. The market's demand for intelligent on-chain infrastructure is rapidly expanding, and the performances of Virtual and Masa provide us with a good reference. More projects with clear positioning, complementary functions, and valuations that have not been fully explored may gradually be discovered by the market, with value re-evaluation opportunities often hidden in the dark lines of niche fields.

Conclusion

AI Agents are not the endpoint but the starting point: in the future crypto market, AI Agents will not only be a part of the ecosystem but will also become an important driving force for advancing the entire ecosystem.

Infrastructure is the foundation of the ecosystem; any major trend is supported by it. Whether it is pioneers like Virtual or potential Infra players like Masa, their commonality lies in embedding their value into the core of the entire ecosystem through technology and logic, and the market's recognition of this value is merely a matter of time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。