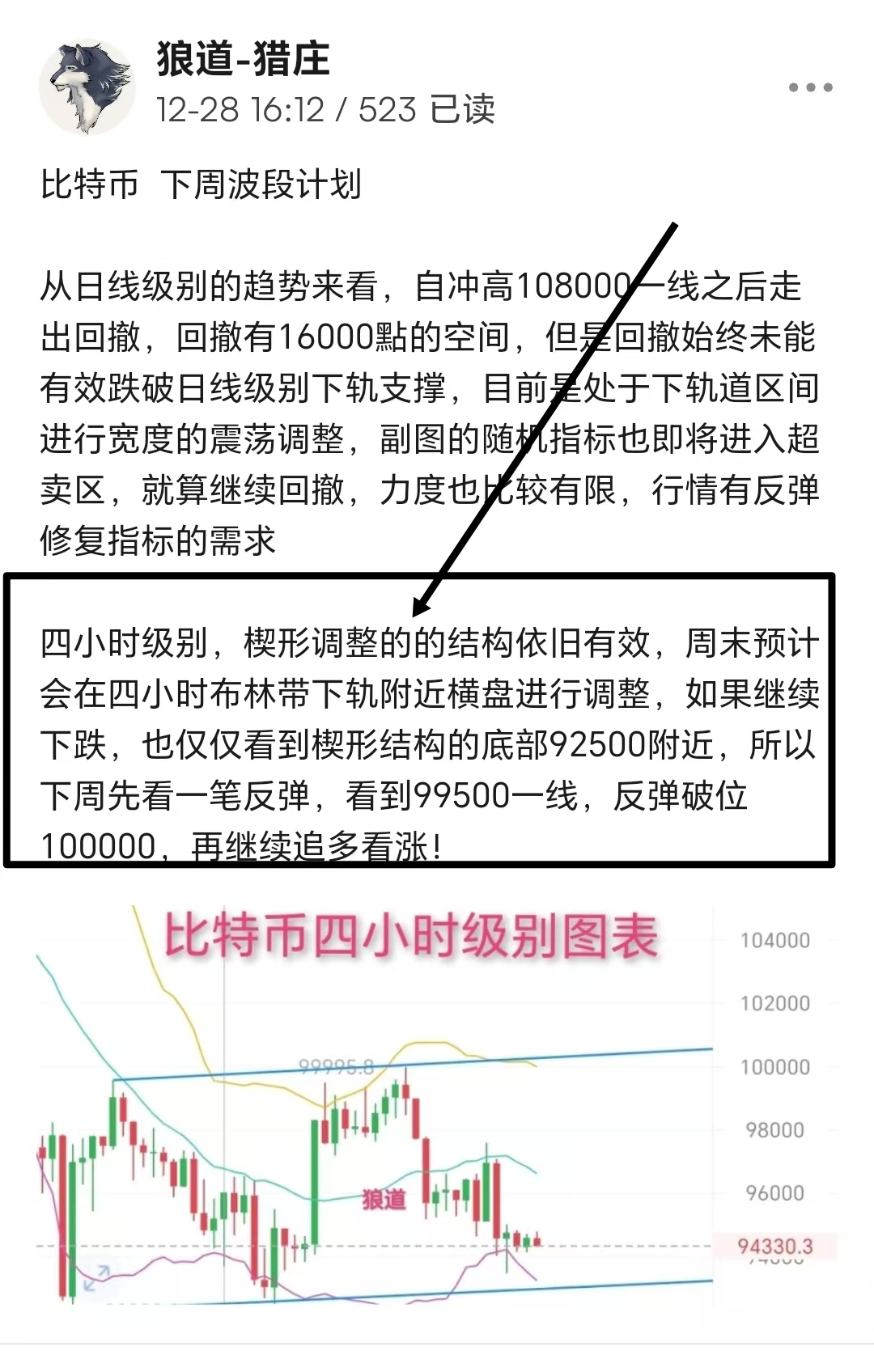

This week's segment analysis

As shown in the picture, the segment trading analysis provided last week can be considered quite perfect! The bullish segment from 92500 to 99500, although it did not reach the target, still had a range of 5000-6000 points to capture!

Last week, we observed a wedge adjustment, but the pullback in the market was a bit strong, and the decline has already negated this pattern. However, we have now entered a clearly defined consolidation range. The current strong resistance level to watch is the high point pressure between 99500-100000. First, pay attention to the breakout situation at this resistance line. There are two operational strategies: if the rebound breaks the resistance area, continue to go long, targeting above 106000. If the rebound fails to break the high point and faces resistance, go short, continuing to watch the consolidation of the range, with a pullback to the lower point of the range around 93000.

From the perspective of Ethereum's structure, there is still a certain difference from Bitcoin. Currently, it is in an ascending channel structure, and the rebound continues to test the pressure at the upper track of the channel. The same two strategies apply: if it can break the pressure in the 3700-3730 area during the day, then continue to go long this week, targeting around 3900-3950. If the upper track of the channel faces resistance, then look for a pullback, targeting around 3380.

The above suggestions are for reference only!

Official account

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。