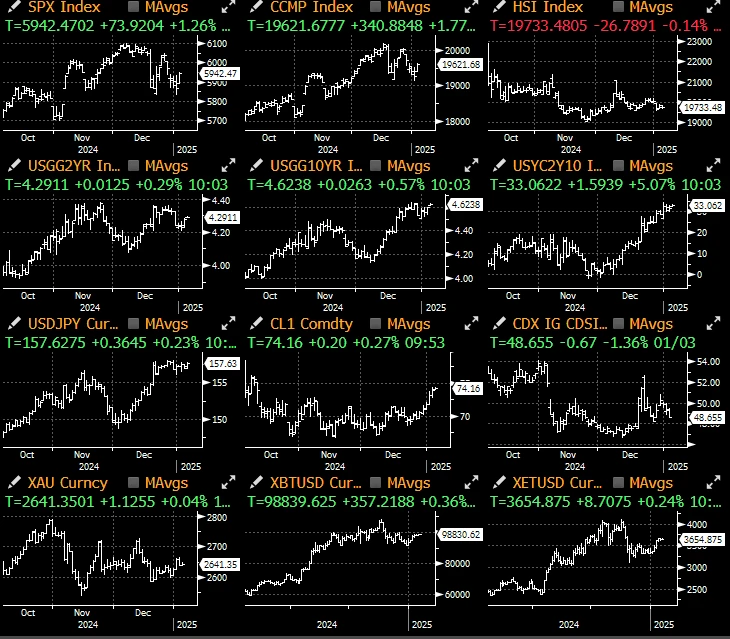

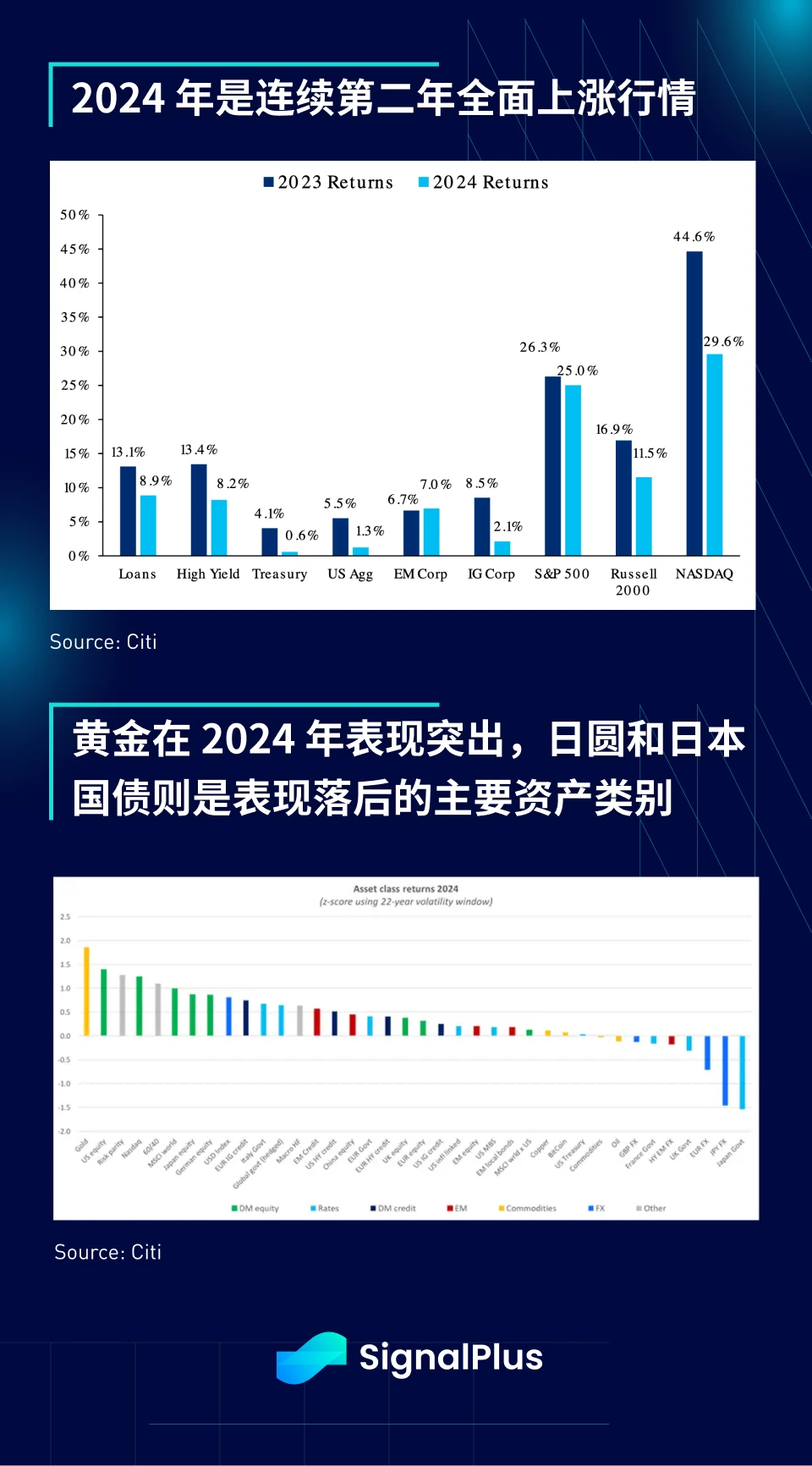

Looking back at 2024, the market once again showed a comprehensive upward trend, with almost all major macro asset classes achieving positive returns. Stocks performed outstandingly in terms of absolute returns and risk-adjusted returns, while gold steadily rose throughout the year with minimal volatility, performing excellently. In contrast, the Japanese yen and Japanese government bonds lagged behind, as the Bank of Japan refused to tighten monetary policy even in the face of rapidly rising domestic inflation.

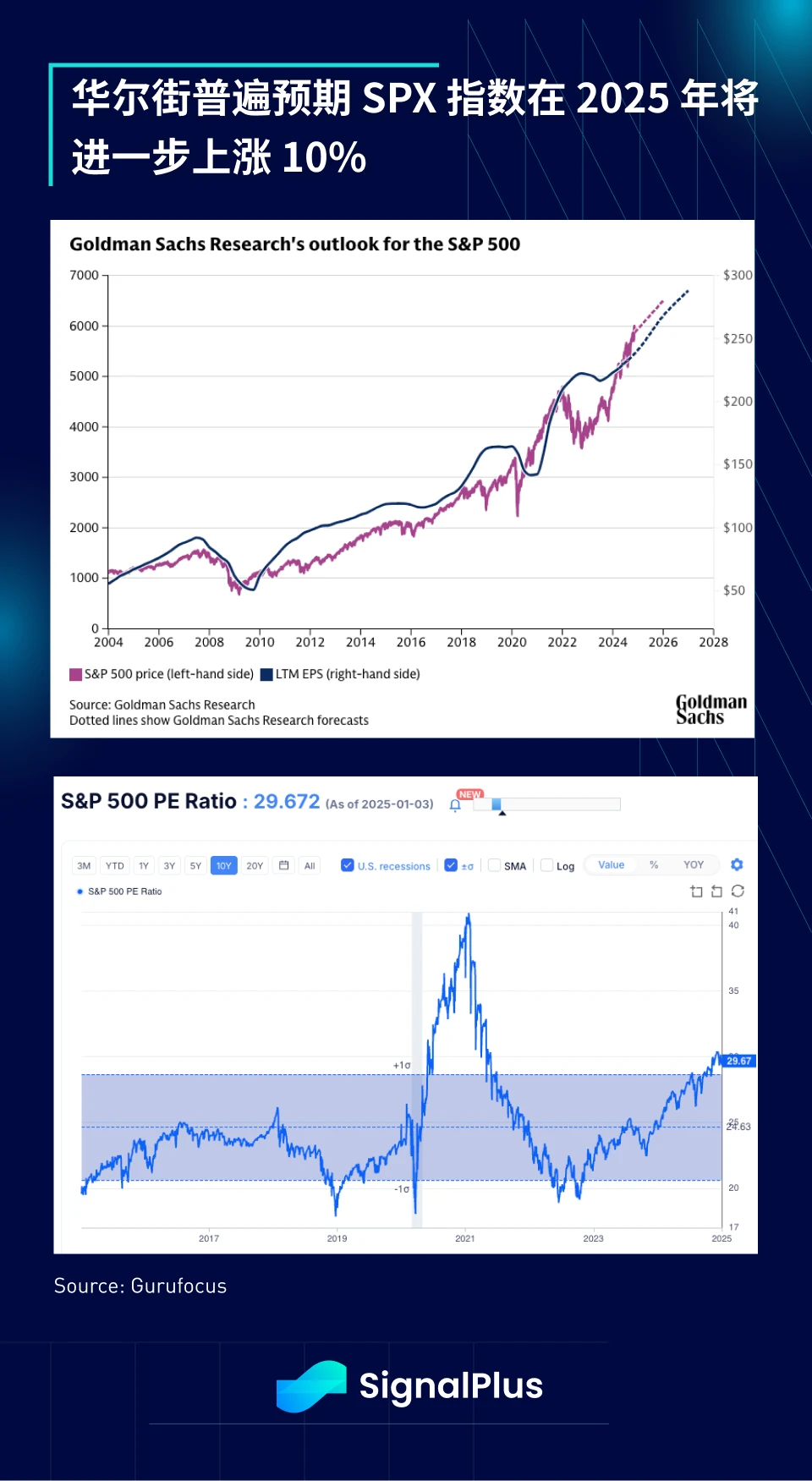

As we enter 2025, market sentiment remains consistently bullish, with most Wall Street banks predicting that the SPX index will rise another 10% this year, with a forward price-to-earnings ratio reaching around 24-25 times, and EPS expected to reach about $270 by the end of the year.

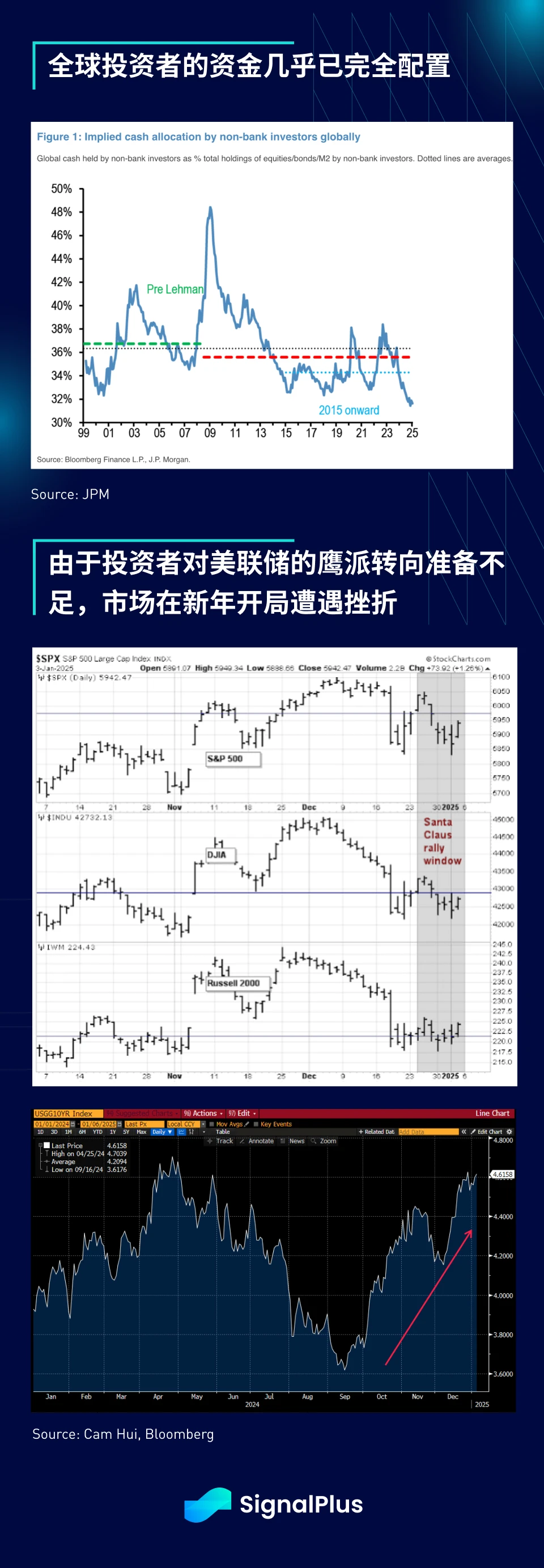

In fixed income, due to persistently high inflation and the Federal Reserve showing a clear hawkish stance in December, bond investors expect fewer than two rate cuts in 2025.

“I believe the upside risks are greater than the downside risks,” Richmond Fed's Barkin stated in a talk last Friday in Maryland. “Therefore, I think it is more appropriate to keep rates restrictive for a longer period.”

Additionally, the Trump 2.0 policy is expected to exert upward pressure on prices, although the extent of the transmission will depend on the implementation of these policies. We anticipate that the resistance faced by the new government may be greater than the current market expectations.

At the same time, most of the funds from global investors have already been fully allocated, with cash holdings at a low point, leading to a somewhat difficult start for 2025. The market is still affected by the Fed's unexpected hawkish turn, with the 10-year U.S. Treasury yield rapidly approaching the highs seen before the Fed's rate cuts in 2024.

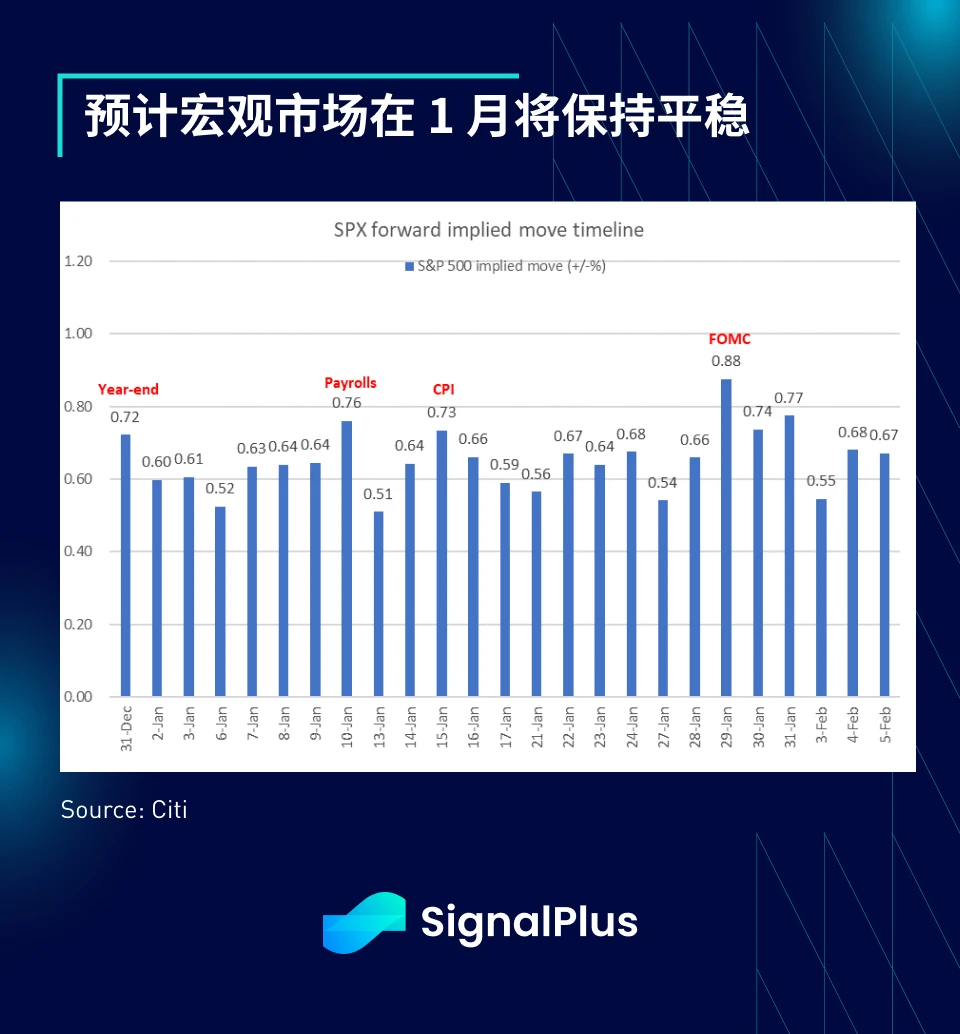

Nevertheless, it is expected that market volatility will remain low ahead of Friday's non-farm payroll report, which will officially kick off the trading activities of the new year. In the short term, economic data is expected to show signs of a "soft landing," with the most volatile event this month anticipated to be the FOMC meeting at the end of the month.

A potential source of volatility may come from China, where the 30-year bond yield has fallen below that of Japanese bonds for the first time. As deflationary concerns intensify, the People's Bank of China is expected to adopt more aggressive easing policies. The interest rate differential between China and the U.S. and developed markets continues to widen, which will have a significant impact on the renminbi exchange rate, and the market has high hopes for the People's Bank of China's policies this year.

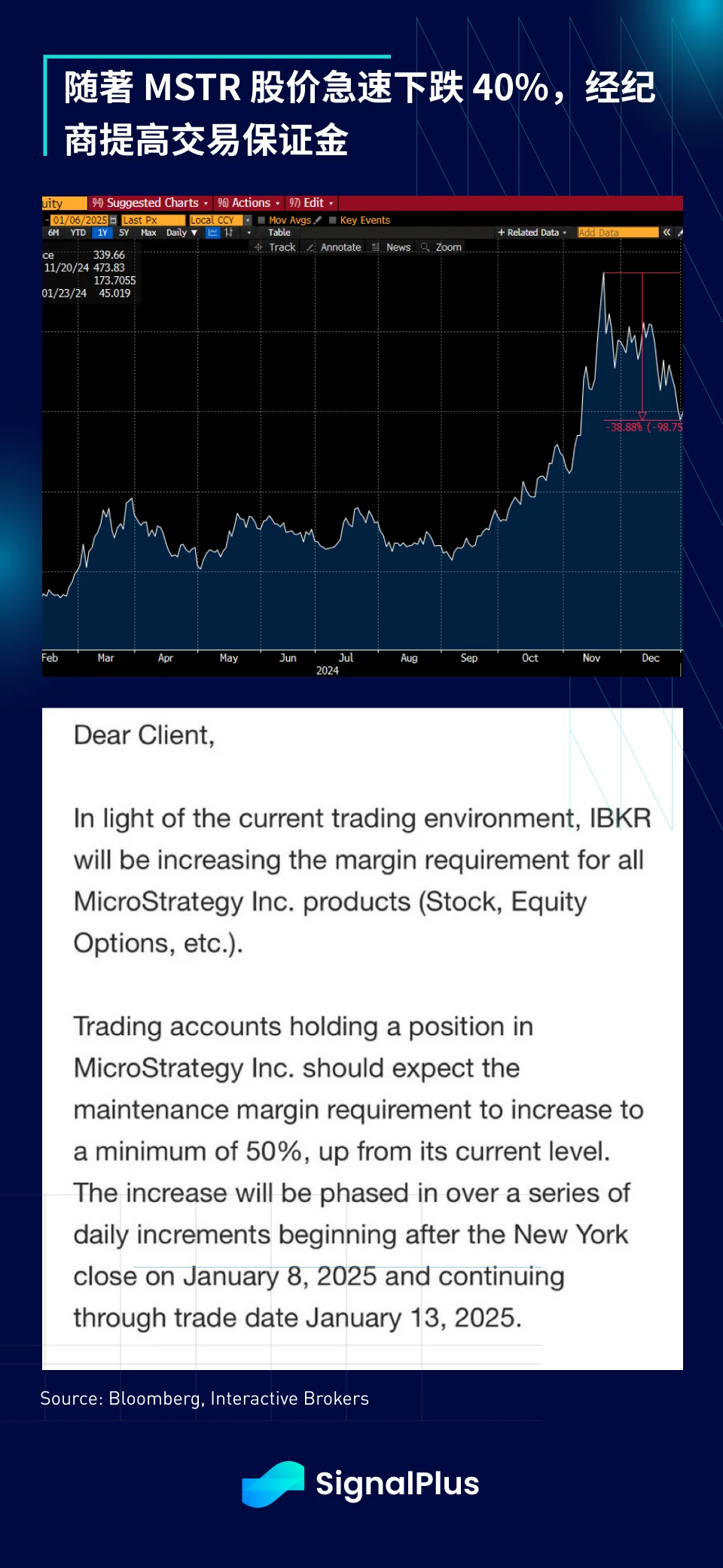

In the cryptocurrency space, the significant pullback in Microstrategy's stock price has led brokerages to raise trading margins, and there has been a substantial outflow of funds from ETFs, with IBIT recording a net outflow of $333 million in a single day, the largest single-day outflow since its launch, marking the third consecutive day of net outflows and the longest streak of outflows. In contrast, futures clearing has been much milder, indicating that this adjustment is more driven by TradFi and is a response to the sharp decline in MSTR's stock price, with the company's net asset premium now falling back to "only" 1.8 times.

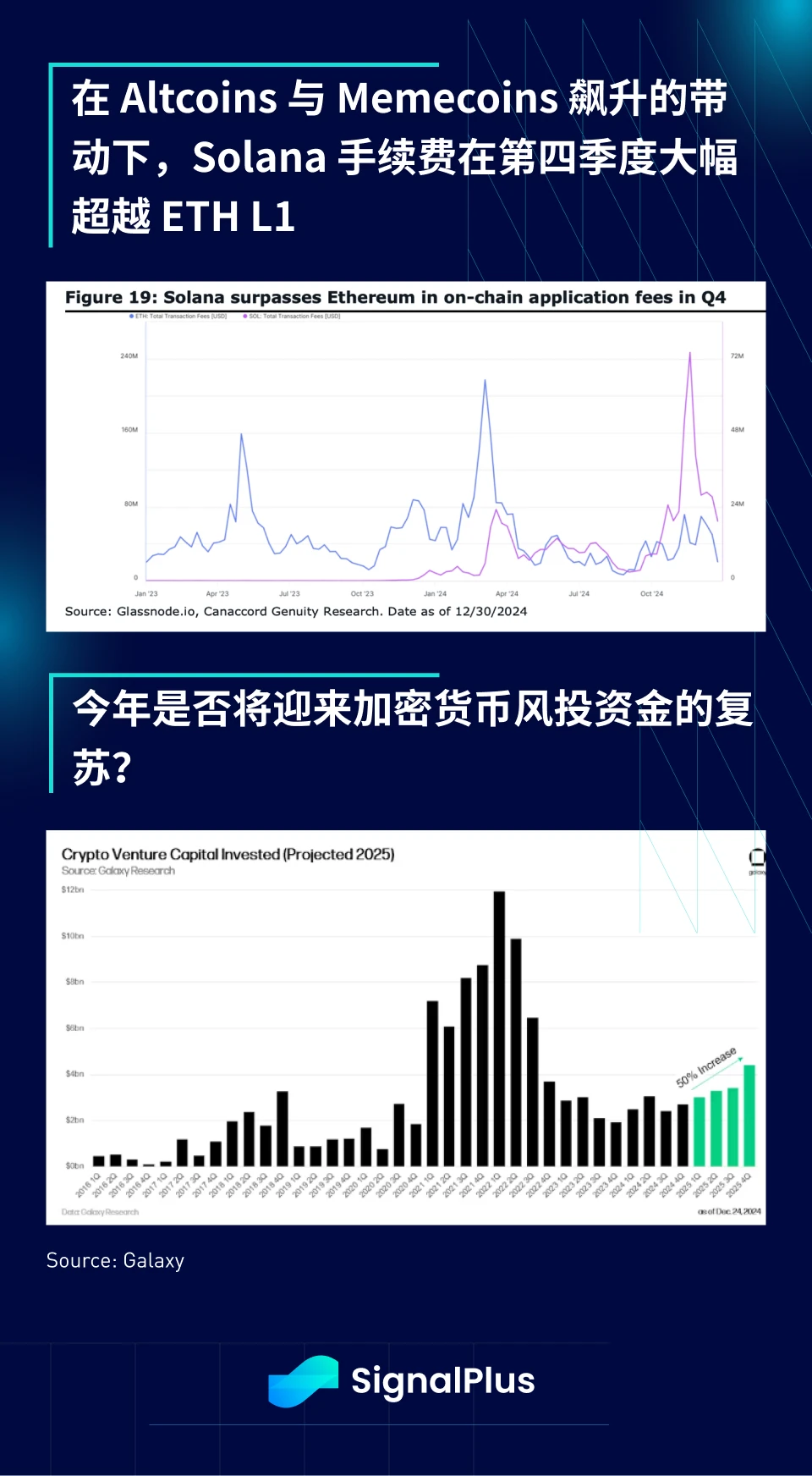

Finally, from on-chain activity data, thanks to the altcoin boom, the trading volume of decentralized exchanges (DEX) has surpassed historical highs, but the dominance of DeFi has declined, with the total value locked (TVL) still far from the peak in 2021. As Trump’s policies are expected to bring new hope for mainstream adoption of cryptocurrencies, will this year become a year of renewed inflow of venture capital into cryptocurrencies?

Happy New Year! Wishing everyone smooth trading and abundant gains in the new year!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。