Original|Odaily Planet Daily (@OdailyChina)

At the beginning of the new year 2025, the market seems to have started a gradual price recovery amidst a fluctuating decline.

Around 10 AM today, the price of BTC briefly rose above $99,000, currently reported at around $98,800; ETH has rebounded from around $3,300 on January 1 to above $3,600; SOL has also gradually recovered from around $180 on January 1 to above $210. As the date of Trump's inauguration as President of the United States approaches, market sentiment is gradually warming up. Odaily Planet Daily will summarize recent market views in this article for readers' reference.

Buying pressure continues: Long-term buying funds exist at the national, institutional, and corporate levels

The price recovery is naturally inseparable from the influx of buying pressure. After experiencing the "Christmas fluctuations," the buying power for the new year still seems to be long-term and increasingly robust.

Data: Historical cumulative net inflow of Bitcoin spot ETF has reached $35.909 billion

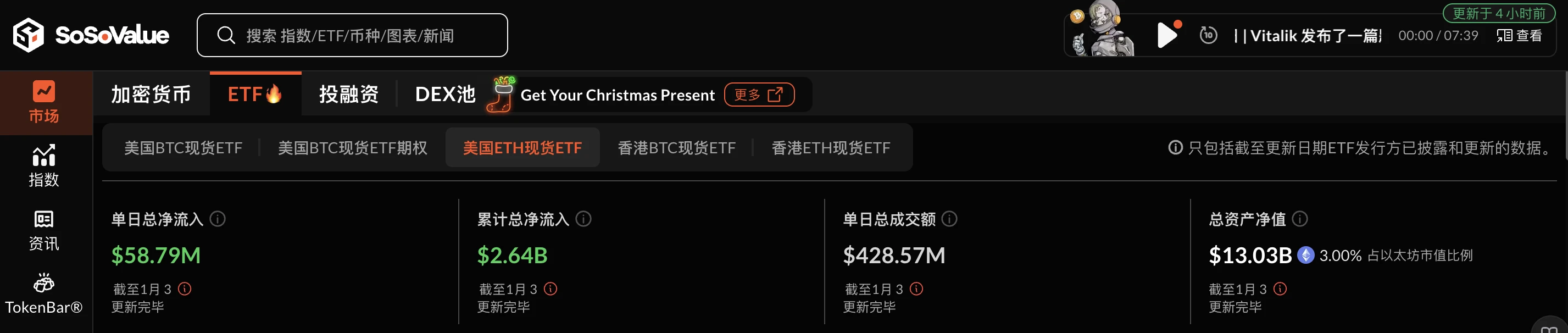

According to SoSoValue data, as of January 3, the total net asset value of Bitcoin spot ETFs is $111.46 billion, with an ETF net asset ratio (market value compared to total Bitcoin market value) of 5.72%, and a historical cumulative net inflow of $35.91 billion; the total net asset value of Ethereum spot ETFs is $13.03 billion, with an ETF net asset ratio (market value compared to total Ethereum market value) of 3%, and a historical cumulative net inflow of $2.64 billion.

BTC spot ETF data

ETH spot ETF data

In addition, institutional reports also show confidence in the continued net inflow of funds into Bitcoin and Ethereum spot ETFs in 2025.

Steno Research: Expects net inflows of $48 billion and $28.5 billion for Bitcoin and Ethereum ETFs in 2025; BTC to rise to a minimum of $150,000

Steno Research recently stated in a report that its bullish forecast for BTC and ETH prices reflects "an unprecedented favorable regulatory environment for cryptocurrencies, a supportive macroeconomic environment marked by declining interest rates and improved liquidity, and historically strong performance after Bitcoin halving."

It also mentioned, "Moreover, institutional adoption is expected to reach unprecedented levels, and the significant inflow of funds into U.S. Bitcoin and Ethereum ETFs further drives this trend."

Steno expects net inflows for BTC and ETH ETFs in 2025 to be $48 billion and $28.5 billion, respectively. Additionally, the report states that by 2025, DApp TVL is expected to exceed $300 billion, far surpassing the approximately $180 billion peak in 2021.

Previously, Steno Research indicated in a report that it expects Bitcoin's price to rise from about $94,000 to a minimum of $150,000 by 2025, while ETH's price is expected to more than double, rising from $3,400 to at least $8,000. That is, the ETH/BTC exchange rate is expected to rise from the current 0.0357 to 0.06 within the next 12 months, similar to the price trends of previous cycles, with altcoins becoming the focus of attention.

El Salvador has increased its holdings by 5 BTC since the new year, currently holding about 6,009 BTC

According to today's on-chain data, since the new year, El Salvador has increased its holdings by 5 BTC, bringing its total holdings to approximately 6,009 BTC.

MARA CEO: Will continue to increase Bitcoin holdings in 2025, currently holding over 40,000 BTC

According to the CEO of Bitcoin mining company MARA Digital, it was stated that in 2025, they will continue to increase Bitcoin on their balance sheet.

MARA currently holds a total of 44,893 BTC, valued at over $4 billion.

Large BTC options purchase on Deribit: 150 BTC call options for $97,000 expiring on January 10

According to Lin Chen, head of Deribit's Asia-Pacific business, it was stated that the largest BTC options purchase today was: a user paid $559,000 to buy 150 BTC call options expiring on January 10 (this Friday) at $97,000.

Standard Chartered: BTC price will reach $200,000 by 2025, MicroStrategy will buy more BTC

Geoffrey Kendrick, head of digital asset research at Standard Chartered, predicts that Bitcoin's price will double. In a report, he stated that he expects Bitcoin to reach $200,000 by the end of 2025.

Additionally, he predicted that institutional investment in Bitcoin will continue to maintain or exceed the pace of 2024 next year. The bank noted that since the beginning of this year, institutional purchases of Bitcoin have reached 683,000 BTC, mainly through the U.S. spot Bitcoin ETF and MicroStrategy, a software company that invests in Bitcoin. Geoffrey Kendrick stated, MicroStrategy's Bitcoin purchases in 2025 should reach or exceed the purchases in 2024. He also added that due to the incoming Trump administration, which is expected to reform the regulations governing traditional financial (TradFi) companies' investments in digital currencies, pension funds should start incorporating Bitcoin into their portfolios through the U.S. spot Bitcoin ETF starting next year. Kendrick pointed out: "Even a small allocation of $40 trillion from U.S. retirement funds would significantly boost Bitcoin prices. If Bitcoin is adopted more quickly by U.S. retirement funds, global sovereign wealth funds (SWF), or potential U.S. strategic reserve funds, we will be even more optimistic."

In addition, major listed companies are still methodically carrying out their "Bitcoin accumulation plans."

Blockstream founder: MicroStrategy may have already increased its BTC holdings

Blockstream founder Adam Back stated: "I believe MicroStrategy has completed its Bitcoin purchases, but must announce it to the market through an 8-K filing before or after normal trading hours when the stock market opens."

Previously, MicroStrategy founder Michael Saylor released Bitcoin Tracker-related information for the ninth consecutive week.

Statistics: 11 listed companies have increased Bitcoin holdings in the past week

Bitwise CEO Hunter Horsley stated: "According to statistics from HODL15Capital, since last Monday, 11 listed companies have purchased more Bitcoin. In 2025, a large number of companies will join the Bitcoin standard. Michael Saylor has scripted a movement."

Metaplanet plans to increase Bitcoin holdings to 10,000 by 2025

As a Japanese listed company that has tasted the benefits of the "Bitcoin reserve plan," Metaplanet's buying will continue.

The company's CEO Simon Gerovich recently stated that this year's goal is to increase Bitcoin holdings to 10,000 by utilizing its "most value-added capital market tools," aiming to promote Bitcoin adoption in Japan and globally, and "expand Metaplanet's influence in Japan and the Bitcoin ecosystem."

Gerovich stated: "We are not just creating a company; we are driving a movement."

Compared to the continuously growing buying pressure, the "selling pressure" has also significantly eased as we enter 2025.

Selling pressure alleviated: Both exchange inflows and miner outflows have decreased

As a major source of selling pressure, exchange inflows and miner outflows have traditionally been seen as reliable indicators, and there has been a significant decrease recently.

Since November 2024, BTC exchange inflows and miner outflows have significantly decreased, indicating reduced selling pressure.

Since November 2024, Bitcoin exchange inflows (the total amount of BTC transferred to exchanges) and miner outflows (the amount of BTC sent to exchanges by miners) have significantly decreased, indicating a reduction in selling pressure. According to CryptoQuant data, Bitcoin exchange inflows peaked at 98,748 BTC on November 25, 2024, following about two months of highly active exchange inflow activity. In December 2024, Bitcoin exchange inflows decreased but remained quite substantial, with the total number of Bitcoins sent to exchanges ranging from 11,000 to 79,000 per day.

The decrease in exchange inflows is accompanied by a reduction in miner outflows, indicating that selling pressure from Bitcoin miners has eased, as they often sell BTC holdings to cover operational costs. Since the historic price surge of Bitcoin following Trump's election in November last year, miner outflows have been declining.

CryptoQuant data shows that outflows peaked on November 11, when miners sent 25,367 BTC to exchanges, at which time the Bitcoin price reached approximately $88,000. On January 1, 2025, miners sent 5,489 BTC to exchanges, 5,748 BTC on January 2, and 2,133 BTC on January 3.

Macro and Micro Predictions: Cautiously Optimistic vs. Highly Optimistic

Regarding macro-level predictions for the cryptocurrency market and micro-level personal views, there currently exists a coexistence of cautious optimism and high optimism. Some traders believe that one should "sell for profit in a timely manner and take profits on swings."

Greeks.live: European and American users gradually returning from holidays, market heat rising

On January 3, Greeks.live researcher Adam stated: "20,000 BTC options are expiring, with a Put Call Ratio of 0.69 and a maximum pain point of $97,000, with a nominal value of $1.93 billion. 206,000 ETH options are expiring, with a Put Call Ratio of 0.81 and a maximum pain point of $3,400, with a nominal value of $710 million. Today marks the first weekly options expiration of 2025, with a total of $2.6 billion in options expiring, and European and American users are gradually returning from holidays, leading to an overall rise in market heat. However, the theme of this week remains adjustment, with clear market differentiation, and no sustained hotspots have emerged yet.

Later this month, Trump will officially take office as the new President of the United States, and the overall market expectations for 2025 are very optimistic. However, the recent significant pullback in U.S. stocks has also brought considerable uncertainty to the market, and it is highly likely that this month's interest rate meeting will maintain the current rates without cuts, leaving the market without more short-term positive news."

U.S. Investment Bank Perspective: Expects BTC market cap to reach a quarter of gold by the end of this year, BTC price to break $220,000

U.S. investment bank HC Wainwright predicts that by the end of 2025, the price of Bitcoin will reach $225,000, which means Bitcoin's market cap will reach $4.5 trillion, approximately 25% of the market cap of gold.

Finance Professor: Supportive U.S. regulations will boost BTC, price reaching $200,000 is entirely possible

Carol Alexander, a finance professor at the University of Sussex in the UK, believes that a $200,000 Bitcoin is possible. Carol Alexander pointed out, "I am more optimistic about 2025 than ever before," adding that Bitcoin's price "could easily reach $200,000, but there are no signs that volatility will decrease." Alexander clarified that she does not personally own any Bitcoin. "By next summer, I expect its trading price to fluctuate around $150,000, plus or minus $50,000." Supportive regulations in the U.S. will boost Bitcoin; however, the lack of regulation on cryptocurrency exchanges will continue to lead to volatility, as high-leverage trading will cause price fluctuations.

It is reported that Carol Alexander has a good track record in predicting Bitcoin prices; last year she believed Bitcoin would reach $100,000 in 2024, which indeed happened.

Mining Industry Practitioner: Bitcoin may peak at $180,000 to $190,000 in 2025, but with occasional sharp pullbacks

Youwei Yang, chief economist at cryptocurrency mining company BIT Mining (BTCM), predicts that the price of Bitcoin in 2025 will be between $180,000 and $190,000, but he remains cautious, believing that price pullbacks may occur.

He noted: "Bitcoin may experience significant upward momentum in 2025, with occasional sharp pullbacks. During market shock moments, such as major stock market crashes, Bitcoin may temporarily drop to around $80,000. However, the overall trend is expected to remain upward. Based on these dynamics, I predict Bitcoin may reach a peak of $180,000 to $190,000 in 2025, which aligns with historical cycle patterns and the increasing trend of mainstream institutions investing in cryptocurrencies."

Ledn Chief Investment Officer: Predicts BTC will hit $160,000 by the end of this year or early next year

John Glover, chief investment officer of cryptocurrency lending company Ledn, stated that Bitcoin may drop to $89,000, then rebound, reaching $125,000 by the end of the first quarter.

Glover said, from that point, Bitcoin may pull back again to $100,000, then hit $160,000 by the end of 2025 or early 2026, a more conservative prediction compared to asset management firms VanEck and Bitwise's forecasts of $180,000 and $200,000.

Analyst: Expects Bitcoin to maintain range-bound fluctuations, may rise to $105,000 in January

Bitfinex analysts expect Bitcoin to rise to $105,000 in January. Bitfinex analysts stated: "We expect Bitcoin to maintain a range-bound market trend, as investors seek to deploy capital across a variety of asset classes. We predict that by the end of January, Bitcoin will fluctuate between $95,000 and $110,000."

On January 20, the inauguration of President Donald Trump may become an important catalyst for cryptocurrency prices. Expectations for the new U.S. government include friendlier cryptocurrency regulatory policies and improved U.S. economic policies. However, according to Bitfinex analysts, Trump's inauguration may not immediately trigger a price surge in cryptocurrencies. "We expect the new U.S. government to bring more clarity to cryptocurrency policy, but we do not believe the inauguration itself will be a significant price surge event; rather, it will lay the groundwork for cryptocurrencies to have a less obstructed path in the U.S."

Placeholder Partner: BTC, ETH, and SOL look strong regardless of the time frame

Chris Burniske, a partner at Placeholder, stated: "Regardless of the time frame, BTC, ETH, and SOL look strong and will soon rise again."

He also added that, similar to previous trends, the Meme coins of the past few weeks have become a good indicator of increased risk appetite.

1confirmation Founder: Expects countries to try to adopt MicroStrategy's strategy to increase Bitcoin holdings

Nick Tomaino, founder of 1confirmation, stated that it is likely we will soon see countries competing to try to adopt MicroStrategy's strategy:

- Issuing government bonds of different maturities (5-year, 7-year, 10-year, etc.)

- Using bonds to purchase cryptocurrencies

- Repaying loans on time according to the loan term

At the same time, he stated that the question is no longer whether countries will do this, but what kind of cryptocurrencies they will purchase, likely starting with BTC, but the next will be ETH; any currency with sufficient decentralization can participate, as the government bond market is larger than the stock market.

Negative Bearish Sentiment and Profit-Taking: Mature Views from Renowned Research Institutions and Traders

Compared to the optimistic attitude towards BTC, the views on ETH and altcoins in the market are relatively rational. Here, we present some representative opinions.

10x Research: Expects ETH's performance in 2025 to lag behind BTC again, not optimistic about the Pectra upgrade

Recently, Markus Thielen, research director at 10x Research, stated in a market report: "While we cannot rule out the possibility of new catalysts, we would not be surprised if Ethereum struggles to achieve a meaningful rebound in 2025. While we understand Ethereum's volatility, we still consider it a poor mid-term investment and expect ETH's performance in 2025 to lag behind BTC again. Therefore, our stance on Ethereum remains clear: 'avoid.'"

Thielen noted that one of the key indicators to watch in 2025 will be the trend of active validators. However, he pointed out that the one-month growth rate of Ethereum validators has turned negative, declining by about 1% over the past 30 days, raising concerns about the increased risk of more validators exiting the network. Thielen stated that the increase in unstaking seems "logical," as he believes Ethereum lacks "real demand" outside of staking.

He also stated that the Ethereum Duncan upgrade in March last year (which reduced network gas fees and allowed it to handle more transactions) was "six months late," missing the peak of the Meme coin surge, leading the market to "turn" to the "more cost-effective" Solana alternative. He expressed skepticism about the Pectra upgrade scheduled for early 2025, noting that "out of the 19 upgrades so far, only two had a significant positive impact on ETH prices, and those upgrades occurred during Bitcoin bull markets." He added, "The three major catalysts for Ethereum in 2024 have essentially all failed, bringing little value overall."

Senior Trader: Trump's Inauguration May Be a Key Trigger for a Bullish Trend in the Crypto Market

Senior cryptocurrency trader The Crypto Dog recently stated that the cryptocurrency market may not see significant fluctuations before President Trump's inauguration on January 20. He speculated that this political event could be a key trigger for the re-emergence of bullish momentum in the cryptocurrency market. He believes that Bitcoin and altcoins may remain stagnant before the inauguration, mirroring market behavior from previous election cycles. His analysis indicates that historical patterns show Bitcoin tends to rise after a new U.S. president takes office. In 2021, shortly after President Biden's inauguration, Bitcoin rose by over 100%. Similarly, in 2017, Bitcoin also experienced significant breakthroughs around the time of the inauguration.

Despite these observations, he also acknowledged that his predictions could be overturned if the stock market (especially the S&P 500) continues to rise. He emphasized that since the launch of the Bitcoin ETF, there has been a strong correlation between Bitcoin and traditional markets, suggesting that sustained strength in the stock market could bring a more optimistic outlook for cryptocurrencies in January.

It is worth mentioning that with about two weeks until Trump's inauguration, the market shows that Trump-related concept coins are experiencing a surge.

Analysis: The Number of Addresses Holding More Than 1 BTC Decreased by 18,530 in the Past Two Months

On-chain analyst Ali shared Glassnode data, stating: "In the past two months, the number of addresses holding more than 1 BTC has decreased by 18,530."

Odaily Planet Daily believes this may indicate that more retail investors are exiting the market, further centralizing the BTC holding structure.

Trader Eugene: As the Bull Market Enters Its Second Half, a Better Strategy is High-Frequency Cashing Out

Renowned trader Eugene Ng Ah Sio stated that as we enter the second half of this cycle, the strategy should be to sell more frequently rather than holding long-term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。