This article explores the development of the combination of cryptocurrency and artificial intelligence, focusing on the practicality of intelligent agents, decentralized finance (DeFAI) applications, DAOs, and future trends in autonomous agents.

Author: @0x3van

Translation: Blockchain in Plain Language

Artificial intelligence is the main theme of the current cycle, and many believe that this field will exist for a long time. On the other hand, there are many valid criticisms stating that most AI agents today are just chaotic entities, and we need another 3 to 5 years to see these technologies become truly meaningful.

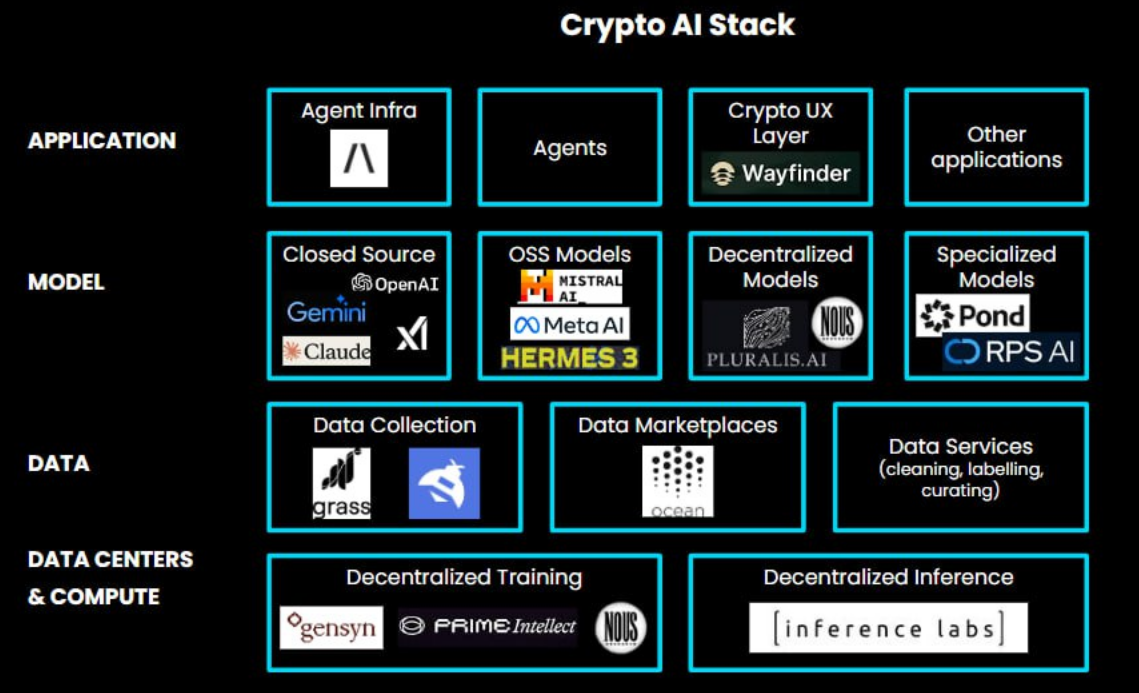

As a preface, the combination of cryptocurrency and artificial intelligence covers many aspects. The true technological potential of cryptocurrency and AI mainly lies in guiding better reasoning processes through cryptoeconomics or providing decentralized computational access. Delphi is a great starting point for understanding the entire tech stack.

Delphi Labs: https://x.com/delphi_labs/status/1834247706103160939

However, the focus of this article is on the current state of intelligent agents. While exciting innovations are happening in other layers of the tech stack, intelligent agents seem to have captured the attention of the mainstream cryptocurrency community. As this layer continues to evolve, here are 6 trends in cryptocurrency and AI intelligent agents that need attention:

1. Framework + Launch Platforms: Value accumulation is becoming important, and frameworks may have long-term viability

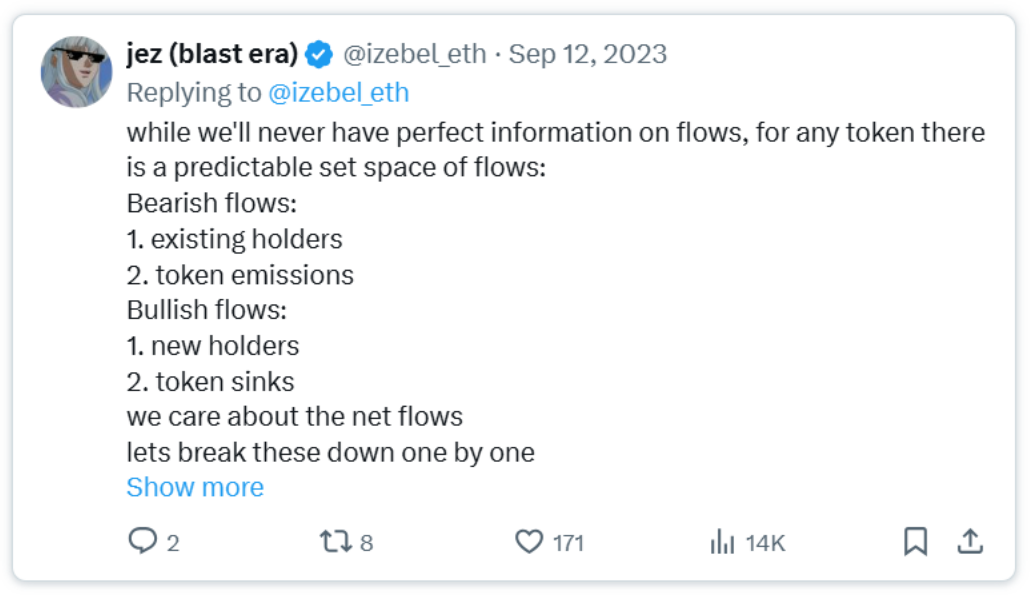

Value accumulation is starting to become important. Why is that? Stepping back, why would someone hold an asset? There are two reasons people trade assets with dollars:

They believe they can sell the asset to someone else at a higher price, benefiting from capturing a market narrative that attracts new buyers.

The asset will generate more cash flow over time.

Jez @izebel_eth mentioned in his article "Old Coin Bad, New Coin Gud" that the only thing that matters is liquidity. These two reasons reflect two bullish liquidity aspects of an asset:

New holders

Token consumption

However, in most cases, we have not seen any phenomena resembling true token consumption or token value accumulation. Using tokens for intelligent agent terminals, such as AIXBT, is more akin to staking rather than traditional value accumulation.

This is also why frameworks like Virtuals, AI16z, Zerebro, and Arc have recently become so popular. Virtuals has already accumulated $60 million in protocol revenue. ai16z initially started mainly as an investment DAO, but since releasing details about its upcoming launch platform and related token value accumulation, it has become one of the top protocols in the field.**

Today, the market for frameworks and launch platforms has become exceptionally saturated, as they leverage the influence of early success stories. There are many reasonable doubts about the role of these launch platforms, especially when many intelligent agents themselves have no practical use. However, many frameworks (like Eliza V2 + launch platform, Zentients, Arc, and their handshake programs) have not even launched their main products yet. If they successfully attract developers and users, they may continue to lead the entire industry.

Reasons why frameworks may have long-term viability: Regardless of whether intelligent agents remain purely "chaotic," frameworks for launching agents will perform well because they still have product-market fit (PMF) in speculation. Frameworks and launch platforms allow users to have both factories and casinos. In many ways, Virtuals has simply replaced pump.fun in the Base ecosystem.

More optimistically, as technology continues to advance, more sophisticated intelligent agents may emerge from leading frameworks, accelerating development alongside open-source codebases like Eliza. Many of these launch platforms are also positioning themselves as coordination layers for communication between groups and agents, facilitating some form of value transfer through their tokens. For a deeper article on Eliza's value capture, see here:

Project Cases: Currently, @virtuals_io, @ai16zdao, @0xzerebro, @arcdotfun are the main names, but the market for launch platforms is becoming increasingly saturated. The fastest innovators, the most scalable frameworks, and those offering the most unique features (e.g., "Can this framework build functionalities that others cannot?") are worth watching.

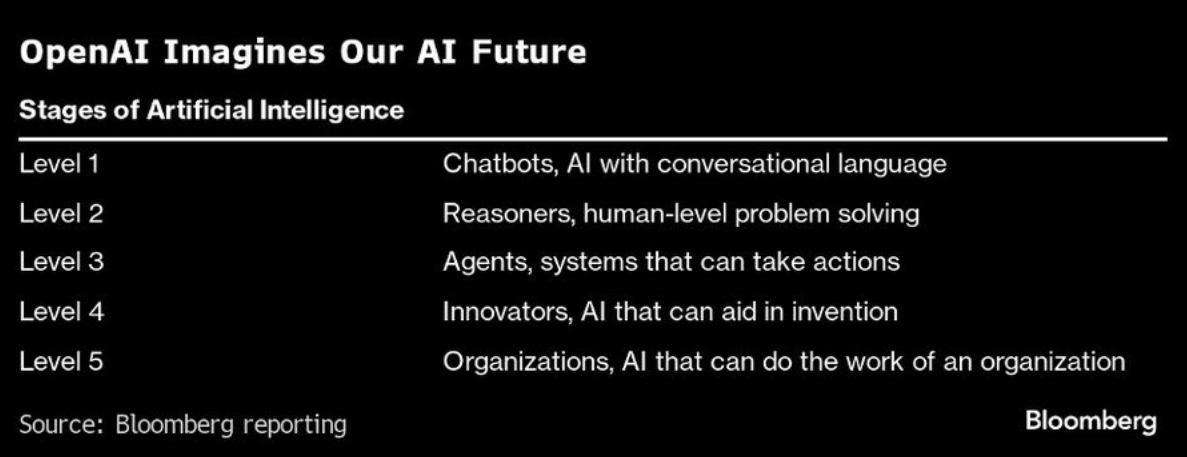

DeFAI

DeFAI: The next wave of intelligent agents will focus on practicality and value accumulation, and DeFAI (DeFi x AI) may be the first area to achieve product-market fit (PMF). Most intelligent agents only have meme tokens without actual functionality. To advance the field of intelligent agents, the next wave of agents must perform specific tasks for us. New opportunities will arise from true value accumulation and agents capable of taking action. I believe this will be a process of jumping from level one agents to level three agents, expected to be realized within the next year.

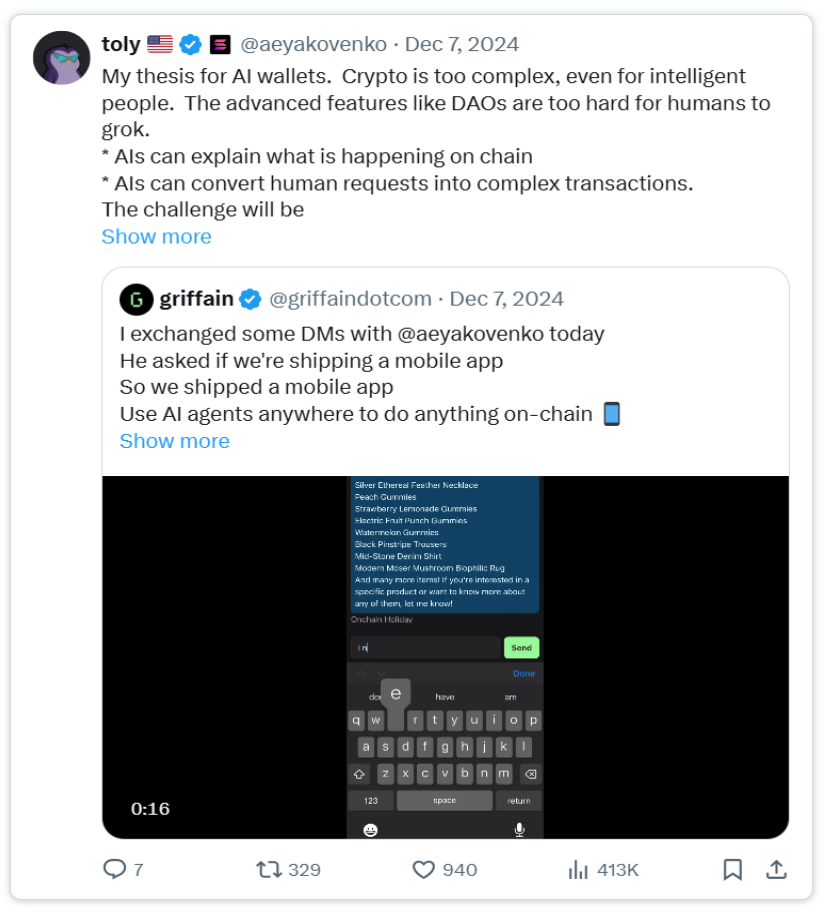

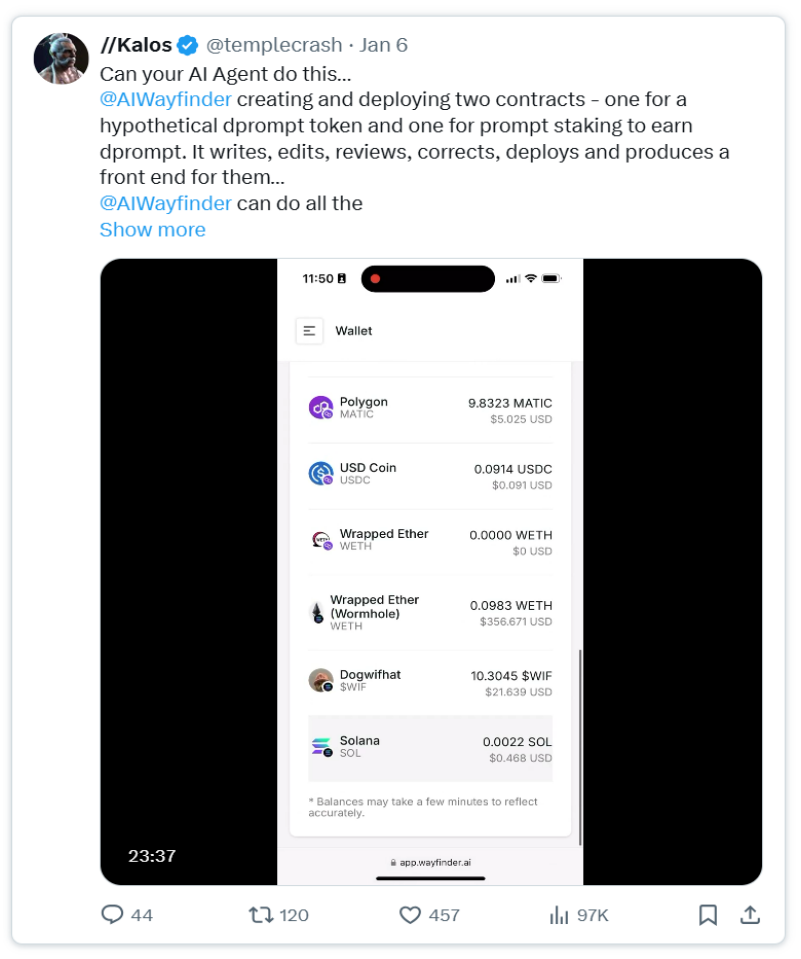

We first see this trend realized in decentralized finance (DeFi). We will see more terminals that allow users to express desired outcomes through natural language or voice, with intelligent agents executing tasks behind the scenes. Existing wallets and protocols will also integrate intelligent agents to improve user operation flows.

Project Cases: @AIWayfinder @griffaindotcom @HeyAnonai @LimitusIntel @neur_sh

Long articles on this field:

Consumer Level—Agent Representatives, Autonomous Worlds, and Games

Attention-based intelligent agents will develop more complex personalities and multimedia interactions. This could lead to the next wave of development in gaming and metaverse technologies.**

One issue with existing intelligent agents is that they all start to blend into commoditized, beautified chatbots. While some agent projects will shift towards infrastructure (many are already doing so), others will begin to think about useful products or applications, while others may continue down the path of attention tokens. However, the next generation of attention agents will be more powerful, with more complex personalities and higher interactivity. This may be presented through audiovisual forms or by giving agents 3D representations and physical bodies.

@digimon_tech is a game similar to "Pokémon," where creatures psychologically evolve based on interactions. @smolverse uses Eliza, featuring an agent character driven by a large language model that performs actions in a virtual world based on your commands.

Agent Organizations: The Return of DAOs -------------------------

Decentralized agent organizations are the next evolution of DAOs. Groups or multi-agent systems are very exciting because they may be able to coordinate and execute more complex strategies, similar to operating a company. Heterogeneous groups containing various types of specialized agents/models working in synergy may perform more efficiently than a single large model.

While fully autonomous agents and groups may take some time to realize, the next iteration of DAOs will likely include interactions between humans and groups. This will reduce inefficiencies in bureaucracies and lower the costs and time of human execution. From a liquidity perspective, the next step will be for those agents capable of generating income to develop into complete revenue-generating organizations.

Project Cases: Agent Group Infrastructure: Projects like @swarmnode, @joinFXN focus on multi-agent frameworks and coordination as infrastructure providers, but mainstream agent frameworks like @0xzerebro and @ai16zdao have also expressed intentions to build at this level.

DAO Launch Platforms: Most of the initial attention we see today is concentrated on investment DAOs. I believe @daosdotfun is the first major DAO launch platform, giving birth to ai16z. There are also some emerging launch platforms, such as @daosdotworld, where AI-driven funds like @3berascapital_ are attracting increasing attention.

5. Verifiable Agents

Today's agents are evolving towards greater autonomy, truly possessing their own liquidity: Currently, most agents still require a high level of human intervention. The next wave of agents will move towards true autonomy, starting with managing their own funds. The product-market fit (PMF) of agents with cryptocurrency lies in the fact that cryptocurrency provides financial infrastructure for real economic agents. However, most agents have an untouched treasury or are managed by human teams. To achieve true economic agency, agents must be able to autonomously manage their own funds. This will begin to change agent behavior, as you can impose economic constraints on agents, requiring them to pay for their own reasoning costs. This introduces Darwinism to agents, who must earn income to survive.

Project Cases: @freysa_ai is one of the earliest agents capable of controlling its own keys and has performed exceptionally well (including attracting Elon’s attention). They recently announced they are building a framework that allows agents to have verifiable autonomy in a Trusted Execution Environment (TEE), along with keys controlled by the agents.

@LitProtocol also has an agent framework that allows autonomous agents to transact on-chain and manage private keys through a storage and execution system. @galadriel_AI launched an SDK called “Proof of Sentience” that enables developers to fully verify the existence of agents on-chain.

6. Summary

Rather than seeing a billion people on-chain, we are more likely to first see a billion intelligent agents on-chain.

Cryptocurrency is inherently unfriendly to human users, while intelligent agents are indifferent to this. We will start with interactions between humans and agents, but the ultimate manifestation of crypto AI will be the interactions between agents, with swarms of autonomous agents interacting and transacting on-chain within their native economies.

To realize economic agency, enabling it to incentivize behavior (paying service fees) and coordinate real-world activities, intelligent agents need the capability to control and deploy capital. Cryptocurrency is the home for these agents—blockchain infrastructure allows agents to participate in a permissionless financial system. Stablecoins and high-performance L1s are ideal vehicles for driving cost-effective, 24/7 global trading.

Beyond metadata and narratives, we have ample reason to be optimistic about the long-term prospects of on-chain agent economies. Perhaps many practical use cases, DAOs, and revenue-generating agents are closer than we think.

Article link: https://www.hellobtc.com/kp/du/01/5626.html

Source: https://x.com/0x3van/status/1876142580737487188

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。