Last time, we introduced the excellent investor background of #Chainbase (@ChainbaseHQ) and the Chainbase Genesis airdrop tutorial event. This time, we will focus on its future potential and competitive analysis. 🧐

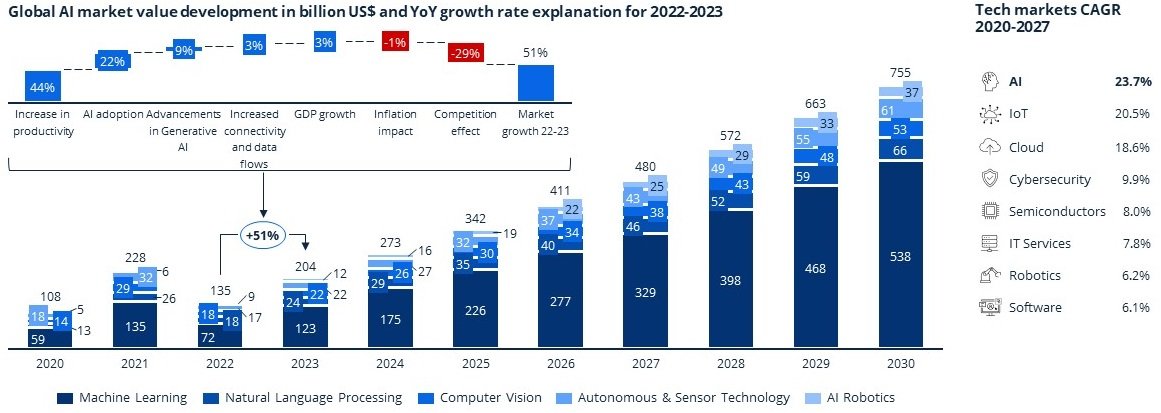

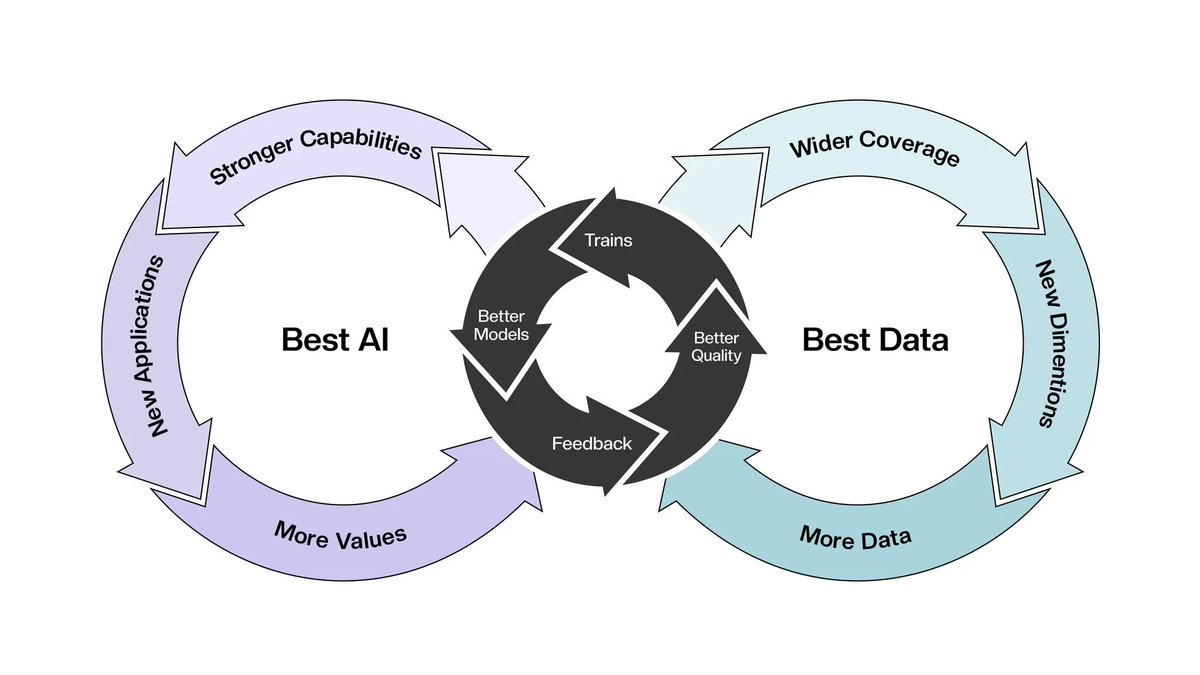

Data is the most important component in the future development of #AI, just like the relationship between cars and oil; both are indispensable and crucial! According to predictions from several authoritative institutions, the development of the AI data field is expected to reach a market size of over $500 billion by 2030. Recently, Databricks, a Web2 company with a high similarity to #Chainbase's business (focused on data cleaning and analysis), completed a $1 billion Series J financing round with a valuation of $62 billion, becoming the highest-valued private tech company in history. You can think of #Chainbase as the Databricks of the Web3 space, and the possibilities become immediately apparent!

1️⃣ Project Introduction:

Chainbase is an advanced full-chain data network dedicated to integrating blockchain data into a unified ecosystem. As the world's largest hybrid blockchain + AI data network, Chainbase provides a transparent and interoperable data infrastructure for the AI era by building a unified data layer. Its goal is to address the issue of traditional data processing methods not adapting to blockchain block logic and to become a leader in the blockchain and AI data field through innovative streaming data warehousing.

Although we discussed #Chainbase's investment institutions last time, it's worth mentioning again. When looking at investment institutions, we should not only consider how much they invested but also the resources and value behind them, as well as the potential for future empowerment. #Chainbase secured $15 million led by Tencent and Matrix Partners. It's neither too much nor too little. However, the two well-known brands of Tencent and Matrix Partners, along with the resources they bring, are incomparable. As the only project in the Web3 + AI field invested by Tencent, its strength is unquestionable; while Matrix Partners, as the largest venture capital institution in China, manages $60 billion in assets and has always been committed to the mission of "discovering the future and empowering the future," serving as a benchmark for long-term investment in startups! Interestingly, Tencent and Matrix Partners have invested in 43% of China's leading AI startups and many potential AI projects globally over the past two years.

As the central network for processing AI + blockchain data, many AI application projects invested by Tencent and Matrix Partners will have the opportunity to connect to #Chainbase with the future integration and rapid development of AI + Web3. The imaginative space and value empowerment within this will be self-evident!

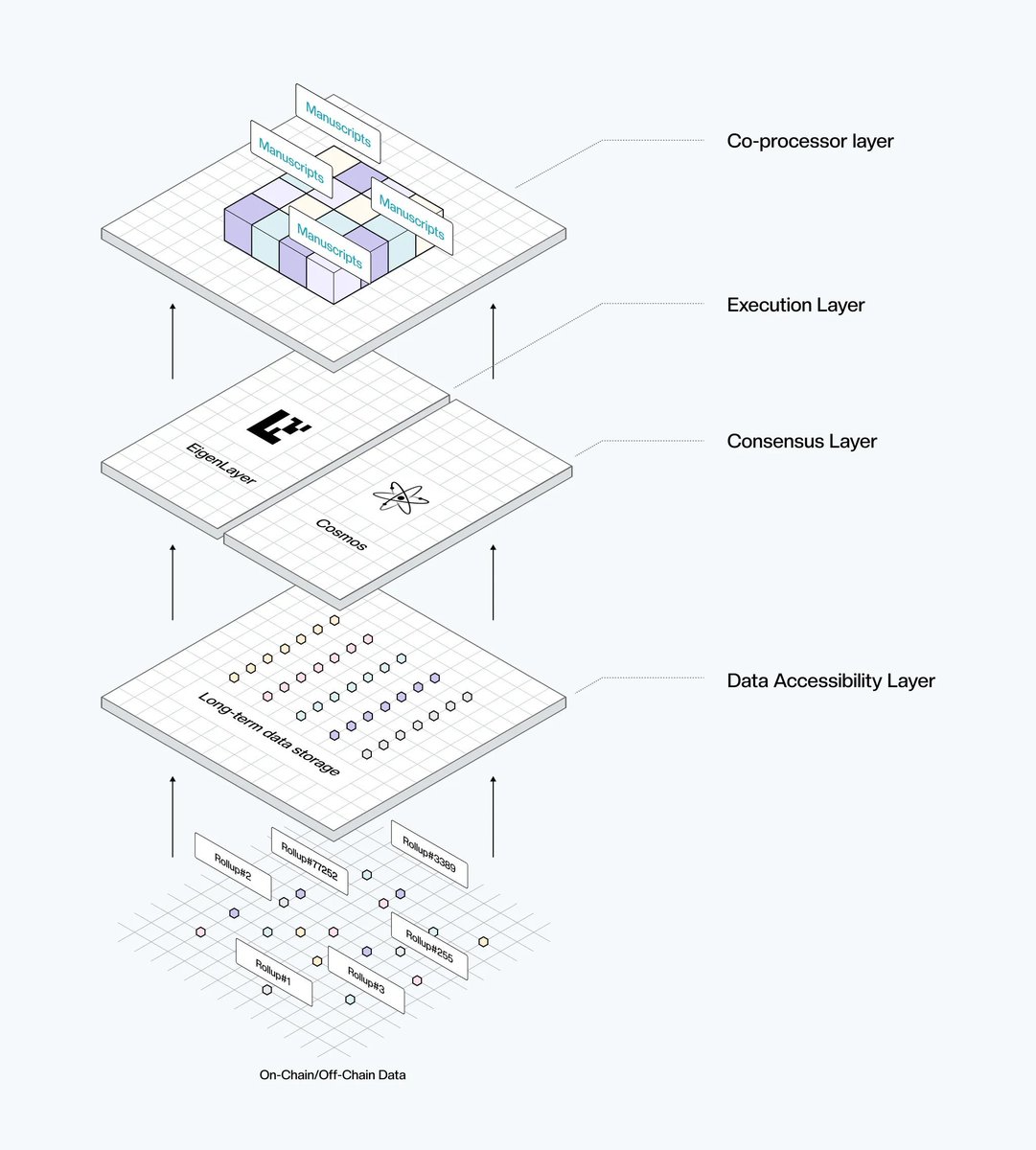

2️⃣ #Chainbase Four-Layer Architecture Components, Ensuring Decentralization and Security Efficiency:

• Collaborative Processor Layer: Uses Manuscripts to standardize data and provide programmable scripts for datasets prepared for artificial intelligence.

• Execution Layer: Efficiently processes data through a customized Chainbase Virtual Machine (CVM).

• Consensus Layer: Ensures network security through Delegated Proof of Stake (DPoS) and CometBFT.

• Data Accessibility Layer: Collects and verifies on-chain and off-chain data, achieving seamless AI integration.

3️⃣ Core Functions and Technical Advantages

Chainbase's technical architecture and functional design are unique and forward-looking:

• Unified Wallet Management: Simplifies cross-chain asset management for users, enhancing convenience.

• Enhanced Security: Real-time security alerts and in-depth security analysis effectively address potential threats.

• AI Integration: Supports multi-chain data-driven AI model deployment, improving decision-making efficiency and intelligence.

• Social Platform Interoperability: Facilitates seamless interaction among users across different blockchains, creating a more inclusive social ecosystem.

• DeFi Enhancement: Supports cross-chain lending, increasing liquidity and flexibility, and promoting the development of DeFi applications.

• Robust Infrastructure: Chainbase provides developers with a wealth of developer tools and a wide range of data sources for building Web3 dApps.

4️⃣ Background Potential and Competitive Analysis:

Currently, the market value of AI and big data in the crypto field has rapidly grown from $1.5 billion at the beginning of the year to $7 billion, becoming one of the fastest-growing sectors in the crypto industry. As a project focused on on-chain data, Chainbase's potential can be compared to The Graph and Arkham:

• The Graph ($GRT): Market cap of $2.1 billion, FDV of $2.36 billion, primarily provides Web3 data indexing and query services, offering public data subgraph API solutions. Developers: 42. Network data revenue for 2023-2024: $960,000.

• Arkham ($ARKM): Market cap of $520 million, FDV of $1.6 billion, primarily focuses on Web3 on-chain data analysis + AI processing, building data intelligence applications. Developers: Unknown. Network data revenue for 2023-2024: No data available.

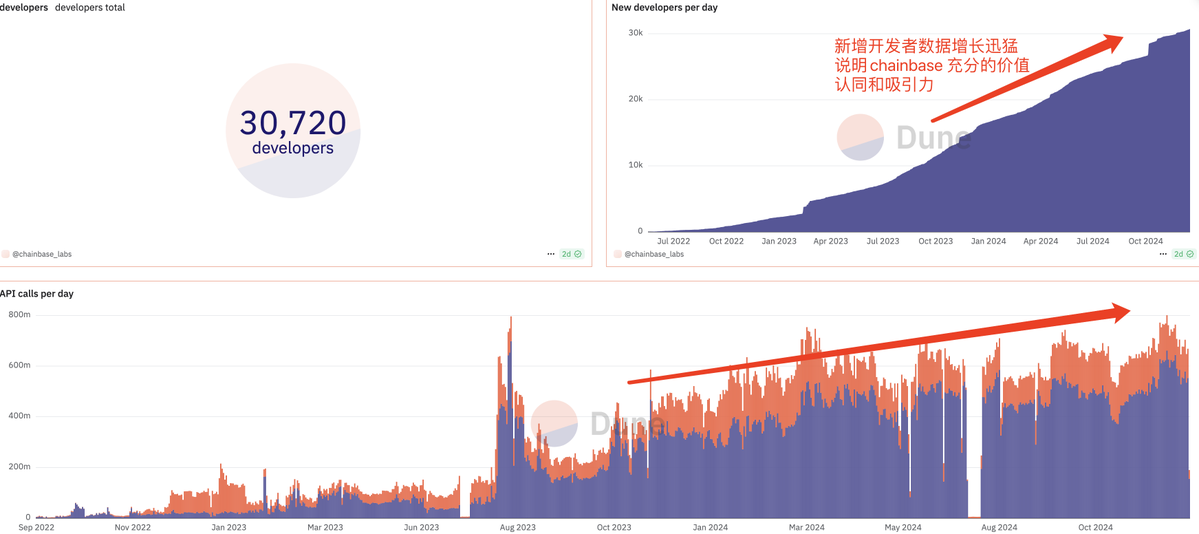

• Chainbase ($C): Last round of financing FDV valuation of $150 million, primarily operates as an AI + Web3 full-chain data network. Developers: 30,720. Network data revenue for 2023-2024: Over $1.5 million.

In comparison, #Chainbase's last round of financing valuation is only $150 million, which has more than 10 times the growth potential compared to competitors. As a central platform network for AI + Web3 data, it offers more imaginative space compared to singular applications. Additionally, Chainbase has higher user activity and developer support: Currently, there are over 30,000 developers and 8,000 projects actively using the #Chainbase network, with the monthly active developer count far exceeding that of The Graph. The over 31 million wallet addresses and the strong growth in address numbers also demonstrate the project's popularity among users, as shown in the images below.

5️⃣ Token Economics and Incentive Mechanism

$C is the native token of Chainbase, with multiple practical functions, including payment for data query fees, validator staking, and governance voting. Its token economics design focuses on sustainability and effective incentives:

• Data Query Fees: 80% allocated to operators and their delegates, 15% to data developers, and 5% burned to control inflation.

• Incentive Operator Pool: 15% of the token supply allocated over six years to reward reliable computing resource providers.

• Block Rewards: 100% rewards validators, ensuring network security and stability.

• Inflation Control: The annual token issuance cap is 3%, ensuring token value stability through a burning mechanism and extensive utility.

In summary: As the "Databricks" of the #Web3 field, #Chainbase has enormous potential under the trend of data and AI integration, and the positive flywheel is starting to turn. Its unified data network provides efficient tools and infrastructure for developers and enterprises, while strong capital and ecological support enhance its market competitiveness. In the context of the rapid growth of the AI + big data sector, Chainbase, with its unique technical advantages and wide range of application scenarios, is expected to become an important force in driving innovation in blockchain technology applications. As an investor, #Chainbase represents a highly promising early opportunity with long-term growth prospects, worthy of continued attention and deep involvement. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。