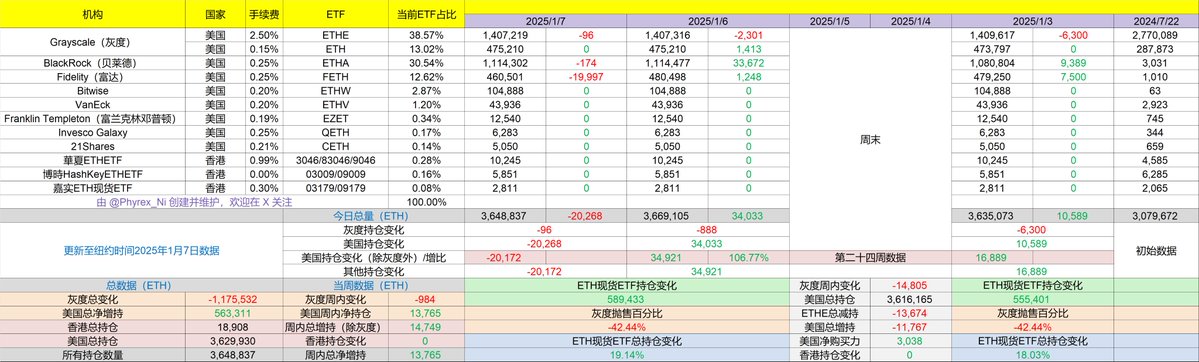

Indeed, the drop yesterday scared quite a few investors. The market was still optimistic on Monday, but by Tuesday, it had completely changed. Both BTC and ETH saw a significant number of users leaving. The difference is that BlackRock's users did not buy the dip in #ETH but instead heavily bought #BTC. In contrast, ETH experienced a pure net outflow, with Fidelity, which previously had strong buying power, seeing its largest single-day net outflow ever, nearly 20,000 ETH.

Although the outflow from BlackRock's investors was not large, there was still an outflow of 174 ETH. On the other hand, the previously heavily sold $ETHE had not even reached triple digits in outflow. However, the data from Tuesday shows that there was either a net outflow or zero, with no net inflow at all.

Looking purely at the ETF data, it is evident that some users are in a state of panic, especially with ETH. If we look at BTC, there was even more widespread selling, as most investors in ETH are still taking a wait-and-see approach. From a macro perspective, if the sentiment decline is indeed due to labor shortages as mentioned in yesterday's analysis, then Friday could very well be a price-in event or possibly a rebound.

After all, in reality, non-farm payroll data is the most important, and it may not necessarily be bad. The current drop is likely a reaction to expectations regarding the non-farm data.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。