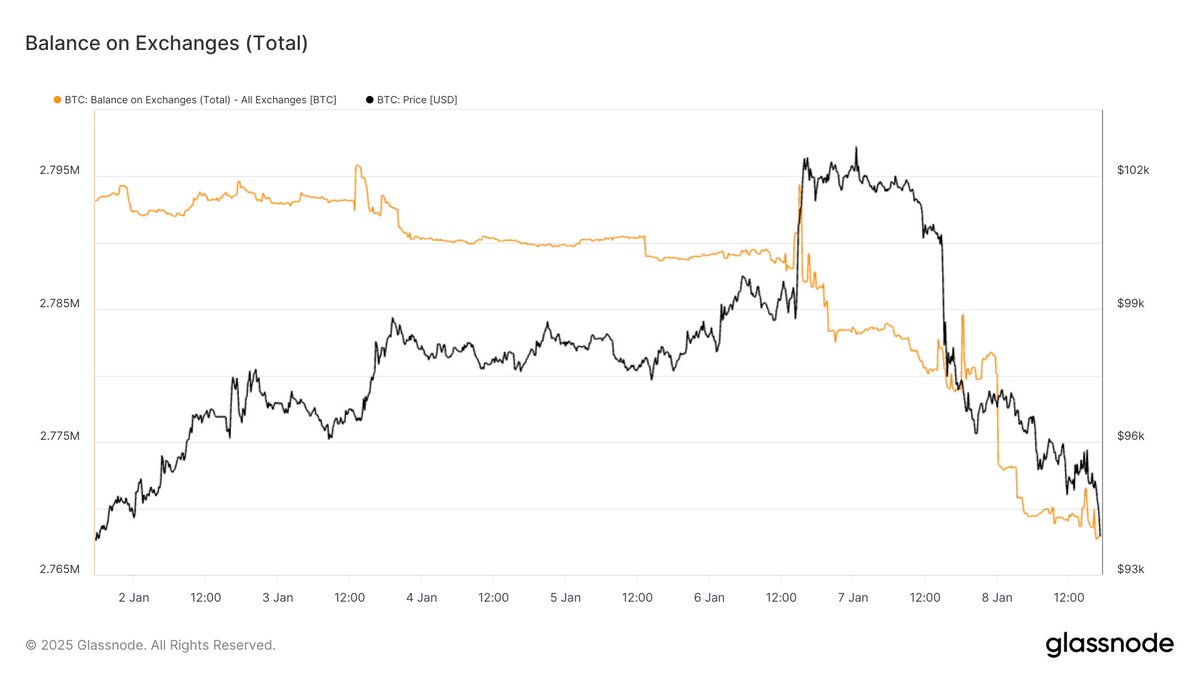

I looked at the data, and the selling pressure transferred to exchanges in the past few days is not significant. Of course, it is very likely that the existing stock on the exchanges is being sold, which is possible, especially in a risk-averse market. The current #BTC clearly shows signs of panic.

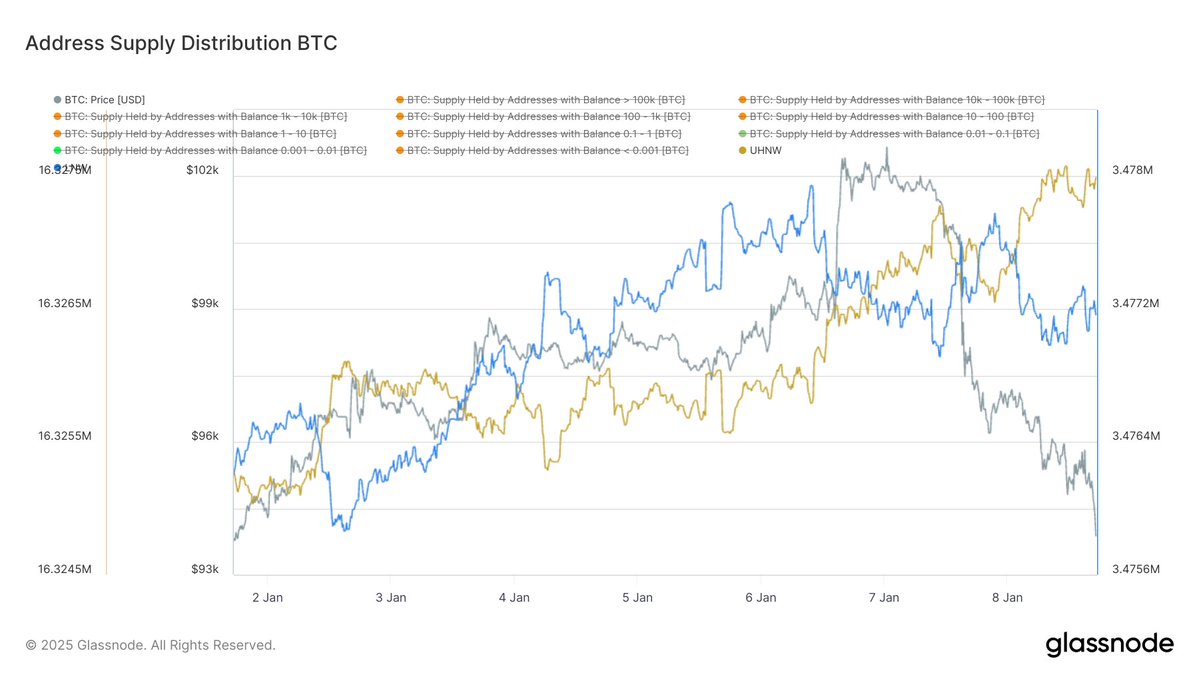

However, from the data, it can be seen that during the decline, investors holding less than 10 BTC have a noticeable trend of reducing their positions, while investors holding more than 10 BTC have a clear trend of increasing their positions.

Some may ask, could it be that investors holding more than 10 BTC are addresses of exchanges? So I also checked the exchange data and found that as the price of BTC declines, the holdings of exchanges are also decreasing. Therefore, it is highly likely that the increasing investors are not exchanges.

Thus, it can be inferred that there are indeed high-net-worth investors (holding more than 10 BTC) currently bottom-fishing. Of course, this does not mean that high-net-worth investors are necessarily correct, but their ability to withstand pressure is generally stronger. It is even possible that they are users of ETFs; for instance, during the significant drop yesterday, BlackRock's investors made substantial purchases.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。