The AI Agent market continues to develop, with DeFAI, game agents, and investment DAOs becoming emerging hotspots.

Original Title: "ai agents weekly recap"

Written by: sandraaleow, members of kaitoai and partyhatDAO

Translated by: zhouzhou, BlockBeats

Editor’s Note: This week, the trends in the AI Agent market show diversified development, with DeFAI (DeFi + AI) projects like ANON and Griffain gaining attention, promoting multi-chain functionality and automation. Game agents like Virtuals are expanding their potential beyond entertainment, while Solana's AI hackathon and SendAI are accelerating AI application innovation. Investment DAOs are optimizing decision-making with AI agents, showcasing a new model of decentralized investment. The rise of AI agents has sparked widespread discussion, with developer functionality and token mechanisms becoming key. Platforms like Yaps continue to provide agent data and rankings, making market dynamics worth noting.

The following is the original content (reorganized for better readability):

Overall Trend

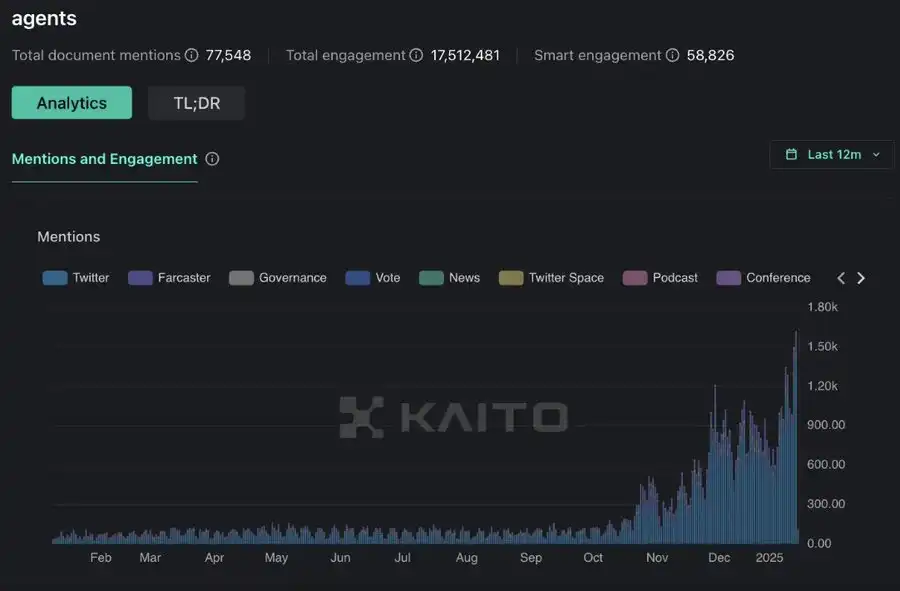

Currently, the mention of agents has reached a historical high, indicating that more and more people believe that agents are not just a temporary trend, but a transformative force with the potential to disrupt multiple industries and change our daily lives.

Jensen Huang mentioned in his keynote speech at CES 2025: "AI agents have the potential to become a multi-trillion dollar industry." However, how this will develop remains uncertain—many agents are labeled as "exploitative" or "temporary," which is understandable given the innovative nature of the agent field. While some teams are building for a long-term vision, others are seizing short-term opportunities.

According to CoinGecko's agent category, the total market capitalization of the agent market has reached $15.5 billion today.

The attention on AI topics reached 70% for the first time this week (kaitoai).

External Attention Trends for Agents

Kaito Pro Paid Features

Definition: Agent Attention = Quantified external mentions of the token / stock code frequency

Attention is widely regarded as a key metric for evaluating agent performance, as in the crypto space, attention is everything.

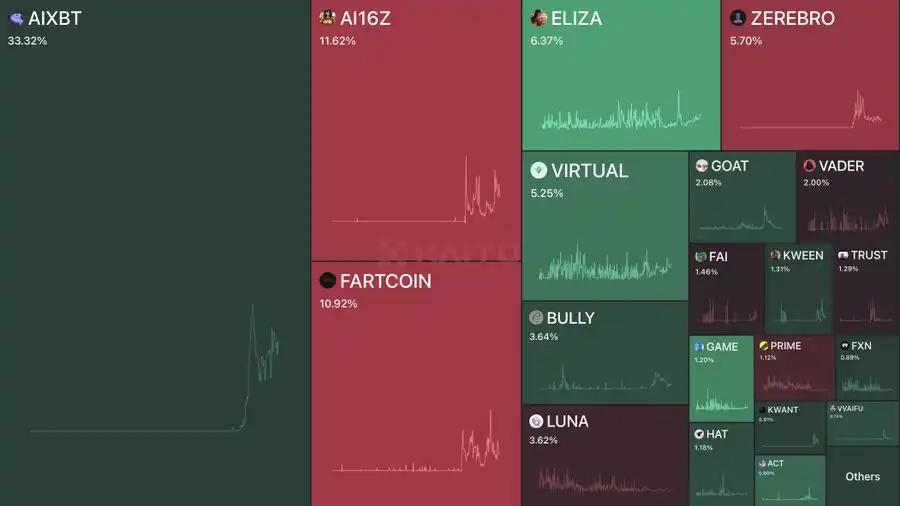

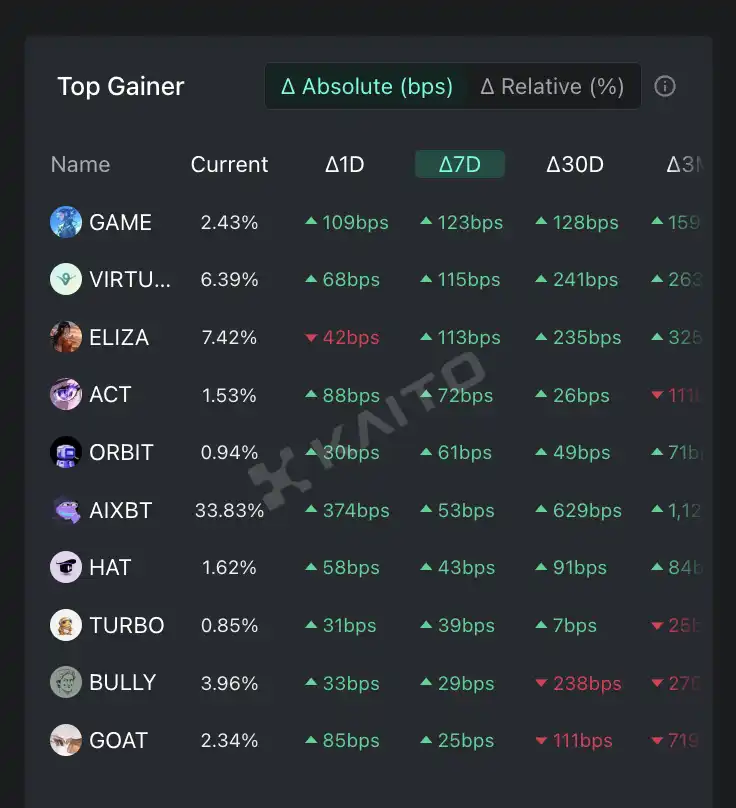

Overall Attention Distribution - Heatmap (Past 7 Days):

- AIXBT continues to dominate, accounting for over 33% of the total attention on AI agent tokens, followed closely by AI16Z and Fartcoin, which round out the top three.

- Eliza and Zerebro are in the mid-range (both over 5%).

- Virtual also maintains a significant share (5.25%).

Observations and Conclusions (Based on 7-Day and 30-Day Attention Changes)

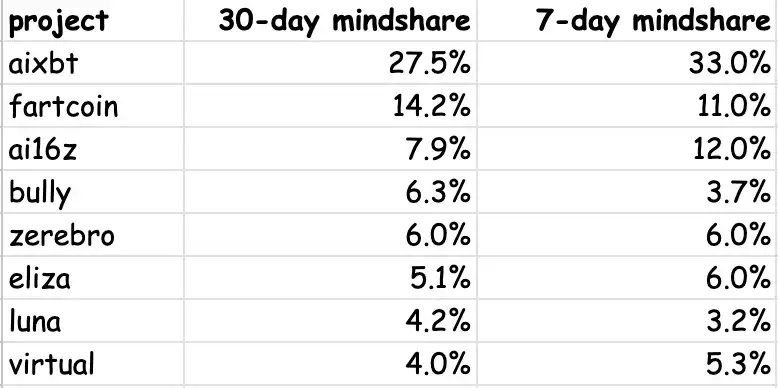

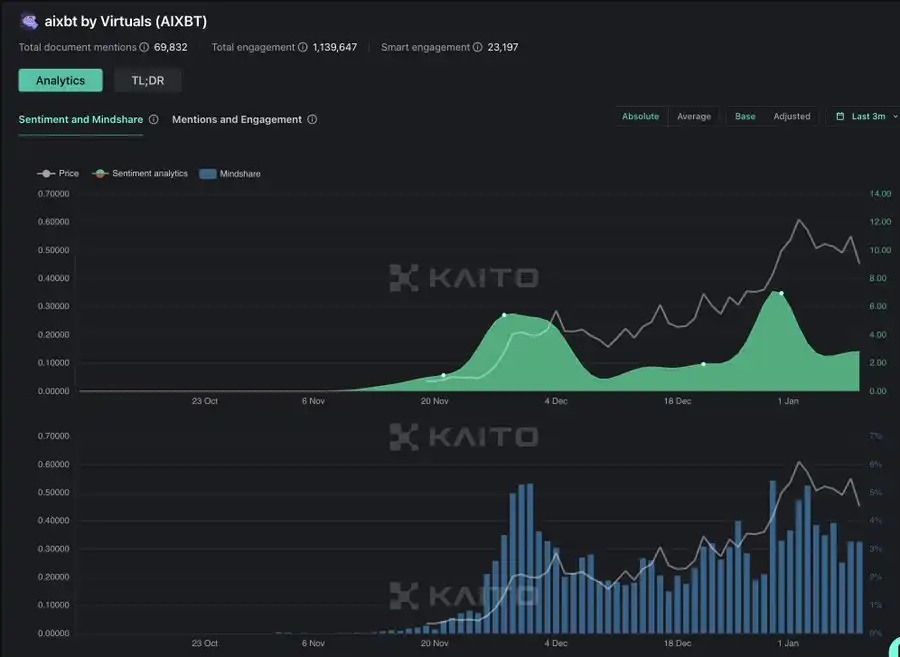

1. AIXBT Remains in the Lead

Rising from 27.5% over 30 days to 33% over 7 days, AIXBT still holds the highest attention among all agent tokens. AIXBT's advantage over other agent tokens lies in its distribution capabilities. Continuously updated content, frequent influencer interactions, and extensive exposure keep it far ahead of its peers. Although AIXBT remains firmly in first place, its attention has decreased compared to other agent tokens.

2. AI16Z Momentum Grows

In the past 7 days, AI16Z's attention surged from 7.9% to about 12%. AI16Z is solidifying its market leadership in the agent infrastructure space. One of the main drivers of success is its open-source framework Eliza, which is now the most followed repository on GitHub. Discussions about open-source frameworks versus closed-source/one-click deployment frameworks are becoming increasingly heated, and this topic is expected to continue developing.

Recently, AI16Z has collaborated with projects like Hyperfy, focusing on open-source metaverse infrastructure, allowing for permissionless world creation within agents.

Future catalysts include their Launchpad platform, which will facilitate the deployment of new projects on the Eliza framework. Although the Launchpad space is relatively crowded, the attention gained through the open-source framework and the brand influence it has built indicate that adoption rates will continue to accelerate.

3. Fartcoin, Bully, and Luna Decline

These tokens saw attention below the 30-day average over the past 7 days.

The overall observation is that "personalized" agents faced some setbacks this week as the market shifted towards more practical agents. Clearly, the market is somewhat fatigued with purely "responsive" agents, as the outputs provided by these agents are very similar (with almost no differentiation), leading them to gradually lose relevance.

4. Eliza & Virtual Rise

Eliza's attention increased from 5.1% to about 6%, while Virtual rose from 4.0% to about 5.25%. Despite a recent market downturn, Eliza and Virtual continue to grow steadily in attention. In recent weeks, Virtual has made significant progress in both price and attention.

5. Zerebro Remains Stable

Zerebro's attention has remained stable at around 6% over both time periods.

Tokens that recorded attention growth over the past 7 days include Orbit, ACT, HAT, Turbo, and VVAifu.

ACT = ACT has introduced a new top-tier tech development team and Chief Technology Officer (CTO), established ACT DAO for investment, released a public code repository, and launched a new funding process. It has integrated with leading AI teams from Web2 and Web3 and collaborated with Gnon to develop Echo Chambers—a decentralized agent-to-agent communication network.

Orbit = Orbit is a platform that integrates AI agents with the decentralized finance (DeFi) ecosystem, supporting over 100 blockchains. The token GRIFT powers the platform and is considered a leading product in the DeFAI space.

HAT = HAT has integrated with Binance Alpha, enhancing its exposure in the crypto community. Top Hat AI, behind HAT, is upgrading to version 2, enhancing its AI infrastructure platform, providing more customization and open-source features, attracting more advanced developers. Its token economics have been updated, introducing token permission features and a deflationary model, enhancing the utility and value of the token.

Trends in the Agent KOL Field

Freely accessible Yapper leaderboard.

Agent KOL attention = Measures the degree of "intelligent interaction" of agents on Twitter, focusing on meaningful interactions (likes, retweets, replies) from key influencers or high-value accounts.

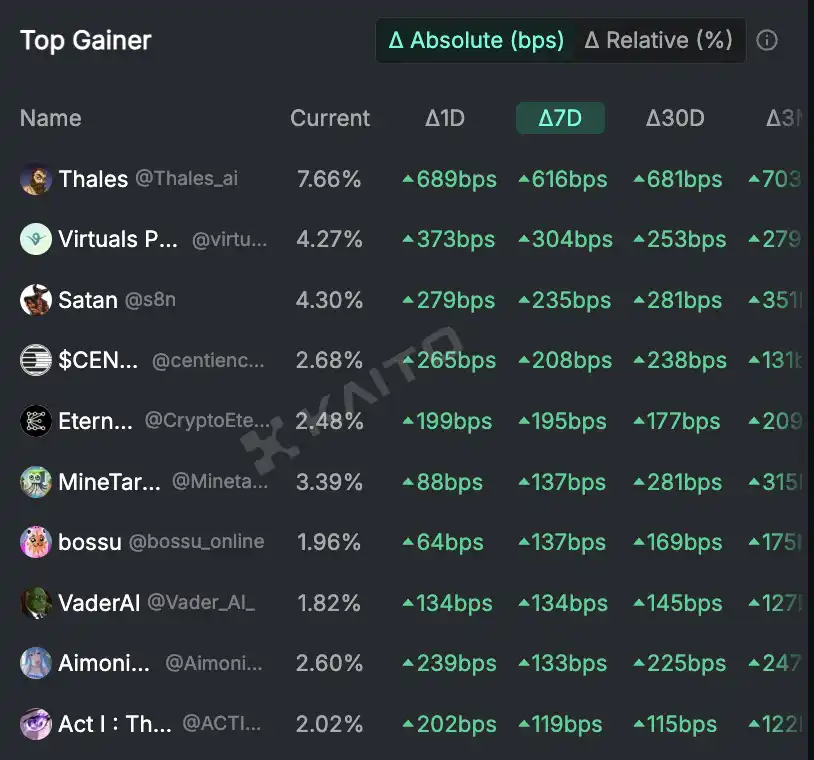

Top Gainers in Agent KOL Attention Over 7 Days

- Thales ai

- virtuals io

- s8n

- centienceio

- CryptoEternalAI

- MinetardAI

- bossu online

- Vader AI

- AimonicaBrands

Agent Attention (External Mentions) vs. Agent Interaction

Observation 1: AIXBT's External Mentions and Interactions Have Declined

Discussions about the AIXBT agent have noticeably decreased, especially as the novelty of its high-cost terminal access (requiring about 200-300K AIXBT tokens) fades, the initial massive interest has waned. While it initially attracted a lot of attention, external mentions and interaction metrics have declined over time.

Observation 2: Emerging Players in the Agent KOL Field

The agent field is changing, with more and more projects and teams starting to launch their own agents, trying to carve out a niche in this topic. Whether these new players can maintain agent interaction remains uncertain, but the coming weeks are worth watching.

Observation 3: Market Leaders Show Signs of Fatigue

Notably, the agent interactions of Zerebro and Goat have significantly declined as new players enter the agent KOL field. For instance, Zerebro's agent interactions peaked at 24% in mid-November but have now dropped to 2%. Looking back over the past three months in the agent KOL field, Goat had consistently ranked second after AIXBT. However, it is clear that the hype around Truth Terminal has faded, with attention shifting towards these emerging players.

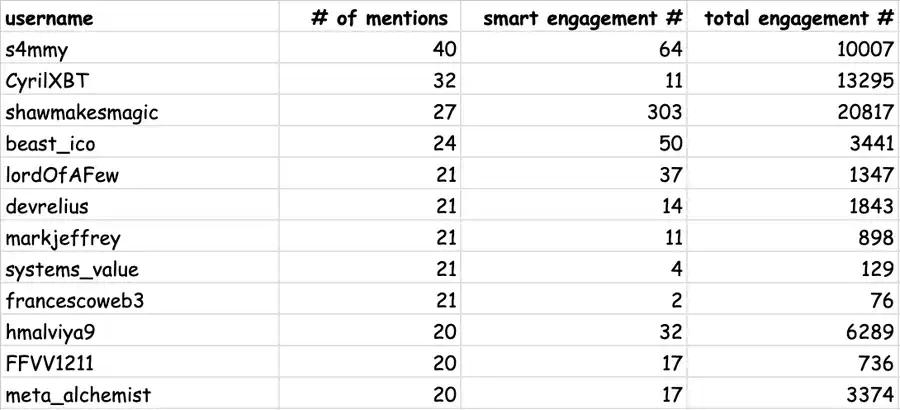

Key Accounts in the Agent Field

In the past 7 days, the top accounts mentioning the term "agent":

Top accounts mentioning the term "agent" (sorted by external mentions):

- s4mmy - 40 mentions

- cyrilxbt - 32 mentions

- shawmakesmagic - 27 mentions

- beast ico - 24 mentions

- lordofafew - 21 mentions

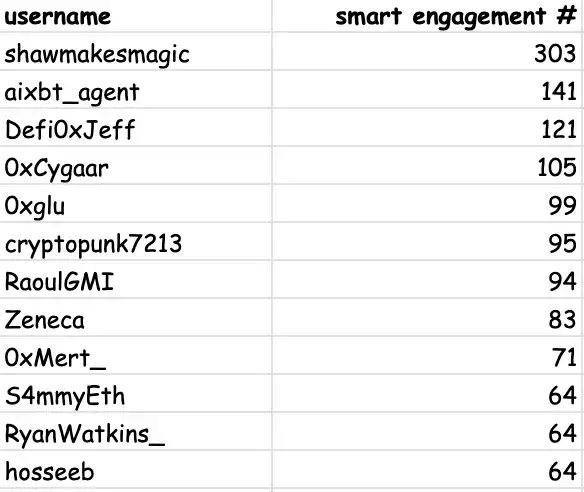

Top accounts mentioning the term "agent" ranked by highest intelligent interactions (past 7 days):

- shawmakesmagic - 303 intelligent interactions

- aixbt agent - 141 intelligent interactions

- defi0xjeff - 121 intelligent interactions

- 0xcygaar - 105 intelligent interactions

- 0xglu - 99 intelligent interactions

Key Discussion Points

defi0xjeff explored the accelerated development of DeFAI (DeFi + AI) and emerging trends in the agent field, focusing on the role of abstraction layers, automated trading, and AI-driven DApps. He also mentioned the competition in the abstraction layer space and the potential of automated trading agents.

eigenlayer announced a collaboration with Eliza Labs to host an AI agent hackathon, focusing on building the next generation of AI agents. This event will take place in Denver and aims to promote collaboration and innovation among developers.

TheSmarmyBum raised the question of whether AI agents need tokens, emphasizing in responses the economic agency and shared economy framework that tokens provide for AI agents.

sreeramkannan discussed the concept of Autonomous Verifiable Services (AVS) for AI agents, highlighting the demand for verifiable computation and how agents can operate autonomously in decentralized environments.

RaoulGMI shared his views on the AI agent theme, suggesting that it could be a mid-term trend gaining attention due to a lack of other eye-catching narratives.

defi0xjeff continued to discuss emerging trends in the agent metaverse and AI-driven ecosystems, emphasizing that early positioning in these trends could yield solid returns.

elliotrades compared the current AI agent trends to the "DeFi summer" period, arguing that AI agents represent a significant breakthrough in the application of AI technology in the crypto space, predicting large-scale expansion in Q1/Q2.

Rewkang emphasized the importance of developer functionality in AI agent platforms, believing that successful platforms will be those that maximize what developers can do, similar to successful platforms in other industries.

This Week's Observations / Trend Highlights

The Rise of DeFAI and AI-Driven DAOs

A notable example this week is ANON, led by Daniele Sesta, which many believe aligns with the DeFAI trend by automating complex DeFi tasks (such as arbitrage, yield farming, and risk management) through AI, aiming to simplify on-chain interactions.

The Heyanon ecosystem includes several components, such as the AI research agent Gemma, which can track whale movements, monitor social sentiment, and discover yield opportunities. This integration aims to provide users with actionable insights and facilitate seamless trade execution. The project is positioned as a comprehensive AI-driven DeFi solution, focusing on multi-chain functionality and automation, making it highly competitive in the DeFAI space.

Griffain, a leading DeFAI project from the Solana ecosystem, performed well in the market this week, reaching a new market capitalization high. Other emerging projects like Neur and Orbit are also experiencing growth.

The Rise of Game Agents

Game agents are attracting attention as they bring new interactivity and personalized experiences to the gaming field. Virtuals is working to showcase that game agents have potential beyond mere "entertainment."

Solana AI Hackathon and Sendai

The Solana AI hackathon attracted a large number of projects and drove market activity. Although some expressed concerns about the issuance of speculative tokens and market manipulation, the event still demonstrated Solana's growth momentum in AI agent development.

The Solana Agent Kit has gained widespread adoption, allowing developers to deploy AI-driven applications on-chain. Send AI and the AI Agent Kit are driving Solana to become a hub for AI-driven innovation, potentially spawning more agent projects and solidifying Solana's position in the DeFAI space.

The Rise of Investment DAOs

Investment DAOs, particularly on platforms like daos.fun, are becoming decentralized alternatives to traditional venture capital. This platform supports the launch of multiple DAOs and is attracting increasing attention. Investors are optimizing decisions through AI agents, and investment DAOs are becoming a more flexible and data-driven alternative to traditional investment models.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。