The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on Jan. 9, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

(The following is a section from the ‘Public Mining Companies’ chapter in the 2024 Bitcoin Mining Review. This report is a collaborative effort with Digital Mining Solutions and is proudly sponsored by NiceHash ❤ )

To assess market sentiment toward Bitcoin mining stocks, we analyze institutional holdings. Large organizations, such as hedge funds, mutual funds, pension funds, and exchange-traded funds (ETFs), are required to submit quarterly disclosures of their equity holdings via SEC filings if they manage over $100 million in assets. In some sense, institutional holdings serve as a proxy for market confidence.

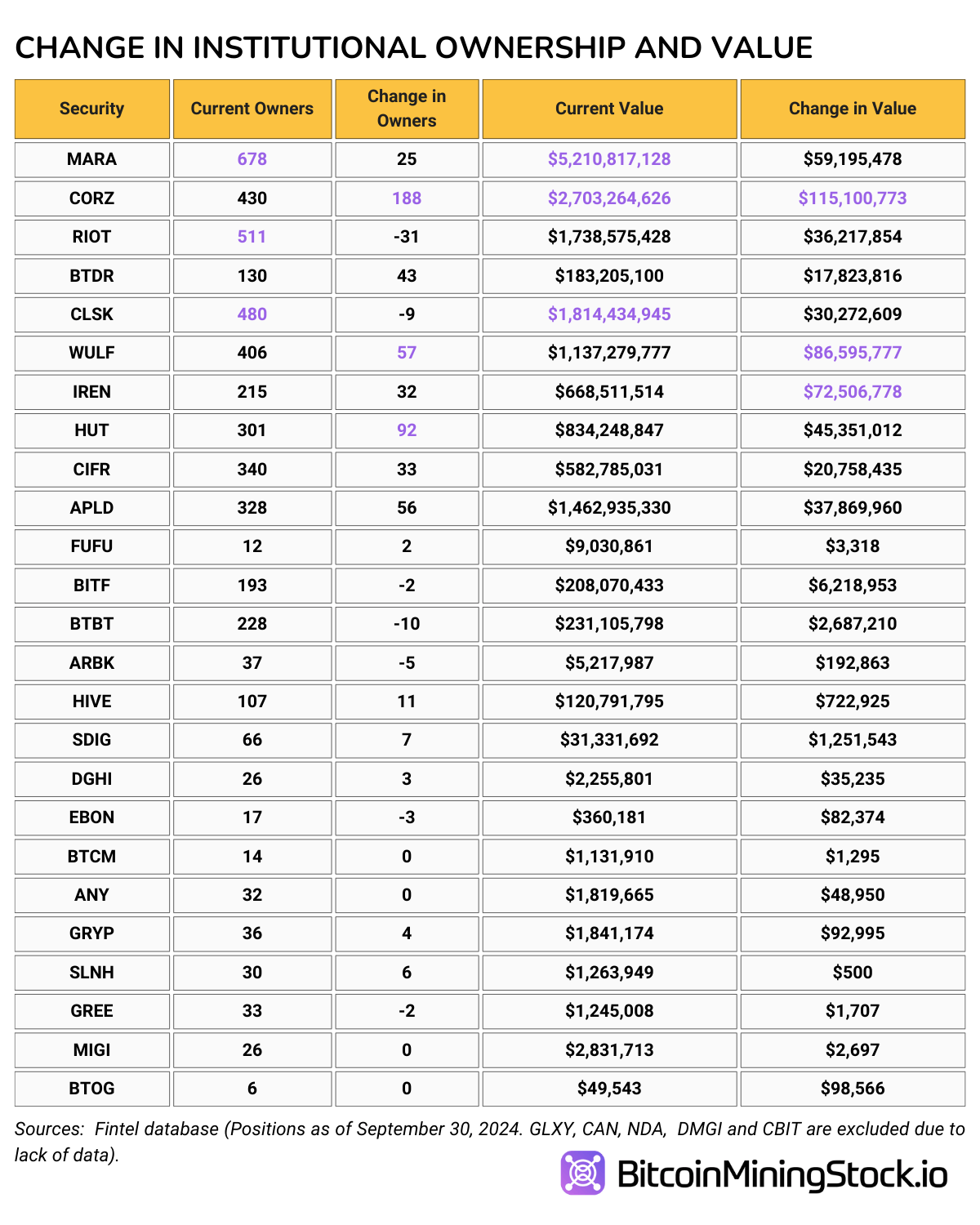

By extracting the most recent quarter’s 13F filings from the Fintel database, we compiled the following table:

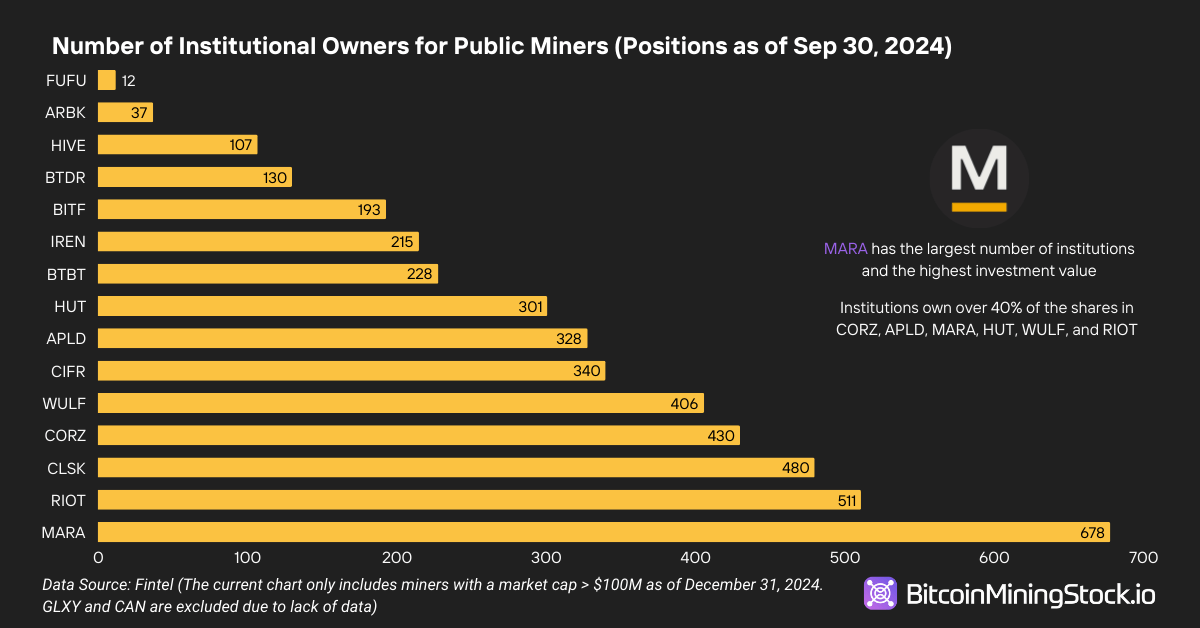

In 2024, institutional interest in Bitcoin mining stocks grew significantly, signaling the industry’s increasing acceptance within mainstream portfolios. This trend is evident in both the rising number of institutions holding shares and the overall growth in the value of their holdings.

Among Bitcoin miners, MARA Holdings (MARA) leads the sector with 678 institutional owners and $5.21 billion in institutional value, reinforcing its position as a market leader. Riot Platforms (RIOT) and CleanSpark (CLSK) follow with 511 and 480 institutional owners, respectively.

Shifts in ownership patterns reveal additional dynamics. Core Scientific (CORZ) recorded the largest increase in institutional ownership, adding 188 new owners and $115 million. TeraWulf (WULF) shows a similar upward trend. Irish Energy(IREN) and Hut 8 (HUT) also demonstrate growth, though in different ways: HUT saw a larger increase in institutional participation, while IREN gained more in terms of total invested capital.

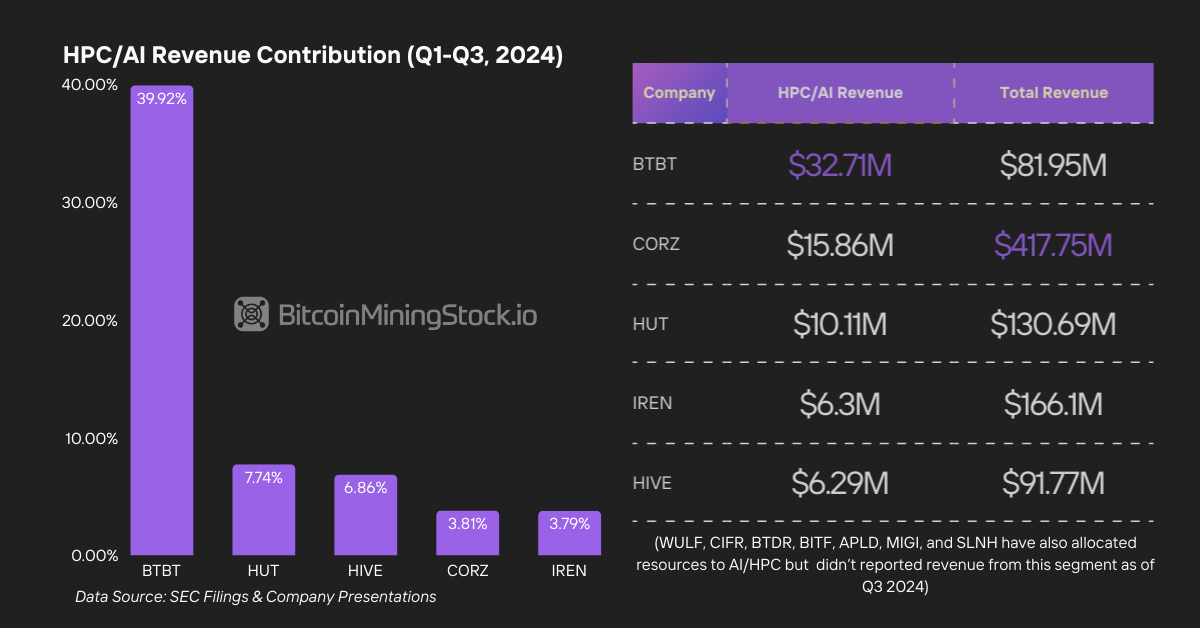

These miners have something in common: strategic pivot toward AI/HPC initiatives and major partnership deals. This trend highlights a clear institutional preference for AI narratives in 2024: stable and predictable revenue streams, higher gross margin, especially when backed by credible partnerships.

However, Bit Digital (BTBT) diverges from this pattern. Despite leading the AI/HPC trend in terms of revenue and contribution (as of Q3 2024), it hasn’t seen the same level of institutional interest. This may be due to its relatively smaller hash rate and market cap compared to larger players. That said, BTBT continues to perform well when benchmarked against peers of similar operational scale. Ultimately, institutional investors still lean heavily toward the industry’s ‘big boys,’ favoring their scale and perceived stability.

TeraWulf didn’t reported revenue from HPC/AI as of Q3 2024. However, its long-term lease agreement with Core42 is projected to generate an estimated $3.11 billion once 207.5MW fully executed.

Overall, larger miners (by market cap) remain the preferred choice for institutions due to their established reputations, broader analyst coverage, and higher trading liquidity. Companies with triple-digit institutional ownership include MARA, RIOT, CLSK, CORZ, WULF, CIFR, APLD, HUT, BTBT, IREN, BITF, BTDR, and HIVE. In contrast, miners with market cap $100m generally have fewer than 50 institutional owners. These stocks remain niche investments and attract institutions willing to take on higher risks for potentially higher returns.

The growing institutional interest in Bitcoin mining stocks reflects a maturing market that continues to attract significant capital. While larger miners dominate due to their scale and credibility, the rising traction of smaller players signals a broadening interest that could reshape the competitive landscape. As Bitcoin mining solidifies its role within the cryptocurrency ecosystem, institutional investors are likely to deepen their participation, further validating the industry’s long-term potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。