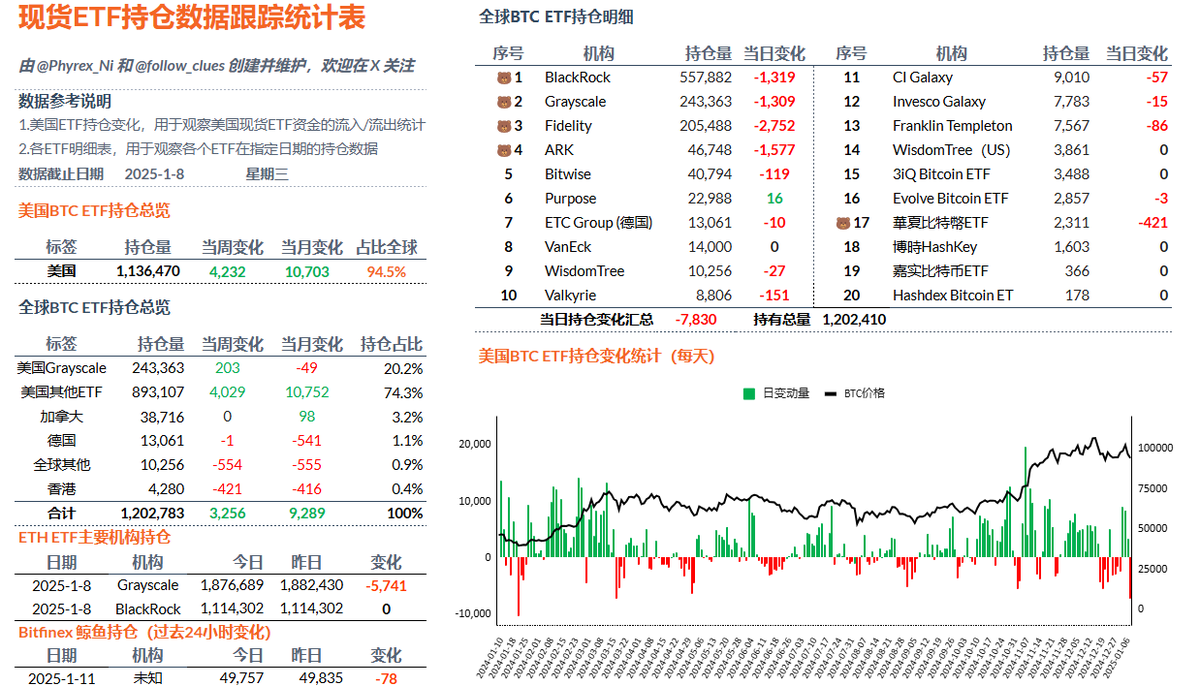

Preventive measures were already taken with ETH, and the data for BTC is not good, or rather, it should be said that it is worse. I have noticed that when the market is rising, BTC always performs better and has stronger purchasing power, but when it falls, the outflow of BTC spot ETFs is even greater, which is quite exaggerated. The largest net outflow of #BTC spot ETFs since January 23 occurred on January 8, marking the second-largest single-day net outflow in history.

The sentiment of investors is understandable. In the data for #ETH, only Fidelity has a significant outflow; although Grayscale also has outflows, they are not substantial. However, in the data for BTC, BlackRock, ARK, and Grayscale all show considerable outflows, and there are three other firms with minor outflows. Among the twelve spot ETF institutions, only four have zero changes, while the other eight have varying degrees of outflows.

The sentiment is a complete mess. Of course, this may be due to the negative impact from the Federal Reserve at the end of December, which has not eased up to now. The only thing that might boost sentiment going forward is Trump; we will see if he mentions cryptocurrency in his inauguration speech.

To be honest, the current macro sentiment is still manageable; at least the economic outlook in the U.S. remains strong. I have been worried about a short-term economic recession, which should not be visible for now. The rise in the dollar index is more likely due to concerns about potential chaos after Trump's inauguration. It seems that cryptocurrency and U.S. stocks are starting to diverge because of one president.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。