Recently, I followed Buffett to invest in a U.S. stock company—#Verisign (stock code: #VRSN). I bought quite a bit, transferring half of my Nvidia stocks to Broadcom and half to VRSN. My fans should know that Nvidia stocks have achieved an ROI of over 600% since 2023. Next, I will discuss my reasoning for purchasing Verisign.

Recently, Buffett's cash reserves have reached a record high, reflecting his risk-averse strategy. However, within this risk-averse approach, he made a move on a company, becoming the largest shareholder with just one investment. Among the top 10 shareholders are major capital firms like BlackRock and Vanguard, all of which are long-term investors! See below for image 2.

What exactly does Verisign, a seemingly unremarkable company, do? Why did Buffett choose to invest in a traditional Web2 company instead of the hot #AI and #Web3 companies?

Verisign is a global leader in domain registration and internet security services. Its main business is relatively simple: operating and maintaining critical internet infrastructure (I am wondering if Web3 domain companies could be a good investment, like #ENS). The core services include:

Domain registration services: Managing and operating the ".com" and ".net" top-level domains, providing services such as domain registration, renewal, and transfer.

Domain resolution services: Operating 2 of the 13 root domain servers worldwide, ensuring users can access corresponding websites and services through domain names.

Internet security services: Providing DDoS protection, DNS Security Extensions (DNSSEC), and other security services to protect internet users.

So why invest? I analyze it from several points:

High predictability and strong customer stickiness. We surf the internet every day, visiting sites like http://youtube.com, http://x.com, http://google.com, etc. These .com, .org, .net domains require annual renewal, and Verisign currently manages 300 million domains worldwide. Consider this: if the outlook for internet or tech companies is poor and they need to cut costs, they typically choose to reduce salaries, lay off employees, or cut back on certain projects. However, they are unlikely to shut down their websites for a few hundred thousand dollars a year. Therefore, there is little concern about customers not renewing in a poor economic environment. The stickiness and predictability are very high.

Strong cash flow. Verisign currently has over $800 million in free cash flow, with $200 million just in Q3. However, they do not pay dividends; instead, they buy back shares, repurchasing 3-4% of the company's stock each year. What are the benefits? This effectively increases EPS and avoids tax liabilities, which is very attractive for long-term investors like Buffett, aligning with his consistent style.

Monopoly position + extremely high gross margin. Verisign currently holds a monopoly in the domain registration market, with a market share of 62%. Verisign's gross margin is 88%, operating profit margin exceeds 70%, and net profit margin exceeds 50%. This high gross margin ensures predictable future revenue. Additionally, it is a 'foolproof' type of business; even if leadership issues arise or management undergoes significant changes, the business can still operate normally without requiring strong R&D investment or charismatic leaders (like Nvidia's Jensen Huang or Tesla's Elon Musk). Essentially, anyone can manage it. This guarantees strong predictable growth for the company while allowing them to continuously create value. This aligns with Buffett's philosophy of investing in companies with long-term competitive advantages.

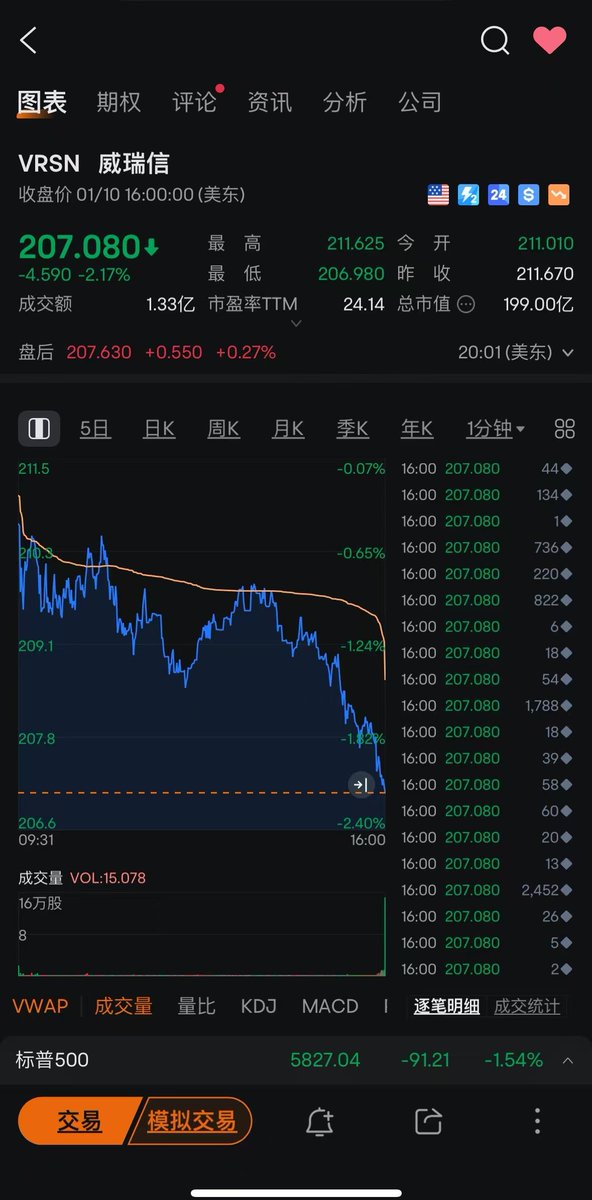

Finally, let's talk about valuation. #Verisign currently has a price-to-earnings ratio of 24, with a market capitalization of $19.9 billion. The Q3 2024 financial report shows that Verisign's revenue grew by 3.8% year-on-year to $391 million, and earnings per share increased by 13.1% to $2.07. It is expected that total revenue for 2024 will be between $1.554 billion and $1.559 billion, with operating income between $1.054 billion and $1.059 billion. Overall, the data is quite impressive.

Despite Verisign's ongoing share buybacks, its stock price has significantly lagged behind the average of internet companies in the Nasdaq 100 index, indicating that the market currently has little interest in Verisign. After all, everyone is focused on companies like Nvidia, TSMC, Broadcom, and Coinbase in the AI and Web3 sectors. But we must remember that Buffett is who he is because he can always find opportunities where others do not see them, buying quietly and selling amidst the noise. Perhaps this time he can create another miracle, making a stunning turnaround. Let's wait and see. It seems like a good opportunity! 🧐🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。