Table of Contents:

Large Token Unlock Data for This Week;

Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Changes/Fund Flows;

Spot ETF Fund Inflow and Outflow Situation;

Crypto Market Fund Inflow Volume Drops by More Than Half, BTC Network Activity Sharply Decreases.

Key Macroeconomic Events and Financial Data Forecast for This Week;

1. Large Token Unlock Data for This Week;

Tokens such as ONDO, CHEEL, and CONX will experience significant unlocks this week, including:

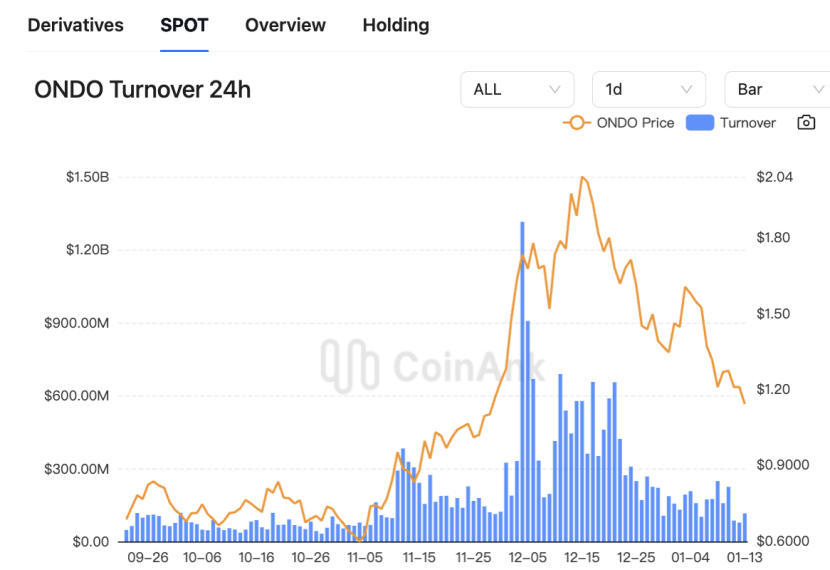

Ondo (ONDO) will unlock approximately 1.94 billion tokens on January 18 at 8:00 AM, accounting for 134.21% of the current circulating supply, valued at approximately $2.41 billion;

Cheelee (CHEEL) will unlock approximately 20.81 million tokens on January 13 at 8:00 AM, valued at approximately $169 million;

Connex (CONX) will unlock approximately 4.33 million tokens on January 15 at 8:00 AM, accounting for 376.3% of the current circulating supply, valued at approximately $85.8 million;

Arbitrum (ARB) will unlock approximately 9.27 million tokens on January 16 at 9:00 PM, accounting for 2.20% of the current circulating supply, valued at approximately $67.8 million;

Polyhedra Network (ZKJ) will unlock approximately 1.72 million tokens on January 13 at 8:00 AM, accounting for 28.52% of the current circulating supply, valued at approximately $33.2 million;

UXLINK (UXLINK) will unlock approximately 2.66 million tokens on January 18 at 8:00 AM, accounting for 15.63% of the current circulating supply, valued at approximately $33.2 million;

Starknet (STRK) will unlock approximately 6.4 million tokens on January 15 at 8:00 AM, accounting for 2.65% of the current circulating supply, valued at approximately $27.6 million;

Sei (SEI) will unlock approximately 5.56 million tokens on January 15 at 8:00 PM, accounting for 1.32% of the current circulating supply, valued at approximately $21.5 million;

QuantixAI (QAI) will unlock approximately 232,000 tokens on January 18 at 8:00 AM, accounting for 4.79% of the current circulating supply, valued at approximately $19.6 million;

ApeCoin (APE) will unlock approximately 15.6 million tokens on January 17 at 8:30 PM, accounting for 2.16% of the current circulating supply, valued at approximately $17.3 million;

Ethena (ENA) will unlock approximately 12.86 million tokens on January 15 at 3:00 PM, accounting for 0.42% of the current circulating supply, valued at approximately $11.8 million;

Cloud (CLOUD) will unlock approximately 48.92 million tokens on January 18 at 11:00 PM, accounting for 27.18% of the current circulating supply, valued at approximately $8.5 million.

The above times are in UTC+8. This week, pay attention to the negative effects brought by the unlocking of these tokens, avoid spot trading, and seek shorting opportunities in contracts. Among them, ONDO, CHEEL, CONXIO, and ARB have a larger proportion and scale of unlocked circulating supply, so pay extra attention.

2. Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Changes/Fund Flows.

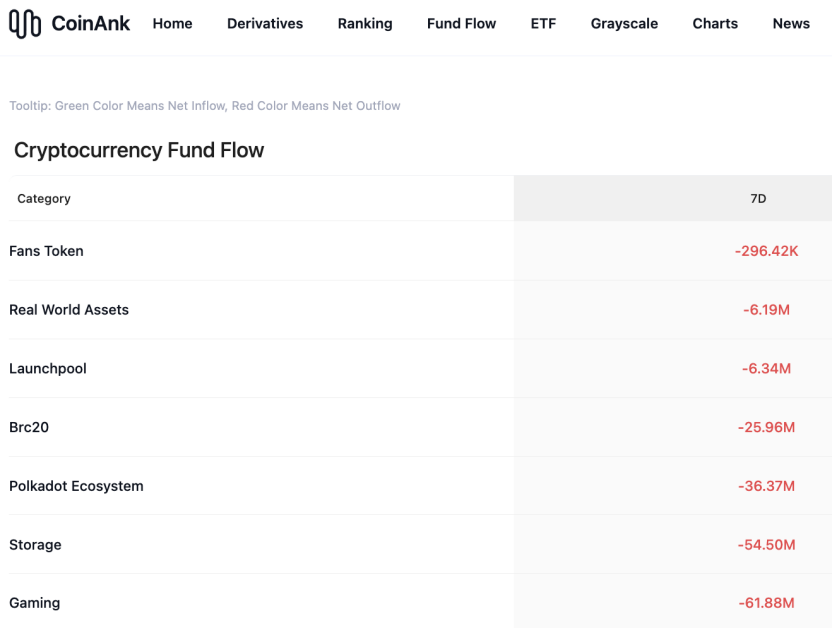

According to CoinAnk data, in the past week, the crypto market has seen a net outflow of funds across all conceptual sectors, with only a few areas such as fan tokens, Launchpool, RWA, Brc20, and the Polkadot ecosystem experiencing relatively small net outflows. In the past week, many tokens have also seen rotational increases. The top 500 by market capitalization include ONT, ONG, PROM, LSK, and GMT, which have relatively higher increases, but due to the overall decline in the crypto market, the overall increase of these tokens is also small.

3. Spot ETF Fund Inflow and Outflow Situation.

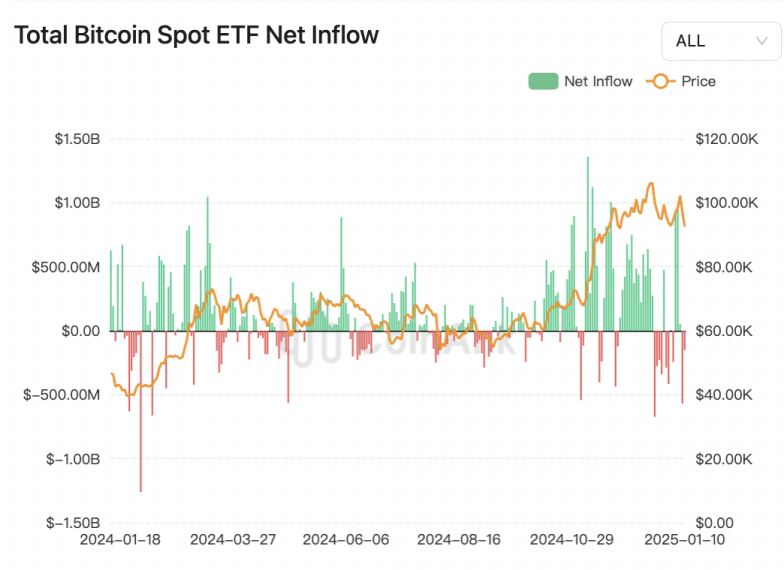

Data shows that last week, the spot Bitcoin ETF had a net outflow of $313.2 million, and the spot Ethereum ETF had a net outflow of $185.8 million, with significant fluctuations in the daily net flow of BTC and ETH. Notably, the last two trading days' net outflows from Bitcoin and Ethereum ETFs may indicate institutional caution, possibly due to macroeconomic factors or profit-taking after recent rebounds.

We believe that the net outflow phenomenon of Bitcoin and Ethereum ETFs last week is due to the cautious attitude of institutional investors, which may be related to macroeconomic factors such as market expectations for Federal Reserve policies, uncertainties in the global economy, or investors choosing to take profits after recent price rebounds. Additionally, considering that the total net asset value of Bitcoin ETFs has reached $111.457 billion, accounting for 5.72% of Bitcoin's total market capitalization, and the total net asset value of Ethereum ETFs is $13.034 billion, accounting for 3% of Ethereum's total market capitalization, these data indicate that ETFs are playing an increasingly important role in the cryptocurrency market.

Despite the short-term net outflows, historical cumulative net inflows show that Bitcoin ETFs have accumulated a net inflow of $35.909 billion, and Ethereum ETFs have accumulated a net inflow of $2.639 billion, indicating that long-term investors' interest in cryptocurrencies remains strong. This long-term trend compared to short-term fluctuations may suggest that the market remains optimistic about the long-term growth potential of cryptocurrencies. At the same time, it also indicates that market participants are closely monitoring macroeconomic dynamics and changes in market sentiment to make corresponding investment decisions. In the long run, if Bitcoin and other cryptocurrencies can continue to attract fund inflows, it will help further mature and stabilize the market.

However, if outflows continue, it may represent a spreading concern among institutional investors, making the future market outlook less optimistic. Other data can also verify this, which we will discuss below.

4. Crypto Market Fund Inflow Volume Drops by More Than Half, BTC Network Activity Sharply Decreases.

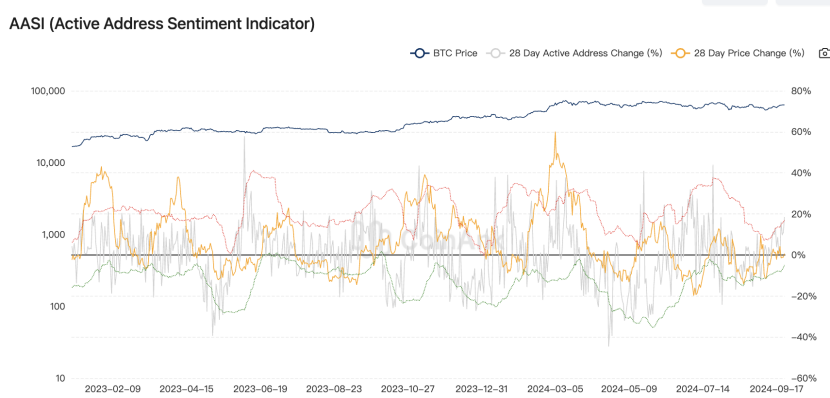

In the past month, the capital inflow volume in the cryptocurrency market has decreased by 56.70%, from $134 billion to $58 billion, indicating a significant reduction in investment activity. Additionally, data shows that BTC network activity has dropped to its lowest level since November 2024, with only 667,100 active addresses.

We believe that the significant decline in capital inflow volume in the cryptocurrency market may be related to various factors. Firstly, the market is undergoing a natural adjustment period, with investors taking profits after previous increases. Secondly, macroeconomic factors such as global economic uncertainty, interest rate changes, and inflation expectations may also be affecting investor sentiment and decision-making, potentially impacting capital inflows to some extent.

The decrease in BTC network activity, reflected in the reduction of active addresses, is a direct manifestation of the market's reduced activity. This may indicate a decrease in trading activity among market participants or that investors are waiting for new market signals or adopting a wait-and-see attitude towards market prospects.

10x Research also mentioned today that since Trump's election in November last year, the U.S. stock market has erased all gains, despite initial expectations that the election would drive stronger growth and lower taxes. The expectation of a rebound in the cryptocurrency market after the election quickly faded on December 6 last year, leading to a significant drop in trading volume, with funding rates peaking on that date, indicating its significance. Macroeconomic factors are the main drivers of the cycles in the Bitcoin and cryptocurrency markets.

5. Key Macroeconomic Events and Financial Data Forecast for This Week.

Tuesday: Data: U.S. December PPI Year-on-Year, U.S. December PPI Month-on-Month.

Events: 2025 FOMC voting member, Kansas City Fed President George speaks.

Wednesday: Data: U.S. EIA, API Crude Oil Inventories; Germany's GDP growth rate for the entire year of 2024; U.S. December CPI data.

Events: FOMC permanent voting member, New York Fed President Williams delivers opening remarks at an event; JPMorgan, Goldman Sachs release earnings reports.

Thursday: Data: U.S. Initial Jobless Claims for the week ending January 11, U.S. December Retail Sales Month-on-Month.

Events: FOMC permanent voting member, New York Fed President Williams speaks; 2025 FOMC voting member, Chicago Fed President Goolsbee speaks; Federal Reserve releases the Beige Book on economic conditions; European Central Bank releases minutes from the December monetary policy meeting; TSMC, Morgan Stanley release earnings reports.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。