Last night around 21:30, the price of Bitcoin plummeted to its lowest point in eight weeks, reaching a low of $89,028; subsequently, driven by key limit price support and market price bottoming, BTC returned above $94,000, forming a V-shaped structure with a cumulative fluctuation of over 12%!

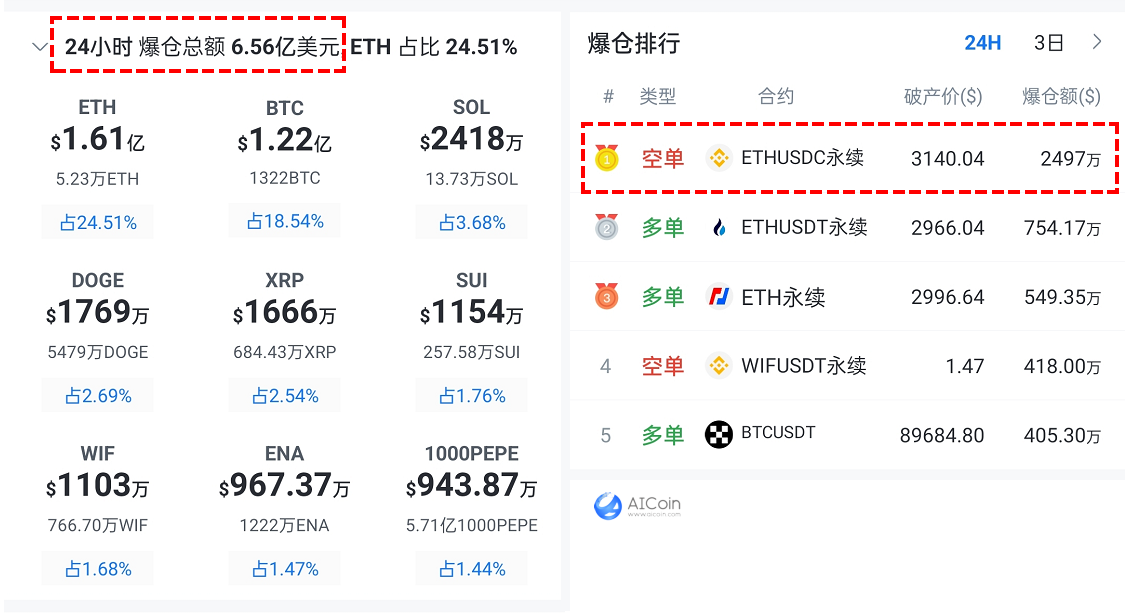

AICoin (aicoin.com) data shows that during the intense fluctuations of BTC, altcoins also experienced significant movements, with a total liquidation in the contract market amounting to $656 million, and a single contract liquidation amount reaching as high as $24.97 million.

According to analysis, the recent price fluctuations of Bitcoin are the result of multiple factors working together.

1. Decline of Risk Assets under the Influence of Federal Reserve Policies

The recent strong non-farm employment data released in the U.S. has left the market uneasy, with investors beginning to worry that the Federal Reserve will continue to maintain a high interest rate policy, thereby reducing demand for risk assets. The rise in the yield of 10-year U.S. Treasury bonds and the strong rebound of the dollar indicate that capital flows are increasingly favoring safe assets. This risk-averse sentiment has spilled over into the Bitcoin market, leading to significant selling pressure.

The weakness in the stock market has exacerbated this risk-averse sentiment. The declines in the S&P 500 and Nasdaq indices directly affect the overall risk appetite of the market, further prompting investors to withdraw funds from high-risk assets like cryptocurrencies. In this context, Bitcoin's price naturally faces significant downward pressure.

2. Continued Accumulation by MicroStrategy: Institutional Confidence Remains Strong

Despite market volatility, large institutions like MicroStrategy continue to accumulate Bitcoin. On January 13, MicroStrategy announced the purchase of an additional 2,530 Bitcoins, bringing its total holdings to a record level. This action reflects that institutional investors' confidence in Bitcoin as a long-term asset remains unshaken. Nevertheless, there are doubts in the market about whether the institution-led "Bitcoin bull market" can continue, especially since institutional purchases during significant price declines may only represent short-term capital flows.

At the same time, MicroStrategy's Bitcoin accumulation has drawn attention to its capital operations. The company plans to raise $2 billion through the issuance of preferred shares to further expand its Bitcoin holdings. This financial support may inject some confidence into the market but also exposes institutional investors to risks associated with their Bitcoin exposure.

3. Fluctuations in Institutional Demand and Market Capital Flows

The potential of Bitcoin as an inflation hedge continues to attract the attention of institutional investors. QCP Capital analysts point out that despite the current market sentiment leaning towards pessimism, Bitcoin still holds certain appeal as an asset for hedging against inflation.

Moreover, the ongoing weakness in the U.S. stock market and its correlation with the cryptocurrency market means that Bitcoin's performance is also highly dependent on macroeconomic trends. For many traders, Bitcoin remains a relatively "high-risk" asset class, leading investors to prefer short-term safe-haven assets and reduce their exposure to cryptocurrencies.

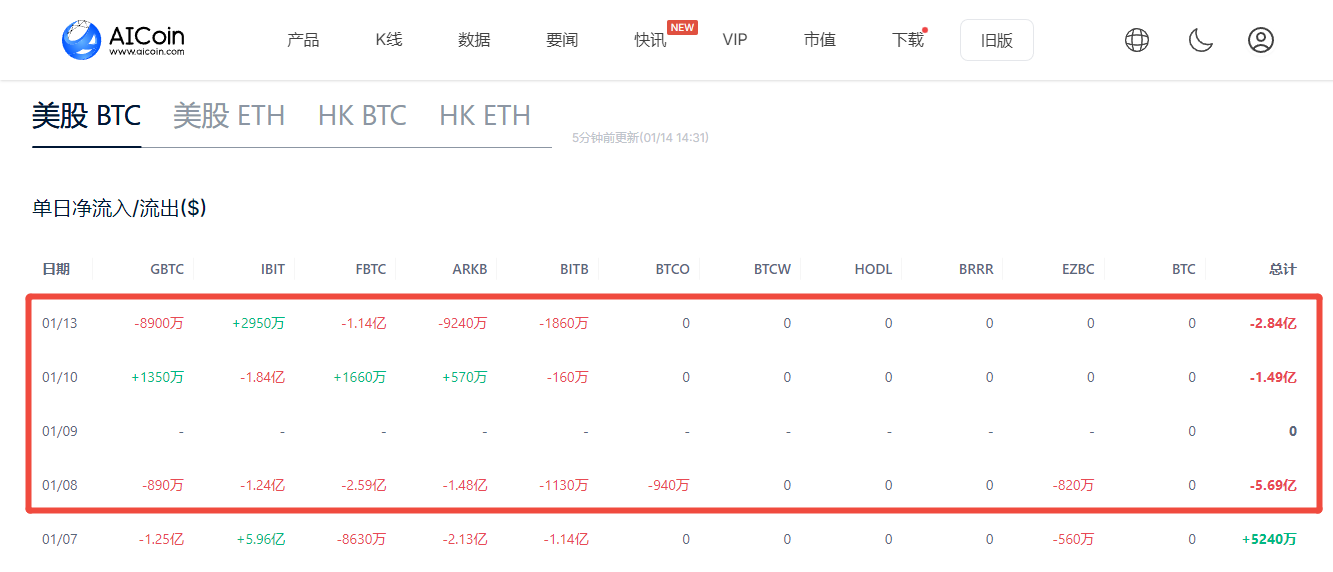

Additionally, AICoin data indicates that funds from the U.S. spot Bitcoin ETF have been flowing out for three consecutive trading days, totaling $1.002 billion, representing a reduction in demand for Bitcoin in the U.S. market, with risk-averse sentiment dominating.

ETF data tracking: https://www.aicoin.com/zh-Hans/web3-etf/us-btc?lang=cn

4. Funding Rates: Echoes of History

Daan Crypto Trades has observed a striking similarity between Bitcoin's current price movements and those from January 2024. He points out that the current funding rate is at its lowest level since last August, which may indicate an impending market rebound. Just as history repeats itself, it provides us with a rare reference point to guide us in finding direction in the market.

5. Technical Analysis: Head and Shoulders Pattern Suggests Larger Correction

From a technical analysis perspective, on the daily chart, the MACD fast and slow lines have failed to truly break through the zero axis and diverge upwards, with overall contract positions showing a downward trend, indicating significant upward pressure in the market.

At the same time, Bitcoin's recent price movements have formed a "head and shoulders" pattern, which is typically seen as a bearish signal. Noted analyst Peter Brandt points out that Bitcoin's price is testing the neckline support level (around $91,000), and if this support level is broken, the target price could drop to around $76,000. The formation of this bearish pattern suggests that Bitcoin may continue to face significant downward pressure in the short term.

Long-Term Potential and Future Predictions for Bitcoin

In summary, the current short-term fluctuations in the Bitcoin market are driven by a combination of macroeconomic environment, market sentiment, and technical factors. Although the market faces pressure in the short term, many analysts believe that Bitcoin still has long-term upside potential, especially given the uncertainty in the global economic environment, as its role as digital gold will continue to attract capital inflows.

Analysts like Dave the Wave suggest that Bitcoin may reach a price peak by mid-2025. He mentions that Bitcoin prices typically peak when they approach the midline of the 52-week simple moving average, with July 2025 potentially being a key moment.

Meanwhile, Rekt Capital points out that Bitcoin's correction has entered the "final stage," a common phenomenon during halving cycles. Historically, similar corrections usually last 2-4 weeks, so Bitcoin may gradually stabilize in the coming weeks, ushering in a new upward cycle.

However, the market remains cautious about whether it can recover and rise in the short term.

AICoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group chat: Customer Service Yingying, Customer Service KK

The above content is for sharing purposes only and does not constitute any investment advice!!!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。