Macroeconomic Interpretation: Last night, the U.S. CPI inflation data and related policy trends became the focus of the market. Based on the latest U.S. CPI data, the Federal Reserve's Beige Book, and the performance of U.S. stocks overnight, we can conduct an in-depth analysis of the U.S. economic situation and its potential impact on the cryptocurrency market.

Data shows that the U.S. CPI rose 2.9% year-on-year in December, while the core CPI increased by 3.2%, both in line with expectations. Notably, the seasonally adjusted core CPI was slightly below market expectations, which alleviated some concerns about rising inflation. The volatility in energy prices was the main factor driving the CPI higher in December, but core inflation indicators such as rent remained relatively stable. The U.S. anti-inflation efforts may soon hit a bottleneck, with rising pressures in core services (like rent) and a relatively stable job market posing obstacles to a decline in inflation. Additionally, the inflation and growth uncertainties that may arise from Trump's administration, along with potential disruptions from trade policies and geopolitical events, have led the market to expect a pause in interest rate cuts sooner rather than later.

Meanwhile, the Beige Book released by the Federal Reserve also revealed a moderate growth trend in U.S. economic activity. Although there was a slight decline in manufacturing net value and no overall change in residential real estate activity, consumer spending saw a modest increase, and the non-financial services sector also exhibited slight growth. Businesses expressed concerns about the uncertainties surrounding Trump's policies, which could impact future economic activity. In the labor market, employment numbers have increased, but some industries still face a shortage of skilled workers. Overall, prices have risen moderately, with respondents expecting prices to continue to rise in 2025, with tariff increases potentially being one of the factors driving price hikes.

In the overnight U.S. stock market, Tesla led a surge in automotive stocks, reflecting market optimism regarding U.S. inflation data and future policy directions. The three major U.S. stock indices opened high and continued to rise, the VIX fear index fell, gold prices increased, and the dollar index declined. BTC prices rose again to $100,000. These market reactions indicate that investor confidence in the U.S. economic outlook has strengthened, which has also positively impacted the cryptocurrency market.

From the perspective of the cryptocurrency market, the U.S. inflation data and related policy trends cannot be ignored. First, stable inflation data helps boost market confidence and drives an increase in risk appetite. In a context of rising risk appetite, cryptocurrency assets, as high-risk, high-reward investment options, often attract more investor attention. Additionally, with the continuous development of cryptocurrency payment and settlement technologies, the scenarios for practical applications of cryptocurrency assets are increasing, which also supports their price rise.

However, uncertainties in policy may still pose pressure on the cryptocurrency market. The trade policies and geopolitical strategies that may be adopted by the Trump administration, as well as the future direction of the Federal Reserve's monetary policy adjustments, could significantly impact the cryptocurrency market. For example, if the Trump administration adopts more aggressive tariff policies, it could lead to rising prices for imported goods, thereby exerting inflationary pressure on the cryptocurrency market. On the other hand, if the Federal Reserve ends the interest rate cut cycle early or even begins to raise rates, it would increase market interest rates, raising the holding costs of cryptocurrency assets and thus suppressing their prices.

It is worth noting that the correlation between the cryptocurrency market and traditional financial markets is increasing. The performance of the U.S. stock market often reflects investors' confidence in the overall economic outlook, and this level of confidence can also transmit to the cryptocurrency market. Therefore, when analyzing trends in the cryptocurrency market, it is necessary to consider the dynamics of traditional financial markets and the impact of related policies.

The impact of U.S. inflation data and related policy trends on the cryptocurrency market is multifaceted. Against the backdrop of stable inflation data and moderate economic growth, the cryptocurrency market is expected to benefit from increased market confidence and rising risk appetite. However, uncertainties in policy and the correlation with traditional financial markets may also exert pressure on the cryptocurrency market. Therefore, investors need to consider various factors comprehensively when analyzing trends in the cryptocurrency market to make rational investment decisions.

BTC Data Analysis:

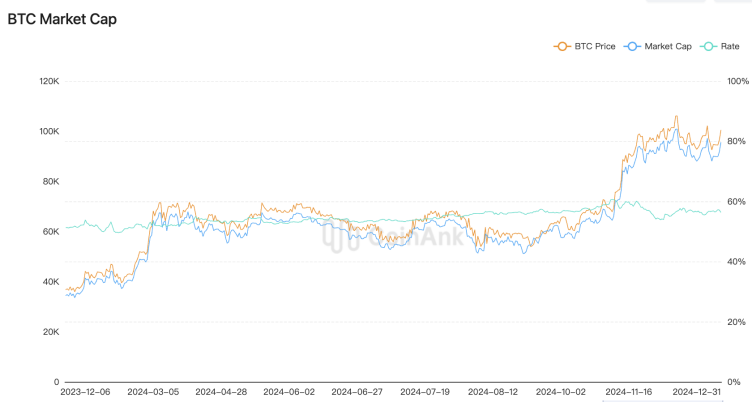

In the fourth quarter of 2024, the total market capitalization of the #cryptocurrency market grew by 45.7%, reaching a historic high of $3.91 trillion in mid-December. The dominance of #Bitcoin continues to strengthen, with coinank data showing that BTC currently accounts for 53.6% of the total cryptocurrency market capitalization, and it first broke the $100,000 mark on December 9, setting a historic high of $108,135. Notably, in the fourth quarter of 2024, #Solana surpassed Ethereum to become the dominant public chain for decentralized exchanges (DEX), with a market share exceeding 30%.

The performance of the cryptocurrency market in the fourth quarter of 2024 was remarkable, with a total market capitalization growth of 45.7%, reaching a historic high in mid-December. This not only reflects strong demand for cryptocurrencies but also shows that investor confidence in this asset class has increased. Bitcoin's dominance further strengthened, and Solana surpassed Ethereum in the fourth quarter to become the leading public chain for decentralized exchanges, with a market share exceeding 30%. This indicates that the market demand for different blockchain platforms is growing, and Solana's advantages in providing efficient, low-cost transactions are being recognized by the market, demonstrating that the cryptocurrency market is continuously maturing and diversifying.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。