Macroeconomic Interpretation: As January 20, 2025, approaches, the United States is about to witness Trump's second inauguration. This event has not only attracted widespread attention in the global political and economic arena but has also had a profound impact on the cryptocurrency market. Recently, Bitcoin's price successfully broke through the $105,000 mark, a trend closely linked to Trump's impending return to power. We will conduct an in-depth interpretation and analysis from the perspectives of Trump's policy expectations, the cryptocurrency market's response, and the correlation between the two.

With Trump set to take office, his policy proposals will undoubtedly become the focal point of market attention. According to the latest research report from CITIC Securities, Trump may sign multiple executive orders in his first month in office, covering various fields such as the economy, energy, society, and foreign affairs. In terms of the economy, Trump may sign executive orders on tariffs, deregulation, and encouraging the development of cryptocurrencies, which are expected to bring new development opportunities to the cryptocurrency market. Particularly, his encouraging stance on cryptocurrency development will undoubtedly boost market confidence and drive up the prices of mainstream cryptocurrencies like BTC.

In the energy sector, Trump may sign executive orders supporting traditional energy production and strengthening the supply chain for key resources. Although this policy may spark environmental controversies, the stable supply of traditional energy will lower mining costs and improve mining efficiency, thereby indirectly pushing up cryptocurrency prices. Additionally, if Trump withdraws from the Paris Agreement, it will reduce international restrictions on carbon emissions, providing a more lenient environment for energy-intensive industries like cryptocurrency mining. In terms of foreign affairs, Trump may propose a plan to end the Russia-Ukraine conflict and pressure NATO allies to increase their military spending contributions. These policies may lead to international turmoil, but in the short term, they could create a certain demand for safe-haven assets in the cryptocurrency market.

It is worth noting that not all of Trump's policy proposals will be smoothly implemented. Especially in areas requiring cooperation from Congress, such as debt, tax cuts, and energy subsidies, Trump is expected to face significant congressional resistance and negotiation. The uncertainty surrounding these policies may also have some impact on the cryptocurrency market. However, overall, Trump's encouraging attitude towards cryptocurrency development and his policy proposals in energy and foreign affairs are expected to bring long-term development opportunities to the cryptocurrency market.

Bitcoin's price broke through the $105,000 mark last night, a trend closely linked to Trump's impending return to power. On one hand, Trump's policy expectations have boosted market confidence, driving up cryptocurrency prices; on the other hand, the complexity and uncertainty of the global economic situation have intensified the market's demand for safe-haven assets, further pushing up the prices of mainstream cryptocurrencies like Bitcoin.

From a technical perspective, the continuous maturation and improvement of Bitcoin's blockchain technology provide strong support for the stable development of the cryptocurrency market. At the same time, as the global digital economy continues to develop, cryptocurrencies, as an emerging payment method and store of value, are expanding their application scenarios and market demand. These factors collectively drive up the prices of mainstream cryptocurrencies like Bitcoin.

Trump's impending return to power has had a profound impact on the cryptocurrency market. His policy proposals not only bring new development opportunities to the cryptocurrency market but also increase market volatility and uncertainty. In the long run, as the global digital economy continues to develop and cryptocurrency technology matures, the cryptocurrency market is expected to welcome broader development prospects. Investors should closely monitor market dynamics and policy changes, rationally analyze market trends and risk factors, and make informed investment decisions.

Multiple informed sources have revealed that President-elect Trump plans to use his executive power to alleviate the regulatory burden faced by cryptocurrency companies and promote the adoption of digital assets in the days following his inauguration. It is expected that Trump will sign an executive order to establish a cryptocurrency advisory committee, a concept he first proposed last July.

According to a Bloomberg report, Bitcoin rose again this Friday due to market rumors that Donald Trump might soon issue an executive order prioritizing cryptocurrencies as a national issue. It is reported that Trump may announce the establishment of the cryptocurrency advisory committee he previously promised in the executive order he releases, giving the cryptocurrency industry a voice in his administration. Investors expect that any statements from the new government next week will drive Bitcoin prices up and potentially set new highs. However, Wall Street has warned that while Congress and the White House will support cryptocurrencies in 2025, which will undoubtedly foster innovation in the industry and asset class, the market may take some time to feel the effects. We will wait and see.

BTC Data Analysis:

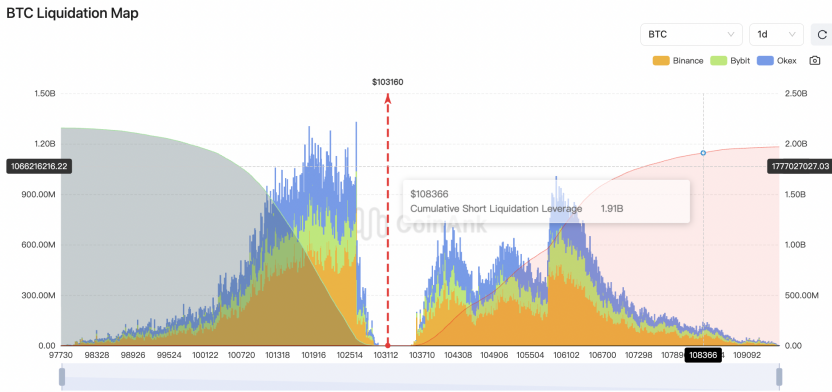

According to the latest data from CoinAnk's contract liquidation map, if the BTC price breaks above $108,366, reaching a new all-time high, approximately $1.91 billion in short positions will be liquidated;

If the BTC price falls below $97,730, approximately $2.14 billion in long positions will be liquidated.

These data intuitively reflect the risk control positions of major funds and can also serve as a reference for trading or entry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。