In the bitcoin ETF domain, Blackrock’s IBIT emerged as the dominant recipient, attracting $375.92 million in capital allocations. Fidelity’s FBTC trailed with an impressive addition of $326.26 million. Bitwise’s BITB garnered $208.07 million, while Grayscale’s Bitcoin Mini Trust secured $21.82 million in inflows, reflecting continued interest in diversified exposure to bitcoin.

Grayscale’s primary GBTC fund recorded an additional $20.76 million in inflows, while Vaneck’s HODL fund collected $11.91 million. Invesco’s BTCO added $6.28 million, and Valkyrie’s BRRR brought in $3.72 million. Meanwhile, Wisdomtree’s BTCW accounted for $4.47 million. These collective gains elevated the total net inflows since Jan. 11, 2024, to an impressive $38.08 billion.

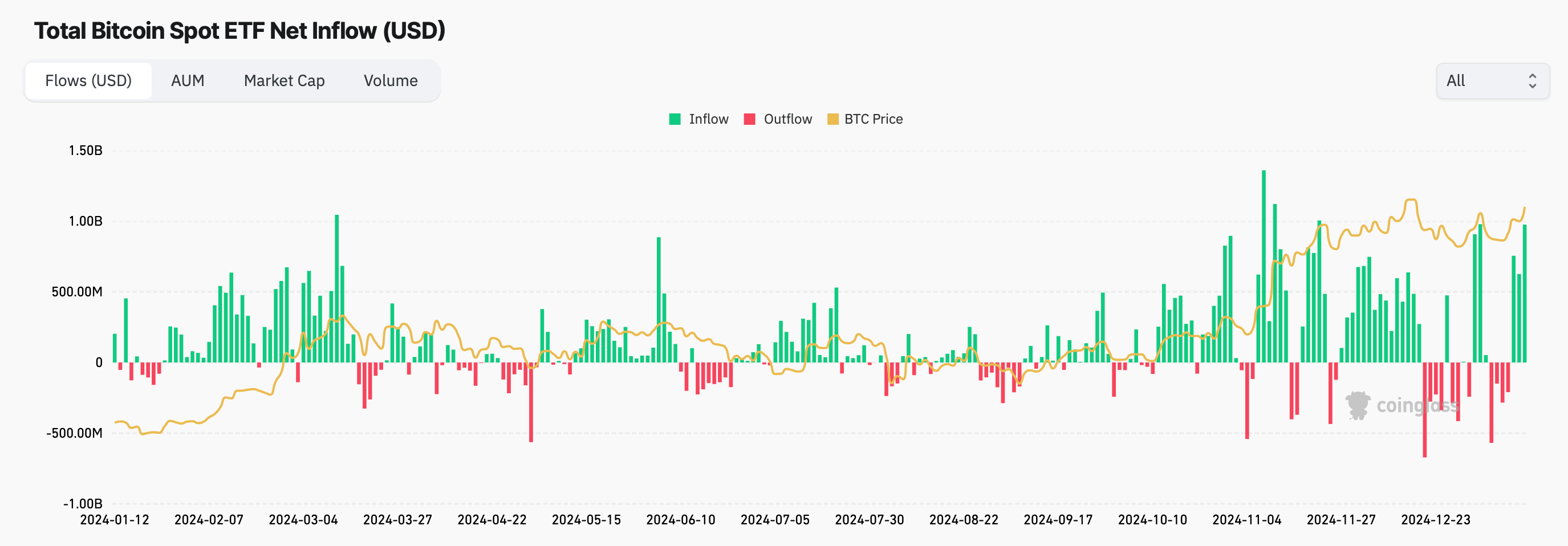

Spot bitcoin exchange-traded funds (ETFs) saw three days of net inflows. Source: Coinglass.com ETF data.

Approximately $5.44 billion in trades were executed across the spot bitcoin ETFs on Friday, with the combined holdings of these 12 funds now reaching $120.95 billion in bitcoin reserves—representing 5.84% of the cryptocurrency’s total market capitalization, according to sosovalue.com’s recorded metrics.

On the ethereum side, three of the nine spot ETH ETFs captured $23.87 million in new inflows, pushing cumulative net inflows since July 23 to $2.66 billion. Fidelity’s FETH led with $13.99 million, while Blackrock’s ETHA added $7.38 million. Bitwise’s ETHW rounded out the gains, amassing $2.5 million.

The ethereum ETFs processed $393.43 million in trading volume on Friday, with their collective reserves now standing at $12.66 billion. This figure corresponds to 2.99% of ether’s overall market capitalization, according to sosovalue.com stats.

The influx of capital into both bitcoin and ethereum ETFs underscores a deepening interest from institutional players, further embedding these vehicles as pivotal conduits between traditional finance and the burgeoning cryptocurrency sector. The accumulation of reserves not only signifies confidence in digital assets but also highlights their growing integration into mainstream financial portfolios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。